Investors are not slowing down. Is the US housing bubble growing?

The construction sector is closely watched during all stock market turmoil due to its role in the crisis of 2008. We must admit that it is one of the best barometers for determining the business cycle in which we are currently. Real estate is not only investments that are intended for wealthy investors looking for passive income. The real estate market also generates a demand for loans (everyone is well aware of the amounts that must be spent on the purchase of real estate) and a wide range of services. It is hardly surprising that the data on this market are so closely monitored by investors and analysts. They set a trend and shed some light on the moods and actions of consumers. In today's article, we'll look at a little bit more about the current situation in this market and how it relates to currencies and credit. I invite you to read!

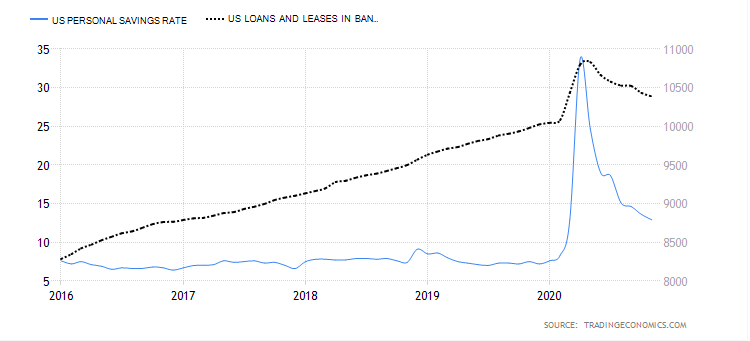

We cut expenses, but are we everywhere?

The consumer is at the center of the analytical world for a reason. It is through the hands of households that the most important spending decisions pass. It is there that wages flow, savings and profits of enterprises are accumulated there, and liabilities for various goods and services are incurred. It should therefore come as no surprise that household cash flows are so frequently and readily researched by forecasters and analysts. Moreover, this sector is the basis of macroeconomic indicators such as the consumer sentiment index and inflation. Coming back to the point, however, the private sector during the crisis naturally cuts expenditure, especially investment expenditure. Therefore, we could assume that investments that are the most capital-intensive should drop out of the basket first. De facto looking at it with a sober eye is sensible and even obvious. How is it today? Well, see for yourself.

Source: Trading Economics

The graph shows two variables over a 5-year period. The first, blue one, determines the level of household savings, the second - black one, a loan for the private sector. The peak in 2020 is, of course, the turn of April / May, when we dealt with the first wave of COVID-19 and the first, strong restrictions on economies. As you can see, the level of savings has increased drastically. The credit, however, remained virtually intact. Has such a high degree of money thesaurisation among households influenced the level of investment? Yes of course. The more relevant question in this regard is where has the investment spending contracted the most? Certainly not in real estate.

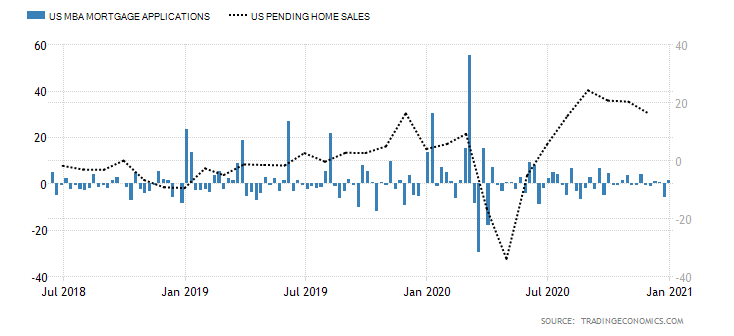

Source: Trading Economics

In the chart above, we have two more variables. Bar data show mortgage applications and second, linear figures show property purchase contracts. The high demand for loans is partly justified by the low interest rates that took place during the April-May fiscal stimulation. Here you can see exactly what the demand for cheap loans has pumped into the mortgage market.

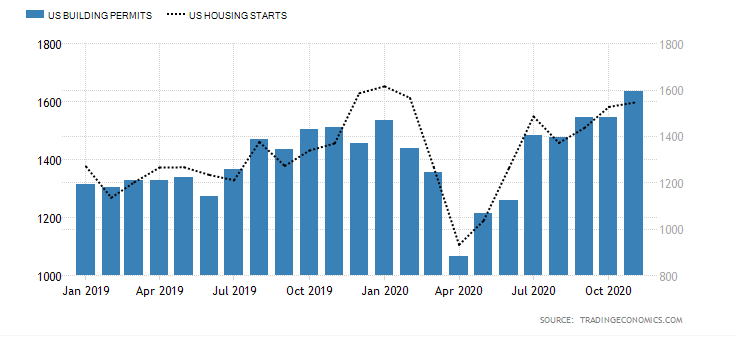

Source: Trading Economics

Looking also through the prism of building permits (blue bars) and the real estate construction works commenced index (black line), the dynamics has practically not changed since 2019 and remains at a relatively high level. Investors, looking through the prism of the above-mentioned data, did not give up despite the crisis on the real estate market.

Construction sector resilience

The resistance of the real estate market to crisis perturbations is largely based on cheap loans. Low interest rates and a realistic vision of keeping them at such a low level (not only in the United States) in the long term are a tempting proposition to incur liabilities like a mortgage. The interest rate on this type of loan is currently the cheapest in several dozen years, as shown in the chart below.

There is therefore a real chance that the real estate boom will continue until a severe interest rate hike begins. It could also be assumed that we are facing a situation of inflating cheap money to horrendous sizes and a repeat of 2008.

Who is lending to Americans?

We have already described on the pages of our portal some time ago HP Minksy's model of crisis. Interestingly, it indicated that each crisis is preceded by a long period of stabilization. Another determinant of a potential bubble in a given sector is the number "Unprofessional" financial institutions (institutions other than banks) that grant loans for specific purposes.

At the end of 2018, The Wall Street Journal published a very interesting list of non-banking entities that finance the mortgage market. Importantly, 51,7% of the total debt market for real estate purchases came from such institutions, not banks. The situation is probably the same now, as the demand has not died down, and the environment of low interest rates and cash printing is conducive to incurring liabilities. So where is the risk? Non-banking entities do not have deposits collected from clients at their disposal. They do not carry out activities related to raising money in the form of deposits. They are forced to finance their activities in a different way. It is known that many of them act as suppliers for banks by intermediating in taking out a mortgage (the loans granted are usually a component of their balance sheet for a while). Then they are sold packed in larger ones "Donuts" banks.

Another issue is the credit contracts that can be securitized, which means that they can be exchanged for secured securities and liquidated on the market. The liquidation takes place through the sale of such securities to investors of various types, including individual investors, most of whom have not dealt with such products before. At this point, we can see what Minsky meant and what risks he was looking for in the sectors. I do not want to speculate about the upcoming real estate bubble, although it is worth keeping a close eye on this market. The economic situation in the US after 2020 is not the best. The United States still has problems with high indebtedness (a huge increase last year), a large number of unemployed and the burden of further restrictions. Low interest rates and a large share of non-banking institutions in mortgage financing already create an interesting vision for the coming years.

In addition, there is the issue of the profitability of apartments bought for rent. Those who purchased them at the current price frenzy will not be able to come to terms with the low return. On the other hand, the part of investors who purchased real estate cheaper will not have a mental barrier to achieve a slight plus or proverbial zero at this point, getting rid of a low-profit investment. I am deliberately omitting the square footage aspect here, as it is much broader content (including commercial premises, which, as we know, are now equally difficult).

What's the dollar for all this?

As you can see, the real estate market is still hot. Printing money and low interest rates favor the credit market. A large amount of cash in the market and a lack of restraint in proposing new fiscal packages should weaken the dollar at least in the medium term. However, the demand for credit remains high. The saving rate is decreasing and the return on investment in deposits is almost negligible. Therefore, investments that will bring a few percent profitability seem more interesting.

Looking at the dollar index in the futures market, it doesn't look very good. Currently, it oscillates around the lows of 2018. The USD discount and the further prospect of its weakening create interesting trends on the market. First of all, I mean the improvement in the situation of US exports, where a weak dollar improves its competitiveness and economic outlook. In general, the value of the dollar is delayed in time and is prognostic for the real estate market. Of course, the value of housing prices depends on the demand. The higher the demand, the higher the prices - a simple relationship that we see in every market. Does a cheap dollar significantly affect home prices?

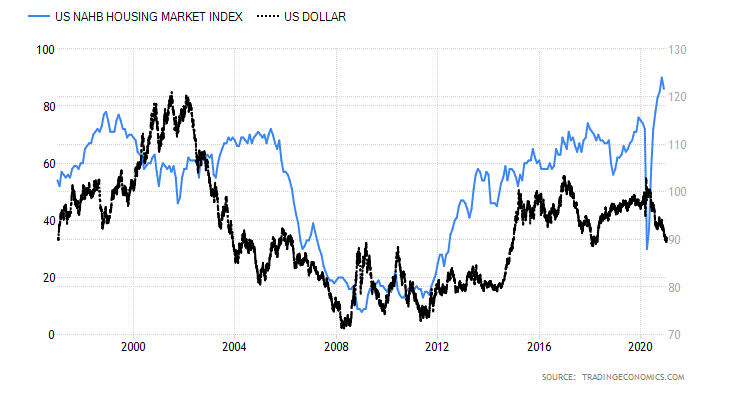

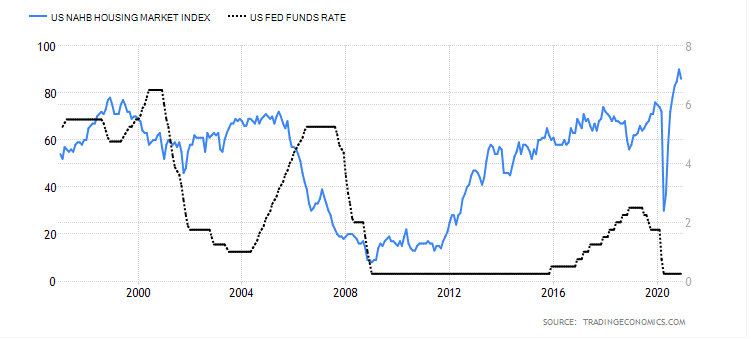

The above chart shows the relationship between the dollar index (black line) and the NAHB (National Association of Home) housing price index. It is hard to see any uniform regularity in the behavior of one indicator and the other. I supplemented it with one more important variable - the interest rate.

In this chart, we have the housing index (blue line above) and the US interest rate (black line). If we compare both charts (with the dollar index and the interest rate), we notice that a good environment for the real estate market arises when interest rates are low and the USD is cheap.

Summation

The above considerations are of course my subjective assessment of the real estate market. However, taking into account the current situation and the macroeconomic environment, which I enriched with Minsky's theory (due to the fact that he based his research on credit), it is likely that real estate will be significantly discounted in the near future. What do I mean by the laconic phrase "near time"? Mainly such a period in which the debt structure will not change significantly, and the market, due to restrictions or natural limitations (population, investment profitability, etc.), will start to create the supply of real estate.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)