How many traders earn from Forex? It depends ... on the broker (?)

How many traders are making money on the market? This question appears so often on forums and social groups that it can only compete with it "What kind of stocha do you use?". For many, especially beginners, this information is apparently very important because they can use it to estimate the chances of their success. But does it work like that? What does it depend on whether we will earn? This is such a complex issue that it cannot be covered in one article (or even an entire series). This time, we will focus our attention on the earning percentage and choosing a broker. Does one affect the other?

Truth, holy truth and ... statistics?

There are many opinions that say that the market earns only 2%, 3%, 5% ... sometimes 10%. Summarizing, "I know that I know nothing"because there are no official statistics that would prove it, so the truth is unknown. Really?

Together with entry into force of the new guidelines from 31 September 2016. The Polish Financial Supervision Authority has imposed an obligation on Polish brokerage houses to publish quarterly information on the percentage of earning clients, broken down into classes of instruments. This to some extent undermined the myth that only 2-5% earn, because the average results very often oscillated around 30%, and there were also quarters closer to 40%. But does that show the complete picture? Not really - the statistics are released every quarter and concern only domestic brokers, while very often Polish clients choose foreign offers. We also have no information on the amount of profits, the number of customers and other key information.

With the entry into force of the ESMA regulations on Forex / CFD market from 1 July 2018, brokers registered in the European Union were obliged to place uniform information on risk on the website, supplemented by the percentage of losing clients. These data also have to be updated quarterly.

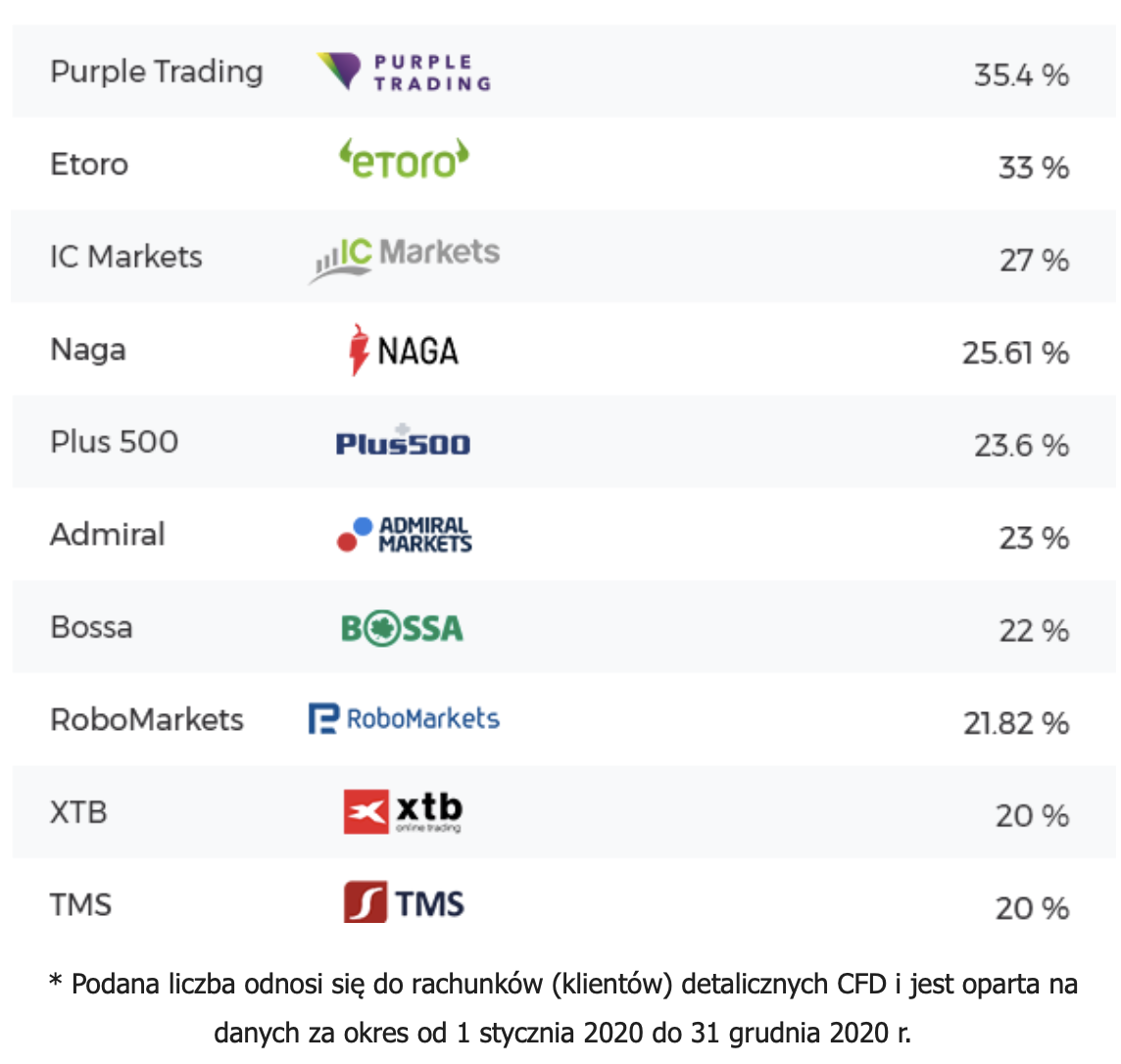

In March this year Czech broker operating under a Cypriot license – Purple Trading – prepared a list of 10 companies from Europe. These data are based on published information on risk, but they are interesting because they concern many popular foreign brokers in Poland, as well as relate to a relatively long time horizon (the whole year 2020). However, it should be remembered that the numbers in the table are the average values of the quarters.

These data apply only to customers from the European Union, although in the case of companies such as TMS or Bossa, which operate only in our country, they include only Polish investors. We also do not have information about the size of the statistical sample. It should also be noted that only these 10 companies have been compared and we do not have information about other brokers outside the list.

Polish brokers = poor results?

Looking at the above list, it is impossible to get the impression that people who choose Polish brokers achieve worse results. TMS took 10th place, XTB 9th, and Bossa 7th. What could this be the result of? XTB is often chosen as the first broker of his career "Retail trader". This is due to large expenditures on marketing, education and a wide offer addressed to a diverse group of recipients. TMS and Bossa operate "locally", and it is no secret that beginners also most often start with Polish brokers, because they offer service in their native language, the comfort of "proximity" to the office, PIT-8c, or access to CFDs on Polish stocks and WIG20. At the same time, it's hard to expect beginners to start earning money right away. After all, some people never make it, especially the beginning of the road happens "bumpy". And this explains Polish brokers to some extent.

Low spread means savings (and only)

Does the amount of transaction costs matter? It would be naive to think that it was not. After all, if the broker has X spread with a commission on EUR / USD is 0,7 pips, and at broker Y already 1,4 pips, then with 100 transactions with a volume of 1.0 lot we can save ... $ 700. But is this the decisive factor in whether we will earn or not? I am ready to argue that NEVER , although there are certainly exceptions that prove this rule. And of course, saving $ 700 is always welcome :-).

Leaders offer copy trading

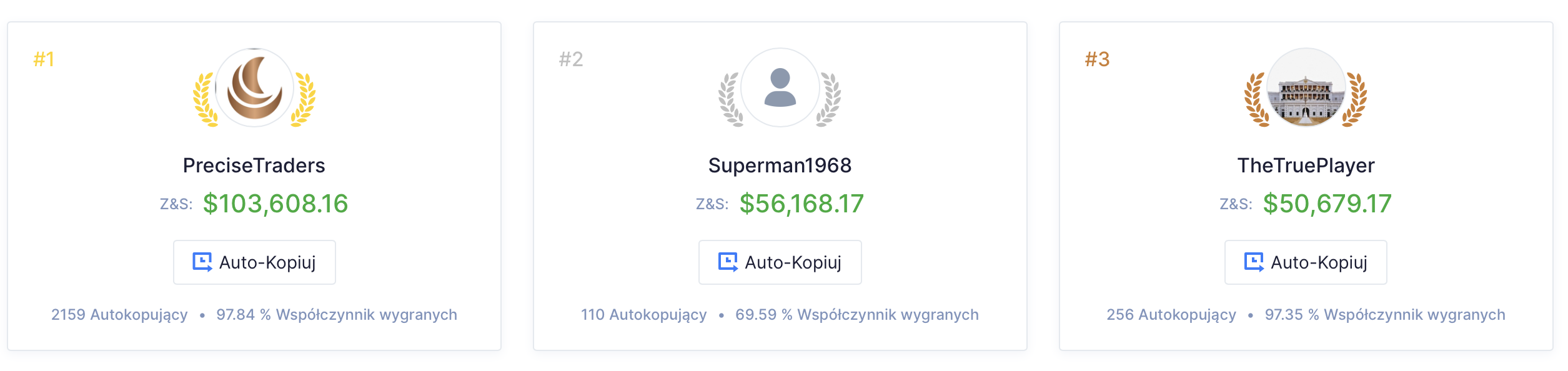

However, it is impossible to notice a large disproportion between the first two items in the table and the rest. eToro is a broker famous for social trading. The platform is very easy to build, it does not offer "Water jets", and yet has experienced a real boom in recent months, noting a record number of registrations. Transaction costs? Rather above average.

Be sure to read: Social trading and the art of choosing a signal provider

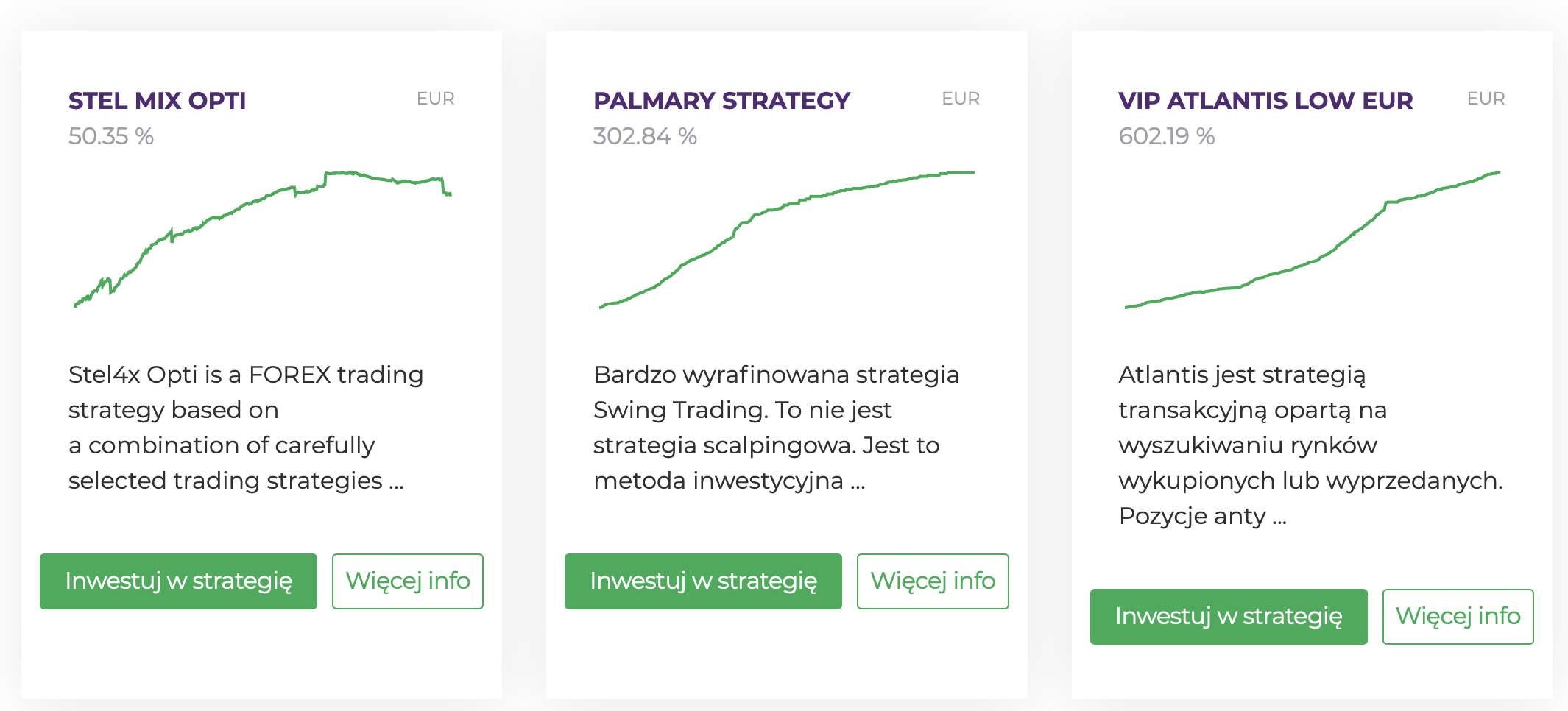

Purple Trading is a relatively new entity on the market, but also in its offer you can find the option of copying plays from investors, i.e. the so-called strategy providers. Although some of the strategies presented on the website suggest from the capital curve that they are "Related" z grid / martingale, however, they are the leader of the list.

Naga Markets came fourth. You won't guess ... YES, also have a social trading platform. There are thousands of signal providers, although only a handful are of interest. Again, the TOP3 suppliers from the ranking present themselves as practitioners of the grid / martingale strategy.

Social trading is the key to success?

If you regularly read articles about the contest Trader of the Month, organized by Tickmillthen you know that grid / martingale strategies can be effective (at least on a monthly basis 🙂). And this despite the fact that many consider them to be evil incarnate. However, no one knows how long the strategy will take, and the chance that it will happen one day "Rash"is highly probable, which results from the very nature of this approach. The more thoughtful assumptions, conservative capital management, iron discipline and adherence to rules, the better the prospects.

But whether social trading = profits? If that were the case, the average earning customers would probably be even higher. Or maybe the boom in this way of investing is still ahead of us? There is already a lot of traders and copying strategies on the market. Some do not work at all, others last 3 days, and "White ravens" they can last for many months.

The layout of the statistics may, first of all, suggest that the problem when investing is first and foremost no strategy of any kind and all the causes of mistakes in applying these strategies. By entrusting this task to a third party, we delegate this task to their shoulders, hoping that they will cope with the challenge. Based on the shared transaction history of a given supplier, we know more or less what to expect. There is always risk.

Can the selection of the right broker clearly decide whether we will earn or not? Rather only in extreme cases. But does choosing a broker matter? Certainly. Low transaction costs mean savings, good regulations mean safety, a functional platform means comfort of work, and efficient customer service means no stress when solving problems. But without an idea for trading, it's all for nothing.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)