Investing During Recession - Opportunity or Masochism?

For some, investing in a recession is clearly an opportunity to 'buy cheap'. For others, it seems that this is the worst time to buy assets. What's the truth? It is somewhere in the middle, because it all depends on how and what we invest. An active investor should always be prepared for changing market conditions. The media and social networks constantly bombard investors "Extremely important" information. The market prospects depend on various market expectations regarding, inter alia, down:

- future results of the company,

- the condition of the entire sector,

- global capital flows,

- interest rate paths,

- domestic and global inflation,

- economic prosperity.

In today's text, we will explain how to think about investments in times when world economies are shrinking and which asset classes are a good idea for difficult times. We invite you to read!

What is a recession?

To know how to invest in a recession, you need to know its definition. As a rule, there is talk of a technical recession when real GDP growth is negative for two consecutive quarters. Of course, there may be various reasons for the decline Gross Domestic Product. According to the simplified formula, GDP is equal to the sum of consumption, investment, government expenditure and net exports. As you can see, the decline in economic activity may result from weaker retail sales or a slowdown in investment in the economy. Sometimes it happens that the decline in GDP is due to external shocks such as, for example, aggression of a neighboring country (visible in the case of Ukraine), economic sanctions (Russia) or a rapid contraction of the economy of the main trading partner (exports then decline). A decline in economic activity may cause:

- Reduction in real wages,

- Increase of unemployment,

- Decrease in investment outlays,

- Reduction of private consumption.

Often times, a recession is caused by several factors that influence each other. If activity in the service and manufacturing sectors declines, then companies reduce employment. As unemployment increases, the pressure on wage increases is weakening. At the same time, rising unemployment causes a decline in consumption among households affected by job loss. Falling private consumption causes the decline in the demand for goods in the economy. As a result, enterprises experience falling domestic demand.

Sometimes the recession is short-lived. Then it is only a temporary shortness of breath before the economy returns to the path of growth. However, sometimes the scale of problems affecting the economy is so great that the decline in GDP lasts much longer than two quarters. Then we deal with economic depression. It is simply a deeper and longer recession. It is often "cleansing" the economy of missed investments. Due to the economic slowdown, banks' portfolios are deteriorating. NPL growth (non-performing loans) requires banks to allocate capital more wisely. As a result, entities with a worse financial position have problems with financing. The most problematic loans go to restructuring. Ultimately, the least profitable investment projects do not receive additional financing. Eventually they are interrupted. For this reason, the demand for capital goods and building materials is declining. As a result, companies producing cement, steel, aggregates or industrial machines may decline in sales.

During depression there is also an increase in unemployment, which causes a decrease in consumption. This is due to a decline in real wages in households. For this reason, household budgets must be limited. Most often, spending on discretionary goods such as furniture, cars and RTV equipment is the first to be limited. This, in turn, translates into lower sales of furniture companies and producers of TV sets and home cinemas. In addition, many households postpone renovation of their houses and apartments. Other "unnecessary" expenses that limit households under financial pressure include going to the cinema, restaurants or concerts.

The deterioration in the liquidity position of banks, combined with lower earnings of households, causes that the supply of housing loans is falling. Due to the fact that many apartments are purchased on a mortgage. A particular problem occurs when, apart from the recession, interest rates are at a high level. Then mortgage loans become more expensive, which significantly reduces the creditworthiness of customers. At the same time, the increase in interest costs, caused by high interest rates, puts many households under financial pressure. This creates another pressure to cut expenses. It is worth mentioning that the difficult situation on the real estate market has a negative impact on real estate developers who have to deal with two problems. One of them is the downward pressure on real estate prices, which negatively affects the margin. The second problem is falling demand, which causes many unsold flats to end up in inventories, which causes "cash freezing" and an increase in liquidity problems in weaker traders.

How are governments fighting recession?

For many governments, the economic recession is very negative news. This is not due to moral reasons but to cold political calculation. Worse economic conditions translate into a more difficult financial situation for many households. This, in turn, translates into an increase in dissatisfaction with the "ineffective" governments of the current political party. In effect for those in power, the main goal is to make the recession as short and gentle as possible. Even if the measures taken cause problems in the long run, many rulers are willing to accept it just to stay in power.

Governments through fiscal policy can soften the recession somewhat. One idea is to increase the budget deficit to finance higher government spending. Examples of such expenses are government unemployment support programs or loan guarantees for key sectors of the economy. Another measure the government can do is to finance infrastructure projects that are expected to increase GDP. Automatic stabilizers are another potential solution to the problem of lower aggregate demand. It is a passive state budget policy that automatically responds to changes in the economic situation. The automatic stabilizers of the economic situation include taxes (lower burdens during an economic downturn) and the "social security net" (eg unemployment benefits, social assistance).

Another option the government has is putting pressure on the national central bank to create a liquidity support package for the banking sector. One solution is the purchase of toxic assets, which improves bank balance sheets. The better condition of banks is expected to increase the supply of loans. This will help fuel consumption and investment in the economy. However, if the monetary package is too large, then the imbalance in the economy may be too large (for example, there may be financing unprofitable investment projects).

Recession in the United States

According to data collected by NBER from 1947 to 2022, there were 10 recessions in the United States. The longest period of decline in Gross Domestic Product occurred between Q2008 2009 and Q1974 1975. This meant four quarters in a row. The "three-quarter" recessions occurred twice. The first at the turn of 1953 and 1954 and at the turn of 2 and 2020. Of course, the strength of the recession varied. The largest recessionary (i.e. 10-quarter) decline in GDP took place in XNUMX, when it amounted to over XNUMX%. The reason was the lockdown, which caused a sharp decline in economic activity.

Some thoughts on the recession

For investors, the recession should not be spooked by the recession. Instead, he should look for opportunities to take advantage of market-based promotions to buy great businesses cheaply.

Recession is not terrible!

From 1871 to 2022, the United States experienced 30 recessions. It meant that on average, there was an economic slowdown every 5 years. Despite numerous recessions, the US stock market provided the annual average real (ie after subtracting the impact of inflation) of 6,9%. Long-term investment in the US stock market was one of the best ways to build wealth, regardless of the current stock market conditions. Of course, this requires a very long-term view of investing in the capital market. Unfortunately, most traders focus on very short-term investments and focus on analyzing the hype that may encourage you to take a position in the market more often than necessary.

Catching highs and lows is not the investor's goal

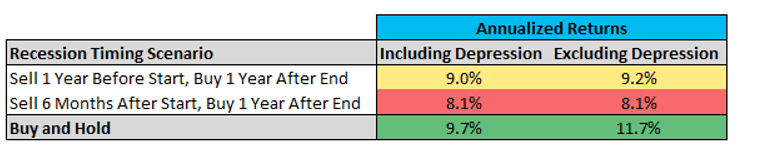

Some finance lecturers recommend investing in safe 3-month treasury bills during the economic downturn. On the other hand, when the recession ends, they recommend buying stocks on the stock exchange. Such a strategy allowed to beat the market by 1 percentage point in the years 1928 - 2021. However, he was responsible for all the differences Great Depressionduring which the shares fell by more than 80%. If you take into account the time since the end of the Great Depression, the strategy generated approximately 10,6% rate of return vs. 11,7% from the buy-and-hold strategy. Charlie Bilello enumerated a strategy in which the investor sells stocks one year before the recession and buys them one year after the recession ends. The results of this strategy are presented in the table below:

This is a confirmation that the capital market is not the economy itself. Most often, the stock market falls before a recession and starts to rise before the downturn ends. Trying to predict market behavior is good for professionals who analyze price movements in the stock market. However, beginning investors and fundamental investors should avoid catching highs and lows.

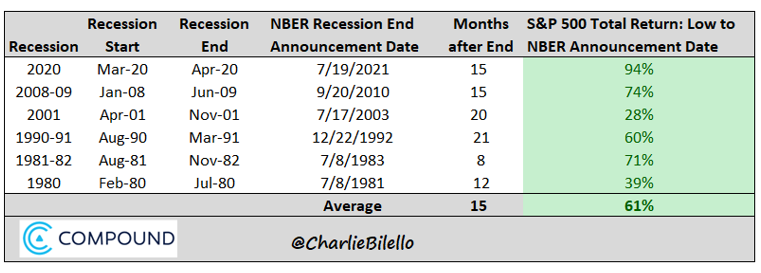

Use inheritance for purchases

Too procrastinating with purchases during market declines is a very big mistake. It is worth remembering that the market anticipates changes in the economic condition earlier. For this reason, you should not wait for the official end of the recession by government agencies to buy stocks. Behavior is a great example the S&P 500 indexwhich in the last 6 recessions grew from lows by several dozen percent before the NBER announced the end of the recession.

Of course, there is no guarantee that the investor will buy the stocks right in the hole. Therefore, a safer strategy is to systematically buy stocks after each major downturn. However, this requires additional funds. They can come from managing your household budget wisely and generating monthly surpluses that can be invested in the stock market.

Of course, there is no guarantee that the investor will buy the stocks right in the hole. Therefore, a safer strategy is to systematically buy stocks after each major downturn. However, this requires additional funds. They can come from managing your household budget wisely and generating monthly surpluses that can be invested in the stock market.

Diversify your portfolio, think long term and be flexible

During a bearish market and the duration of the recession, market sentiment is weak. This causes many asset classes to move in the same direction - downwards. In such periods it is worth having a diversified portfolio, as some market segments perform slightly better than the broad market.

Of course, there are strategies that perform quite well in a bear market. One of them is taking a long position on the VIX index. During a market panic, volatility generally increases, resulting in an increase in the value of the index. During the panic in 2020, the VIX, from January to March 18, quadrupled. However, it was not a good idea to keep this security feature for a long time. From March 19 to July 2020, the VIX index decreased by 50%. On the other hand, if the investor held the position until the beginning of August 2022, the loss on the index would be around 90%.

As you can see, it makes sense to monitor your position and be flexible in hedging strategies. Sometimes the best strategy in "Previous crisis", it does not always work well in subsequent periods of market turmoil. A more long-term horizon should be about the shares held in the investment portfolio.

Take a look at the commodity market

If the market is in the phase of an economic downturn, the level of investment usually drops. This reduces the demand for raw materials needed to complete infrastructure, real estate and industrial projects. For this reason, the demand for copper (also known as Doctor Copper). The PhD in economics is due to the fact that this raw material is used in many industries, therefore fluctuations in copper prices may herald a change in the trend in the economy. Copper it is used from the construction of houses, machines, electronics to transmission networks. For this reason, the fall in demand for copper may herald economic problems. According to the CDA (Copper Development Association) data, around 46% of copper production is used in the construction industry, 21% of electrical parts, 17% of consumer and industrial goods, equipment and machinery, and 16% in transport.

For this reason, copper prices are quite a good indicator ahead of the economic cycle. Canceled orders for copper may cause falling demand to lower the prices of this metal.

Of course, sometimes the change in copper prices can be due to changes in supply. However, as a rule, supply adjusts much slower to changing demand.

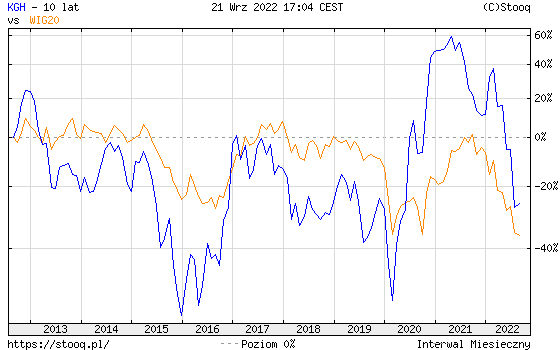

When the recession is making headlines and the prices of copper producers are falling, then investors can look to long for copper mining companies. Companies of this type are very volatile, which gives speculators an opportunity to achieve a high rate of return in the short term. This can be seen in the chart below. The blue line shows changes in the price of KGHM (one of the largest producers of copper and silver in the world). The orange line marks the changes in the WIG 20 index.

In turn, rising copper prices (with no changes in supply) may indicate a recovery in the economy. Raw material companies have an inflexible cost structure, therefore the increase in copper prices significantly increases the profitability of companies extracting this raw material.

In turn, rising copper prices (with no changes in supply) may indicate a recovery in the economy. Raw material companies have an inflexible cost structure, therefore the increase in copper prices significantly increases the profitability of companies extracting this raw material.

Investing During a Recession - Summary

The period of recession is especially frustrating for investors who have a long-term investment horizon. Falling stock prices, coupled with "Information noise", do not inspire fainthearted investors in a positive way. Newspaper headlines, Twitter, economic TV stations inform about further bankruptcies and economic problems. This can encourage the sale of even a good quality company by a scared investor.

During the market downturn, a broad market falls, which includes both very good companies with great prospects and companies with financial problems. For a fundamentals investor, this market situation can provide an opportunity to buy stocks well below the intrinsic value of the enterprise. What is important is to avoid the urge to catch highs and lows. Selling stocks in the hope that they will soon be cheaper may cause the investor to sell the stock at the height of the panic.

It is worth remembering that even the biggest recession and bear market will end sometime. It is followed by a time of economic recovery and a market boom. For this reason, investors should always be optimistic about the long term. Time is always the greatest ally for companies with good prospects (e.g. a company has permanent competitive advantages).

Raw materials companies are an interesting investment idea for investors who like short-term or medium-term transactions. A period of recession can be a good place to take a long position on overpriced companies, e.g. z mining sector.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)