The tequila hangover, or the Mexican Crisis of 1994 - causes and effects

Mexico is one of the largest Latin American economies. Proximity to the United States should be one of the country's strengths. Economic cooperation should lead to convergence. However, for convergence to take place, macroeconomic, political and legal stability is needed. In the case of Mexico, the country in the second half of the XNUMXth century was affected by many economic crises. The most popular of them was currency crisis of 1994. The Mexican Crisis was also referred to as tequila crisis. The crisis in Mexico has also hit other countries in the region. This has particularly affected countries such as Chile i Brazylia. The impact of the Mexican crisis on these countries was called the tequila effect. In today's article, we will briefly explain what were the reasons, course and consequences of the Mexican crisis.

READ: Mexico - one of the largest economies in Latin America

Before 1994 - The Mexican party is in full swing

Paul Volcker, source: wikipedia.org

How did the crisis of 1994 come about? As with most currency crises, this was no accident. This was due to the imposition of many problems that erupted at one time. For this reason, conventional solutions have failed.

As we have already mentioned, Mexico experienced several crises in the second half of the 1982th century. One of them was the crisis of XNUMX. Then came the debt crisis. The reason was the restrictive policy FED. The central bank of the United States, in order to fight inflation, began a series of interest rate increases (the so-called Volcker shock). The Fed's move caused the value of the dollar to rise. As a result, many emerging economies (Mexico, Poland) began to have problems with servicing debt denominated in dollars. Mexico, as a result of the crisis, began deregulation, which was fashionable at the time. The Mexican government began privatizing state-owned companies, deregulating sectors, and reducing many tariffs that protected the domestic market. Moreover, incentives were introduced for foreign investors.

Despite the reforms, Mexico continued to struggle with debt problems. The United States came to the rescue. In 1989, US Treasury Secretary NF Brady announced a debt relief plan. It was addressed to the 39 most indebted developing economies. According to the plan, the debtors were offered a partial debt reduction. In return, countries were to carry out market reforms. Mexico was the first country to benefit from this plan. The agreement was signed in July 1989. Thanks to the signing of this agreement, Mexican banks and companies were able to borrow funds in developed financial markets. This sparked enthusiasm among foreign investors, who were bolder in investing in Mexican debt.

NAFTA, source: wikipedia.org

Investors were also satisfied with the negotiations between Canada, the United States and Mexico regarding the NAFTA (North American Free Trade Agreement). The common market between these countries was to encourage foreign investors to invest in Mexico. The inflow of capital was supposed to lead to faster economic development. Mexico also had to ease restrictions on capital controls. Liberalization made it easier for foreign investors to invest in stocks, bonds and derivatives.

There was only a problem with inflation and exchange rate. At the end of 1991, the so-called crawling pegs. This was to encourage investors who were afraid of currency risk to invest in Mexico. The peso exchange rate was pegged to the dollar, but exchange rate fluctuations between the upper and lower bands were allowed. The upper band over time was supposed to slowly rise. This set the maximum level of peso depreciation. This solution was supposed to fulfill 3 functions:

- giving investors protection against excessive depreciation of the peso,

- Mexican companies had it easier to take out a loan from foreign institutions,

- exchange rate management was intended to help combat inflation in the country.

Mexico's banking sector

In 1982, as a result of the financial crisis, Mexico decided to nationalize many private banks. After less than 10 years, there was a wave of privatization. Nevertheless, the transformation of the banking sector has been slow. The Mexican banking sector was characterized by strong concentration and still high influence of politicians on the lending activities of banks. The four largest banks held 70% of the total assets banking sector. At the same time, Mexico did what it could to prevent foreign competition from operating. According to many Mexican governments, this could take away the market from Mexican banks. The problem was also that Mexico was reluctant to implement "western" accounting standards in banking. A particular problem was the very liberal approach to NPL loans (a loan in which the debtor does not pay installments on time). In Mexico, only interest on a loan not paid on time was treated as NPL. On the other hand, the capital value was treated as overdue. This meant that the situation of Mexican banks was worse than it appeared at first glance. The banking supervision, which was just learning its role, was also a problem. Moreover, the problem was that the Mexican government guaranteed all deposits. Thus, people did not have to wonder in which bank to invest their savings.

After the privatization of the banks, there was a credit boom. Banks, in order to increase their market share, offered preferential loans. The procedures regarding the conditions that must be met by the customer to receive a loan have also been significantly relaxed. In order to finance credit expansion, banks borrowed on foreign markets. Of course, the debt was issued in US dollars.

The Mexican crisis of 1994 - causes

As with most crises, there were a great many factors that contributed to the outbreak of the Mexican currency crisis. It is impossible to list them all. For this reason, we will focus only on the most important of them:

- trade liberalization that allowed capital to flow into Mexico;

- low interest rates in the United States;

- persistently high current account deficit in Mexico;

- the issuance of tesobonos by the Mexican government to stem the outflow of foreign exchange;

- political and social unrest in Mexico.

The liberalization of trade and capital flows caused Mexico to experience what the Asian Tigers experienced four years later. First, speculative capital flowed to Mexico. This created a small economic boom. Then, when capital began to rapidly flow out, there was strong pressure on the weakening of the Mexican peso. This resulted in the Mexican central bank having to defend the peso in some way.

READ: Asian Crisis - A boom "killed" by imbalances and corruption

Another problem was the loose policy of the Fed. For this reason, American investors were “pushed out” from the United States. The hunt for returns has begun yieldhunting). Investors were looking for higher returns with acceptable risk. The peso's creeping exchange rate limited the risk of a sharp devaluation in theory. Foreign investors "jumped" into Mexican securities. In 1994, the Fed began raising interest rates. However, the Mexican central bank did not immediately follow the Federal Reserve. Investors started selling Mexican bonds as the price-risk ratio was no longer as attractive.

Mexico has experienced a current account deficit for many years. As a result, the country was indebted to "foreign". The deficit was financed with dollar-denominated loans. As long as they were willing to borrow money, the deficit was not a problem. When the flow of capital slowed down, the peso found itself in trouble.

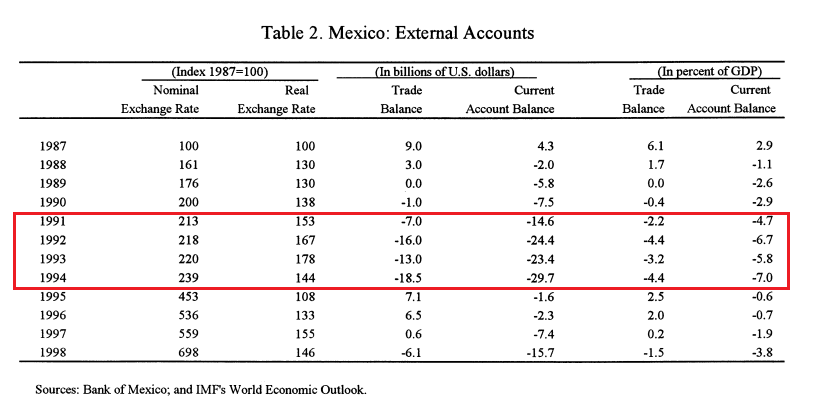

source: IMF 1999

Emission thesobonos allowed to stop the outflow of capital for a while. However, this was a very short-term approach. Tesobonos were issued for a short term. In second half In 1994, investors began to pay increasing attention to the relationship between short-term dollar-denominated debt and foreign exchange reserves.

Social unrest was associated with the Zapatista movement. Zapatista militias attacked 5 districts in eastern Chiapas. The purpose of the formation was to overthrow the legally elected government in Mexico. After two weeks of fighting, the uprising began to die down. However, this prompted the Mexican government to grant autonomy and privileges to the indigenous people who lived in the country.

Fiscal and Monetary Policy - A True Mexican Stamp

Mexico's politics in the 90s fit the test perfectly fulfillment of the triangle of impossibility. This means that it is not possible to simultaneously:

- maintaining a fixed exchange rate,

- maintaining an independent monetary policy,

- introduction of free movement of capital.

The central bank's attempt to defend PEG was not possible without significantly depleting foreign exchange reserves. The alternative choice was to raise interest rates. However, this was impossible in an election year. A rate hike would slow down economic growth, hit borrowers and increase unemployment.

In the first half of the 90s, the peso moved within a crawling peg. The Mexican currency was pegged to the dollar, but the central bank allowed the exchange rate to fluctuate between certain ranges. The Mexican peso was therefore partly dependent on the Fed's monetary policy.

Mexico's central bank also had to monitor foreign exchange reserves. The outflow of dollars from Mexico pushed the peso closer to the upper limit of the fluctuation band. Strengthening the currency in such conditions was a real challenge for the central bank. It should be remembered that the weakening of the currency supported exports. However, the weakening of the peso led foreign investors to demand a higher risk premium when issuing government debt or deciding to invest in Mexico. The central bank tried to keep the peso in check. However, with each passing month of 1994, it became more and more difficult.

Financiers and economists came up with the "brilliant" idea in April 1994 to rebuild foreign exchange reserves. The Mexican government then issued short-term dollar-denominated debt. This product was called tesobonos. Investors, borrowing money in dollars, were sure that the currency risk would not materialize (they had no exposure to pesos). Borrowings rebuilt foreign exchange reserves. This provided a temporary stabilization of the peso. However, this was a short-term solution. In November there was a significant outflow of capital. On November 18, 1994 alone, $1,8 billion left the country. It was a considerable amount.

The political situation did not improve the situation. At the turn of November and December 1994, a new government was formed. On December 15, the new finance minister, Jaime Serra Puche, denied rumors of a devaluation of the peso in an interview with the Wall Street Journal. The markets reacted according to the principle:

I'll believe the rumors when the government denies them.

As a result, on December 16, 1994, $855 million flowed out of Mexico. The situation was getting more and more difficult.

The Central Bank of Mexico had to intervene somehow. On December 20, the bank raised the upper limit of the fluctuation band by 15%. This meant a de facto devaluation of the peso. The effects of this decision were not long in coming. Between December 20 and 21, 1994, $4,6 billion left Mexico. It was the value of half of foreign exchange reserves. It was a real disaster for the Mexican central bank. It was not possible to keep the peso exchange rate within the fluctuation band. As a result, the peso exchange rate was freed. December devaluation of the peso was 35%. Mexico needed urgent help. Suddenly, thesobonos became a pressing problem for the Mexican government.

US, IMF and BIS to rescue Mexico

Bill Clinton, source: wikipedia.org

In January 1995, attempts were made to improve the situation on the financial market. The session was attended by US President Bill Clinton, Secretary of the Treasury Robert Rubin, Head of the Federal Reserve Alan Greenspan and Larry Summers. It was decided to carry out a rescue operation, which was estimated at $ 50 billion. The plan itself encountered great difficulties in the United States. This was because the opposition believed that the US was too generous in helping its economically unstable neighbor. William Seidman mentioned that Mexico should negotiate with creditors on its own and not involve its Northern neighbor in its problems.

In turn, supporters of the Clinton administration mentioned that Mexico's economic problems are also socio-economic problems of the USA. One of the key arguments was the fear that illegal immigration to the US would increase. This will increase unemployment among the poorest Americans. Another problem was that Mexico, plunged into recession, would import less goods from the US. This, in turn, will reduce US exports and raise the unemployment rate. The debate was very long and ended up being rejected by Congress Mexican Stabilization Act. Ultimately, the Clinton administration circumvented the problem by providing guarantees through the US Treasury Exchange Stabilization Fund. The loans generated $600 million in profit and were repaid by Mexico ahead of schedule. However, the transaction raised doubts. There have been accusations of conflicts of interest. The problem was the Secretary of the Treasury's past. Before holding public office, Rubio was one of the heads of Goldman Sachs. An American investment bank was involved in investing in the Mexican market. He was involved in distributing Mexican stocks and bonds to his clients.

The result was coordinated assistance from the International Monetary Fund and the United States. January 26, 1995 MFW extension offered assistance of $7,8 billion. Five days later, a new aid proposal of $5 billion followed. The aid funds included:

- $20 billion in aid from the United States,

- $18 billion from the International Monetary Fund (including $7,8 billion in earlier aid),

- $10 billion from the Bank for International Settlements (BIS),

- $3 billion from private banks.

The aid was intended to roll over short-term dollar-denominated debt (tesobonos). The cost was higher interest costs and the need for economic reforms. A painful period of adjustment for the Mexican economy began. The austerity policy resulted in a decrease in investment in the economy.

Impact on the economy

On the one hand the Mexican crisis caused a slowdown in investments. On the other hand, the depreciation of the peso made Mexico export more. In the first half of 1995, Mexican GDP shrank by 10%. However, in the next period there was a rapid economic recovery. In the following years, there was an economic growth of 6% on average. In 1995 there was an improvement in the current account. The current account deficit in 1994 was -5,8%. However, the following year it was around -0,5%. Unemployment was a problem, rising from 3,7% in 1994 to 6,2% in 1995. However, with the economic reconstruction, it began a systematic decline.

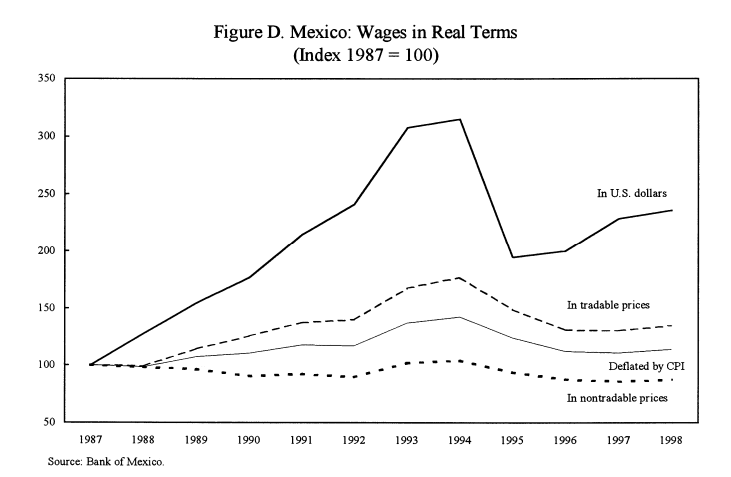

Many investors were concerned about inflation, which for many years was a problem not only in Mexico, but also in many Latin American countries. Some economists expected an inflation explosion associated with a phenomenon known as "importing inflation". The devaluation of the peso made imported goods more expensive (per peso). For this reason, importers also increased prices in order to protect their margins. Between 1995 and 1996 inflation rose to 35%. For comparison, in 1994 inflation was 7%. Over the following years, high inflation was Mexico's problem. Only in 2000 did it drop to single digits.

The Mexican crisis also affected the poorest. The currency crisis hit the rural population particularly hard. This was due to the weakness of the provincial labor market and the lack of access to credit. Many farms in the countryside took up farming for their own use. Across the economy, retail sales fell by 15%. Many citizens have significantly reduced their consumption of discretionary goods. The emigration community responded to the decline in the standard of living in the country. Money transfers to Mexico doubled between 1995 and 1996.

source: IMF 1999

The Mexican crisis and its impact on the banking sector

Even before the currency crisis broke out, the banking sector was in a difficult situation. The reasons have been outlined earlier in the text. They were:

- race for market share;

- easing of credit conditions;

- insufficient level of banks' capital;

- banks borrowed heavily in US dollars;

- weak banking supervision;

- very liberal NPL calculation policy.

The devaluation of the peso has created a problem for the Mexican banking sector. First, the debt owed by the banks in dollars became increasingly difficult to repay. The second reason was that some of the bank's clients (large companies) financed part of their borrowing needs through debt denominated in foreign currencies. The devaluation of the peso meant that some companies had problems with servicing their liabilities. As a result, impaired loans increased. The weak position of the banks threatened Mexico's macroeconomic stability. As a result, the government has prepared an aid program in which:

- provided liquidity to the banking sector;

- allowed banks to transfer parts of the “bad loan portfolio” to the government;

- recapitalization of banks that did not have a minimum capital level of 8%.

At first, banks stopped lending. This resulted in a sharp decline in the value of economic activity. However, in the following quarters of 1995, the banks eased their lending policies. Despite the aid packages, the Mexican banking sector took years to regain its vitality.

What the Mexican crisis taught us

The currency crisis was a kind of earthquake for the Mexican political scene. In mid-1997, the PRI political party, which had dominated Mexico for 70 years, lost power in the capital, Mexico City. Moreover, the PRD party took over Congress. Three years later, the PRI lost the presidential election.

The Mexican crisis of 1994 led to the reluctance of a large part of the Mexican society to take loans from banks, especially in dollars. Another effect was an even greater reluctance of the public to hold savings in the Mexican peso. The Mexican central bank, as a result of the crisis, began to pay more attention to the amount of foreign exchange reserves.

Summation

The Mexican crisis had a negative impact on Mexico's economic development. Additionally, inflation became a problem for the country over the following years. There was an impoverishment of society and undermined the effectiveness of the so-called "Washington Consensus". The impoverishment of the society and the reduction of expenditure on health care resulted in an increase in the mortality rate of children and adults.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)