Hedging - A Simple Hedging Strategy?

Surely you've heard of the concept of hedging more than once in the context of trading in the financial markets. It is a very common technique in the Forex market to hedge open positions by limiting the risks arising from them. Any investor that trades on Forex market he should know the technique, even if he ultimately decides not to use it.

It is worth noting at the outset that the hedging strategy can be considered completely defensive. It is not a strategy that aims to get profitable trades right away. However, it can be very useful for not closing a trade prematurely with losses when the market reading still indicates that we are 'in the right direction'.

It often happens that we have to close a trade at a loss when we cannot hold a large position due to capital management. But closing a trade is still confirmation of the temporary loss we are incurring, while it is possible that sooner or later the market will come back in favor of the concluded trade and what was a loss will turn into a profit.

How to implement a hedging strategy?

Hedging makes it easier to stay in losing trades without taking too much of a loss when price moves against us. How can this be done? It's very simple and intuitive at the same time: you take a position opposite to your main trade to balance the maximum risk you are willing to take.

READ NECESSARY: Risk management of all capital in the forex market

An example makes it much easier to understand: if you buy 1 lot on a pair EUR / USD after 1.1845, it is clear that you will make a profit when the price rises and a loss when the price goes down. However, it is possible that the price will not hit a bullish position at the time of our purchase. We can cover the initial losses that may be incurred by selling 1 lot EUR / USD simultaneously in the same 1.1845 price zone.

That way, no matter how much the price goes down in the initial phase, whatever you lose on the main buy, you gain on the sell position, so the final result will be neutral.

Thanks to the hedging strategy, you will be able to wait for the EUR / USD to actually take the expected direction and then close the short hedging position, leaving the buy position open, making a profit on the trade.

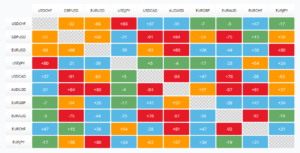

Hedging strategy and correlation

In fact, hedging is much more complex. You can hedge against currencies or various other negative correlation products. By means of derivative instruments such as, for example, options, forwards, futures. You can open hedging positions with partial amounts by changing the hedging factor, activate the hedging option at a distance from the main price.

Correlation of major currency pairs. Source: Tickmill MetaTrader 4 - Correlation Matrix

However, it should not be forgotten that hedging requires you to pay a double commission as two or more trades are opened. It must also be managed dynamically, because in the extreme case, if we do nothing with two opposite positions open, we will completely limit losses, but also profits.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Day Trading or Scalping? Money Management – Mr Yogi, part 2 [VIDEO] Money Management - MrYogi. Time frames and position size risk](https://forexclub.pl/wp-content/uploads/2023/11/Money-Management-przedzialy-czasowe-v2-300x200.jpg?v=1701591046)

![Position size management - Tom Basso [Review] managing the size of tom basso items](https://forexclub.pl/wp-content/uploads/2021/07/zarzadzanie-wielkoscia-pozycji-tom-basso-300x200.jpg?v=1627446760)