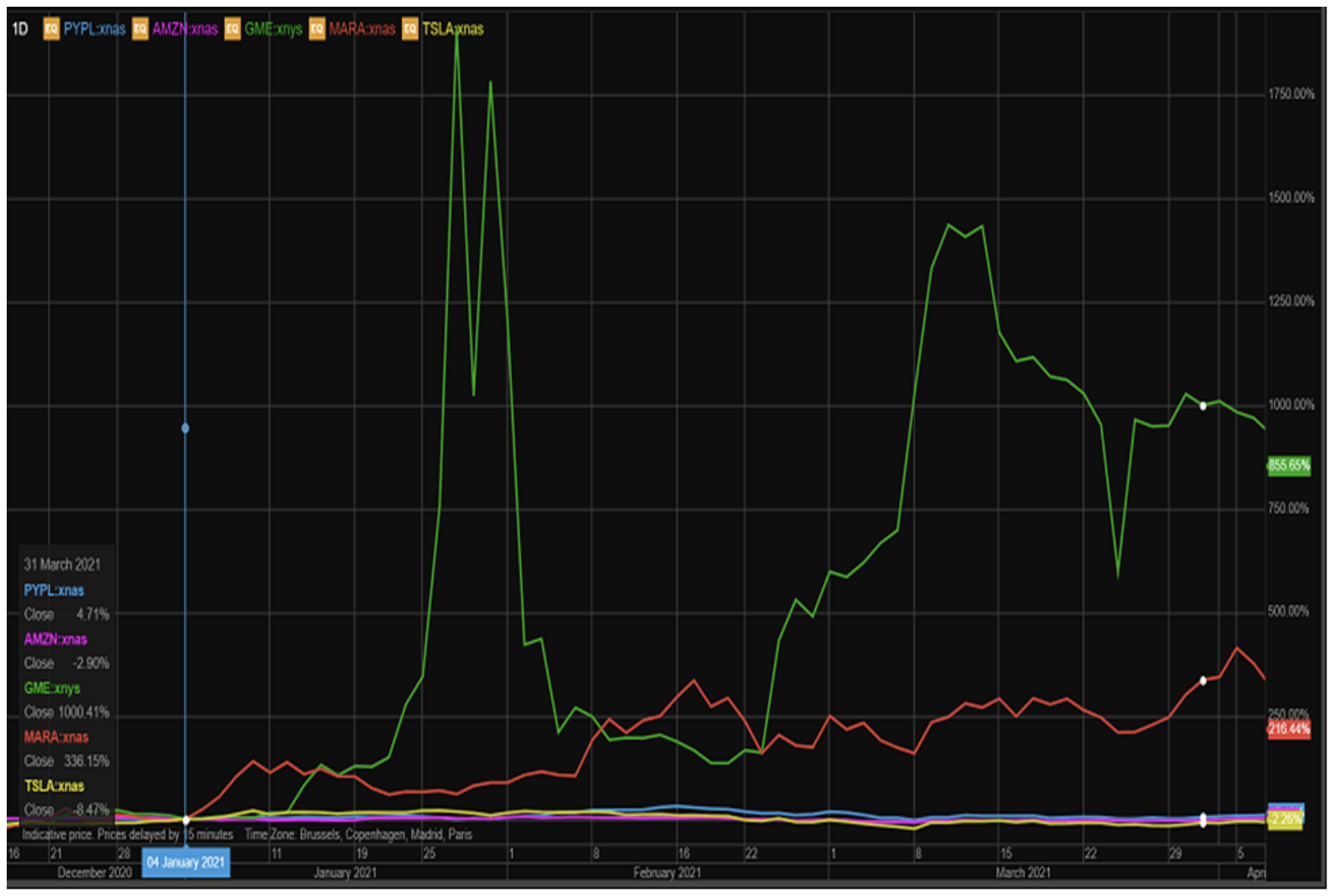

Players versus cryptocurrency mining - the most popular actions in Q2021 XNUMX

Global equities continued to gain in the first quarter amid increased volatility, which was particularly evident in a few heavily shorted equities at the start of the year, such as GameStop and AMC. Many of them continue to be of interest to retail investors, although some seem to have lost their popularity. We continually encourage investors to exercise caution and monitor risk when trading these unprecedentedly high volatility stocks.

Tesla remains a popular company among all our clients. Growing competition is somewhat at odds with its current valuation, but the company still surprises, producing 170 sq m in QXNUMX. vehicles, which exceeded analysts' estimates. This was largely due to the strong surge in Model Y sales in China, around which there was some uncertainty and which was fueling the short-term dynamics of the company's share price. However, Tesla's generation of free cash flow is limited, which will be a long-term focus for investors with increasing competition.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

We believe investors should increase their exposure to the commodities sector and high-quality, low-debt companies in the coming reflation period. Rising interest rates are likely to drive stock prices down in the most speculative growth segments such as e-commerce, gaming, green transformation, and next-generation medicine. Also for this reason, we are seeing a rotation towards cyclical sectors that will benefit from the economic recovery and the reflecting environment.

The most popular stocks among Polish investors are Saxo

In the first quarter of 2021, the companies most often chosen by Polish investors of Saxo Bank can be divided into two categories: unprecedented events on the financial markets and cryptocurrencies.

The most popular among Saxo's Polish clients were: GameStop, Amazon, PayPal, Marathon Digital Company and Tesla. What was behind their popularity? Below is my comment on individual companies.

GameStop (GME: xnys)

The power of the Internet and the street. Who won? Wall Street or online young investors who use free trading applications? In my opinion, it was a draw. The situation on the stock exchanges was brought under control, it did not lead to the bankruptcy of any of the stock exchanges hedge-funds or other institution. It is important to remember that the involvement of the US Securities Commission and the losses suffered by the funds cannot be ignored.

Attempts to implement a similar scenario on other instruments have not been as successful (see the silver price to $ 50, where it was only possible to raise it to $ 30 for one day), though some other companies where street speculation was evident, such as AMC and BlackBerry also increased its capitalization sharply. Ultimately, the GameStop price in the first quarter increased by over 1000%, although it was not ATH (all time high) as at some point in January the price increased by as much as 2000%. It is hard to expect a similar growth dynamics to continue in the coming months ... unless the community Reddit he will attack again.

Marathon Digital Company Inc. (MARA: xnas)

Although the company dealing with cryptocurrency mining and blockchain technology grew significantly in the first quarter, its strengthening did not have such an impact on the markets as GameStop. Polish investors, however, showed excellent timing by investing in Marathon. Bitcoin in the first quarter, it grew by approximately 120%, and Marathon shares - over 336% (with the results of the Business Services sector below 1,5%). It is worth watching the development of the company. Merrick Okamoto (CEO of the company) argues that the company will increase its mining capacity by 4000% over the next year. Will such prospects, however, be able to prevent possible drops in the company's price in the event of a strong correction on cryptocurrencies?

PayPal (PYPL: xnas)

PayPal recorded less than 5% growth. The market leader in online payment solutions has been offering its services for over 20 years. Without a doubt the time of a pandemic is an environment where the company's offer could gain new usersbecause even the most reluctant were forced by the "new normal" to buy online. The financial results for 2020 confirm this. Thus, the company entered the next year with momentum and although the dynamics of growth decreased due to the general mood on the stock exchanges, the company's management did not stop there and introduce new products to its offer. From the end of 2020, it has cryptocurrencieswhich are to become a strong point of the offer. This can be confirmed, among others, by acquisition of Curv, a provider of security solutions for digital assets located in the cloud. The company's management board also expects the income from the platform to double peer-to-peer under the name Venmo. With a solid cash pool (4.8 billion in cash and 8.3 billion in short-term investments), PayPal shows significant investment opportunities in completely new solutions and expansion into new markets and geographies.

Amazon (AMZN: xnas) i Tesla (TSLA: xnas)

Regular participants in this ranking gave no reasons to be satisfied with their investors. In the first quarter, both companies recorded declines of 2.9% and 8.5%, although Tesla was positively surprised by the amount of cars delivered, well above analysts' expectations. This state of affairs was influenced by falling prices of US bonds, the price of which is inversely correlated with their yields. The level of 2% of the nominal value, to which the 10-year Treasuries (US XNUMX-year Treasuries) were approaching throughout the first quarter, which as a result of increasing inflationary pressure is a turning point at which the sale of risky assets is very likely, and such companies include e- commerce or EV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)