How to invest in Turkey? High inflation, low rates and a weak currency [Guide]

Turkey appears quite often in the economic press. No wonder, it is one of the largest economies in the world. According to purchasing power parity, the country ranks 11th. For comparison, Poland is on the 22nd place. Another reason why the market does not forget about this country is “unconventional” anti-inflation policy. According to the leader of Turkey Recep Erdogan – an increase in interest rates causes an increase in inflation. For this reason, the country maintains very low real interest rates. In February 2023, the Turkish central bank decided to cut the interest rate from 9% to 8,5%. It is worth mentioning that inflation in January 2023 was over 50%. Therefore real interest rates in Turkey are -40%. Problems with inflation meant that in the perspective of the last decade, the exchange rate of the US dollar to the Turkish lira (USD / TRY) increased by more than 900%. The Turkish stock exchange also had problems for many years. The dollar-denominated index traded in a strong downtrend and then sideways from 2013 to 2021. Of course, the exchange rate of the main indices expressed in Turkish lira rose, but did not keep up with the loss of the Turkish lira.

USD/TRY chart, MN interval. Source: xNUMX XTB.

In early February 2023, Turkey was hit by a major earthquake, which brought the country back into the media. The number of victims exceeded 40 people, while more than 000 million were made homeless. This caused a little panic in the Turkish market. As a result, the exchange decided to suspend trading so that investors could cool down a bit. The stock market has been closed for the entire week. It was the first such incident in more than two decades. When the market reopened, there was no sign of the panic.

Turkey is a country between Europe and Asia

Turkey is one of the “bridges” that connect Europe and Asia. The history of the country was inextricably linked with the history of Europe. Turkey's relations with Europe have been very turbulent. Periods of war interrupted times of trade and cultural exchange. Tulips came from Turkey to Europe. For centuries, however, Christian Europe trembled before the might of the Ottoman Empire. Since the XNUMXth century, the country has been undergoing phases of "closing" and "opening" to the Old Continent. It was similar with modernization when periods of reform were followed by times of stagnation. A new period in Turkish history began with Ataturk's reforms. As a result of his reforms, Turkey ceased to be "sick man of Europe" and became a secular country focused on the modernization of the economy.

Today, Turkey is one of the largest economies in the world. In terms of trade, it is oriented towards the countries of the European Union. The largest destinations for Turkish exports are Germany (9%), the United Kingdom (7%), the United States (6%) and Italy (5%). Historically, the most important import directions were: Germany, China, Russia, Italy and the United States.

The Turkish economy is very diversified. This can be seen in the structure of exports. They dominate there clothing, appliances, auto parts and cars and chemical products. Of course, a significant part of exports are also products with lower added value, such as agricultural, metallurgical products or raw materials.

Turkish capital market

Thinking about investing on the Turkish stock exchange, it is impossible to ignore the local stock exchange. Boris Istanbul (in brief ARE) is the country's main securities trading market. The exchange was established in 2013 as a result of a merger Istanbul Stock Exchange (tur. IMKB), Istanbul Gold Exchange (tur: IAB) and Derivatives Exchange of Turkey (turn: VOB). The shareholders of Borsa Istanbul are:

- government of Turkey: 49%

- IMKB: 41%

- VOV: 5%

- IMKB shareholders: 4%

- brokers operating on IMKB: 1%

- IAB members: 0,3%

- others: 0,7%

It should be added that Borsa Istanbul is a member of the World Federation of Exchanges (WEF). In addition, the Turkish stock exchange is accredited by ESMA (European Securities and Markets Authority), which Forex traders associate primarily with many restrictions (e.g. lowering the allowable leverage) imposed on CFD instruments in the European Union a few years ago. Additionally, Borsa Istanbul is also a member of the Exchanges Forum of the Organization of Islamic Cooperation. Moreover, it is one of the few exchanges that is a member London Bullion Market Association (LBMA) and World Federation of Diamond Bourses (WFDB).

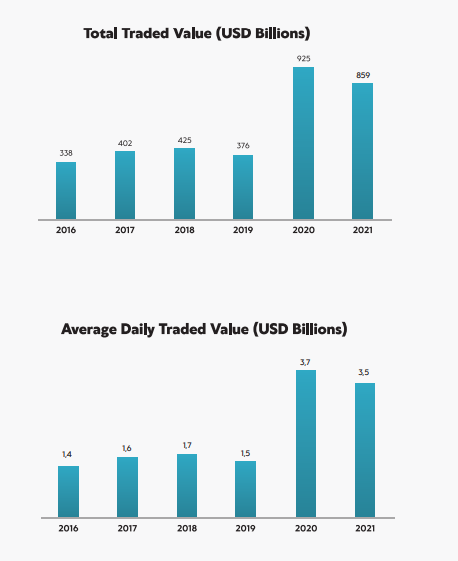

Source: Borsa Istanbul

The figure above shows a significant increase in turnover on the Istanbul Stock Exchange. The reason is the inflow of capital from abroad and the escape of cash by the Turks. One of the channels of “capital flight” is the Turkish stock exchange. It is also worth mentioning that some companies listed on the stock exchange are beneficiaries of the decline in the strength of the Turkish lira. This makes exports more and more profitable and boosts operating profitability. The influx of capital caused the stock exchange to gain more than 2022% in 100 (already converted to dollars!). However, it is worth not only focusing on the last year, but also looking at how far the Istanbul Stock Exchange has come to become the leading market in Asia.

It is also worth noting that it is the sentiment of foreign investors that is of great importance to the Turkish stock market. According to Borsa Istanbul data, in 2021 about half free float (in terms of value) was held by foreign investors.

The development of the stock exchange

The beginnings of organized securities trading in Turkey date back to the 1866th century. In 1853, the first organized trading place was established in Istanbul. Its purpose was to refinance foreign debt incurred during the Crimean War of 1856-1873. Seven years later, in XNUMX, the place of trading gained legal grounds by creating the Dersaadet Securities Exchange. This is how dynamic development began Bankalar Caddesi, which became the financial heart of the Ottoman Empire. It is worth mentioning that Turkey was then called "sick man of Europe", because it began to lose distance to the increasingly dynamically developing European economies. All that remains of the Empire's former glory is history. After World War I, the Empire disintegrated. Turkey was saved only by Ataturk, who bet on modernization. The financial market developed dynamically in the following years. Investors from Europe (just like just before the Great War) were attracted by the opportunity for higher rates of return.

From 1929 to 1989: changing fortunes

In 1929, already in the Republic of Turkey, the operation of the stock exchange was reorganized to suit the new times. Also renamed to “Istanbul Securities and Foreign Exchange Bourse”. Despite the reform, the following years were difficult for the Turkish stock market. She has been strongly experienced by Great Depression and the subsequent World War II. The Cold War made Turkey part of the “western” camp. Over the next decades, the development of the exchange continued. However, the situation accelerated significantly in the 80s with the next wave liberalization of the economy.

In 1981, a new law was introduced regarding the regulation of the capital market. Thanks to it, foreign investors could start investments on the Bosphorus in an easier way. In the following years, further regulations regarding trading in shares, bonds and other financial instruments were introduced. In 1985, the Istanbul Stock Exchange was established, which became the only place for trading securities in Turkey.

1990 - now

Recep Tayyip Erdoğan, President of Turkey.

The following years saw the dynamic development of both the Turkish economy and the stock exchange. The liberalization of the market and the country's desire to join the European Union helped. The enthusiasm for joining the community cooled down as the formalities and requirements of the European Community piled up. Since 1981, the stability of the Turkish financial market has been guarded by the CMB, i.e Capital Markets Board of Turkiye. Borsa Istanbul operates in four markets: equities, debt instruments, derivatives and precious metals and diamonds.

Turkey is one of the leading emerging markets in Europe. Before the Russian invasion of Ukraine, if an investor wanted to gain exposure to the countries of “eastern Europe”, there were practically two markets to choose from: Rosyjski i Turecki. However, the non-standard economic and monetary policy of the Turkish government somewhat dampened the enthusiasm of investors. For a period of time, Turkey, instead of being the gateway to the Levant, became again "sick man of Europe". The potential that is in this country was suppressed by very high inflation. This was evident in the rising USD/TRY exchange rate. The fall in the value of the Turkish lira made investors reluctant to invest in a macroeconomically unstable environment. The years 2013-2018 were very difficult for foreign investors with exposure to the Turkish market. In turn, from mid-2018 to mid-2022, there was a long-term sideways trend (looking at the dollar valuation). Only the second half of 2022 brought an influx of capital to the market, which resulted in a sharp increase in the value of the index. This concerned both the one expressed in Turkish lira and the one denominated in dollars.

How to invest in Turkey?

It is worth introducing the names of the leading indices on the Turkish market. These are:

- BIST 30 it is an index of the 30 largest and most liquid companies listed on the Istanbul Stock Exchange in the Stars Market group. Very often it is BIST 30 that is the benchmark for foreign investors. This is due to the fact that these companies provide adequate liquidity for the largest foreign players on the stock market.

- BIST 50 includes all companies belonging to BIST 30 and the next 20 leaders in terms of capitalization and turnover. Also in this case, the companies are taken from the Stars Market.

- BIST 100 it is the most popular index on the Turkish stock market. It includes the 100 largest and most liquid listed companies in Borsa Istanbul. Like BIST 30, it is often used as a benchmark for many ETFs or funds actively investing in Turkey.

An investor who wants to have exposure to the Turkish market in his portfolio may choose the following solutions:

- buy Turkish stocks directly on the market,

- take advantage of derivatives traded on the exchange in Turkey,

- take advantage CFD on the BIST index,

- buy a fund actively investing in the Turkish market,

- buy ETFs giving exposure to the Turkish market.

Projects

Buying stocks directly from the market is not an easy solution. First, you need to find a broker that allows you to trade Turkish companies directly from the Istanbul Stock Exchange. Another option is to look for Turkish companies listed on major stock exchanges in North America or Europe. If an investor finds access to this market, it is not the end of the road. When selecting companies individually, it is worth considering what strategy to develop (strategy for entering and exiting positions). Individual selection of shares, however, requires knowledge of the market, which can be a problem for novice investors. Another problem is that by investing directly in Turkey, the investor is exposed to currency risk, which must be neutralized in some way (e.g. through hedging transactions).

Futures contracts

Another possible solution is to invest in futures or options available on the Turkish market. The advantage of such a solution is the possibility of using financial leverage. The disadvantages are similar to the previous point. The need for a broker with access to the Turkish market. Additionally, investing in derivatives is not always appropriate for long-term investors due to rollover costs.

CFD instruments

Another way to gain exposure to the Turkish market is to take advantage of the CFD offer. The advantage is the possibility of using financial leverage and relatively easy access to the Turkish market. The disadvantage is the high cost (spread + swap points).

Investment funds

Another idea is the possibility of taking advantage of the offer of funds with exposure to the Turkish market. The advantage is that the investor will not have to spend time investing on their own. The disadvantage of this solution is usually high management costs, which do not guarantee a higher rate of return than investments in the index itself.

ETFs

Another solution is to use ETFs that give exposure to this market segment. The advantage is that you do not have to choose the companies yourself and the fund will do it for you. Another advantage is usually quite low management fees. The disadvantage, however, is that the achieved rate of return will be worse than the benchmark in the long term (including management costs).

Forex brokers offering ETFs and stocks

How to invest in Turkey? As we mentioned, finding access to the Turkish market is not an easy task. However, an increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

What are the big ETFs with exposure to Turkey?

There is only one significant ETF with exposure to Turkey. He is iShares MSCI Turkey ETF. The benchmark for the fund is the MSCI Turkey IMI 25-50 index. The index developed by MSCI focuses on the largest companies from the Turkish market. This index is dominated by companies from the industrial and material sectors. Both components account for about half of the index value. iShares MSCI Turkey ETF is a small fund. Assets under management amount to only $315 million. It is also worth noting that this is not a cheap ETF. Annual management costs are 0,57%. The largest ETF components include companies such as:

- Turkiye Petrol Rafinerileri AS – 6,7%

- Turkiye Sise ve Cam Fabrikalari AS - 5,7%

- BIM Birlesik Magazalar AS – 5,5%

- Blanket Holding AS - 5,2%

- Turk Hava Yollari AO- 5,1%

iShares MSCI Turkey ETF Chart, MN interval. Source: xNUMX XTB.

Summation

Turkey is certainly one of the largest economies in the world, and the stock exchange there has ambitions to become a key player at least in the region of "Nearer Asia". There is still a threat to investing in the country high inflation and very weak currency. It is also worth remembering that a high return in 2022 is not a guarantee of achieving similar results in subsequent years. However, it is worth remembering that on the Turkish market you can find interesting companies with a business model diversified in terms of products and geographical areas. However, it is worth looking at the behavior of such indices as BIST 30, BIST 50 and BIST 100.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Turkey? High inflation, low rates and a weak currency [Guide] how to invest in turkey](https://forexclub.pl/wp-content/uploads/2023/03/jak-inwestowac-w-turcji.jpg?v=1677665541)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to invest in Turkey? High inflation, low rates and a weak currency [Guide] Record profits of PKN Orlen](https://forexclub.pl/wp-content/uploads/2023/03/Rekordowe-zyski-PKN-Orlen-102x65.jpg)

![How to invest in Turkey? High inflation, low rates and a weak currency [Guide] nvidia chatgpt](https://forexclub.pl/wp-content/uploads/2023/03/nvidia-chatgpt-102x65.jpg?v=1677679681)