Invest, don't speculate, i.e. passive investing with Finax [Guide]

Are you fed up with the commotion of the stock market and staring at green or red indices? Perhaps you may want to consider allocating a portion of your portfolio to a globally diversified equity and bond portfolio. As it turns out, it can be simple, cheap and, perhaps most importantly, effective.

A service created by Slovak fintech finax it is quickly gaining popularity on the Vistula River. In March, they used Finax over 4 thousand investors from Polandand the value of their assets exceeded PLN 80 million. There are many reasons for its rapidly growing popularity. Finax is a service that gives exposure to ETFsthat invest in nearly 10 securities from around the world. It also does not require a significant time commitment and adjusts the strategy to the risk profile of a specific person. It is the algorithm that will create, on the basis of the answers provided in the questionnaire "Tailor-made" strategy and model portfolio of ETFs. It is the investor's responsibility to provide funds for its implementation, with the minimum payments starting from PLN 100.

Be sure to read: Bogleheads - Save and Invest. A philosophy of financial freedom

The decalogue of intelligent investing

Behind the robo-advisor there is a philosophy that we like, because it serves the investor at every point and cares for his portfolio. It is worth getting to know it, even if we are not going to use Finax. Many of the assumptions below can be used in building your own investment strategy. Finax's philosophy consists of ten fundamental rules:

"The stock exchange is a place where wealth moves from active to patient".

This quote Warren Buffett probably knows every investor. The American billionaire made his fortune not by day-trading, not by catching lows, but by patience and regular saving. Buffett is the best advertisement for long-term investing. He holds shares of selected companies for many years. Along the way, it makes smaller or larger corrections, and even bearish periods, but it almost always comes out on its own. It is similar with the entire market. The indices are graded but in the long term they are rising most of the time. So why not take advantage of it?

Always smart

“Investing should be more like watching the paint dry or the grass grow. If you want thrills, grab $ 800 and go to Las Vegas ".

Paul Samuelson hit the point. In order to invest and make money on the stock market, you do not have to spend long hours in front of the proverbial monitor "Finger on the key". Active trading gives a huge dose of adrenaline, but also involves risk and does not work for everyone (it sometimes ends in a severe loss). In fact, in many respects, playing for quick profit is more like gambling rather than investing.

Paradoxically, the greatest threat to our capital can be ourselves. The list of mental pitfalls is really long, and even if we know it, we can still make a mistake. In this respect, the robuditor has an advantage. In investments, he is not guided by emotions or sentiment towards the industry, company or brand. It is an algorithm that selects an appropriate portfolio for the client in accordance with the parameters indicated by him (goal, attitude to risk, financial situation, experience).

The goal is important

W Finax the investor determines the investment goal and horizon from the very beginning. This includes these factors will determine the composition of the future portfolio and, consequently, the rate of return. What are the most popular declared goals of the portfolios among Polish customers?

- 60 percent - building wealth

- 21 percent - retirement

- 12 percent - kids

- 11 percent - financial pillow

The values do not add up to 100%, because one customer may have several (maximum 99) accounts.

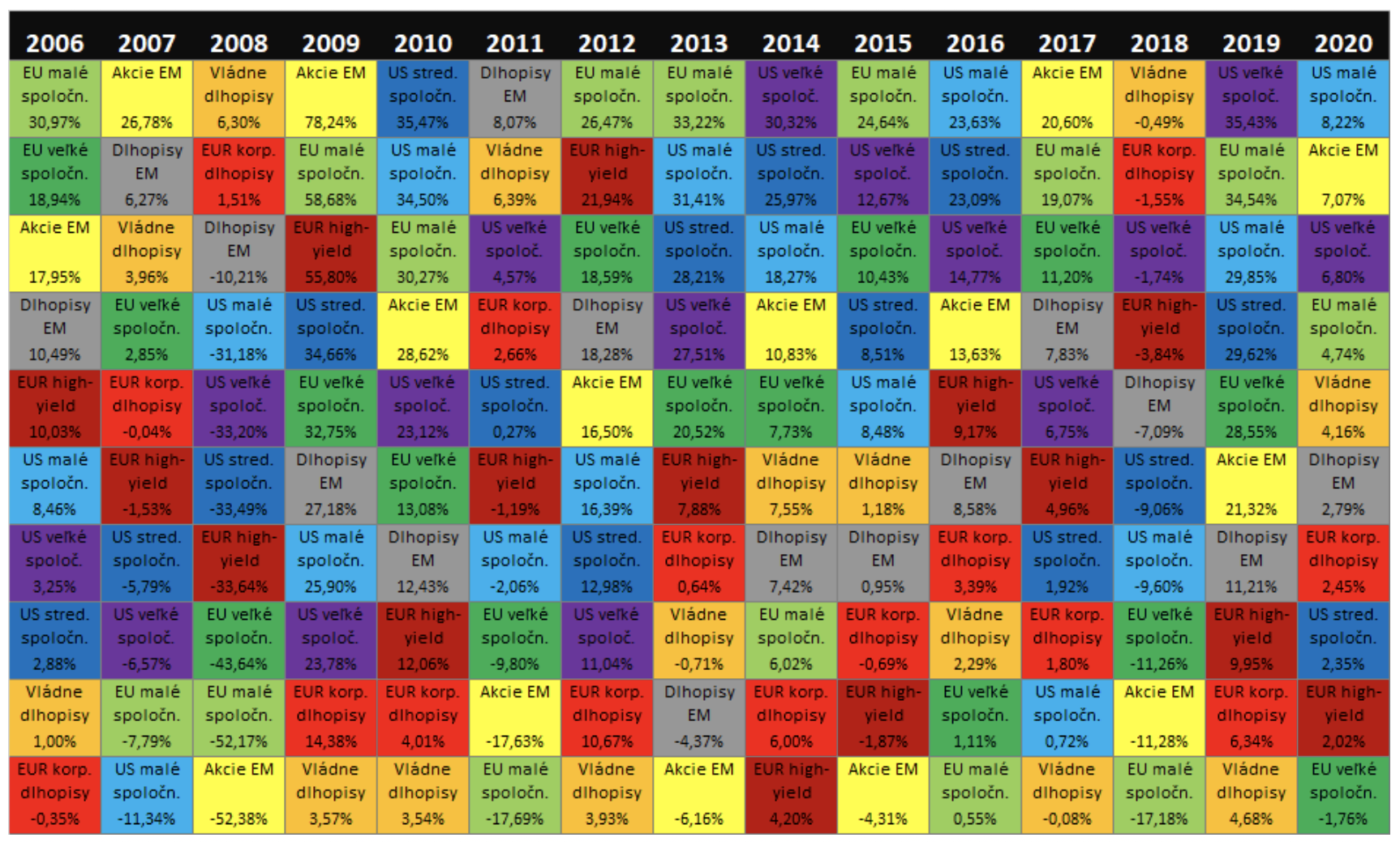

Diversification, you fool

See the above chessboard? It is true that there is no pattern in it? These are ETFs from Finax portfolios, ranked from best to worst for the year. A horse with a row to who will predict the order in the next year. Experienced investors know very well that you do not put all your eggs in one basket, i.e. you do not invest all your capital in one instrument. And it is not only about the susceptibility to price fluctuations, but also about the stress that accompanies such an investment.

If we were to point out one feature of the Finax that makes the greatest impression, this is it is definitely scale diversification. Slovak fintech offers 10 ETFs, which include, among others American large, medium and small business indices (S & P 500, S & P 400, Russell 2000), European companies of all sizes (Euro Stoxx 600, MSCI Europe Small Cap), stocks of companies from emerging countries (MSCI Emerging Markets), global government bonds (Citi World Government Bond Developed Markets, Bloomberg Barclays Emerging Markets Sovereign), European corporate bonds (Bloomberg Barclays Euro Corporate Bond, iBoxx EUR Liquid High Yield). Pretty much 10 securities from 90 countries available to every investor from PLN 100.

Be sure to read: MSCI - "Netflix" of the investment industry

Through Finax wallets, you simultaneously invest in:

- 500 largest American companies (e.g. Facebook, Apple Lossless Audio CODEC (ALAC),, Coca-Cola ...)

- Top 400 US midsize companies (e.g. US Steel, Avon, Energizer)

- 2000 leading small American companies (e.g. GoPro, Guess ?, WD-40)

- euro area corporate bonds

- 985 small European companies (e.g. Uniqa, Philips, Juventus)

- nearly 2000 leading companies from countries such as China, Brazylia or Russia.

But the diversification in Finax does not end with the broad portfolio. Throughout the investment period, a mechanism takes care of the appropriate adjustment of the portfolio and risk distribution rebalancing. Individual client accounts differ in the share of individual funds according to the selected portfolio risk. The composition of the portfolio changes over time as 10 individual asset classes never grow at the same pace. Some are growing faster than others, or some are growing while others are falling.

For example, if the algorithm selects a 50 percent balanced portfolio for the client. from equity funds and 50 percent. from bonds, in a few years the share of shares may change to 70%, and the share of bonds to the remaining 30%. However, such a portfolio already has a completely different investment strategy and risk. Is it worth rebalancing? According to the simulation, yes, because it maximizes profits in the long run (the machine sells high and buys cheap). Michał Szafrański and Jacek Lempart even calculatedthat the rebalancing algorithm adopted by Finax in a portfolio with a predominant share of shares adds on average approx. 0,45 percentage points to the annual result. The first blogger invested considerable funds with Finax, and his real wallet can be tracked online. Currently, he has over PLN 250 on his account.

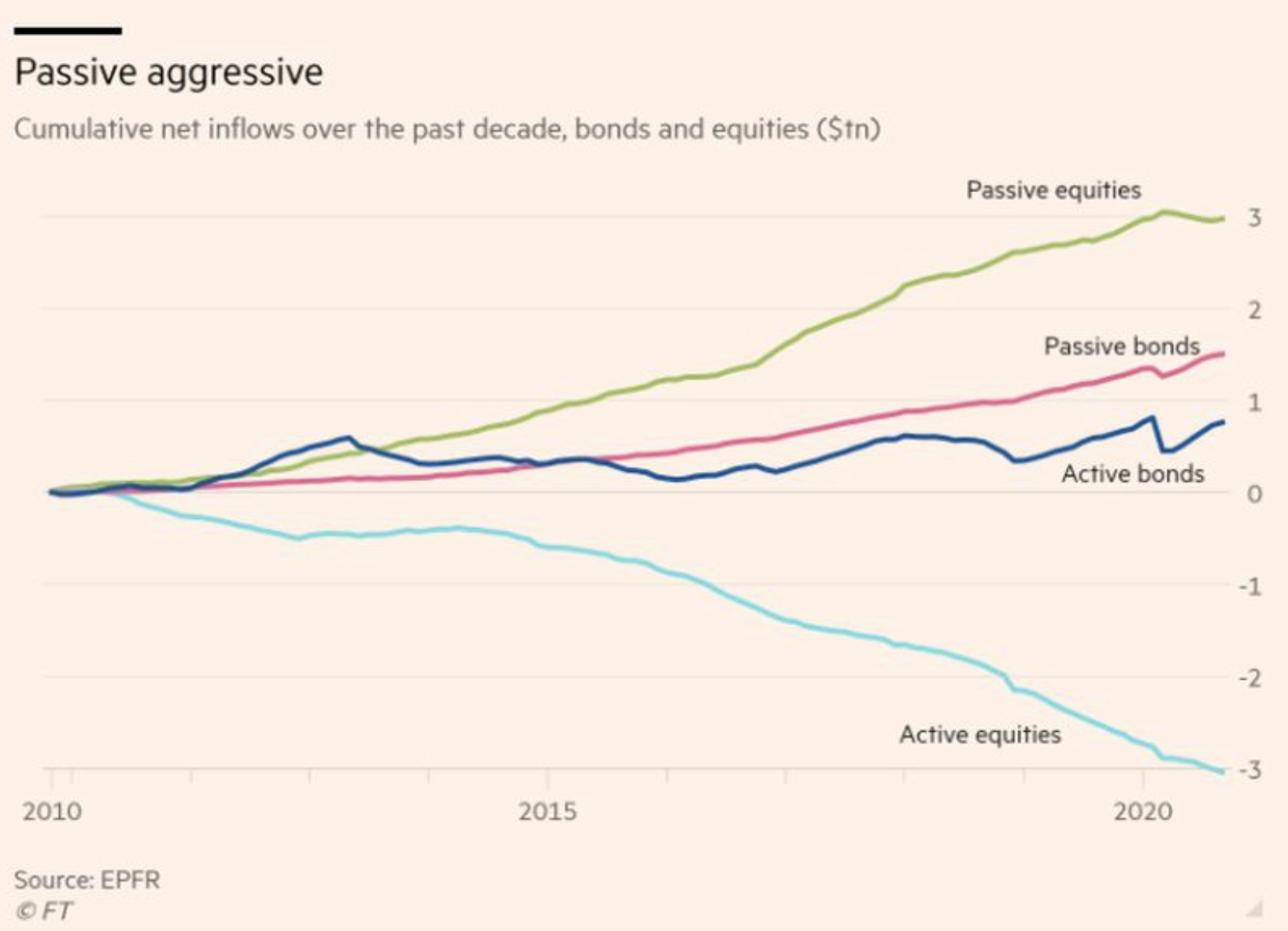

Passively = cheaper?

Investing in the long term should be cheap. It is prices that are responsible for the passive revolution taking place on world markets. If you are in doubt as to whether it is actually happening, just take a look at fund flows, recently published in the Financial Times:

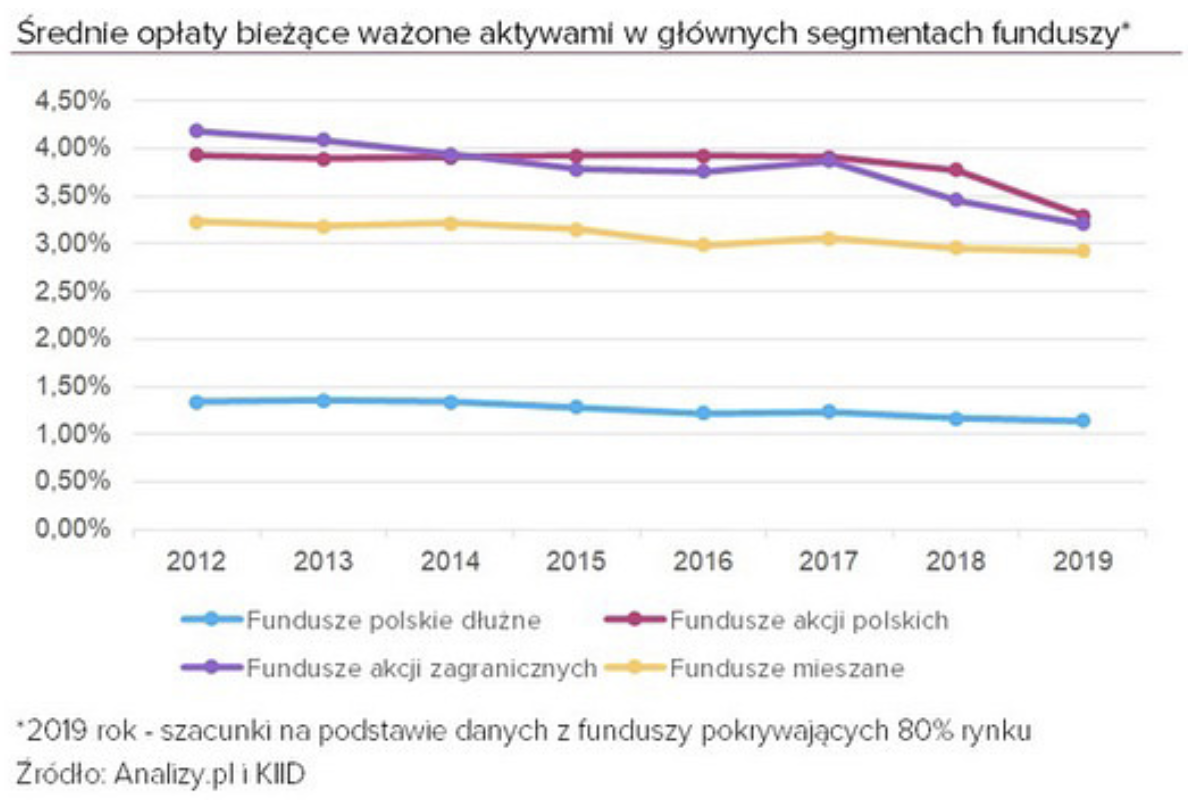

Over the years, every penny, every percentage point of commission or management fee counts. The Polish investor is not easy on this issue. Virtually all available funds have been charging a few percent fees for years, much higher than in the West. Even the Ministry of Finance dealt with the scale of the "high prices", which reduced the rates from the top. From January 2019, investment funds can charge a maximum of 3,5%. fixed management fee per year. In 2020, the maximum rate was 3%. This year, 2,5%, and in 2022 it will drop to 2%.

Compared to actively managed funds, the offer of the Slovak fintech is cheap. The annual portfolio management fee at Finax is 1 percent annually + VAT. In addition, there are handling fees for payments below 1 thousand. euro (or the equivalent in PLN).

Finax does not charge transaction fees, fees for storage, profit or withdrawal of funds.

Finally, the most important, i.e. the results ...

Finax supports a long-term approach to investing, but sometimes it's worth taking a look at the results. After all, we invest for profit. In 2020, the rates of return on Finax's portfolios were surprisingly similar - regardless of whether you had more bonds or shares in your portfolio. The portfolio based solely on bonds, i.e. instruments much safer and more stable than stocks, brought a rate of return of 9,7%. In turn, the portfolio with 100 percent commitment. in shares he earned 11 percent. (after deducting management costs, which amount to 1,2% per year). The highest result was generated by the equity portfolio with a minimum "admixture" of bonds (11,32%). For formalities, it is worth adding that at the same time the WIG20 index fell by 7,7%, mWIG40 has gained 1,75%, and the sWIG80 grew by 33,6%

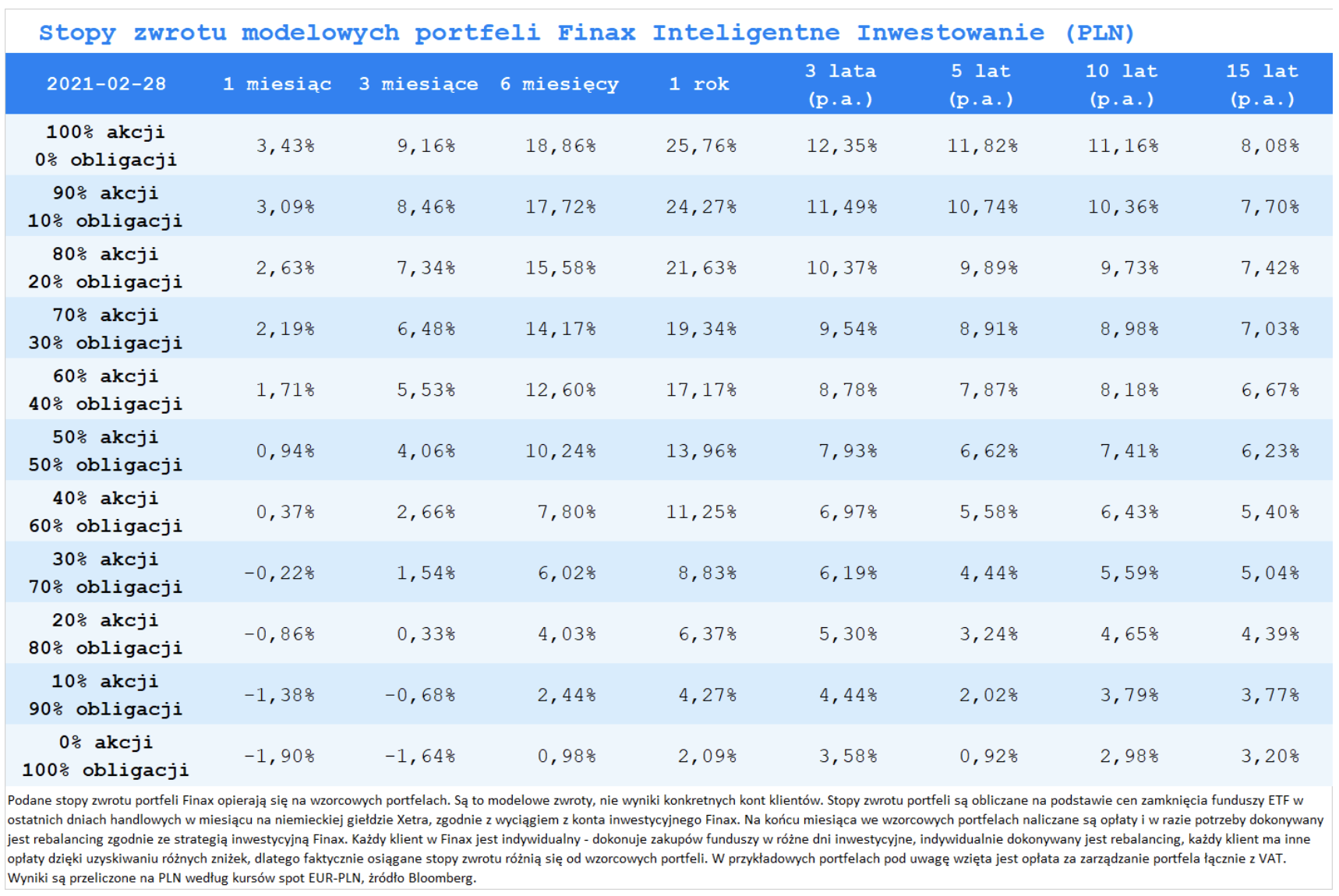

The beginning of 2021 brought the expected retreat from bonds, which can be seen in the results below. Remember, however, that Finax is a passive investor and does not want to change its portfolios depending on the market situation. Bonds, although they are cheaper for the time being, add a lot of value to the portfolios - they stabilize it, which makes it less risky.

… And security at Finax

Finax is a Slovak brokerage house. Its activity in Poland is based on the so-called passport and it is supervised by the National Bank of Slovakia. Additionally, Finax is part of the Deposit Guarantee Scheme through the Investment Guarantee Fund. Each investor's assets is protected up to the equivalent of 50 Euro (in the case of Polish brokerage houses, these guarantees slightly exceed EUR 20).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Invest, don't speculate, i.e. passive investing with Finax [Guide] finax opinions passive investing](https://forexclub.pl/wp-content/uploads/2021/03/finax-opinie-inwestowanie-pasywne.jpg?v=1616497184)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Invest, don't speculate, i.e. passive investing with Finax [Guide] ctrader desktop 4.0](https://forexclub.pl/wp-content/uploads/2021/03/ctrader-dekstop-4.0-102x65.jpg?v=1616491602)

![Invest, don't speculate, i.e. passive investing with Finax [Guide]](https://forexclub.pl/wp-content/uploads/2021/03/Jack-Schwager-invest-cuffs-2021-102x65.jpg?v=1616522545)