How the monetary policy of central banks works [Part I]

Central bank policy belongs to the type of "economic data" that is closely watched by investors from all over the world. It greatly influences the valuation of financial instruments on the market and the allocation of funds to individual assets. Federal Reserve is the national body of monetary policy in the USA (in Poland it is the Monetary Policy Council), which undoubtedly has the greatest impact on the creation of money in the world (due to the fact that most of the world's debt is issued in USD). In today's article, we will discuss monetary policy and open market operations. Understanding how central banks affect the economy will help to understand why particular financial instruments behave the way they do when the bankers make certain decisions.

Who Needs Politics?

In answering this question, I will tell you about its goals. In very general terms, central banks create the monetary policy they aim to maintain "Healthy economy". The concept of a healthy economy is very imprecise. Expanding this sentence a bit, we can say about a healthy economy as an economy with a low unemployment rate, relatively low inflation (under control) and maintaining a "moderate" level interest rates in the long term. Speaking moderate, it is one that does not change by 1% -2% over a period of several months.

Thus, the Federal Reserve and other central banks usually have their own "benchmarks" (e.g. inflation target) - in other words, the forks in which the market is trying to fit. For example: the Fed's interpretations of maximum employment and stable price targets (i.e. de facto processes related to inflation) have changed as the economy developed. Suffice it to look at the long period of expansion following the Great Recession of 2007–2009, where labor market conditions became very stable and strong, but did not result in a significant increase in inflation, which usually happens when a society is characterized by a low unemployment rate. As such, the Fed has not underscored its earlier fears that employment may exceed the maximum levels, focusing instead only on employment shortages below maximum levels. In this more recent interpretation, formalized in "Statement on long-term goals and monetary policy strategy" FOMC of August 2020, high employment and low unemployment do not raise concerns of the FOMC, as long as they are not accompanied by unwanted increases in inflation or the emergence of other threats that could jeopardize the achievement of the targets. Therefore, knowing and using the documents published by central banks, we can assess potential changes in their policy in a relatively simple and effective way. Each central bank is required to publish such "ranges" and assumptions regarding long-term monetary policy. Additionally, they often bring to light smaller messages about potential changes. A good example is The FED Beige Bookabout which we wrote here.

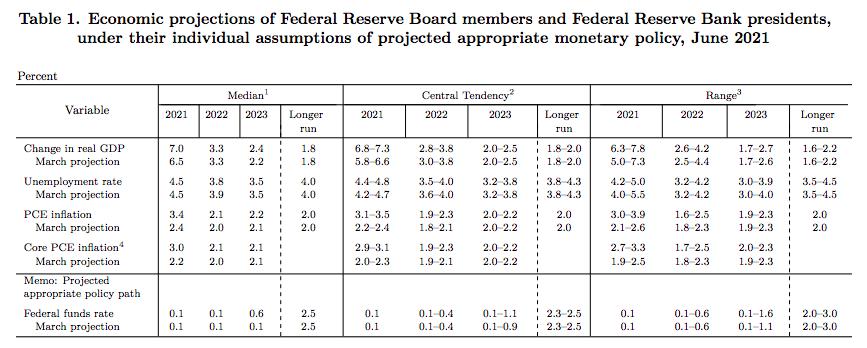

Central Banks also issue macroeconomic projections for the coming years. They are usually found in press releases related to interest rate meetings. The above graphic shows the latest macroeconomic projection of the Federal Reserve on the most important indicators. Therefore, we can (looking backwards through the prism of several messages) whether the bank's forecasts regarding economic growth and price increases are more favorable for a given currency or not.

Employment and inflation

Let us return for a moment to the issue of employment. You certainly remember the words of Powell, who mentioned that the US labor market is of key importance to monetary policy. On the one hand, I have always pointed out that this factor is treated a bit neglected as unemployment is always mentioned as the final argument for maintaining a loose policy, on the other hand, it is the piece of the puzzle that significantly influences others. More generally, maximum employment is a broad and inclusive goal that is not directly measurable and is affected by changes in the structure and dynamics of the labor market. So the Fed does not set a fixed target for employment. This is, in some ways, the exception to the forks. It is difficult to “parameterize” the labor market and define a fixed value that is to be maintained in the economy. Assessments of the employment gap from the maximum are based on a wide range of indicators. The Federal Reserve is therefore relying on intuitive estimates of the long-term unemployment rate, which is somewhat in line with maximum employment, and this generally hovers around 4 percent.

The case is easier when it comes to inflation. Here, the goal is defined as a specific value. Fed policymakers estimate that the 2% rate of inflation, as measured by the annual change in the price index for personal consumer spending, is the most consistent over the long term. In simple terms, the Reserve decided that 2% annual inflation is currently the best level for moderate and healthy price increases. The Fed began to clearly set a 2 percent target in 2012. In its "Statement on long-term goals and monetary policy strategy for 2020," the FOMC changed this target to inflation, which averages 2 percent over time. It allowed us to shoot this indicator down to the levels at which we have it today. Due to the fact that the average over a dozen or so months is calculated, inflation still remains within the target. Earlier (before the averaging), changes in interest rates were clearer. Still, a significant proportion of banks still have a clear target. To keep price inflation in check, the Fed may use its monetary policy tools to, for example, raise the federal funds rate. Monetary policy is said to be tightening / tightening in this case or simply becoming more restrictive. Taking into account the opposite situation, ie the economic slowdown (increased inflation), the Fed may use its monetary policy tools to lower the federal funds rate. Then, monetary policy is either softer / looser or becomes more "expansionary" or "accommodative".

Conducting monetary policy

Central Banks have certain tools at their disposal with which they can shape monetary policy. Take the Federal Reserve as an example. Ultimately, it uses three tools to conduct monetary policy:

- mandatory reserves,

- discount rate,

- open market operations.

In 2008, the Fed added to its monetary policy toolbox the payment of interest on reserve balances held with Reserve Banks. An even more interesting tool is the recently added overnight reverse buyout agreements by the Fed to support the level of the federal funds rate. All these tools that central banks have at their disposal may seem complicated to a large extent, although getting to know them in detail will allow to assess what assets will be in increased demand when the central bank makes a move. Open market operations are considered to be one of the most effective tools to a large extent in economies with highly developed equity markets. They allow for a relatively flexible and at the same time effective monetary policy. The United States has the greatest experience in this type of operations, which has been using the above-mentioned operations practically since the 30s. In Europe, the first reasons for these solutions were the economies of France and England, which began to use it more widely in the 70s.

In the following articles, we will discuss in detail the monetary policy tools - how they work and when they are used. We will focus in particular on open market operations and real examples of how they work in practice.

Central bank policy - where to find information?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How the monetary policy of central banks works [Part I] central bank policy](https://forexclub.pl/wp-content/uploads/2021/06/polityka-bankow-centralnych.jpg?v=1624965159)

![How the monetary policy of central banks works [Part I] zloty market interest rates](https://forexclub.pl/wp-content/uploads/2021/06/rynek-zlotego-stopy-procentowe-102x65.jpg?v=1625040210)

![How the monetary policy of central banks works [Part I] gamestop shares gme how to buy](https://forexclub.pl/wp-content/uploads/2021/07/gamestop-akcje-gme-jak-kupic-102x65.jpg?v=1625060223)

Leave a Response