Passive investing - what is it | Advantages and Disadvantages [Guide]

Over the last two decades, there has been a change in the method of allocating funds on the capital market by individual and institutional investors. There is a slow shift away from active investing towards passive investing (the so-called passive portfolio). Good results of passive solutions combined with low fees and the simplicity of using this solution have found many supporters. Thanks to these solutions, the investor does not need to be familiar with fundamental and technical analysis. All you need is a brokerage account, consequence and resistance on capital slips.

Passive strategies

W "Explosion" passive solutions were also helped by the "great boom" of 2009-2020 and a very quick recovery by indices of most markets after "Korabessie". As a result, US investors have not experienced a long bear market in over a decade. It should be remembered that during long stagnation (eg WIG20 in 2011-2020) passive strategies perform equally poorly.

Be sure to read: Bogleheads - 9 steps to financial freedom

In time "Permanent bull market on American stocks", the passive strategies associated with this market also performed very well. If the S&P index has nearly tripled in value in the last 10 years, then ETFs and index funds achieved a very similar rate of return.

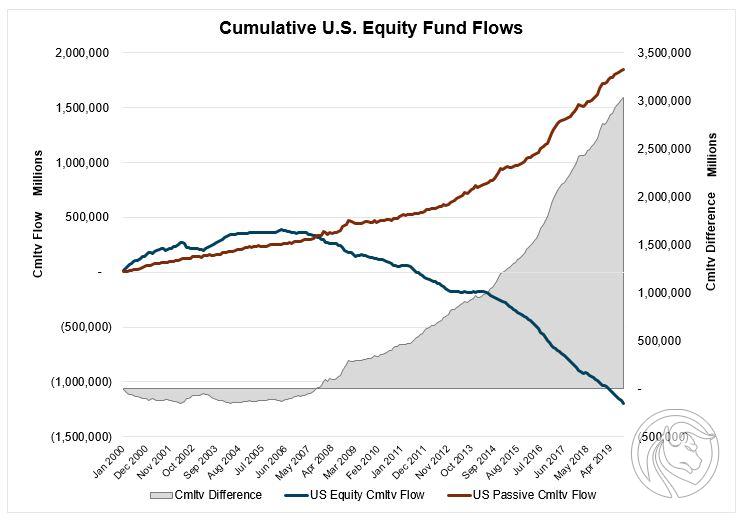

In the United States, for over 10 years there has been an outflow of funds from active solutions and an inflow to passive solutions. It is therefore fashionable to invest in products that imitate the markets, not try to beat them. This can be clearly seen in the chart below.

Source: 361capital.com

What is a passive wallet?

It is a portfolio that has exposure to instruments that mimic indices or particular asset classes. This portfolio can consist of both ETFs and index funds. The purpose of passive solutions is to reflect a given benchmark as accurately as possible. ETFs and index funds will never beat the performance of a given benchmark (it will be lower due to management fees), but they are a simple and cheap solution for large portfolio diversification.

The passive portfolio should be selected according to the investor's temperament. The more "aggressive" ones should have greater exposure to the stock market in their portfolio. On the other hand, investors avoiding risk can either use the 60:40 strategy or add instruments to the portfolio with exposure to the commodity and real estate markets (REITs).

What is active investing?

Active investing requires the investor to either build a portfolio on their own (individual selection of shares, bonds) or invest in an actively investing fund. Active investment requires constant analysis of the market situation, selection of optimal companies for the equity portfolio and bonds for the "bond" part of the portfolio. When investing in equity instruments, you must be familiar with either fundamental or technical analysis. By investing on their own account, the investor saves the cost of asset management, but at the opportunity cost is the time spent reading financial statements or analyzing charts.

By investing in actively managed funds, the investor entrusts funds to professionals who hire analysts to find investment opportunities that will "beat the market". In return, the fund charges a higher management fee to cover fund management costs. However, high management fees mean that much of the fund's profits are "eaten". As a result, most active funds perform below their benchmarks. It is no wonder that in Poland some funds charge a few percent of the management fee.

"Investing is simple but not easy"

It is worth remembering the words of one of the best investors in history. One of the sayings Warren Buffett was:

"Investing is simple, but it's not easy."

At first glance, the above sentence may not make sense. However, on closer examination, the above quote makes sense.

Investing is simple because you only need to buy an asset with the available funds. However, it is not easy as you should invest your funds with sense. Buying a hectare of a plot of land in the Sahara desert for farmland may not be the best investment idea. Likewise, buying shares in a company that is undergoing bankruptcy proceedings may result in a loss of investor funds.

Another problem is the investor's emotions that can get in the way of following the investment plan. Interestingly, emotions interfere with all market conditions.

During an uptrend, an appreciation of assets can induce the investor to take profits. It is classic "Cutting profits"as the selling investors found out Amazon in 2010 because it "grew too much." At the same time, an uptrend may cause FOMO (Fear of missing out), i.e. fear of missing an opportunity. In such a situation, the rapid growth of, for example, companies related to the marijuana industry (in 2018) could persuade the investor to purchase shares "on the hill".

Periods of market stagnation

Another aspect is the investor's reaction in the event of a downtrend. Stock adjustments and other underlying instruments are an integral part of the market. Long-term investing requires the acceptance of bearish periods, during which assets will regularly depreciate. Such periods are good places for a greater accumulation of financial instruments. However, a nervous investor may not withstand periods of falling prices. As a result, it will start selling "on the classic hole". Also, periods of market stagnation (sideways trend) encourage more frequent portfolio rotation, which results in transaction costs (commission + spread).

A great workaround for psychological traps is to invest in passive solutions on a regular basis. In this case, the investor has a time horizon of 20 or 30 years. As a result, he does not care about current prices. Each month, it purchases a certain number of ETFs or index funds. During sudden sell-offs, it takes advantage of the sell-off and purchases more units of funds. He doesn't have to be afraid of making a wrong choice. It buys solutions diversified both in terms of sectors and countries. Such an investor does not want to beat the market. Doesn't waste time looking for the next Amazon or Apple Lossless Audio CODEC (ALAC),. He focuses on his life and uses the capital market to multiply his capital.

Who is passive investing a good idea for?

Passive investing is a very good solution for people who do not have time to analyze the capital market. This applies to people who have to work full-time, have their own business, or do not have time to train in the field of fundamental and technical analysis.

Those using passive solutions must be realistic about investing. Passive solutions will not allow you to "earn extra money" within a month or two. It is necessary to invest regularly and be consistent in the implementation of investment strategies. The passive way of multiplying savings is not suitable for "Interesting stories at the grill". Choosing a passive wallet is not possible "Finding the next Microsoft". On the other hand, thanks to geographic and market diversification, the risk of a significant loss as a result of investing most of the funds in a failed venture is reduced.

Advantages and disadvantages of passive investing

The advantage of passive instruments are lower management fees, which result from lower costs that the managers of the index fund or ETF have. The cost advantage of passive solutions over active ones results, among others, from because there is no need to hire analysts who are paid to seek and analyze investment ideas that will "beat the market".

By creating an investment portfolio, the investor can easily gain exposure to global markets and a wide range of assets with one click of the mouse. When choosing passive solutions, an investor does not have to follow market news, analyze companies or the policies of central banks.

The hypothetical investor may also forget to track changes in the economy. Successful companies will increase their share in the index, while the "losers" will either drop out of the index or be marginalized.

The downside of passive investing is "fund blindness". This means that an index fund or ETF invests in the entire index. The basket includes both companies increasing the scale of operations and enterprises from "dying industries", whose revenues and financial results decrease in each subsequent year.

Another disadvantage is the blindness of passive solutions. This applies to investing in companies that are contrary to the investor's worldview (e.g. gambling, tobacco companies, etc.). Another downside is the inability to achieve above-average profits, as passive investing will almost always underperform the benchmark (management fees have a lower rate of return).

Another weakness is the low flexibility of passive investment. An ETF or index fund buys stocks whether they are expensive or cheap. During downturns, passive funds do not use hedging strategies that can minimize losses.

Summation

Investing should be simple. You do not need to know advanced mathematics or knowledge of derivative pricing models to enjoy the increase in the value of the portfolio. Thanks to passive investing, the investor can acquire a diversified portfolio of assets with exposure to both the "standard market" (S & P 500, S & P 400, DAX 30) and specialized investments (robotics, growth companies, Brazilian companies). The most difficult thing about passive investing is dealing with your emotions. Behavioral aspects such as dealing with longer periods of loss are key to achieving financial independence.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Passive investing - what is it | Advantages and Disadvantages [Guide] passive investing what is it](https://forexclub.pl/wp-content/uploads/2021/03/inwestowanie-pasywne-co-to-takiego.jpg?v=1616671785)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Passive investing - what is it | Advantages and Disadvantages [Guide] mbank forex crypto fraud](https://forexclub.pl/wp-content/uploads/2021/03/mbank-oszustwa-forex-crypto-102x65.jpg?v=1616662273)

![Passive investing - what is it | Advantages and Disadvantages [Guide] retail sales macroeconomic indicators](https://forexclub.pl/wp-content/uploads/2021/03/sprzedaz-detaliczna-wskazniki-makroekonomiczne-102x65.jpg?v=1616748978)