How to buy Amazon shares? Everything about investing in Amazon [Guide]

How to buy Amazon shares? Everything about investing in Amazon

Initially, Amazon was an online bookstore. Currently, it is the largest multi-sector online store in the world. Amazon is also active in other industries - it produces its own e-book readers under the trade name Kindle, Amazon Fire tablets, has developed a virtual smart assistant - Amazon Alexa, has its own VOD platform - Amazon Prime, which is the main competitor Netflix globally. In 2019, Amazon took 4th place in the ranking of the world's largest trading companies with revenues of $ 118 billion.

Chart - Amazon Stock

Basic information about Amazon

| Logo | |

| Name | Amazon.com |

| Headquarters | Seattle, USA |

| creation date | July 5 1994 |

| Stock symbol | AMZN |

| trade | consumer electronics, e-commerce |

| Capitalization | 1,2 trillion USD |

| Dividend | - |

| Web page | www.amazon.com |

Founder - Jeff Bezos

Jeff Bezos has been recognized for 3 years in a row (2018, 2019 and 2020) the richest man in the world according to the Bloomberg ranking. His assets are estimated at $ 151 billion, most of which are Amazon.com shares.

Jeff Bezos has been recognized for 3 years in a row (2018, 2019 and 2020) the richest man in the world according to the Bloomberg ranking. His assets are estimated at $ 151 billion, most of which are Amazon.com shares.

Before he founded his company Amazon.com, he worked as a financial analyst.

In addition to Amazon.com, Jeff Bezos also owns the Blue Origin company, which deals with the space industry and The Washington Post, which he bought in 2013.

Company creation history

Amazon.com began in 1994 as an online bookstore. Within a few years, it expanded its range to include DVDs, computer and electronic equipment, furniture, toys and food products.

In 2002, the company began to provide Internet services under the Amazon Web Services brand. Initially, these were mainly traffic statistics for marketers and programmers. Then Amazon introduced the Elastic Compute Cloud services, i.e. offering cloud computing power and Simple Storage Services, offering space for storing data over the internet.

Amazon distribution network

Amazon began working on a distribution network in 1997, when two logistics centers were established in Seattle and in New Castle in Delaware. Currently, Amazon has 100 distribution centers with over 125,000 employees.

There are 7 Amazon logistics centers in Poland employing 14,000 people.

Selected Amazon products

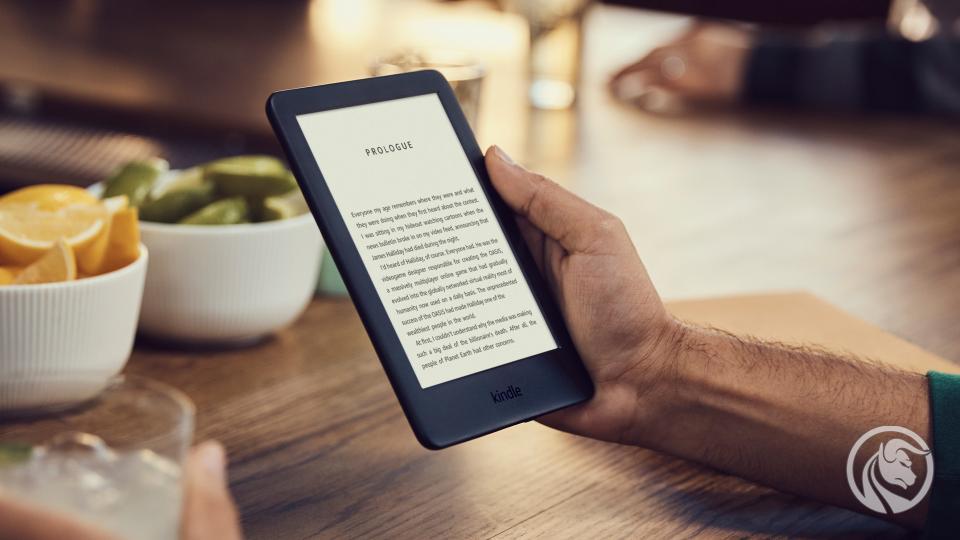

Kindle

Kindle is a device for reading e-books and other media (newspapers, articles) using the E Ink technology. The first KIndle was introduced to the US market in 2007. Kindle is the most popular e-book reader. In Poland, in 2011 Kindle readers accounted for 60% of all e-book readers.

Amazon Web Services (AWS)

Amazon Web Services is an Amazon subsidiary focused on providing computer services. The most popular of them include sharing computing power in the cloud, providing disk space for data storage. The services are based on server farms around the world managed by AWS. Fees for services are charged in the "pay-as-you-go" model, i.e. only for services and resources used. Currently, Amazon is also working on Internet of Things services.

Amazon Prime

Amazon Prime is a paid subscription program that gives Amazon customers access to premium services. These services include free fast delivery (1 or 2 business days), access to VOD services and music. In January 2020, Amazon Prime paid 150 million subscribers from around the world.

Origin of the name

Initially, Jeff Bezos's company was to be called cadaver. However, because of too much resemblance to the English word cadaver (corpse), he finally settled on Amazon. The name of the company refers to the great river of South America - Amazon. The name was chosen by Jeff Bezos to reflect the planned scale of the flow of goods through his online store.

How to buy Amazon shares

To buy Amazon shares, you can create an account in a brokerage house and buy shares through it directly on the US Stock Exchange.

Buying is another option CFDs on Amazon shares. This can be done e.g. with Forex brokers. The advantages of this choice are direct and exclusive exposure to Amazon shares and the ability to invest using leverage.

For people who want to diversify their investment more, they may be a good choice ETFs containing Amazon shares.

[FDIS] Fidelity MSCI Consumer Discretionary Index ETF

-

- Annual fees: 0.08%

- Issuer: Fidelity

| AMZN | Amazon.com Inc | 33,20% |

| HD | Home Depot Inc. | 8.53% |

| MCD | McDonald's Corp | 4.28% |

| NKE | Nike inc | 3.54% |

| TSLA | Tesla inc | 3.53% |

| SBUX | Starbucks corp | 2.86% |

| LOW | Lowe's Companies Inc | 2.86% |

| TGT | Target Corp. | 2.00% |

| BKNGMore | Booking Holdings Inc. | 1.88% |

| TJX | TJX Companies Inc. | 1.86% |

[VCR] Vanguard Consumer Discretionary ETF

-

- Annual fees: 0.10%

- Issuer: Vanguard

ETF offering exposure to the luxury goods sector on the US market. The fund includes almost 400 companies from the industry. The table below presents the percentage share of the 10 largest of them. Amazon accounts for nearly 30% of the fund's valuation.

| AMZN | Amazon.com Inc | 28.91% |

| HD | Home Depot Inc. | 8.73% |

| MCD | McDonald's Corp | 4.38% |

| NKE | Nike inc | 3.62% |

| TSLA | Tesla inc | 3.61% |

| LOW | Lowe's Companies Inc | 3.00% |

| SBUX | Starbucks corp | 2.98% |

| TGT | Target Corp. | 2.06% |

| BKNGMore | Booking Holdings Inc. | 1.98% |

| TJX | TJX Companies Inc. | 1.91% |

[XLY] Consumer Discretionary Select Sector SPDR Fund

- Annual fees: 0.13%

- Issuer: State Street SPDR

One of the better ETFs associating companies from the luxury goods industry. It is characterized by high liquidity, market depth and low management fees. Amazon has the largest share in the fund (almost 25%). Below 10 largest companies by percentage share in the described ETF:

| AMZN | Amazon.com Inc | 24.72% |

| HD | Home Depot Inc. | 13.11% |

| MCD | McDonald's Corp | 6.57% |

| NKE | Nike inc | 5.44% |

| SBUX | Starbucks corp | 4.40% |

| LOW | Lowe's Companies Inc | 4.38% |

| TGT | Target Corp. | 3.08% |

| BKNGMore | Booking Holdings Inc. | 2.90% |

| TJX | TJX Companies Inc. | 2.87% |

| DG | Dollar general corp | 2.33% |

Where and how to buy Amazon shares

Below is a list of offers from selected brokers offering ETFs, CFDs on ETFs, shares and CFDs on Amazon shares.

| Broker |  |

|

|

| End | Poland | Denmark | Poland |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 1 - stocks + CFDs on stocks 5 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Amazon stocks, i.e. which instrument is better - traditional stocks or CFDs? It all depends on our expectations, strategy and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the short term, CFDs allow you to maximize your profit thanks to leverage, even if there is low volatility in the market and the fees are generally higher. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Amazon shares? Everything about investing in Amazon [Guide] how to buy amazon shares](https://forexclub.pl/wp-content/uploads/2020/05/jak-kupic-akcje-amazon.jpg?v=1589800135)

![How to buy Amazon shares? Everything about investing in Amazon [Guide] minsky moment](https://forexclub.pl/wp-content/uploads/2020/05/minsky-moment-102x65.jpg?v=1588922829)

![How to buy Amazon shares? Everything about investing in Amazon [Guide] cryptocurrency verge](https://forexclub.pl/wp-content/uploads/2020/05/verge-kryptowaluta-102x65.jpg?v=1589003667)