How to calculate if and when to increase position size?

Many players speculating on currency markets ask the above question very late if at all. Sometimes it happens that resigned, after a series of failures, they will never do it again. Bankruptcy leaves a huge mark in the speculative mentality and will never let you forget about yourself until you are found guilty. Finding it in us, we have a chance to develop, draw conclusions and provide reliable learning. However, it often happens that the market, big players or dishonest brokers become guilty. Then everything is "Sure", we are guilty and the road to the market is closed once and for all.

Checkability of the strategy

To start a discussion about whether and how to manage the size of the item, we should first focus on the strategy. Without a good, verifiable strategy in the long run, there is no way we can go to the next stage.

There are several schools. Some say that with just any strategy, good money management and the size of the position (so-called Money Management) will be created by the earning system, other schools argue that without a good strategy, you can possibly with good luck "Go to zero." I, personally, are closer to the second approach. I believe that the strategy must bring profits, which, thanks to proper capital management, we can further optimize in terms of profitability. In short - Money Management brings out the maximum possibilities offered by our strategy.

Position size and ratio Z: R

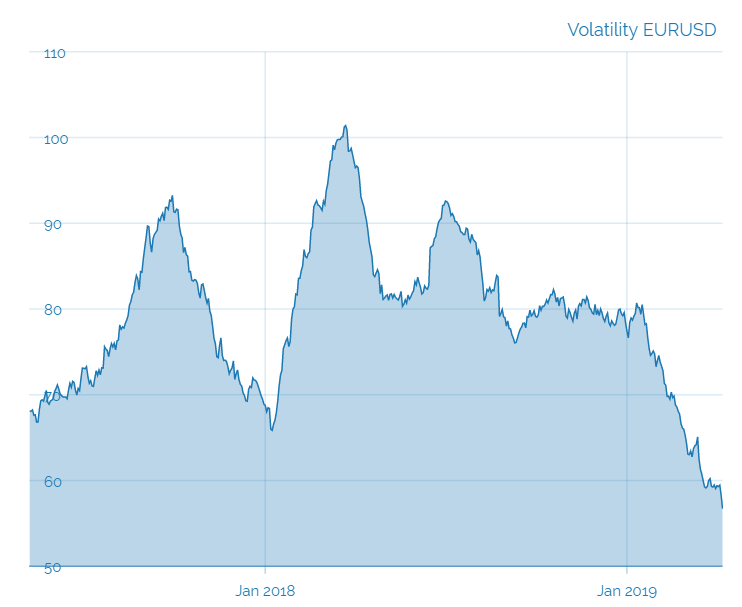

Risk management on forex it is undoubtedly very important. The average daily volatility of currency pairs from month to month begins to decline. With low volatility, setting a stop loss that is too close may expose us to a false breakout, and a profit that is too distant, to the necessity of a long wait for its implementation, combined with frustration and numerous corrections along the way. Expecting high YoY ratios of 3: 1 may turn out to be very time-consuming in such markets. In such cases, it is definitely better to focus on the ranges z / r 1: 1 - 2: 1 and develop a higher effectiveness ratio. Declining volatility combined with consolidation may result in the fact that the assumed target at the z / r 3: 1 level may not be achieved for long weeks.

The daily volatility in the pairs of the EURUSD pair has been steadily declining for the last year. Source: Mataf.net

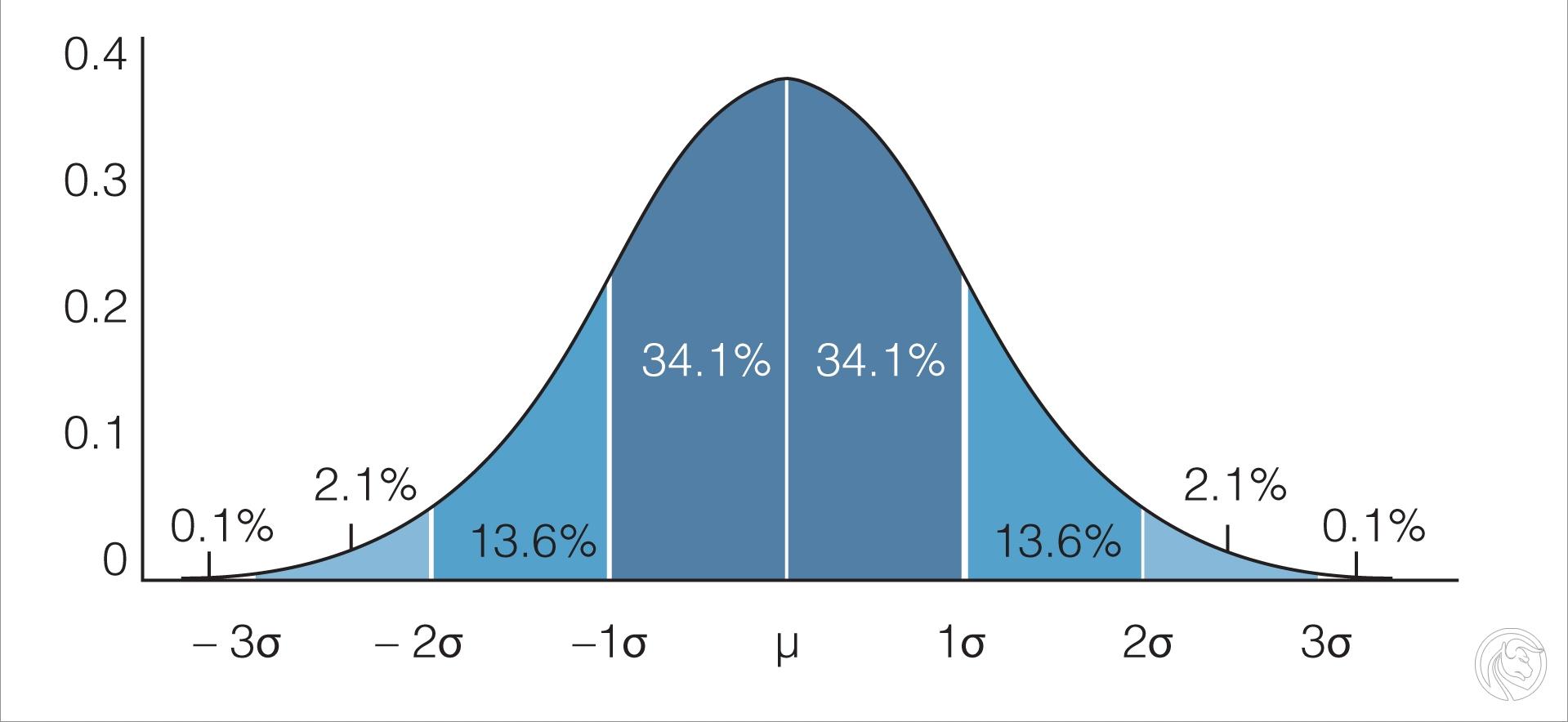

It also seems to me that looking for a position with a high profit / risk ratio may be a psychological trap for some people. This may open the way to more frequent mistakes. All you need to do is be right in 34% only to get the 3: 1 ratio to the minimum plus. It can sometimes lead to hasty decisions, because according to the above assumptions, "we can afford them".

Hence the approach I prefer. The lower ratio z / r forces a greater attachment to the precision of inputs, allows faster verification of the transaction result (higher profit, a much longer waiting time for the result and often the need to "survive" many adjustments along the way). In addition, strategies such as swing trading they are based on low ratios from /.

Gambling or investment

Some authors say that there are no real investors left today. As a rule, the investor looks at the distant horizon, he wants what he has invested in to develop genuinely. The return on investment in the form of cash happens by the way. A speculator, on the other hand, is recognized by the fact that, first of all, he seeks markets that will bring him quick and high profit. Correct naming of our activity will allow us to mentally locate what we want to research. Therefore, we agree that we do not call ourselves currency investors, but speculators (the pejorative overtone of this word has already been forgotten along with the times rightly passed). We also agree that there is uncertainty as to which direction and at what time a given currency will go. These observations inevitably lead us to the conclusion that de facto forex is not much different from betting on sports or poker. In each of these areas, the only elements we have influence on are the amount of the "put on the table" stake (in the forex in the form of a stop loss). Our only analysis upon which we make decisions is probability analysis. These observations suggest that we can and should learn from the best poker players and sports tipsters. High efficiency and appropriate selection of rates - this is the recipe for success.

Observation

There are many interesting sites with statistics. I will use the site typersi.pl. It organizes regular competitions for the best and most successful sports tipsters. What is the most interesting in it is the fact that it gives access to real users' chances, allows you to view the average relationship with r / z, staking and effectiveness. Most people achieve satisfactory results there without using high z / a ratios. In fact, most of them are in the 1 range: 1 to 2: 1. There are a few exceptions with very high indications, but the Gauss curve is unbeatable and better aimed at achieving average results than at best. Few will be the best and in order to stand with them in court, you need to master the lower levels of development.

Normal distribution (Gauss-Laplace). It plays an important role in the statistical description of the world. This is the frequency distribution of a given value of any variable. It shows that the majority of observations (eg of the subjects) have a very close to average result. The further from the average, the fewer people get the result.

The Golden mean

Aristotle, an ancient Greek philosopher, already over 2000 years ago expressed the view that the so-called the golden mean makes it possible to achieve happiness in every area of life. We are not inclined by this approach, neither by excessive sacrifices, nor at high risk. Most importantly, it is best for the psyche considering the long term. We all know how dangerous extremes can be.

Personally, I think that until we have a very highly verifiable and reliable strategy, it will be a bad idea to modify the size of the item every time and adjust it to the current state of the deposit. Percentage rate based on the current deposit amount in the case of a series of losses very quickly plunges the account and creates a great difficulty with going out then "at zero". With the decrease in the deposit, the amount of the rate decreases. So that after a series of losses "go to zero", you need to achieve above average effectiveness, because due to smaller rates the amount of profitable positions must be greater than the loss items preceding them.

For the majority of people and above all for the greater mental comfort, in my opinion, a flat rate is recommended (percentage of the original deposit) and its possible increase by a certain capital increase (eg every 1 000, 10 000 or 100 000 PLN, depending on amount of the invoice). If someone wants to regularly pay profits, it's probably better to focus on effectiveness than to manipulate the rate.

MetaTrader 4

A multitude of instruments on trading platforms and related requirements, makes it contrary to appearances that setting a flat rate on each of them is not so obvious and, unfortunately, requires every calculation. Let him come with help a very simple form created by me in Excel and attached indicator.

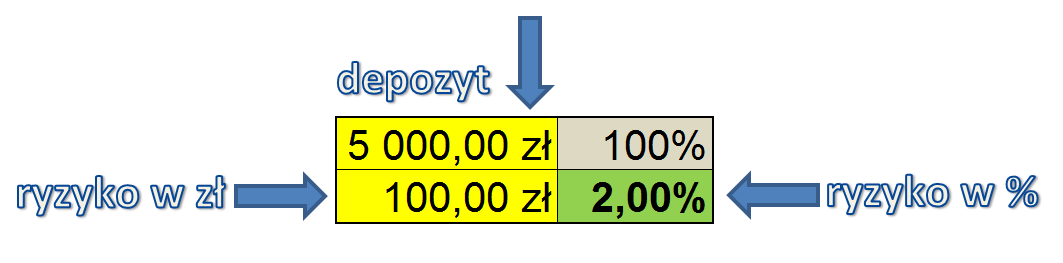

In Excel, we give the amount of the deposit and the amount we will risk. On the right side we can see what percentage of the deposit is the amount indicated by us.

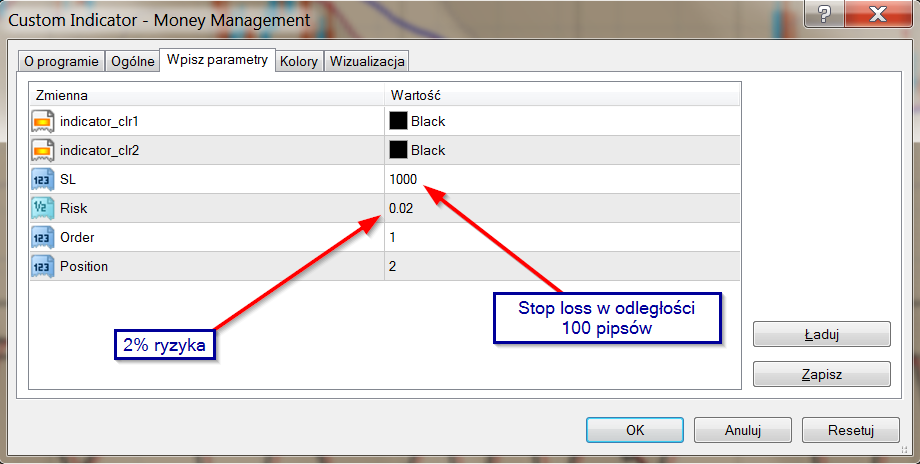

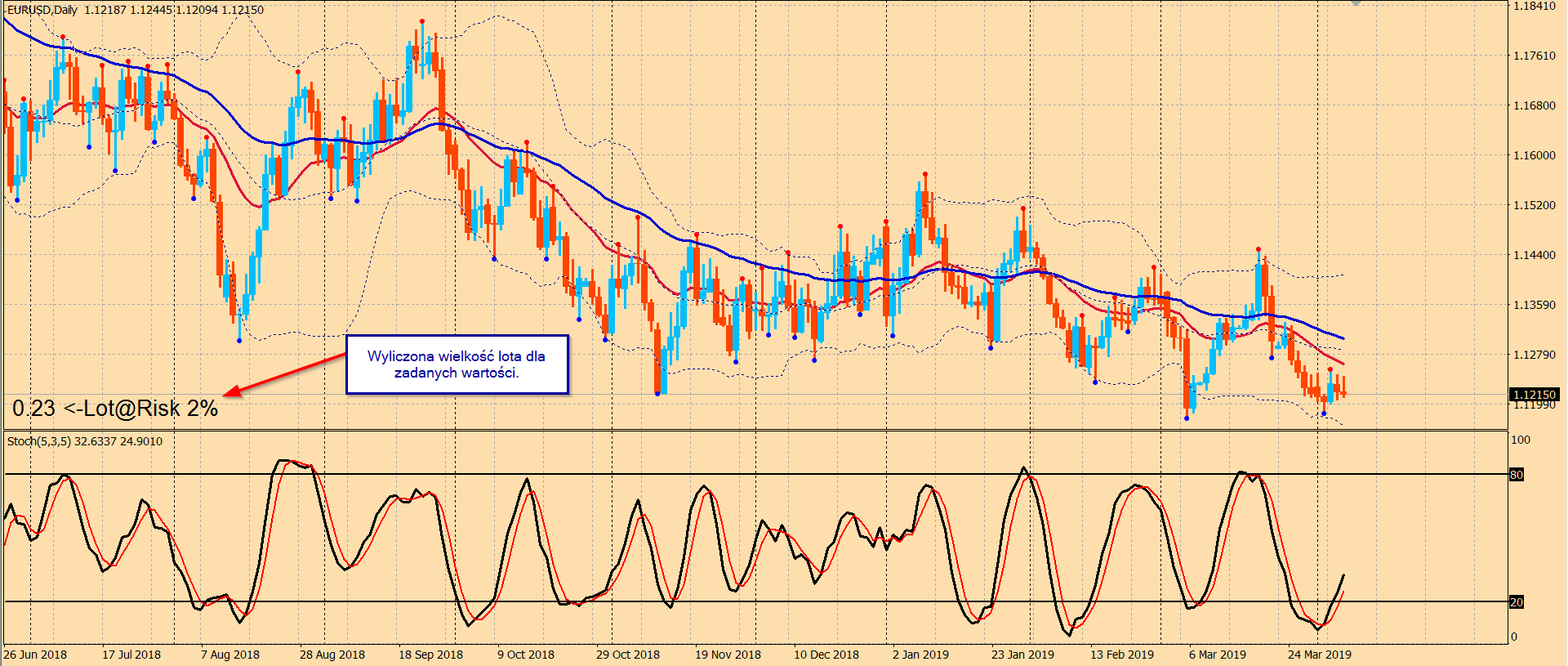

Now we are adding indicator to the graph and enter the distance stop lossa in pips and risk percentage.

After clicking OK on the screen, we will see the size of the position that we should open. After losing or winning, in Excel we change the entry in the deposit field, we leave the amount of risk in PLN unchanged.

Thanks to the above treatments, we can focus on the effectiveness of the games. Remember that you never know what the market will do. Sticking to the rules is very important. I would like to point out that most books overlook this issue. Two percent is said, but no one specifies whether they are to change over time or whether it is to be 2% of the original or current capital.

I hope that thanks to this article you have noticed a topic that perhaps you have so far avoided while looking for the ideal index or ideal formation. Most of the forex tools in the Money Management category focus on calculating 2% books on your current deposit. It's hard to find one in which you can enter a fixed amount that we are willing to risk in each transaction. I hope this article will somehow fill this gap.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)