How to invest in energy during the energy crisis? [Guide]

We are used to not thinking about the energy sector, but the associated growing global crisis has exposed our primary energy deficits. They result from many years of underinvestment in the fossil fuel industry and insufficiently fast scalability of renewable energy sources in the context of green transformation and electrification of our economy. At present, it seems more likely that the energy sector - both non-renewable and renewable - will deliver attractive returns as we will need both to deal with the energy crisis in the short term and with the aspirations for a greener energy future in the long term.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

The energy crisis continues to worsen

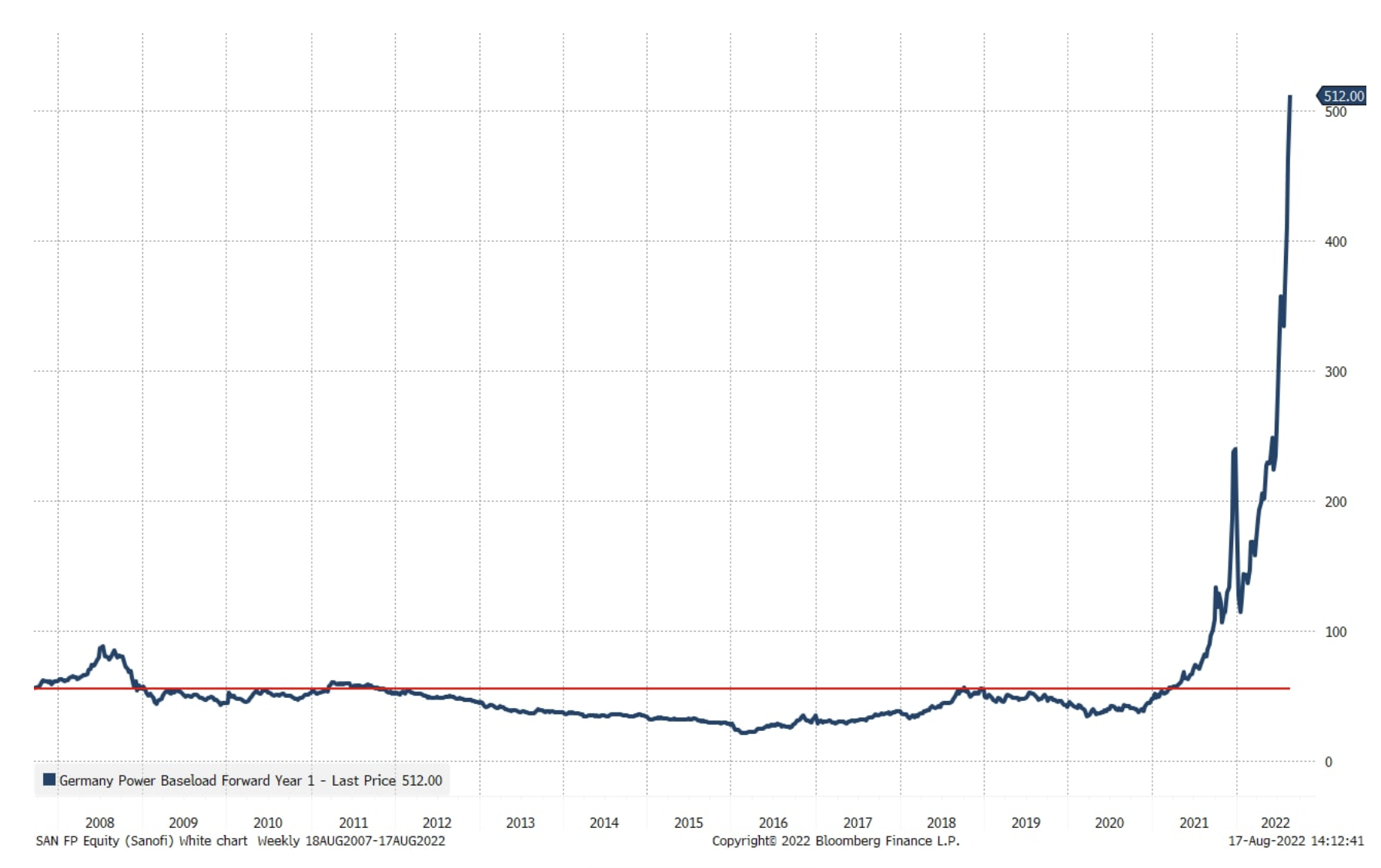

Electricity prices in Europe are nine times higher than the historical average after 2007, as the lack of investments and the abandonment of energy supplies from Russia have severely limited energy supply on the market. Even before the pandemic, we devoted many articles to the green transformation, which involves the expansion of renewable energy sources and the electrification of all sectors of the economy in order to reduce the carbon dioxide emissions associated with our current standard of living. Switching a large part of the transport sector to electricity or ecological fuels, switching from natural gas to renewable energy through electrification (air-to-water heat pumps) etc. increase in carbon dioxide emissions over the past 300 years. We described it in the article "Inconvenient truth about energy and GDP". Separating our wealth-generating function from our carbon footprint is perhaps the most important task a person has ever set for himself.

German electricity at base load in the perspective of 1 year. Source: Bloomberg.

There is no "one-size-fits-all" solution to the energy crisis

According to the report published by BP, "2022 Statistical Review of World Energy"(" Global Energy Statistical Review 2022 "), primary energy demand in 2021 has eclipsed the 2019 data, suggesting that global energy demand is now higher than it was before the pandemic, and the use of fossil fuels (82 %) only slightly decreased compared to the situation five years ago (85%). We still live, to a large extent, in an economy based on fossil fuels. Things will change over time and the share of fossil fuels is likely to decline, but it is naive to assume that the world can make a green transformation by electrifying everything from renewable energy sources. Investors should also remember that the change in primary energy demand is driven primarily by non-OECD countries. Renewable energy is not scaling up fast enough to make a full transformation due to the pace of electrification, and recently Orsted and Vestas CEOs have complained about bureaucracy to approve new offshore wind projects.

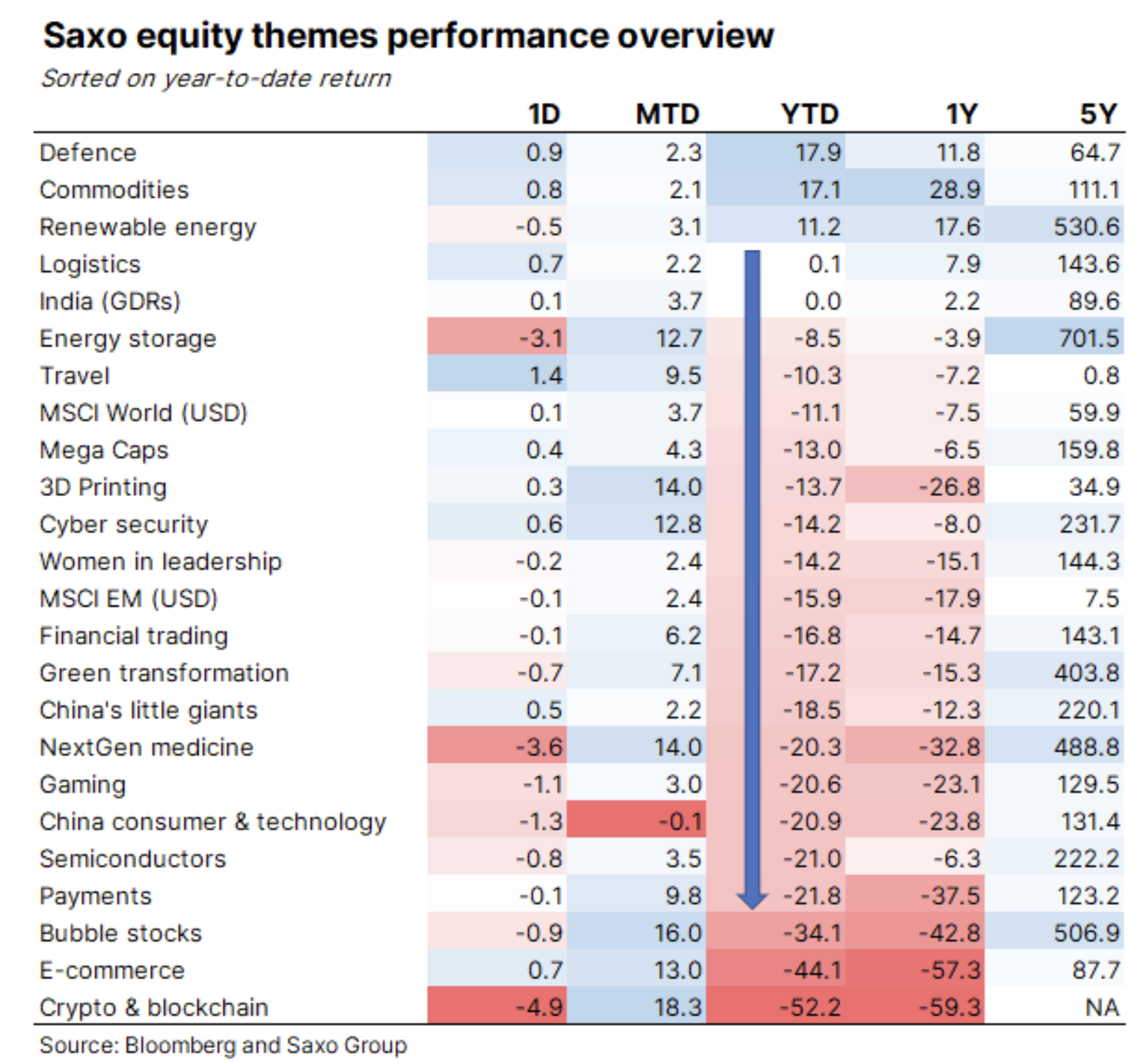

The recently adopted US Climate and Tax Act recognizes that we will need oil and gas longer than expected three years ago, so our current energy crisis makes both renewable energy and fossil fuel energy equally good investments. The Renewable Energy Thematic Basket is third in terms of results this year; the leader is a basket of raw materials (including oil and gas and mining companies).

Our view of the future of energy is that there is no "one-size-fits-all" solution to the current energy problem. We must focus on energy diversification. We will need many different sources of energy and we should not overly rely on one. Germany's dependence on natural gas in its economic model turned out to be the Achilles' heel. Even France's firm commitment to nuclear power has proved unsustainable due to corrosion and now also to excessively high water temperatures in rivers. The world must invest in all types of energy, which is why in our opinion investors should ensure exposure to broadly understood energy in the future.

The non-renewable energy sector at a glance

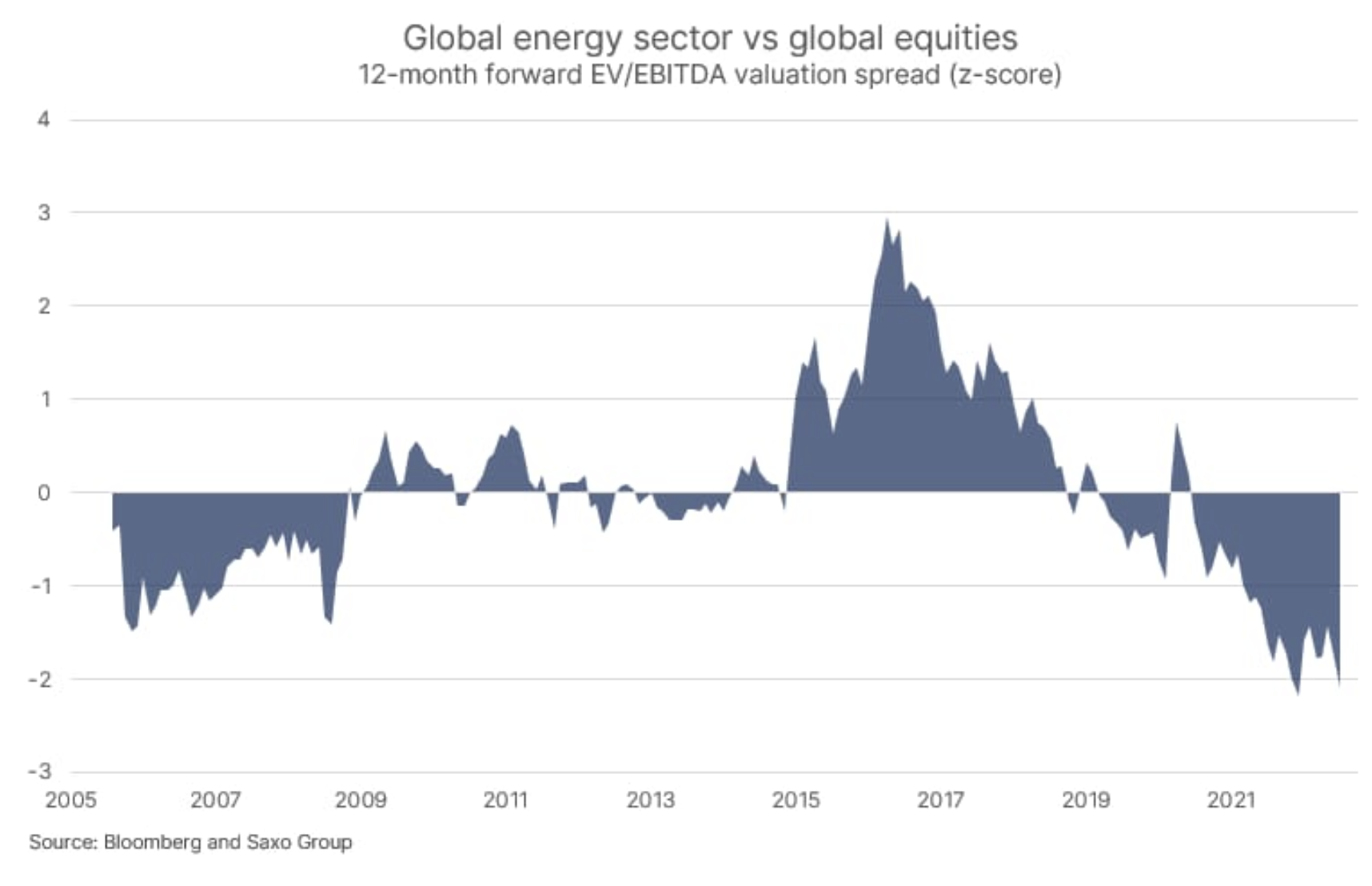

In this stock market material, we focus on non-renewable energy because it is the part of the energy sector that has changed the most from market valuations and expectations, and where there is scope for further repricing. Despite high oil and gas prices, the energy sector is still relatively cheap, which we already described in May in the article "Shares of global energy companies are the cheapest in 27 years", In which we measured the valuation by the rate of return on free cash flow. High oil and gas prices have also led to record refining profitsand recently to the highest ever quarterly profit in the global energy sector, which we described in the article "Profits have hit record highs and inflation is proving to be win-win".

The global energy sector (defined by the GICS standard and being a non-renewable energy sector) is still cheap compared to the global stock market, and the XNUMX-month EV /EBITDA is two standard deviations below the average of the valuation spread since 2005. In terms of total return, the global energy sector outperformed the global stock market after 1995 (see graphs below). It is also worth noting that as measured by the XNUMX-month EV / EBITDA multiplier, the renewable energy sector is valued twice as high as the non-renewable energy sector, reflecting the differences in expectations for the future, captured by the market in its valuations.

As described in our forecast for Q10, the current dividend yield and its expected growth suggest that the global energy sector has an expected long-term return of XNUMX% annualized, of course subject to a high degree of uncertainty related to the compression in the valuation of equities in this industry or a lower future dividend increase than currently anticipated.

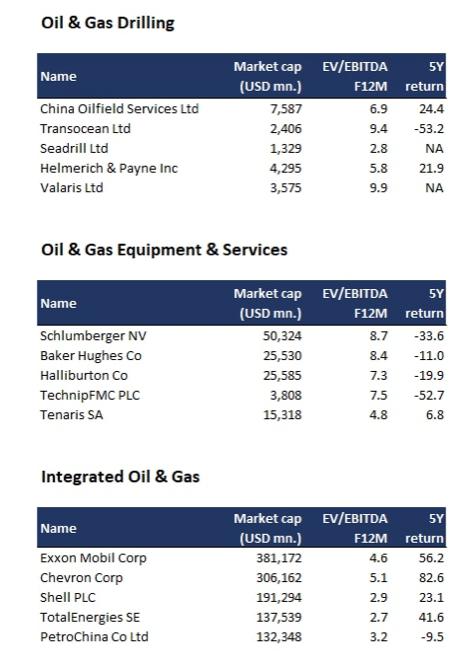

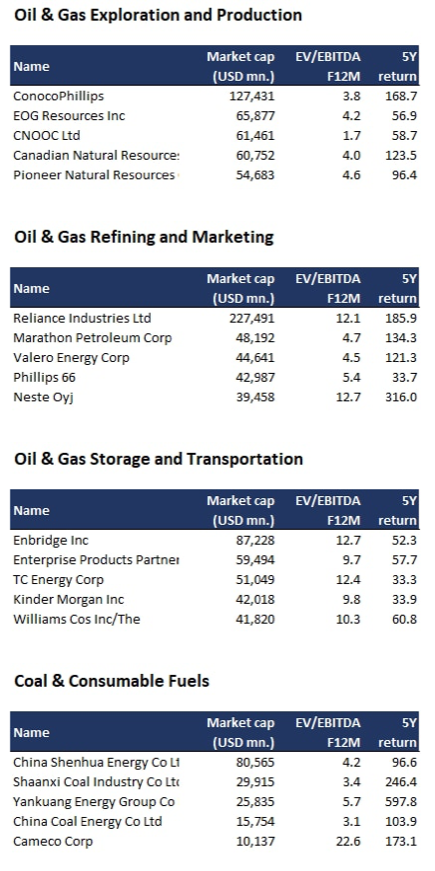

The easiest way to invest in the energy sector are exchange funds (ETFs) monitoring this sector and most investors should do so. Another approach is to invest in specific parts of the non-renewable energy sector. The tables below show the top five companies by market value in each of the GICS energy industries. As shown by the five-year total returns in the "USD" column, drilling-only and drilling-equipment industries were the worst performers as a decline in investment after 2015 translated into a decline in activity in the industry. The oil and gas giants fared better in terms of refining and trading activities. In the last five years, the industry that performs the best in the energy sector has been the refining industry due to the fact that refining margins ( crack spreads, the difference between the prices of crude oil and refinery products) increased during the pandemic. The global coal industry was also doing very well, in the context of climate change and restrictions carbon dioxide emissions It is a sad observation, but we should be aware that the primary source of fuel for electricity production in the world is still coal.

Forex brokers offering ETFs and stocks

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in energy during the energy crisis? [Guide] how to invest in energy](https://forexclub.pl/wp-content/uploads/2022/08/jak-inwestowac-w-energie.jpg?v=1660818689)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to invest in energy during the energy crisis? [Guide] CySEC](https://forexclub.pl/wp-content/uploads/2017/02/cysec-102x65.jpg)

![How to invest in energy during the energy crisis? [Guide] WSE, Free float, free float](https://forexclub.pl/wp-content/uploads/2022/08/Gielda-Papierow-Wartosciowych-102x65.jpg?v=1660801217)