Hedge Fund and trend following, i.e. market neutral trading

During the coronavirus, the topic of hedge funds stood out. When we look at the rates of return of the best of them, they can be as high as several hundred percent per annum (admittedly, we had a flood of "bargains" due to Covid-19), when volatility favored investors.

Traders, both at the beginning of their path and when changing the trading system, look for the most profitable strategies. Without going into the technicalities of building your own trading plan, it can be said that there are some "proven" methods that have been around for a while and are used by the Hedge Fund. There is nothing to cheat, but none of them will give away their trading system. Instead, they use certain basic rules whose application is universal. Hedging strategies themselves are, in theory, risk mitigation. Various instruments are used for this, which give the possibility of entering short positions. Classically, hedging strategies aim to enter into positions that are intended to compensate for exposure to price movements on the "main" activity / transaction. We will talk a little more about the following trend in the further part of the text.

What is trend following?

The very name of the strategy tells us a lot about the technical aspects of the trading system. It is mainly about following the trend. It is more characteristic of stock and commodity markets than currencies, although some people also successfully use it in Forex market. We can find trends both at low intervals and at higher intervals. The only difference is the duration of the transaction.

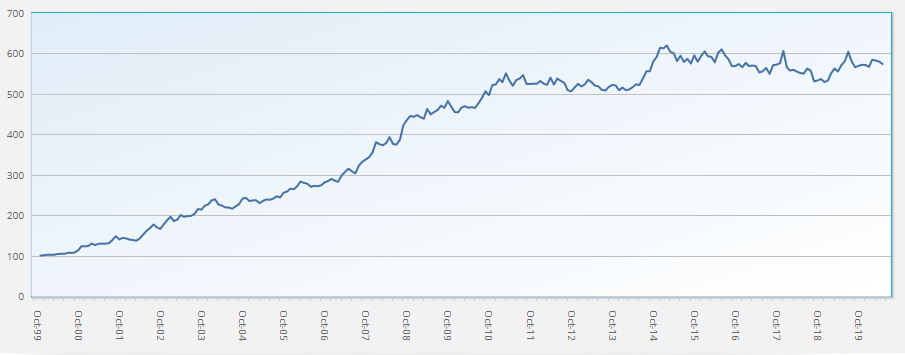

Source: EurekaHedge.com

A valuable resource regarding hedge fund exposure is the Eurekahedge Trend Follower. It is an equally weighted index of 24 founding funds. The index is designed to provide a broad measure of the performance of hedge fund managers underpinning. You can read a lot of interesting information from it. The most important thing, however, is that the trend is an effective profit-generating tool.

Strategies based on the idea of the following trend are designed to follow the trend. Various techniques can be used to generate a buy / sell signal. The direction of the price movement can be determined by moving averages, a trend line or related breakouts of price channels. So what are the differences between the strategies used by Hedge Fund and traders? Since, in fact, we are dealing with simply following market trends, and with the help of technical methods? One of the major differences is that traders - speculators take risks in order to profit from a given move. Hedging, on the other hand, focuses on placing positions that are intended to reduce or allow him to practically completely avoid risk. Of course, everything has its price, and the risk we take is not always possible to eliminate.

Undoubtedly, one of the most important skills closely related to the trend following strategy is the ability to quickly cut losses. The point is to make the most of the emerging trends. Thus, we can almost “to the end” derive financial benefits from a given traffic, regardless of the interval.

Market neutral position

When talking about market neutral position, the most important thing is to understand the concept of price asymmetry. It is the most important part of this idea. We assume that prices will return to equilibrium sooner or later. This state may be shown, for example, by averages, from which the “detachment” (price rebound) is a certain asymmetry. We could say that this strategy relies primarily on statistical arbitrage. Typically, trading is based on machines that use certain statistical models (mathematical and quantitative) developed by funds. Therefore, market neutral positions based on statistical arbitrage are usually used for rich portfolios equitywhile being based on automatic trading. What's the lesson and how can you use this knowledge to trade? I am not encouraging anyone to build huge databases for a given financial instrument, calculate and build models and mathematical deviations. Interesting from the commercial point of view, the idea of using the asymmetry of quotations alone seems to be interesting. They can be deviations from the trend line or the average. By running a long position that strongly reacts to, for example, a given macro, and thus bounces us back from the average, we can (assuming that it returns to equilibrium) with small transactions for a short time, securing the profit against potential drops. When the chart returns to normal (the trend is confirmed), we can close such a "hedge" on a small minus or a small profit.

Being market neutral does not necessarily mean just hedging reverse positions in the same instrument. In the case of currencies, it will be looking for correlated pairs. Of course, science distinguishes between several types of correlations, but we will only care about negatively correlated ones. This means that an increase in one asset will lead to a decline in the other. It is also worth bearing in mind that correlations between individual financial instruments they are not constant but dynamic. Therefore, they may change over time, deepening the negative factor (to our advantage) or neutralize it completely.

Go With The Trend & Hedge Fund

The vast majority of traders who have tried to catch "all" moves on a specific trend have certainly encountered at least one of two dilemmas. The first, how to catch (enter a position) the first signs of a trend change (or a short-term trend with the potential for further ups / downs) or the second one involving a problem in driving a position. Practically from the beginning of our lives we are used to the fact that nothing good lasts forever. Therefore, often traders trying to catch and "pump out" virtually all of the traffic do not do it because they believe that it is better to take the profit while it is there.

Playing with the trend should be associated with the belief that you have an advantage. Even if the trend is only the result of the behavioral aspects of investing, playing against the overall sentiment in the market statistically increases our chances of success. Now we could say that there are some hedgers who they play contrarian to the market. They are indeed. However, their specificity of trade and the level of selected security measures allow you to earn money on this approach.

Playing with the trend should be associated with the belief that you have an advantage. Even if the trend is only the result of the behavioral aspects of investing, playing against the overall sentiment in the market statistically increases our chances of success. Now we could say that there are some hedgers who they play contrarian to the market. They are indeed. However, their specificity of trade and the level of selected security measures allow you to earn money on this approach.

The following trend is, above all, appropriate risk management. As traders, we do not have to worry too much about the volume on the market (as long as we do not trade with less liquid companies), that they need to hedge. Nevertheless, we should prioritize the issue of capital management and setting higher and higher levels stop lossesin order not to follow a trend like Zabłocki on soap in case of failure. Hedging some of the profits and closing the transaction always gives us some comfort. One in the form of earning and cutting a possible loss. The second, however, is related to the fact that we can conclude the transaction again. When assuming an appropriate hedge (appropriately selected exposure and position size), always the second instrument (taking into account the correlation), It will “cushion” a potential loss.

Double-edged sword?

Of course, each trading method has its undoubted drawbacks. The downside of securing each transaction is that the operations are time-consuming. In the beginning, we will have to put in a lot of work to make our position market neutral. We are also giving up some of the profits at the cost of less risk exposure. The proverbial "something for something". The trend following itself is undoubtedly difficult to implement. It requires the nerves' patience with reins and the ability to make "alternative" decisions. We de facto follow the conviction that the trend gives us an advantage and returns to its own "limits".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)

Leave a Response