How to trade the Euro Stoxx 50 Index? [Guide]

The European capital market has always been fragmented. Each country wanted its own flagship index representing blue chip companies. However, at the end of the 90s, the concept of creating a "European" index began to appear, which would aggregate the behavior of the largest companies from the Eurozone countries. As a result, indexes from the family were created STOXX. The most famous is Euro Stoxx 50 and Stoxx 600 Europe. The article describes the first index.

Index history

Euro Stoxx 50 was established in early 1998. Like most indices, the Euro Stoxx 50 is weighted by capitalization, which is free-float market capitalization.

The index is quoted in five currencies (Euro, US dollar, Canadian dollar, British fund, Japanese yen). Euro Stoxx is also calculated in the following variants: price, net return and gross return).

The index includes representatives of 19 out of 20 supersectors (companies from the financial sector are excluded from Euro Stoxx 50). It is worth mentioning that the Euro Stoxx 50 covers approximately 60% of the free float of the Euro Stoxx Total Market Index (TMI).

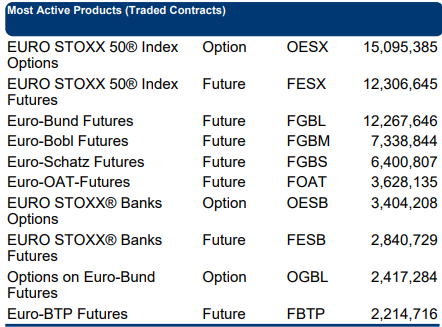

It is worth mentioning that derivatives based on the Euro Stoxx 50 index are the most liquid in terms of trading volume. This applies to both options and futures. The turnover for August 2021 is presented below.

For comparison, in August 2021 on futures contracts on DAX the turnover was 1,3 million units. Of course, keep in mind that the DAX futures contract has a much higher notional value than the Euro Stoxx 50 futures.

Chart - Euro Stoxx 50

Index composition

According to the data provided by Qontigo, the Euro Stoxx index had 2021 components at the end of the second quarter of 50). The index is dominated by French (34%) and German (27,4%) companies. Another important country is the Netherlands with over 18% share.

The largest shares are held by companies from the following industries:

- Discretionary goods (19,5%)

- IT (18,1%)

- Industry (14,1%)

- Finance (13,9%)

- Raw material industry (9,5%)

As you can see, the index is very diversified in terms of sector coverage (19). There is also no one dominant sector. However, it is certainly an index dominated by companies from the "old economy".

The largest components of the index are the following companies:

- ASML Holding,

- LVMH,

- Linda,

- SAP,

- Siemens.

Below is a brief overview of several companies included in the Euro Stoxx 50 index.

Siemens

It is one of the largest industrial companies in the world. Siemens produces both used products in the healthcare segment (€ 14,5 billion in revenues) and mobility solutions (€ 9,1 billion in revenues). It also has a wide range of solutions for industry (production and process automation). Another important segment is "Smart Infrastructure", where the company invests, among others, in systems for controlling HVAC products (heating, ventilation, air conditioning). The company's capitalization exceeds € 110 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 83 049 | 83 040 | 86 849 | 57 139 |

| operational profit | 7 343 | 5 912 | 6 692 | 4 554 |

| operating margin | 8,84% | 7,12% | 7,71% | 7,97% |

| Net profit | 5 993 | 5 683 | 5 171 | 4 120 |

Siemens stock chart, interval W1. Source: xNUMX XTB.

SAP

It is one of the largest technology companies in the world. SAP focuses on providing software to companies in order to better manage resources in the company. The most famous solution is SAP ERP. The company boasts that 91% of the Forbes Global 2000 companies use SAP solutions. In addition to ERP systems, the company provides software for customer relationship management (CRM). It also has a wide analytical offer and also has popular solutions in the field of supply chain management. The company's capitalization exceeds € 140 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 23 460 | 24 708 | 27 553 | 27 338 |

| operational profit | 5 060 | 5 723 | 5 603 | 6 621 |

| operating margin | 21,57% | 23,16% | 20,34% | 24,22% |

| Net profit | 4 018 | 4 083 | 3 321 | 5 145 |

SAP stock chart, interval W1. Source: xNUMX XTB.

L'Oreal

One of the most famous companies focusing on the skincare and make-up market. The offer of this French corporation includes: shampoos, hair care solutions, shower gels, creams, hair colors, styling products and deodorants. L'Oreal also has a very strong portfolio of makeup products from brands such as Maybelline and Stylenanda. Other brands in the company's portfolio include Garnier, LOreal, Essie and Mixa. The company is also a component of the CAC 40 index. L'Oreal's capitalization exceeds € 200 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 26 023 | 26 937 | 29 874 | 27 992 |

| operational profit | 3 581 | 3 895 | 3 750 | 3 563 |

| operating margin | 13,76% | 14,46% | 12,55% | 12,73% |

| Net profit | 3 581 | 3 895 | 3 750 | 3 563 |

L'Oreal stock chart, interval W1. Source: xNUMX XTB.

Sanofi

The origins of the company's history date back to 1973. It is one of the largest pharmaceutical companies in the world. It also achieved its position as a result of many mergers and acquisitions, such as the merger with Synthelabo in 1999, the acquisition of Aventis in 2004. The company's seat is in Paris. It is worth mentioning that Sanofi is also a component of the most important French index - CAC 40. The company is engaged in the research and production of new drugs as well as generics. Sanofi focuses mainly on areas such as: drugs for diabetics, oncology, vaccines, circulatory system, nervous system. The company employs approximately 100 people. Its capitalization exceeds € 000 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 36 204 | 35 677 | 37 631 | 37 369 |

| operational profit | 7 201 | 6 255 | 7 226 | 7 893 |

| operating margin | 19,89% | 17,53% | 19,20% | 21,12% |

| Net profit | 8 434 | 4 306 | 2 806 | 12 314 |

Sanofi stock chart, interval W1. Source: xNUMX XTB.

Volkswagen

The history of the company dates back to the interwar period, because Volkswagen was founded in 1937. It is one of the most popular automotive companies in the world. It sells its products mainly in Europe, the United States and China. The company's headquarters are in Wolfsburg. It is an automotive concern with a wide portfolio of brands. Among them can be mentioned Audi, Skoda, SEAT, Scania, MAN, Ducati, Lamborghini and Bugatti. A few years ago, Volkswagen was involved in a high-profile scandal over tampering with US control tests. The company is currently valued at around € 120bn.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 230 682 | 235 849 | 252 633 | 222 884 |

| operational profit | 13 443 | 14 433 | 16 019 | 10 057 |

| operating margin | 5,83% | 6,12% | 6,34% | 4,51% |

| Net profit | 11 354 | 11 827 | 13 346 | 8 334 |

Volskwagen stock chart, interval W1. Source: xNUMX XTB.

prosus

It is a subsidiary of the South African concern Naspers. Prosus focuses on the development of e-commerce business and companies related to the internet sector. Among the most popular business branches of Prosus are sales platforms such as Olx, otoDom, auto, Auto Trader, payment processing (PayU). The company also invests in the food delivery industry (Volt, Swiggy, Ifood). The company is also developing in the EdTech segment (Brainly, Udemy, stack overflow). The "pearl in the crown" is about 30% of a Chinese technology company - Tencent. The company is also a component of the AEX 25 index. The company's current capitalization is over € 220 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 2 303 | 2 654 | 3 330 | 5 116 |

| operational profit | -588 | -378 | -609 | -953 |

| operating margin | -25,53% | -14,24% | -18,29% | -18,63% |

| Net profit | 11 485 | 4 307 | 3 824 | 7 449 |

Prosus stock chart, interval W1. Source: xNUMX XTB.

Amadeus

It is one of the largest companies in its industry. Together with Saber, it is included in the "big three" of the GDS market (Global Distribution System). GDS is a system that allows travel agencies to book airline tickets, hotel rooms and book cars. The system allows you to make reservations in real time. The aviation market has the largest share in revenues. Amadeus is therefore an intermediary between airlines and travel agencies.

The origins of the company date back to 1987, when it was founded on the initiative of several European airlines: Lufthansa, Iberia and Air France. It was a "European alternative" to the American company Saber. In addition to connecting to GDS, the company also offers airport management software. Currently, over 480 airlines, 128 airports and over 300 hotel groups cooperate with the Amadeus platform.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 4 853 | 4 936 | 5 570 | 2 174 |

| operational profit | 1 323 | 1 393 | 1 475 | -771 |

| operating margin | 27,26% | 28,22% | 26,48% | -35,46% |

| Net profit | 1 003 | 1 002 | 1 113 | -625 |

Amadeus stock chart, interval W1. Source: xNUMX XTB.

Deutsche Boerse

It is the most liquid stock exchange and the largest organized market for derivatives (options, futures) in Germany. Deutsche Boerse operates in the following segments: Eurex (derivatives trading platform), EEX (commodity exchange), 360T (currency trading platform), xetra (electronic stock trading), clearstream (post-trading services). The segment is also worth mentioning Qontigo, which conducts analytical activities and is a supplier of indexes (the leaders in this segment are Msci, S&P Dow Jones Indices and FTSE Russell). Deutsche Boerse is headquartered in Eschborn. The current capitalization of the company exceeds € 26,5 billion.

| € million | 2017 | 2018 | 2019 | 2020 |

| revenues | 2 771 | 3 098 | 3 300 | 3 717 |

| operational profit | 1 171 | 1 228 | 1 445 | 1 559 |

| operating margin | 42,26% | 39,64% | 43,79% | 41,94% |

| Net profit | 874 | 824 | 1 004 | 1 080 |

Deutsche Boerse stock chart, interval W1. Source: xNUMX XTB.

What may affect the value of the Euro Stoxx 50 index?

The condition of the world economy or regions

The companies included in the Euro Stoxx 50 index operate on a global scale. Therefore, it is not surprising that geographic diversification allows for generating more stable revenues. Of course, some economies are more important in sales than others. An example of this is China, which is responsible for most of the revenue growth of companies in the luxury clothing industry. The deterioration of the condition of the "world economy" will mean a slower dynamics of revenues or even a decrease in sales.

The situation in individual industries

The deterioration in the condition of the European real estate market may have a negative impact on the condition of one of the index components - Vonovia (it owns over 400 apartments in Germany, Sweden or Austria). In turn, the condition of the automotive market translates into the sales level of car manufacturers (Volksawagen, BMW, Daimler). Another example is the aviation industry, which has a significant impact on the results of companies such as Amadeus IT and Airbus.

Raw material prices

For some components of the Euro Stoxx 50 index, changes in commodity prices have an impact on sales. Total SA, listed in Paris, deals with the extraction and processing of hydrocarbons (crude oil, natural gas). Another example is the Italian concern ENI, which, apart from the extraction and processing of crude oil, also deals with the retail sale of fuels.

Financial results of companies

In the long term, the financial results generated by the enterprise are the most important in the valuation of the company. Increasing revenues, profits, and free cash flow (FCF) are solid arguments for long-term increases in stock prices. For this reason, it is worth following the financial results of companies included in the index. Especially those that have the greatest impact on changing the index value.

How to invest in Euro Stoxx 50

Futures contracts

The Euro Stoxx 50 index futures contract is one of the most liquid derivatives on the trading platform Eurex. Investors can choose between two types of contracts:

- Basic,

- Micro version.

The Euro Stoxx 50 index futures contract has a multiplier of € 10. This means that the current notional value of the futures contract is around € 41. It is a very fluid contract. On September 000, 24, the turnover on the most liquid series (December) on the Eurex platform amounted to over 2021 units.

There is also a version of the Micro - Euro Stoxx 50. The index multiplier is € 1. This means that an index increase of 1 point leads to an increase in the notional value of the futures contract by € 1. The futures contract expires in March, June, September and December (every third Friday). However, this is not a very popular index. At the end of September 24, 2021, the trading volume for the most liquid series (December) was just over 2 (data from Eurex).

Contracts for exchange differences (CFDs)

Another option, especially popular with retail traders, is to speculate on contracts for difference (CFD). The Euro Stoxx 50 index does not lead the way among the most popular instruments in the offers of Forex brokers (the European number # 1 is definitely the German DAX), but we can easily find CFDs on this index at companies offering access to a large list of instruments. Below we present selected offers of CFD brokers based on Euro Stoxx 50.

| Broker |  |

|

|

| End | Poland | Cyprus, Australia, St. Vincent & Grenadines | Cyprus * |

| Euro Stoxx 50 symbol | EU50 | EURO50 | Europe 50 (CFD instrument) |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

50 USD | PLN 500 |

| Min. Lot value | price * 10 EUR | price * 1 EUR | - |

| Commission | - | - | - |

| Platform | xStation | MT4, MT5 | Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Stocks and ETFs on Euro Stoxx 50

Due to the fact that Euro Stoxx 50 is one of the most popular indices in Europe, they exist liquid ETFs with a very high value of assets under management (AuM). The most popular ETFs include:

SPDR Euro Stoxx 50 ETF

State Street launched an ETF in 2002, which was designed to mimic the movement of the Euro Stoxx 50 index. The product is called SPDR Euro Stoxx 50. At the end of September 24, the fund's assets under management totaled $ 2,8 billion. The annual management cost (TER) is 0,29%. The ETF replicates the index physically.

Euro Stoxx 50 ETF SPDR Chart, Interval W1. Source: xNUMX XTB.

iShares Core EURO STOXX 50 UCITS ETF EUR (Dist) (EEU)

Another ETF giving exposure to the Euro Stoxx 50 index is iShares Core EURO STOXX 50 UCITS ETF EUR. ETF was founded in 2000. At the end of September 24, 2021, the assets under management amounted to € 4 million. The annual management cost (TER) is 308%. This ETF also replicates the index physically.

Another option that gives a partial exposure to the EuroStoxx 50 index is to buy shares of its companies.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to trade the Euro Stoxx 50 Index? [Guide] euro stoxx 50 index](https://forexclub.pl/wp-content/uploads/2021/09/indeks-euro-stoxx-50.jpg?v=1632909490)

![How to trade the Euro Stoxx 50 Index? [Guide] ethereum eth perspectives](https://forexclub.pl/wp-content/uploads/2021/09/ethereum-eth-perspektywy-102x65.jpg?v=1632226859)

![How to trade the Euro Stoxx 50 Index? [Guide] Fast FX Trading scam](https://forexclub.pl/wp-content/uploads/2021/03/Fast-FX-Trading-scam-102x65.png)

Leave a Response