How to buy Google Stock? Everything about investing in Alphabet Inc. [Guide]

Google shares have been extremely successful in the last decade. The result is a 700% increase in the price within 10 years. Google, one of the "Big Four" of American technology giants, is a company whose services and products we use every day, opening a computer or telephone. In 2015, the company changed its name to "Alphabet Inc." and under that name is now traded on the stock exchange. How to buy Google Stock? You can find out from the guide below.

Graph - Google Stock

Basic information about Google

| Logo |  |

| Name | Google (since 2015 Alphabet Inc.) |

| Headquarters | Mountainview, USA |

| creation date | 4 Września 1998 |

| Stock symbol | GOOG and GOOGL |

| trade | Internet, software |

| Capitalization | 1 trillion USD |

| Dividend | - |

| Web page | www.google.com |

Company creation history

Google was founded as a research project by two Stanford PhD students - Larry Page and Sergey Brin. PhD students developed an algorithm called PageRank. Instead of returning search results based on the number of repetitions of a given phrase on the page, the founders of Google developed an algorithm that analyzes the relationships between pages, evaluates the number and "importance" of pages that link to a given source. The company's mission as formulated by the founders was:

"To organize the world's information resources and make them universally available and useful".

After the company was founded in September 1998, PhD students were noticed and supported by four business angels. They received $ 100,000 for development from Andi Bechtolsheim, founder of Sun Microsystems, Jeff Bezos (current CEO Amazon), David Cheriton and Rama Shriram. In doing so, they raised a million dollars in funding, which allowed them to open an office in Menlo Park, California. In 1999, the company obtained another round of financing, worth $ 25 million, and moved its headquarters to Silicon Valley.

Origin of the name

A colleague from the academic room, Sean Anderson, came to the rescue when the founders were looking for a name for their BlackRub search engine. He suggested the name Googolplex. Googol is the name of the number 10100, i.e. 1 and 100 zeros. Such a large number was to refer to browsing and organizing huge amounts of information using the search engine being created. They liked the idea, but Larry Page entered the name of the number with an error and registered the domain google.com, not googol.com.

In 2006, the word "Google" has been added to the Oxford English Dictionary with the explanation "use Google to get information over the internet".

Selected Google products

Google search

Google's flagship and first product. Google currently indexes billions of websites and allows users to search for information on the internet using the google search engine. Google practically dominates the search engine market, leaving the competition far behind.

Google AdSense and Google Ads

Google generates the most revenue from advertising. The Google AdSense ad network accounts for nearly 46% of the company's revenue. Google AdSense ads appear in search results and on partner sites where Google shares its profits with owners of sites using Google AdSense. Anyone can use Google AdSense and earn money on their website from ads displayed by Google and advertise their services on Google's partner sites using Google Ads.

Google Analytics

Google Analytics is an invaluable source of knowledge about website traffic for bloggers and various company website owners. The company provides traffic statistics that allow you to accurately understand and understand the visitors of a given site.

Youtube service

Youtube was purchased by Google in 2006 for $ 1,65 billion in stocks. It is a video sharing and viewing platform.

Internet services

Google offers a number of web services for everyday use. Gmail is an email service, Google Calendar is an electronic calendar, Google Maps is for navigation, and Google Photos is a platform for storing and sharing photos. Google also provides services such as Google Drive, a web drive for storing all data and Google Docs for creating and sharing documents.

Browser and operating system

Google has also developed the Chrome web browser and the Chrome OS operating system that runs the company's hardware.

Electronic equipment

In 2010, Google began selling its own cell phones under the "Nexus" brand. In 2016, the company introduced a new brand of phones called "Pixel".

In 2011, Google launched its first Chromebook computer, and in 2013, Chromecast - a device that allows you to send content from Android phones and computers from Google products (Chrome, Google Docs, Google Photos, etc.) to the TV.

![]()

Technological infrastructure

Google invests large sums in its own global internet infrastructure. Google data centers are located in North and South America, Asia, and Europe. Google's latest investment in this area is to start in 2021 and will be located in Warsaw. Google (Alphabet) is also investing in private telecommunications cables located by the ocean. The first cable of this type to be laid is called Curie and connects California with Chile. It was put into use in 2019. Another investment of this type is the Dunant underwater pipe, which will connect the United States with France.

Google goes public

Google went public (IPO) in 2004. The company issued 19 shares at $ 605 apiece. Google has capitalized on $ 052 billion. In three years, the stock soared to $ 85, largely driven by rising advertising profits. The rise in stock prices was mainly driven by individual investors.

GOOG and GOOGL, C and A stocks

In 2015, Google (now Alphabet Inc.) split the shares into class C shares under the symbol GOOG and class A shares under the symbol GOOGL. Both share classes can be found listed on the US NASDAQ. Google shares are also listed on the Frankfurt Stock Exchange under the symbol GGQ1.

How to buy Google Stock (Alphabet)

To buy shares of Google (Alphabet), you can set up an account at a brokerage house and buy shares through it directly on the American stock exchange. We can also choose ETFs and stock contracts (CFDs).

ETF

For people who want to diversify their investment more, they may be a good choice ETFs containing shares of Google (Alphabet).

[XLC] Communication Services Select Sector SPDR Fund

-

- Annual fees: 0.13%

- Issuer: SPDR

ETF consisting of US companies from the telecommunications and media sectors, which are also located in the S&P 500 index. Facebook shares constitute nearly ¼ of the fund's assets (23.03%). Google Stock is divided into Alphabet Inc. class A (11.19%) and Alphabet Inc. class C (10.98%). The fund is characterized by low annual costs (0.13%) and quite high capitalization ($ 10 billion under management). The average daily spread is very low at just 0.02%.

[FCOM] Fidelity MSCI Communication Services Index ETF

-

- Annual fees: 0.08%

- Issuer: Fidelity

FCOM is a fund that invests in American companies from the telecommunications services sector. Companies are weighted according to market capitalization. Google holds 22% of the fund's assets, in the form of Alphabet Inc. shares. class A (11.07%) and Alphabet Inc. class C (11.26%). The fund boasts quite low spreads (0.07%), low annual fees (0.08%) and quite a large capitalization ($ 561 million under management).

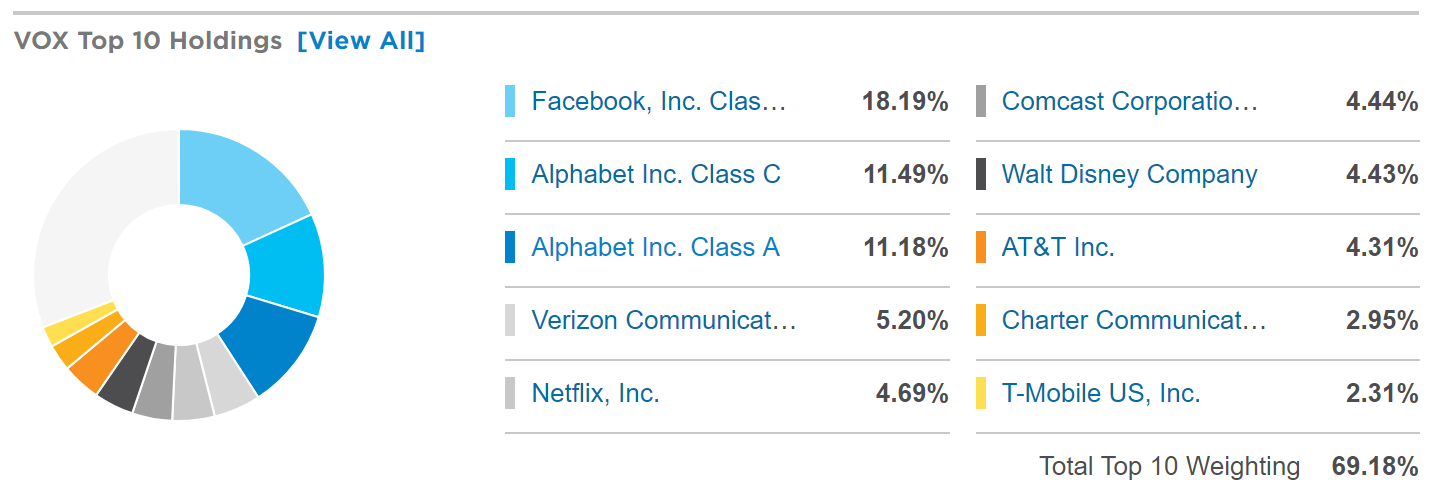

[VOX] Vanguard Communication Services ETF

-

- Annual fees: 0.10%

- Issuer: Vanguard

VOX is a competitor of the FCOM fund. It also invests in US telecommunications companies weighted by market capitalization. The fund includes not only technology companies such as Facebook or Google, but also traditional telecommunications companies. Google can be found in the fund as Alphabet Inc. shares. class A (11.18%) and Alphabet Inc. class C (11.49%). In addition, the fund includes companies such as Facebook, Verizon, Netflix. Walt Disney.

Stocks and CFDs

Another possibility is to buy shares or CFDs for Google shares. This can be done e.g. Forex brokers. The advantages of such a choice are direct and exclusive exposure to Google stocks and the possibility of investing with the use of leverage in the case of CFD instruments.

Where to buy Google Stock

Below is a list of offers of selected brokers offering both ETFs, CFDs on ETFs, stocks and CFDs on Google shares (Alphabet Inc.).

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Google shares, i.e. which instrument is better - traditional stocks or CFDs? It all depends on our expectations, strategy and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the short term, CFDs allow you to maximize your profit thanks to leverage, even if there is low volatility in the market and the fees are generally higher. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Google Stock? Everything about investing in Alphabet Inc. [Guide] how to buy google stock](https://forexclub.pl/wp-content/uploads/2020/09/jak-kupic-akcje-google.jpg?v=1600415313)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to buy Google Stock? Everything about investing in Alphabet Inc. [Guide] usa china trade war](https://forexclub.pl/wp-content/uploads/2020/09/usa-chiny-wojna-handlowa-102x65.jpg?v=1600346357)

![How to buy Google Stock? Everything about investing in Alphabet Inc. [Guide] dark clouds pound gbp](https://forexclub.pl/wp-content/uploads/2020/09/Ciemnie-chmury-nad-funtem-102x65.jpg?v=1600676216)

Leave a Response