How to buy gold? Everything about investing in gold [Guide]

How to buy gold? Everything about investing in gold

For centuries, gold has been a desirable and precious precious metal. From the beginning of time it was used as a means of payment and jewelry material. To this day, despite the lack of gold parity in national currencies, it does not lose its relevance. It is considered a safe haven for capital storage and saving savings from inflation. If you're wondering if it's worth or how to buy gold, then this article will help you answer these questions.

Chart - Gold

Gold mining and deposits in the world

It is estimated that 187 tonnes of gold have been mined throughout human history. Currently, the world's largest producer of gold is China, producing 000 tons per year. Australia comes second with a production of 440 tons per year. Russia is third with 300 tons per year.

The largest deposits of gold

The largest gold deposits discovered are in South Africa (Johannesburg), Russia (Aldan, Kolyma, Ural), Australia (Kalgoorlie), China, USA, Canada, Uzbekistan, Peru, Ghana and Kyrgyzstan.

Gold rush in the nineteenth century

In the nineteenth century, in places where gold deposits were discovered, so-called "Gold rush". The first documented discovery of gold in the US was the discovery of deposits in Midland, North Carolina in 1803.

An example of a gold rush was California Gold Rush which took place between 1848 and 1849. During the construction of a sawmill in Coloma, California (then a remote, sparsely populated province), a gold nugget was found. The news of this spread widely, prompting an influx of approximately 300 people from across the United States and from abroad hoping to enrich themselves from the new gold deposits discovered. At the beginning of 000, California had a population of just 1848. It is estimated that approximately 800 kilograms of gold were mined during the California Gold Rush.

The use of gold

In addition to the monetary function, gold is used in jewelry, electronics, medicine and in industry (space, music, aviation, automotive).

How to buy gold: Gold, CFD, ETF and shares

There are many different ways that allow you to invest directly or indirectly in gold. Each of the solutions has its own pros and cons. Below we describe the most popular methods.

Deposit gold

The most direct form of investing in gold is through the purchase of physical metal. This can be done with the help of gold dealers - bureaux de change, companies dealing in trading in precious investment metals and mints. The downside of this form of investment is that the gold is physically stored in the home and can therefore be stolen. Physical gold also takes place and is not as liquid as gold-backed financial instruments. The advantage of investing in physical gold is that you can store some of your capital outside the "financial system" and guarantee that the metal you buy actually belongs to us and physically exists (it is not a paper that is not covered with physical gold).

Recent events show that buying physical gold is not necessarily that simple and may simply not be available on the market. As a result of the decline in the stock market in February-March 2020, investors began to buy physical gold en masse. Effect? The increase in dealer margins from 20% to even 75%, a big difference between the prices of physical gold and paper prices (on exchanges) and… problems in the supply.

ETF with gold exposure

Exchange Traded Funds, i.e. ETF is a very convenient alternative to investing in gold. The instrument, which is extremely simple in construction, allows you to locate funds in various types of markets, having only the necessary minimum investment knowledge. However, the key is choosing the right ETF that suits our expectations.

[GLD] SPDR Gold Trust

-

- Annual fees: 0.40%

- Issuer: State Street Global Advisors

The SPDR Gold Trust fund is the largest ETF that allows you to invest directly in gold. The price of gold in this fund is based on the price of gold given by LBMA (London Bullion Market Association, simply called the London Gold Exchange). Thanks to this, the GFD ETF price is very close to the actual price of physical metal. It is a very liquid ETF with capitalization of 62 billion dollars and small spreads.

[SGOL] Aberdeen Standard Physical Gold Shares

-

- Annual fees: 0.17%

- Issuer: Aberdeen Standard Investments

SGOL is an ETF based on physical gold. Shares in SGOL are currently at 1/100 the price of an ounce of gold, making this fund attractive especially for people who want to invest smaller amounts in the ETF. Capitalization is 2 billion dollars.

[IAU] iShares Gold Trust

-

- Annual fees: 0.25%

- Issuer:Blackrock

IAU is a fairly popular ($ 24 billion capitalization) ETF based on physical metal. It is a very stable fund that stores physical gold bars in caches around the world. One share in the fund corresponds to 1/100 of the price of an ounce of gold.

Shares of gold mining companies

Another (indirect) investment option in gold is to invest in companies mining this precious metal. Unlike the case oil, where mining companies 'prices react more slowly than crude oil prices, mining companies' prices are more volatile. When the price of gold metal increases, the profits of companies in percentage terms increase faster than the price of gold only. Unfortunately, in the event of a drop in bullion prices, mining companies also record lower profits. Greater volatility of stock prices will appeal to investors with greater risk appetite and speculative line.

How to buy gold indirectly by investing in mining companies? We can choose one of the American companies.

Large gold mining companies listed on the US Stock Exchange are e.g. BHP Billiton, Newmont Corporation i Rio Tinto.

OHS Billiton [OHS]

The largest mining company in the world. In addition to gold, the company also extracts iron, diamonds, silver, copper, coal and even oil. The company is headquartered in Melbourne, Australia. The shares are listed on the London Stock Exchange

The largest mining company in the world. In addition to gold, the company also extracts iron, diamonds, silver, copper, coal and even oil. The company is headquartered in Melbourne, Australia. The shares are listed on the London Stock Exchange

Newmont Mining Corporation [NEM]

Newmont Mining Corporation is the largest gold producer in the world. It extracts about 5 million ounces per year. Has mines in Nevada, Colorado, Ontario, Quebec, Mexico, Dominican Republic, Australia, Ghana, Argentina, Peru and Suriname. Is part of S & P500 index. The head office of the company is in Greenwood Village, Colorado in the USA.

Rio Tinto [RIO]

Rio Tinto is the second largest mining group in the world. The company has headquarters in London. The name comes from the Spanish Rio Tinto River, however it is currently a British-Australian company. Rio Tinto is the largest copper producer in the world. In addition to copper and gold, it extracts coal, iron, diamonds and many other raw materials.

ETFs with mining companies

We can also invest in ETF, which brings together mining companies. A description of selected ETFs of companies extracting precious yellow metal is given below.

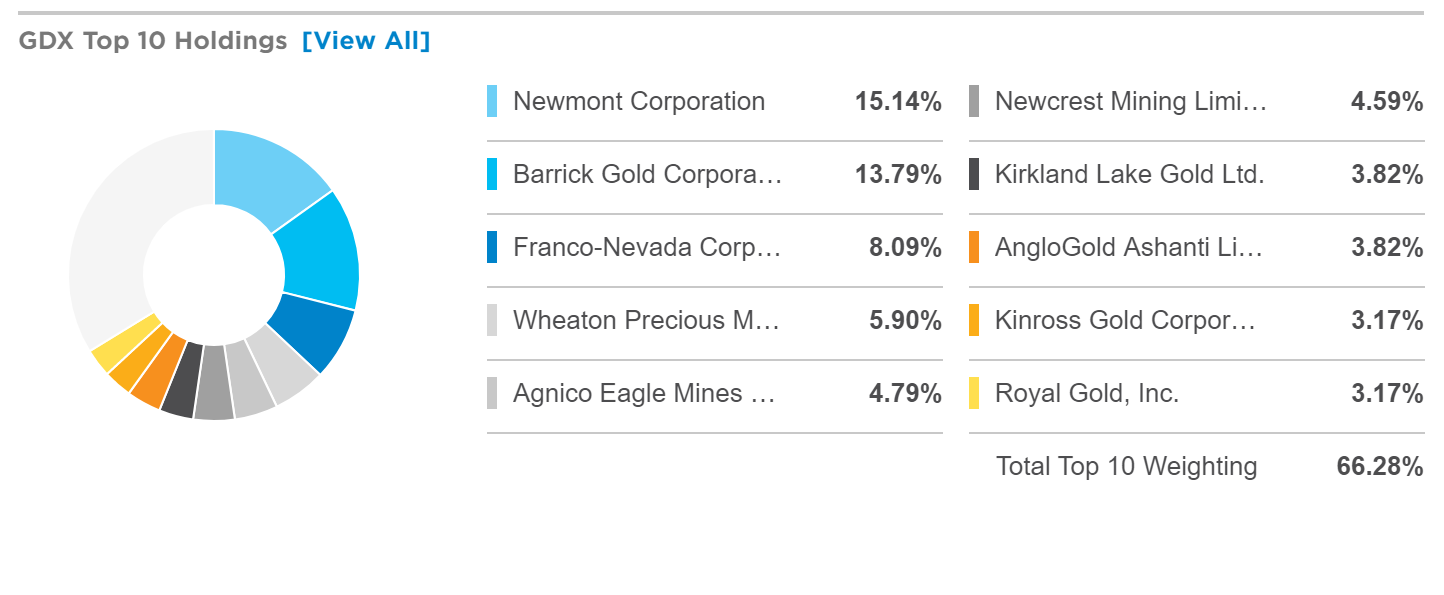

[GDX] VanEck Vectors Gold Miners

-

- Annual fees: 0.52%

- Issuer: VanEck

One of the most popular funds in the gold mining sector. The fund includes not only American companies, but enterprises from around the world. The fund includes all major mining companies as well as smaller players.

The percentage composition of the 10 largest companies in the ETF GDX VanEck Vectors Gold Miners is presented in the chart below.

Where to buy gold - stocks and ETFs

The table below contains a list of brokers offering trading in shares of gold mining companies, ETFs based on the mining sector, and ETFs based on gold itself.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

CFDs

Another way to invest in gold is CFDs available from every major forex broker. CFDs are leveraged - with brokers from the European Union, the maximum leverage for gold is 1:20.

Below is a list of selected brokers offering the best conditions for trading on gold (CFD).

| Broker |  |

|

|

| End | Poland | Great Britain | Cyprus |

| Gold Marking | GOLD | XAUUSD | GOLD, GOLDEURO, GOLDgr, GOLDoz |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 100 | PLN 500 |

| Platform | xStation | MetaTrader 4, MetaTrader 5 | MetaTrader 4 / 5 cTrader |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

How to buy gold - choosing an instrument

How to buy gold, or what instrument is the best? It all depends on our expectations, strategy, as well as the time perspective of the planned investment and investment knowledge. Below is a list of features for individual types of instruments.

| Projects | ETF on shares | ETF for gold | CFDs | deposit gold | |

| Investment time horizon | medium, long | long | long | short, medium | very long |

| Financial leverage | NEVER | NEVER | NEVER | 1:20 | NEVER |

| Swap points | NEVER | NEVER | NEVER | YES | NEVER |

| Possibility of playing for declines | NEVER | NEVER | NEVER | NEVER | NEVER |

| Instrument fluency | high | high | high | very high | niska |

In the short term, CFDs perform best - they allow you to maximize your profit thanks to leverage, even when there is low volatility in the market. In addition, we have the option of betting on price drops. The downside may turn out to be swap points due to the holding of positions for the next day, however, in the case of gold, it should be noted that depending on the direction of our position, they can be both positive and negative. ETFs allow you to slightly diversify our gold-based portfolio, and at the same time they are characterized by high liquidity - a solution often chosen by novice investors. Those with a greater appetite for risk may choose to buy shares of mining companies - but it is worth considering the portfolio composition carefully and not choosing only one company.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy gold? Everything about investing in gold [Guide] how to buy gold](https://forexclub.pl/wp-content/uploads/2020/05/jak-kupic-zloto.jpg?v=1590137126)

![How to buy gold? Everything about investing in gold [Guide] Hossa moves to raw materials](https://forexclub.pl/wp-content/uploads/2020/05/Hossa-przenosi-sie%CC%A8-na-surowce-102x65.jpg?v=1589791092)

![How to buy gold? Everything about investing in gold [Guide] tickmill forex contest](https://forexclub.pl/wp-content/uploads/2020/05/tickmill-konkurs-forex-102x65.jpg?v=1589789306)

Leave a Response