The money illusion can destroy the return on your wallet

High inflation caused central banks in many countries to start a series of interest rate increases. As a result, deposits have become much better interest rates. However, this is only part of the truth. However, the nominal level of interest rates alone is not an indicator of real profits. However, many people succumb to the illusion of high interest rates. This illusion makes a person happy with a high interest rate on deposits. This is because the interest rate is high high nominal profit. The rate of inflation, which can eat up all nominal profits, is also crucial. For this reason, it makes sense to discount nominal profits by the rate of inflation. The illusion of money has a great influence on the illusion of high interest rates.

What is the money illusion?

The money illusion is one of the most well-known cognitive fallacies. This is an economic theory that says that people tend to look at their wealth and income in a nominal rather than real way. In other words, subconsciously people are not aware of inflation (if it is at moderate levels). This means that people, looking at the interest rate on deposits or bonds, focus on the nominal amount of interest they receive. They do not take into account real changes, such as inflation. After all, it's better to have a deposit at 0,0% and have a price deflation of 1% than a deposit interest rate of 4% and inflation of 6%. However, for many people, the first case suggests that money "doesn't work." However, people realize this only in the long run. In the short term, they succumb to the illusion. They focus on the nominal value of earnings. This is easier than converting your salary per square meter of housing or the number of eggs.

For the first time, the term money illusion was introduced to economists by Irving Fischer. This title was introduced in the book “Stabilizing the Dollar”. In 1928, Fischer dedicated an entire book "The Money Illusion" just this phenomenon. The term gained popularity thanks to John Maynard Keynes, who was an "economic star" in the interwar period and just after the war.

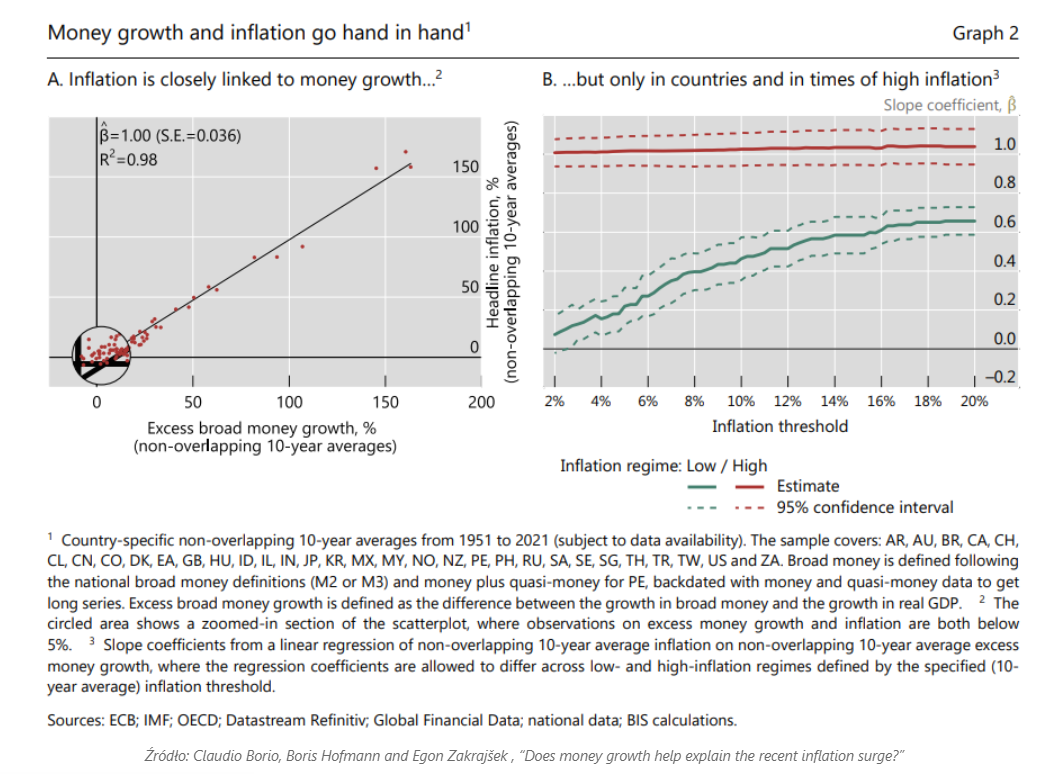

What causes inflation? According to the monetary approach to economics, an increase in the money supply ceteris paribus causes a decrease in the purchasing power of the currency. According to the analysis of the Bank for International Settlements, a particularly strong relationship between the money supply and inflation is found in an environment of high inflation.

Research on the money illusion has been carried out by numerous economists. One of the papers from 1997, whose authors were E. Shafir, PA Diamond and A. Tversky, confirmed the existence of this phenomenon in everyday life. According to them, the causes of the money illusion are:

- Price stickiness The money illusion explains why nominal prices slowly adjust to changes in the price level in the economy.

- Concluded contracts and law – contracts often do not include price indexation of the contract value. This is the case, for example, with employment contracts. Employment contracts with indexed remuneration are rarely signed. Usually, it is the employee himself who must somehow convince the employer to raise the salary.

- No economic education – the mass media are not concerned with educating people in economic knowledge. Many people cannot calculate the real change in salary (i.e. after taking into account inflation).

Of course, price stickiness is not a permanent phenomenon. In the end, enterprises to protect their profit, and must raise prices. According to research conducted in European countries, on average, every 5-7 months there is a change in the price list for products and services during normal inflation.

How to calculate real changes in prices and interest rates?

The so-called Fischer formula is helpful in calculating the real level of interest rates. Its value is calculated according to the following formula:

The real interest rate = [(1+nominal rate) / (1+inflation rate)]-1.

Let's take an example:

The nominal interest rate is 5%, while inflation is 3%. Substituting into the Fischer formula, we get 1,941%.

The illusion of money and earnings

The money illusion also applies to the perception of salary. Employees usually look at it from the point of view of nominal values. An uneducated worker may agree to a nominal wage increase that will in fact be a real wage cut. Thanks to this, the entrepreneur can improve his margin despite the increase in the wage fund in nominal terms. Gentle inflation allows you to create the illusion of an increase in salaries. A 2% salary increase is not a real increase if the cost of living also increases by 3,5%.

If a pay cut occurs due to inflation, workers do not believe that the employer has actually cut their wages. A worker would view a 1% pay cut at zero inflation quite differently. He would treat it as an unfair reduction in salary.

The illusion of high interest rates and investing in the stock market

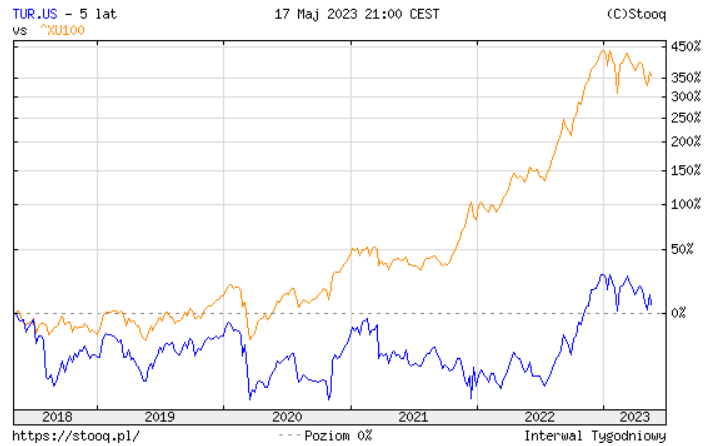

Looking at the nominal increases of the Argentinian or, for many years, Turkish indices, one could get the impression that we missed out on big profits. Nothing could be more wrong. In the case of investing in foreign markets, the impact of the exchange rate is also important. A nominal increase in the Turkish lira means nothing if the lira has lost more value than the stock market has gained. For this reason, when investing in foreign markets, you can look at how the macroeconomic environment is shaping up. Geographical diversification makes sense when investing in stable currencies. However, currency stability itself can be a pipe dream if it is established artificially. The fixed exchange rate was one of the reasons it caused Asian Crisis from 1998.

READ: The Argentine Crisis - Tango with Debt and Bankruptcies

Investors can also be fooled by nominal revenue and profit growth as real growth. What matters is the real growth of the business, i.e. adjusted for inflation. It's one thing to grow a business by 15% at 1% inflation, and another thing to grow 25% at 20% inflation. At first glance, it may seem that the latter company is developing faster.

Therefore, the impact of inflation on investment performance should always be taken into account when investing. Otherwise, we will be tempted by great nominal growth in the stock markets of countries experiencing inflation. However, the real rate of return should always be considered.

A great example is the behavior of the Turkish stock exchange for several years]. Despite the nominal increase in the share price on the Turkish stock exchange, there was a real decrease in the value of shares due to the significant weakening of the Turkish lira. An investor in dollars actually lost money despite generating a nominal profit calculated in Turkish lira. Below you can see a comparison between the BIST 100 index (orange) and iShares MSCI Turkey (blue).

The relationship between the bond rate and the stock rate

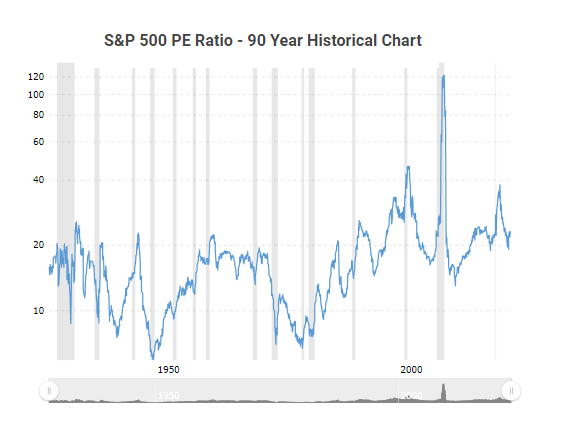

It is also worth remembering that the illusion also applies to the multipliers themselves, which can be misleading. The company's valuation multiples vary depending on the level of interest rates and inflation. It is worth remembering that the investor always has a choice between investing in different financial instruments. The choice depends on the risk-reward ratio. If bond prices fall (yields rise), stock valuations must adjust. Of course, we are talking about a broad market here. For example, if an investor can get 6% on a 10-year government bond, then the 10-year expected return on the stock portfolio should be well above 6%. This is because investing in stocks is riskier than buying treasury bonds. If the market expects that bond yields will not fall, and the stock market provides an average annual rate of return of 5%, a correction of valuations is likely. This was seen in the US stock market in 2022. Concerns about a permanent rise in interest rates in the United States caused the valuations of many companies to plummet.

The chart below shows that during the years of stagflation (1970-1980) the price-to-earnings ratio was in the single digits. On the other hand, in the period of low interest rates, this ratio had a high value. The peak at over 120 was caused by low company profits, which pushed up the value of PE.

source: macrotrend.com

The money illusion and shrinkflation

Very often people have a problem with understanding what the real price is and what the nominal price is. In effect, they compare nominal price change alone. Manufacturers are aware that people are attached to prices. For this reason, they sometimes change the size of the packages (so-called shrinkflation). Currently, chocolate bars weighing 80-90 grams appear in stores, which visually do not differ much from the bars before the weight reduction. This strategy allows you to transfer the cost to the client, but in a hidden form. Not by changing the price, but the size.

There are companies that can maintain fixed prices for their products for a very long time. An example is a hot dog sold at Costco. For many years, its price is $ 1,5 a piece. In order to keep the price at this level, the composition of the sausages, the suppliers of buns have been changed and the number of ingredients in the hot dog has been reduced (cucumbers have been abandoned). The nominal price for the product has not changed, but its quality has changed.

The money illusion: salvation for the borrower and nightmare for the saver

This is a situation where investors focus on the nominal rate of return on a given investment. They often overlook the impact of inflation on profits. The same is true with interest rates. People with savings like high interest rates. In turn, borrowers prefer to pay low nominal interest rates. However, focusing on the nominal value of the interest rate is a cognitive bias. Interest rates should not be viewed from their nominal value. They should always be related to the level of inflation. If in a given country the loan interest rate is 10% and inflation is 15%, this is a more favorable situation for the borrower than in the case when he borrows at 5% and inflation is 0%. In the first case, if only his income grows in line with inflation, the loan will be easier to repay than in the second case.

In the first case, there are negative interest rates. This means that the borrower, at least theoretically, will pay less in real terms than the value of the loan taken. Of course, you will nominally pay more. However, after discounting the payment by the inflation rate, there will be a real loss on the part of the lender (bank, financial institution). Of course, the longer such an imbalance persists, the worse the allocation of capital in the economy will look. There will also be a second factor, the currency of a country with such a monetary policy should depreciate. This, in turn, will cause the phenomenon of "importing inflation". Of course, the more a country depends on trade, the greater the effect of this phenomenon.

Not everyone believes in the existence of the money illusion

However, there are opponents of this theory. They argue that people are not unreasonable. After all, they see price changes every time they shop. This is especially true of high inflation when people remember the old prices. However, if inflation is at 1-3%, many people may not notice the price change right away. It is also worth remembering that companies do everything to hide the real change in the prices of their products. For this reason, they reduce the grammage, composition of the product (looking for cheaper substitutes) or lowering the quality of services.

How to protect your assets against the illusion of money?

Inflation is a hidden tax that is more severe the more cash you save. How to protect your assets? There are many ways to easily hedge against inflation. One of them is investing in geographically diversified stock portfolio. Thanks to this, the investor will have exposure to countries in various macroeconomic environments. Some countries will be beneficiaries of high inflation (e.g. commodity exporters). In a high inflation environment, it is worth having companies with the so-called pricing power, i.e. the ability to transfer rising costs to consumers.

Investors with a more conservative mindset may be thinking of buying gold (historically it has done well during inflation) and real estate in good locations. If someone appreciates diversification, maybe invest in REITs operating on the key infrastructure market.

Summation

The money illusion and the interest rate illusion are related. In both cases, consumers and investors are looking at nominal values. They "forget" such trifles as the impact of inflation, which changes the real level of prices. This has consequences for both the household budget and the investment portfolio. In the household budget, succumbing to the money illusion may cause workers to earn less in real terms, as their wages may not follow inflation. For investors, the illusion of money and interest rates can cause nominal gains to turn into real losses.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response