How to invest in bonds? Beginner's Guide [Tutorial]

Most investors feel insecure with only equity market exposure in their portfolio. Most often this is because portfolio volatility is equated with risk. As a rule, investors like a smooth capital curve. "Smoothness" means that the possible decline in the value of the portfolio is small and of a very short duration. For this type of investor, bearish periods are particularly frustrating. The period of long declines is psychologically devastating for them, as they think they are getting poorer (they equate the current valuation with the intrinsic value of the stock). Not everyone accepts that in the short and medium term, stock prices may significantly deviate from their fundamental value. Therefore, the period of market declines is very stressful. For such investors, there are four solutions:

- stop investing in the stock market;

- use portfolio hedging strategies;

- go for a shorter interval and invest based on Technical Analysis;

- include less volatile instruments in the investment portfolio.

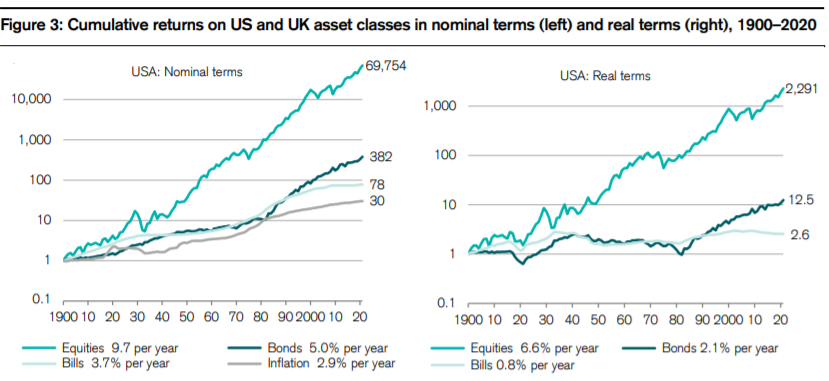

Stopping investing in the stock market is one of the worst choices in the long term. This is because it is the asset class that has given investors the highest returns in the last 100 years. Of course, not all stock markets beat other assets, but geographic diversification of the stock portfolio allows you to profit from the growing global economy. By “cutting off” the stock market, the investor himself limits the potential for long-term profits. These are not empty words. Below are the results of the annual ranking prepared by Credit Suisse on the American capital market:

Using hedging strategies can be compared to buying insurance. In return for the premium, the investor protects himself against unexpected events that may significantly lower the valuation of the stock portfolio. The portfolio can be hedged with instruments such as: short selling, futures or options. The disadvantage of such a solution is the cost, time spent on education and creating security strategies, and… patience. Hedging strategies require patience, especially in times when the market is growing. "Inheritance Insurance Cost" it lowers profits during a bull market, which can frustrate the investor.

Another solution is to change your investment strategy. Instead of building a "portfolio for the next 10 years", the investor significantly shortens the investment horizon. The solution is swing trading or day trading. However, the "cost" is an increase in paid commissions and much more time spent on "keeping an eye on the market". It should be remembered that switching to a shorter-term strategy does not protect the portfolio against significant capital slips.

It is also possible to include assets in the portfolio that will be less correlated with the stock market. Ideally, the correlation should be strongly negative. Then, during a downturn in the stock market, the other part of the portfolio would earn. Thanks to this, when stocks are cheap, it would be possible to rebalance the investment portfolio (purchase of shares and sale of an uncorrelated asset). Bonds are one of the assets that are willingly included in the investment portfolio. In the further part of the article, the issue of including bonds in the investment portfolio will be discussed.

What are bonds

A bond is a debt security issued for a period of more than one year. The issuer of the bond (seller) obliges itself to the buyer (bondholder) to repay the debt with interest in specified payments, within a specified period of time. Bonds can be divided into several types. Here are the most popular of them:

- type of coupon

- how the interest rate is calculated

- type of security for the bond

- issuer

- length of the maturity period

Type of coupon

The basic distinction between bonds is how the coupon is paid out. The most famous type are the so-called coupon bonds. In their case the issuer undertakes to pay periodic interest which is known as coupons. Also associated with bonds is the term "cut off coupons". In the past, bonds were issued with coupons that were “cut off” after each interest payment. Here is an example of a 1944 Chinese government bond:

There are also zero-coupon bonds that do not pay interest until the bond is redeemed. The interest is included between the difference of the nominal amount and the issue price. As a rule, the issue price equals the nominal value, however, in the case of a zero-coupon bond, the issue price is lower than the nominal value. As a result, the investor buys the bond at a discount.

Type of interest

The bonds may have a floating or fixed interest rate. In an environment of rising interest rates, bonds with a floating interest rate (e.g., dependent on the level) are preferable interest rates). On the other hand, when interest rates fall, investors prefer fixed-coupon bonds (their interest rate does not change along with a decline in market interest rates).

Bond security

This is an important issue. Of course, the buyer of bonds does not assume that the issuer will go bankrupt (because then it is better not to invest in the bonds of this issuer), but you should always check whether the bond has collateral. The security may be a mortgage on real estate or receivables (often this solution is used by debt collection companies). As a rule, bonds with good collateral have a lower interest rate than unsecured (due to lower risk). The owners of unsecured or subordinated bonds are in a much worse situation. In such a situation, the holders of such debt instruments are in a lower position in the settlement of claims against an insolvent bond issuer. The lower the position in the "repayment queue", the greater the risk of losing funds in the event of the issuer's bankruptcy.

Issuer

When investing in bonds, it is also important who is the issuer of the bonds. Governments are the largest bond issuers in the world. This type of bond is called a treasury bond. As a rule, this is the safest type of domestic debt. This is because the state rarely goes bankrupt. This is because he always has the tools to deal with rising interest costs (e.g. inflation or tax increases).

Next in terms of risk are local government bonds and the debt of government agencies. Such bonds are indirectly guaranteed by the State Treasury and therefore they are characterized by relatively low investment risk. The Polish Catalyst stock exchange lists, among others, Warsaw bonds. One of the series is due at the end of 2030. The interest rate on this series of bonds is 0,9% + WIBOR6M. The most risky are bonds issued by companies (corporate bonds). When purchasing corporate debt, an investor should carefully read the terms and conditions of the issue and check the issuer's financial condition.

Be sure to read: How to invest in Treasury bond futures

Length of the maturity period

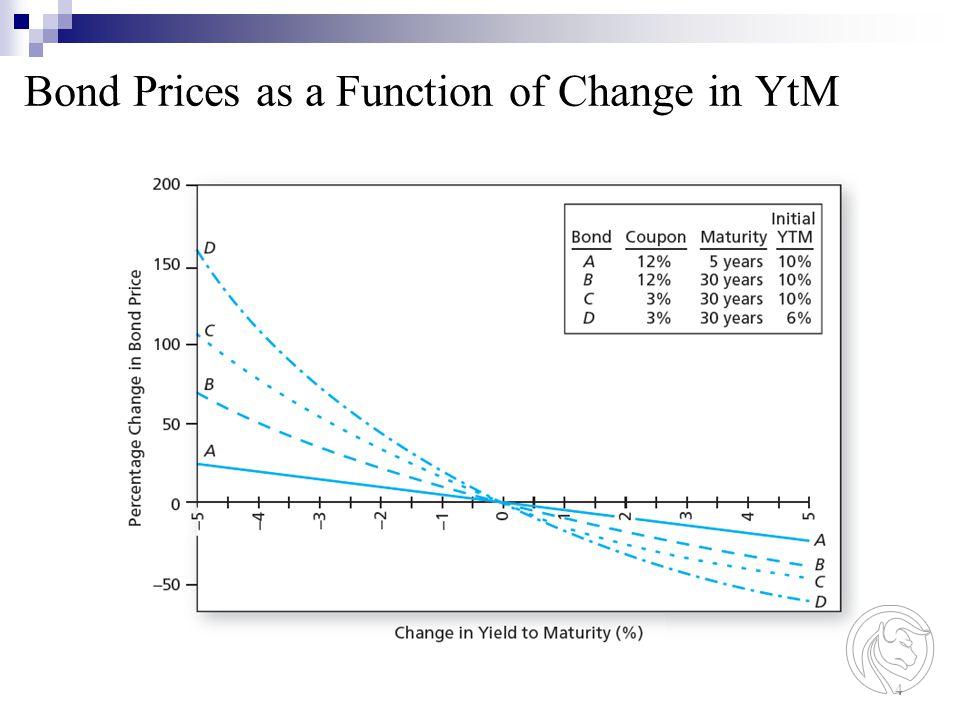

Bonds can also be divided according to the maturity period. As a rule, bonds are divided into: short-term (up to 2 years), medium-term (2-5 years) and long-term (over 5 years). It should be remembered that the longer the maturity, the more sensitive the bond is to changes in the interest rate. Therefore, having long-term fixed coupon bonds negatively affects the portfolio performance as market interest rates rise.

Source: slideplayer.com

Bonds in the portfolio - strategies

There are many strategies for investing in bonds. One of the most popular is the famous 60-40. In this strategy, the portfolio consists of 60% equities and 40% debt instruments. The portfolio is rebalanced periodically (e.g. once a month). If, for example, the share of stocks has risen to 62%, then at the end of the quarter the investor sells the stock and buys bonds with the funds received. The transactions are aimed at restoring the portfolio composition to the value of 60-40. However, the strategy has its drawbacks. In periods of "quiet boom", the investor "dilutes" shares in shares (sells the winners) by increasing positions in debt instruments with a much lower potential rate of return. Of course, the variants of this strategy are different. From aggressive with only 20% of bonds in the portfolio to "defensive" where 60% of assets are invested in debt instruments.

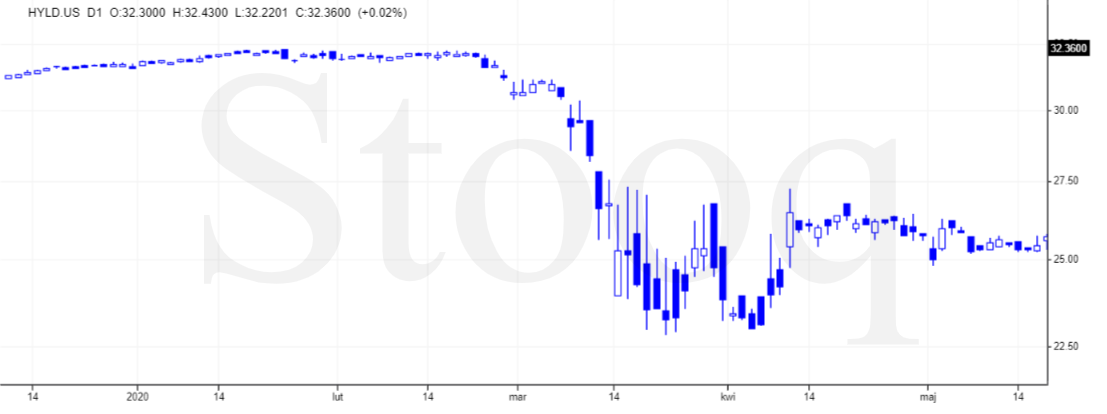

Another issue that should be taken into account is what the debt portfolio should consist of. Each choice has its advantages and disadvantages. If an investor wants to maximize the potential income from the bond portfolio, he should invest in corporate debt. Bonds have the highest yields "Junk" (junk bonds). However, their prices are strongly correlated with the stock market. As a result, many high-yield bonds lose value during financial problems. An example would be ETF with exposure to the junk bond market, which depreciated around 2020% during the March 50 panic.

On the other hand, the choice of treasury bonds means that the yield on the debt portfolio is low, sometimes it may be lower than inflation. It's best to create a mix that combines corporate and government bonds with different investment risks. This will allow to increase the rate of return while leaving the risk at an acceptable level.

Another question is whether the investor wants to focus on short-term bonds (least sensitive to changes in interest rates) or long-term bonds (with the highest interest rates).

Be sure to read: How to invest in futures on German bonds

How to build exposure to bonds

Of course, after determining what the investment portfolio should look like, the investor must decide how he wants to build exposure in debt instruments. He can choose from:

- purchasing the bonds yourself - it is a time-consuming process and requires a lot of capital to obtain diversification benefits. At the same time, the investor should read the terms of the issue, examine the financial condition of the issuer and not overpay for the bonds on the market. This is a very time-consuming choice, but gives you full control over the portfolio composition.

- use of ETFs - it is a shortcut, the investor buys a "basket" of bonds. ETFs have a very wide range of investment policies. There are ETFs that focus only on US junk bonds or European government debt. The downside is having to pay management fees and commission and spread. The advantage is that you can build a diversified bond portfolio at a very low cost. An example of an ETF giving exposure to the bond market is Vanguard Intermediate-Term Bond ETF.

- purchase of participation units in TFI - it is a choice for investors who do not want to invest in ETFs and choose their own bonds for the portfolio. The disadvantages are the relatively large management fees and the lack of control over the investment policy.

- use of derivatives - it is a choice for investors who appreciate the use of financial leverage. The disadvantage is the small selection of bonds that have liquid futures (mainly treasury bonds of the largest economies).

Vanguard Intermediate-Term Bond ETF Chart, Interval W1. Source: xNUMX XTB.

The risk of investing in bonds

Investing in bonds is not without risk. There are a few risks to be aware of when buying bonds. These are:

- credit risk - it is the risk of the bond issuer's solvency. In order to minimize the risk, it is necessary to carefully analyze the security of the bonds and the financial situation of the issuer. It is also worth checking whether the issuer has the rating of a credit rating agency (eg S&P, Fitch, Moody's).

- interest rate risk - the change in the interest rate affects the price of bonds with a fixed coupon and the yields on bonds with a floating interest rate. An increase in interest rates lowers the prices of bonds with a fixed interest rate and increases the profitability of bonds with a floating interest rate. Another problem that a bondholder has to deal with is the reinvestment risk. In a situation of falling interest rates, the investor has a problem with reinvesting interest at the previous (higher rate).

- early redemption of bonds - this is a situation that may seem favorable on the surface. The investor recovers the invested capital, i.e. no longer has credit risk. It must therefore reinvest the capital received in the bond market. Keep in mind that the early redemption of bonds deprives the investor of future positive cash flows (coupons).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in bonds? Beginner's Guide [Tutorial] how to invest in bonds](https://forexclub.pl/wp-content/uploads/2021/09/jak-inwestowac-w-obligacje.jpg?v=1631690257)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)

![How to invest in bonds? Beginner's Guide [Tutorial] creditcoin ctc](https://forexclub.pl/wp-content/uploads/2021/09/Creditcoin-ctc-102x65.jpg?v=1631685454)

![How to invest in bonds? Beginner's Guide [Tutorial] iphone 13 apple premiere](https://forexclub.pl/wp-content/uploads/2021/09/iphone-13-premiera-apple-102x65.jpg?v=1631695722)