How to buy Apple shares? Everything about investing in Apple [Guide]

How to buy Apple shares? Everything about investing in Apple

Apple is a company that produces computers and consumer electronics. In addition to computers, the company offers smartphones, smartwatches, tablets and music players. Software production is also a big branch of the company's activity. From operating systems (MacOs, iOS), through online sales platforms (App Store, iTunes) to video and music processing programs (Final Cut Pro, Garage Band). Apple belongs to the so-called technological big four, which includes American technology companies: Apple, Amazon, Google and Facebook.

In 2012, Apple was recognized as one of the strongest brands in the world according to Forbes. In 2018, Apple became the first company in history to capitalize on the US stock market to break the $ 1 trillion barrier.

Chart - Apple Stocks

Basic information about Apple

| Logo |  |

| Name | Apple Lossless Audio CODEC (ALAC), |

| Headquarters | Cupertino, California, USA |

| creation date | April 1 1976 |

| Stock symbol | AAPL |

| trade | consumer electronics, software |

| Capitalization (as of April 28) | 1,37 trillion USD |

| Dividend | 0,8% |

| Web page | www.apple.com |

Steve Jobs and Steve Woźniak - visionary and engineer

Apple was founded by combining the talents of Steve Jobs and Steve Woźniak. Steve Jobs was distinguished by an unusual sense of the market and a sense of design. It is thanks to him that Apple has created innovative products and set trends in the industry. He supervised the design aspects of equipment, setting the bar very high for engineers and designers to meet his expectations and vision regarding the appearance and operation of products. Jobs's charisma and entrepreneurial and sales skills were also significant.

Apple was founded by combining the talents of Steve Jobs and Steve Woźniak. Steve Jobs was distinguished by an unusual sense of the market and a sense of design. It is thanks to him that Apple has created innovative products and set trends in the industry. He supervised the design aspects of equipment, setting the bar very high for engineers and designers to meet his expectations and vision regarding the appearance and operation of products. Jobs's charisma and entrepreneurial and sales skills were also significant.

Steve Wozniak's contribution to the development of Apple, in turn, was the technical, engineering mind and skills that allowed him to design and construct the first Apple products - Apple I and Apple II personal computers. On the Apple II computer, Wozniak wrote the Basic programming language interpreter. Steve Woźniak left Apple in 1985.

Company creation history

Apple was founded in 1976 by Steve Jobs, Steve Wozniak and Ronald Wayne. At that time, personal computers were a product aimed at geeks and tech geeks. There were no "ready" computers on the market, the computer itself consisted of selected components. Steve Jobs and Steve Woźniak saw a niche to be developed on the market. They decided to sell ready-made, assembled computers right away.

First products and market conquest

Apple's first product was the Apple I computer. It was a personal computer designed and built from start to finish by Steve Wozniak. The Apple I was selling for $ 666,66 (about $ 3000 today, inflation adjusted).

The product gained recognition in the market, and Apple began to grow exponentially, doubling its revenue every 4 months for the first 5 years. Between 1977 and 1980, annual sales grew from $ 775 thousand to $ 118 million, giving averaged annual growth of 533%.

At that time, the successor to the first Apple II (premiere in 1977) and Apple III (premiere in 1980) was created.

Company development

By the end of the 70s, the company already employed a team of designers and a computer production line. Work began on a computer with a graphical user interface (Lisa, Macintosh) that would allow computers to become even more widespread. Until now, you had to be able to use the command line to operate the computer.

Admission to the stock exchange

On December 12, 1980, Apple went public with 4,6 million shares at $ 22 a share. By the end of the session, Apple's share price had risen to $ 29, generating over $ 100 million in revenue. At the same time, Apple has raised more capital than any other company during its IPO since its listing on the Ford Motor Company in 1956.

Apple products

Macintosh

The first Macintosh appeared on the market in 1984 and was met with a very enthusiastic reception. CNN television considered him a "masterpiece". It became the first personal computer to popularize the GUI, i.e. the graphical user interface instead of operating the computer through the command line.

Currently, Apple offers a whole range of computers from the Macintosh family. Among them we will find:

- iMac - desktop computer,

- Mac Mini - miniature desktop computer,

- MacBook Pro - a professional laptop addressed to professionals,

- Mac Pro - desktop computer for professional use,

- MacBook Air - the ultra-thin personal laptop.

iPod

Entering the market of portable music players was a milestone in Apple's development. The company practically dominated the market by launching in 2001 a very futuristic player with a huge (for those times) 5GB capacity - iPod. By 2015, more than 390 million different generations of iPods had been sold worldwide.

iTunes

When talking about the revolution on the music market, it is impossible to ignore the iTunes platform. By creating iTunes, Steve Jobs wanted to reduce the distance between artists and performers and their fans. The iTunes store was established in 2003 and was a truly revolutionary form of music distribution. With iTunes, customers could only pay for selected individual songs instead of buying entire albums. By 2007, iTunes controlled 80% of the world's Internet music sales. While the iPod has made Apple a leader in music player sales, iTunes has made Apple a leader in online music sales. Thanks to the successes in the popular music market, Apple was able to create its next breakthrough products - iPhone and iPad.

iPhone

Another revolutionary and futuristic Apple product that set trends in the mobile phone industry for many years was the iPhone. The premiere of the device took place in 2007. The goal was to create a device combining the functions of a mobile phone, entertainment platform and internet messenger. Innovative solutions for those times was the complete abandonment of the physical keyboard buttons in favor of a touch screen. The iPhone was a highly anticipated Apple product, a few days before the premiere giant queues lined up outside Apple showrooms. Many people wondered how to buy Apple shares in connection with the premiere of the iPhone, and after the premiere the price of shares increased by 15%, and then return to the level from before the premiere.

iPad

Another product setting trends in the industry for the coming years was the iPad - tablet. The premiere of the iPad took place in 2010, when the market of personal tablets was still in its infancy. iPad is a device that is a kind of entertainment center for the whole family. You can read newspapers, e-books, watch and take photos and videos, listen to music, write texts, play games and use most applications available on the iPhone.

MacOS and iOS operating systems

In addition to creating hardware, Apple also creates operating systems on which this equipment works. This is a big competitive advantage of the company, thanks to which the company can ensure stability, consistency and reliability of offered products. It is a determinant of the company that every element of the user's contact with Apple products is well thought-out and is one consistent experience.

Apple stores

Apple has put on sale via the Internet (since 1997) and through a network of its own stationary stores (since 2001). Apple stationary stores were distinguished by their architectural design and decor. The opening of physical sales outlets turned out to be a bull's-eye, sales grew rapidly, exceeding $ 1 billion in annual revenue in just three years.

The creation of GeniusBars was an original and innovative idea regarding Apple stores. These are the positions where users can receive technical advice, help and repair their Apple equipment. Apple has initiated the Today At Apple program since 2017. As part of this program, customers can receive free lessons in several thematic categories including, for example, programming for children or editing and video editing.

Apple name and logo

The sources of the name Apple are most often seen in the experiences of Steve Jobs in working on apple harvest in a Oregon farm. Another theory is the inspiration of Apple Corps and Apple Records record labels strongly associated with The Beatles, whose big fan was Steve Jobs.

Steve Wozniak in his book "Apple Confidential 2.0: The Definitive History of the World's Most Colorful Company" this is how the company name was created:

"We both tried to come up with another, more technically sounding name, Executek and Matrix Electronics, but after ten minutes of testing, we realized that none of them would sound as good as Apple Computer. "

Steve Jobs, in turn, comments years later on choosing the name Apple for his company:

"The name sounded funny, thrilling, but not overwhelming. "

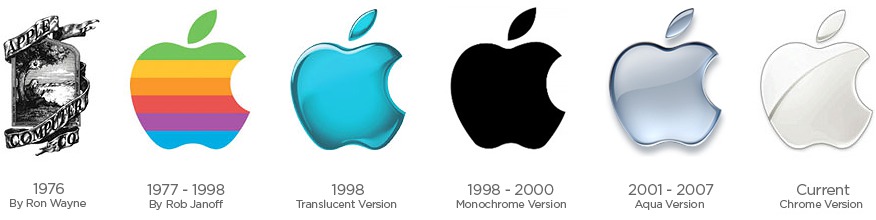

The following illustration shows the evolution of the Apple logo over time.

The first version of the logo depicting Isaac Newton sitting under an apple tree was designed by Ronald Wayne. This version was quickly abandoned due to the excessive amount of details and too intellectual nature.

The idea with a bitten apple comes from the similarity of the English words bite (bite) and byte (the smallest unit of computer memory).

The colorful version of the Apple logo was to symbolize the uniqueness of the Apple II computer, which was the first in the world to display colorful graphics on its screen.

Then the logo was simplified to a single-color version, because Steve Jobs decided that the rainbow logo would not fit into the new computer design.

How to buy Apple shares

To buy Apple shares, you can set up an account in a brokerage house and buy shares through it directly on the US Stock Exchange.

Buying is another option CFDs on Apple shares. This can be done e.g. with Forex brokers. The advantages of this choice are direct and exclusive exposure to Apple shares and the ability to invest using leverage.

For people who want to diversify their investment more, they may be a good choice ETFs containing Apple shares.

[VGT] Vanguard Information Technology ETF

-

- Annual fees: 0.11%

- Issuer: Vanguard

Vanguard is one of the most popular ETFs. It consists of American shares from the broadly understood IT sector. Despite the fact that it consists of over 425 assets, more than half of the fund's value falls on 10 companies. The percentage share of the 10 largest companies in the fund is presented in the table below. Apple is responsible for 19.09% of the fund's valuation. It is noteworthy that VGT pays an annual dividend of 1.18%.

| AAPL | Apple Inc | 19.09% |

| MSFT | Microsoft Corp. | 18.46% |

| V | Apple Inc | 4.29% |

| INTC | Intel Corp | 3.57% |

| MA | Mastercard Inc | 3.44% |

| NVDA | Nvidia Corp | 2.51% |

| Csco | Cisco Systems Inc | 2.51% |

| Adbe | Adobe Corp | 2.45% |

| PYPL | PayPal Holdings Inc. | 2.19% |

| CRM | Salesforce.Com Inc. | 2.07% |

[XLK] Technology Select Sector SPDR Fund

-

- Annual fees: 0.13%

- Issuer: State Street SPDR

ETF consisting of technology companies operating mainly in the IT services and telecommunications sectors. The largest percentage shares in the fund have Apple (20.33%) and Microsoft (22.01%). The fund pays dividends of 1.28% annually.

| MSFT | Microsoft Corp. | 22.01% |

| AAPL | Apple Inc | 20.33% |

| V | Visa Inc. | 4.85% |

| INTC | Intel Corp | 4.04% |

| MA | Mastercard Inc | 3.86% |

| NVDA | NVIDIA Corp. | 3.05% |

| Csco | Cisco Systems Inc | 2.84% |

| Adbe | Adobe Inc. | 2.78% |

| PYPL | PayPal Holdings Inc. | 2.61% |

| CRM | Salesforce.Com Inc. | 2.50% |

[FTEC] Fidelity MSCI Information Technology Index ETF

- Annual fees: 0.08%

- Issuer: Fidelity

FTEC is one of the cheapest technological ETFs, despite that it enjoys less popularity than Vanguard ETFs (VGT) or State Street (XLK). FTEC pays an annual dividend of 1.14%. The largest companies in the fund are Apple (19.03%) and Microsoft (18.40%). Below is the percentage composition of the ten largest companies in FTEC.

| AAPL | Apple Inc | 19.03% |

| MSFT | Microsoft Corp. | 18.40% |

| V | Visa Inc. | 4.27% |

| INTC | Intel Corp | 3.56% |

| MA | Mastercard Inc | 3.43% |

| NVDA | NVIDIA Corp. | 2.54% |

| Csco | Cisco Systems Inc | 2.50% |

| Adbe | Adobe Inc. | 2.44% |

| PYPL | PayPal Holdings Inc. | 2.18% |

| CRM | Salesforce.Com Inc. | 2.07% |

Where and how to buy Apple shares

Below is a list of selected brokers offering ETFs, CFDs on ETFs, shares and CFDs on Apple shares.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Apple shares, i.e. which instrument is better - traditional stocks or CFDs? It all depends on our expectations, strategy and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the short term, CFDs allow you to maximize your profit thanks to leverage, even if there is low volatility in the market and the fees are generally higher. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Apple shares? Everything about investing in Apple [Guide] how to buy apple shares](https://forexclub.pl/wp-content/uploads/2020/05/jak-kupic-akcje-apple-1.jpg?v=1589361978)

![How to buy Apple shares? Everything about investing in Apple [Guide] trading on forex losses](https://forexclub.pl/wp-content/uploads/2020/05/trading-na-foreksie-straty-102x65.jpg?v=1588661510)

![How to buy Apple shares? Everything about investing in Apple [Guide] abbc coin](https://forexclub.pl/wp-content/uploads/2020/05/abbc-coin-102x65.jpg?v=1588754577)