How to invest in the real estate market through stocks and ETFs [Guide]

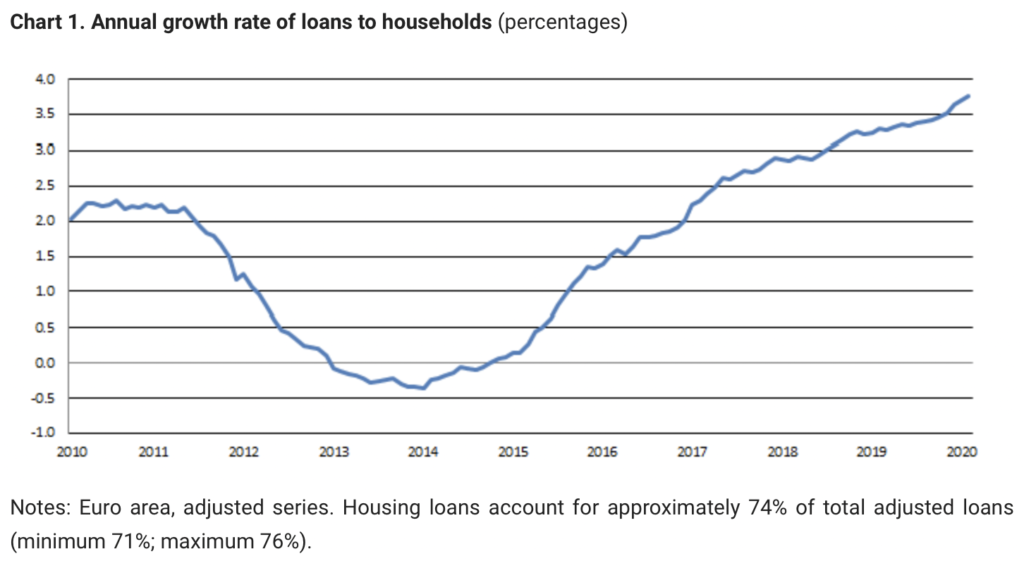

In a period of low interest rates, investing in real estate was an alternative for those seeking "Safe" profits with a yield higher than that of bonds. Lured by low financing costs, investors in real estate for rent benefited from the favorable spread between the loan interest rate and the rental profitability. This has encouraged some property owners to scale their rental business. They used the surplus generated by the flats to cover the interest and capital installments of subsequent flats taken for credit. While in some countries it is possible to take a loan for a fixed interest rate, for example in Poland or Finland loans with a variable interest rate dominate. Below is a breakdown of the interest rate on variable-rate mortgage loans in the Eurozone countries.

Source: Euro-area-statistics.org

In the event of an increase in interest rates, floating rate loans will have higher debt servicing costs. This, in turn, would lower the difference between the interest cost and the rental profitability.

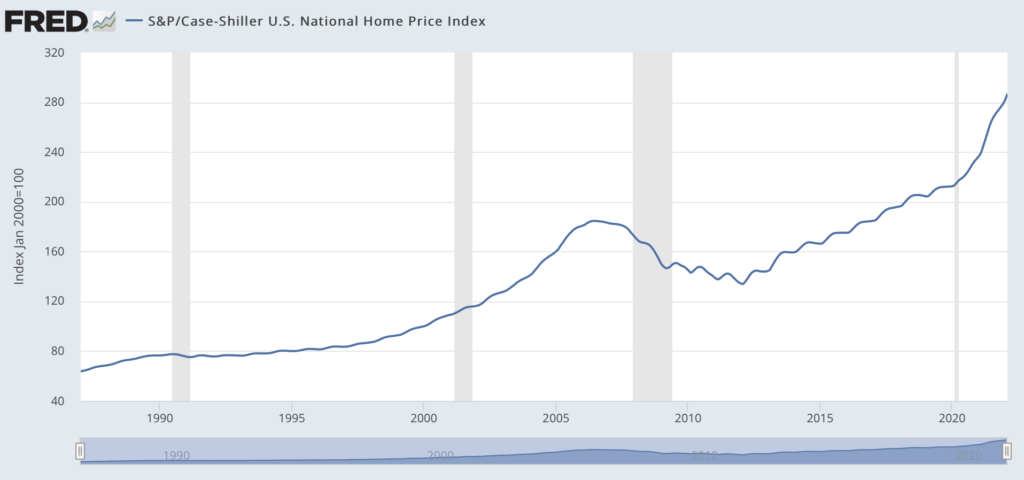

Cheap financing has allowed people to take out mortgage loans at historically low financing costs. The increase in demand caused real estate prices to rise. As a result, the net worth of property owners grew. Real estate developers also took advantage of the low interest rates. They could finance investments cheaply. At the same time, flats were selling on the stump, due to high demand (which also stimulated the low cost of debt). Thanks to the strong demand for apartments, developers were able to pass on the rising costs of materials and workers onto property buyers. Below is a chart showing the US housing market index. As you can see, in the years 2020 - 2022 there was an acceleration in price growth. Of course, nothing can grow indefinitely, as investors in the US real estate market found out in 2007. In many cases, they had to wait over a decade for nominal prices to return to pre-subprime levels.

Source: Fred.stlouisfed.org

Investing for rent has its drawbacks

First, the liquidity of investments is much smaller than first-class bonds and stocks. The second problem is building a well-diversified real estate portfolio. It's hard to build large enough to have real estate in different countries and on opposite continents. In addition, the problem is the different legal order, which may protect the owner of real estate in some countries and the protection of tenants in another. For example, in Spain, the law supports illegal tenants, the so-called squats. In 2020, there were over 120 illegally occupied flats and houses in this country. What is the reason for this phenomenon? Spanish law makes it much more difficult to evict illegal tenants if you haven't evicted them within two days.

However, the real estate market is not only about apartments and houses for rent. You can also invest in industrial properties, warehouses, hotels, office buildings and healthcare buildings. It is also worth having a diversified real estate portfolio for these investments. The creation of such a portfolio is, in principle, impossible for an investor with limited capital to build. The solution is to take advantage of ETFs giving exposure to many segments of the real estate market. One of the most famous is Vanguard Real Estate ETFwhich gives you exposure to a truly diversified real estate portfolio.

According to the data published on the Vanguard website, the fund's assets are mainly invested in:

- Specialized REITs - 35,6%,

- Residential REITs - 15,3%,

- Industrial REITs - 12,6%

- Retail REITs - 10,5%,

- Health Care REITs - 8,3%.

The largest components of the index in the portfolio are:

- Prologis,

- American Tower Corporation,

- Crown Castle International,

- equinix,

- Public Storage,

- Simon Property Group,

- welltower,

- Digital Realty Trust.

CHECK: Vanguard - One of the "big three" of the ETF market

Prologue

The origins of parts of the company date back to 1983, when Hamid Moghadam and Dough Abbey founded Abbey, Moghadam and Company (later AMB). The established company was initially focused on investing in office buildings and shopping centers. In 1987 she quit investing in office buildings. Instead, she began to focus on the industrial and commercial real estate market. In 1997, the company made its debut on the stock exchange. In 2011, the company merged with ProLogis (AMB bought ProLogis for $ 8,7 billion and changed its name to Prologis). It is currently one of the components of the S&P 500 index. Prologis owns, manages and develops a portfolio of logistics real estate. It currently operates in 19 countries and has approximately $ 104 billion in assets (both owned and managed). The assets include more than 4 buildings with an area of approximately 700 million square feet. At the end of 1, the company has approximately 000 customers. Most of the revenues (2021-5%) are obtained by the company from rents paid by companies for renting logistics real estate (e.g. warehouses).

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 2 804 | 3 331 | 4 439 | 4 759 |

| operational profit | 847 | 992 | 1 402 | 1 617 |

| operating margin | 30,21% | 29,78% | 31,58% | 33,98% |

| net profit | 1 693 | 1 614 | 1 515 | 3 015 |

Prologis chart, interval W1. Source: xNUMX XTB.

American Tower Corporation

This is another REIT listed on the New York Stock Exchange. The American Tower is also one of the components the S&P 500 index. The company owns and operates communications infrastructure in the United States and several countries. The company was founded in 1995 as part of American Radio Systems. In 1998, ARS merged with CBS Corporation, followed by a spin-off from which the American Tower was spun off. One of the company's main businesses is the acquisition of cell towersthat receive and send signals from cell phones. Following the acquisition, the American Tower Corporation makes the antenna site available to mobile phone owners. At the end of 2021, the company had 221 stations of this type, the most of them in the United States (over 000). The more the company manages to find more tenants for one tower, the greater the profitability of such a facility. The company boasts that the ROI (Return on Investments) of the tower with 43 tenants is over 000%, compared with the two - around 3%.

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 7 440 | 7 580 | 8 042 | 9 357 |

| operational profit | 1 905 | 2 688 | 3 128 | 3 328 |

| operating margin | 25,60% | 35,46% | 38,90% | 35,57% |

| net profit | 1 227 | 1 888 | 1 691 | 2 568 |

American Tower Corporation chart, interval W1. Source: xNUMX XTB.

Crown Castle International

It is a company similar to the American Tower Corporation. It also has cell stations that are then monetized through rental of antenna sites to mobile operators. At the end of 2021, Crown Castle International had approximately 40 such towers. In addition, the company also has approximately 000 miles of fiber optic lines. Additionally, they have about 80 small relay stations placed, for example, on street lamps. Smaller stations are expected to meet the greater consumption of data by smartphones. Over the years 000-115, the company has allocated approximately $ 000 billion on investments (including the acquisition of fiber optic towers and lines and maintenance CAPEX). Most of the funds came from generated positive operating flows ($ 2011 billion). In order to meet the ambitious goals, the company had to use debt, which currently exceeds $ 2021 billion. Most of the debt is at a fixed rate, which gives you more peace of mind in an environment of rising interest rates. It is worth mentioning that, like all of them profitable REITs, Crown Castle International is a dividend companywhich in the years 2014-2021 increased the paid dividend per share by an average of 9% per year.

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 5 423 | 5 763 | 5 840 | 6 340 |

| operational profit | 1 485 | 1 591 | 1 947 | 2 023 |

| operating margin | 27,38% | 27,61% | 33,33% | 31,91% |

| net profit | 558 | 747 | 999 | 1 096 |

Crown Castle International chart, interval W1. Source: xNUMX XTB.

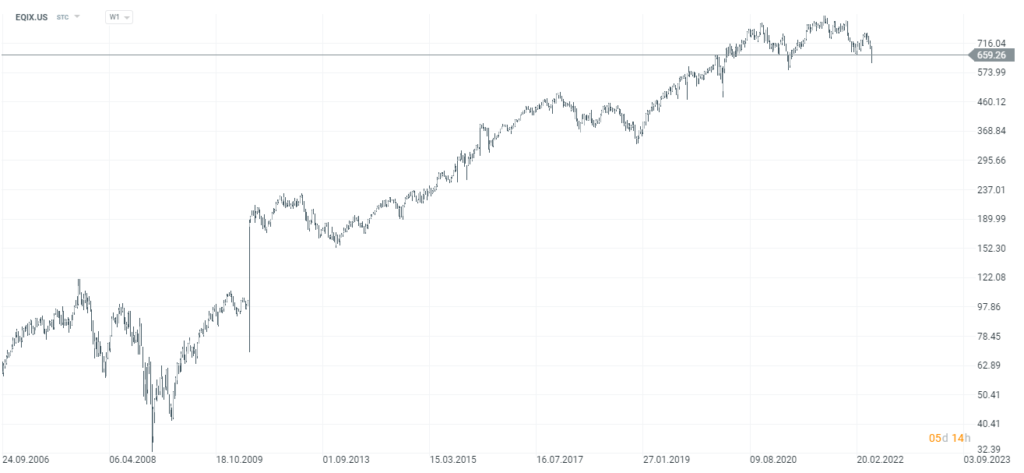

equinix

This is another REIT that is a component of the S&P 500 Index. Equinix takes care of acquisition, construction and management of data centers. It is in data centers that data that is "in the cloud" is stored. About 36% of the company's revenues come from the cloud segment. It should be noted that Equinix is responsible for approximately 42% of the "space" provided by AWS (ie Hyperscale Cloud Edge Nodes). In the case of Azure, this indicator is at the level of 43%, and Google Cloud is 44%. Of course, space in data centers is also made available to companies that need external servers with very high reliability. About 60% of revenues are generated from proprietary data centers. In turn, 25% of revenues come from data centers rented for a period longer than 15 years. In order to increase revenues, a company must first fill the space of its data centers and build new ones. New construction projects require debt financing. For this reason, at the end of Q2022 12, the company had around $ 6bn in interest debt (only 2018% of debt has a floating rate). Equinix is a dividend company that increased its dividend per share by over 2021% between 25 and XNUMX.

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 5 072 | 5 562 | 5 999 | 6 636 |

| operational profit | 1 006 | 1 166 | 1 115 | 1 120 |

| operating margin | 19,83% | 20,96% | 18,59% | 16,88% |

| net profit | 365 | 507 | 370 | 500 |

Equinix chart, interval W1. Source: xNUMX XTB.

Public storage

Another REIT and another component of the S&P 500 index. The company's history dates back to 1972, when B. Wayne Hughes began to develop concept of warehouses for storing things by people. The company currently employs 5 people and has more than 600 facilities located in 2 states. Over 600 million people use the company's services. The company is the market leader and is trying to increase its advantage over smaller competitors. Over the past 39 years, the company has increased its warehouse space by 1,6 million square feet. The largest competitor at the same time increased the area by 15 million square feet. The company has caught the trend of using the so-called "Self storage" in the United States. In 90, only 52% of Americans used the services, now this percentage has increased to 1987%. The most important markets for the company are Los Angeles, San Francisco and New York. Since 3, the company has spent over $ 9 billion on investments. Of this, over 2010% for acquisitions, and 6% for the organic expansion of the number of stores.

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 2 754 | 2 847 | 2 915 | 3 416 |

| operational profit | 1 412 | 1 465 | 1 411 | 1 681 |

| operating margin | 51,27% | 51,46% | 48,40% | 49,21% |

| net profit | 1 489 | 1 273 | 1 089 | 1 732 |

Public Storage Chart, interval W1. Source: xNUMX XTB.

Simon Property Group

A component of the S&P 500 and S&P 100 indices. It is a REIT that specializes in the commercial real estate market. The main areas of activity are the rental of shopping centers, outlets and other similar stores to tenants. The company was founded in 1960 by the Simons brothers (Melvin and Herbert). In 1993, the company made its debut on the stock exchange. At the end of Q2022 232, Simon Property Group owned 186 properties totaling 80 million square feet. The company's properties are located in North America, Europe and Asia. The company is also a majority shareholder (XNUMX%) of TRG (The Taubman Realty Group) and a minority shareholder of the French company Klépierre. Both TRG and Klépierre are local REITs operating in the same market as Simon Property Group. The key geographic areas for the company are the states of Florida, California and Texas.

| 2018 | 2019 | 2020 | 2021 | |

| revenues | 5 658 | 5 755 | 4 608 | 5 117 |

| operational profit | 2 911 | 2 908 | 1 972 | 2 413 |

| operating margin | 51,45% | 50,53% | 42,80% | 47,16% |

| net profit | 2 436 | 2 098 | 1 109 | 2 246 |

Simon Property Group chart, interval W1. Source: xNUMX XTB.

Forex brokers offering ETFs and stocks

The market offers a number of alternatives to the "physical" purchase of real estate, e.g. in the form of purchasing shares of selected companies, entire packages in the form of ETFs or REITs. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in the real estate market through stocks and ETFs [Guide] investing in the real estate market](https://forexclub.pl/wp-content/uploads/2022/05/inwestowanie-w-rynek-nieruchomosci.jpg?v=1652689782)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to invest in the real estate market through stocks and ETFs [Guide] Elwood Goldman Sachs Barclays](https://forexclub.pl/wp-content/uploads/2022/05/elwood-goldman-sachs-barclays-102x65.jpg?v=1652693750)

![How to invest in the real estate market through stocks and ETFs [Guide] zloty currency analysis](https://forexclub.pl/wp-content/uploads/2019/11/z%C5%82oty-analiza-waluty-102x65.jpg)