Goldman Sachs - affairs, scandals and relations with the government

W In the previous part, we presented the history of Goldman Sachswhich is one of the largest investment banks in the world. Due to the length of the material, we had to divide the article into two parts. In the present we will look at relations with the government and more famous cases associated with Goldman Sachs.

Revolving door - Goldman Sachs' relationship with governments

The crisis on the US subprime market has brought banks under fire. They began to be accused of having been saved and that the costs were borne by American taxpayers. Critics raised voices that the relationship of financial institutions with the US government resembled a "revolving door". It happened that senior managers from the bank ended up in prominent positions in the government. Sometimes the traffic was the other way. After some time, officials left their posts to pursue careers in the financial markets. One of the most famous cases is Goldman Sachs.

A politician is the best banker, a banker is the best politician

Goldman Sachs was best known for using the revolving door strategy in the United States. However, there are numerous cases of applying this strategy also in the relations of the investment bank with the countries that are part of the European Union and the EU authorities. This was probably to "look after" the interests of investment banks in the EU. Hiring a networked politician is a treasure for any investment bank. Thanks to this, it is possible to lobby more effectively for changes in the law or limit potentially dangerous reforms that may hit the financial sector. It should be added that Goldman Sachs and other institutions making such transfers do not break the law. They operate legally and in a legal way try to gain influence on shaping the regulation of the financial market. Another point is that many former bank employees went on to politics and achieved good results in it.

Peter Sutherland - The road to Goldman is through the WTO

The relationship between Goldman Sachs and European politicians began as early as the XNUMXs. The first recorded case was Peter Sutherland. In the years 1985 - 1989 he was the EU Commissioner responsible for developing the EU's competitiveness policy. In 1992, he was the author of the Sutherland Report on the EU's internal market. He then left the EU authorities to join the GATT (General Agreement on Tariffs and Trade), where he was the Director General. He was a strong supporter of globalization. He was the one who lobbied for GATT to become the World Trade Organization (WTO). In pushing for globalization, the GATT/WTO has begun to make much wider use of the power of the media. Thanks to this, the first half of the XNUMXs was a period of a sharp reduction in regulations, which was conducive to the growth of international trade.It is worth noting that Peter Sutherland became the president of the World Trade Organization. Then, in June 1995, he joined Goldman Sachs International as Chairman of Goldman Sachs. Goldman Sachs International was a subsidiary of an American investment bank. GSI operated as a broker-dealer in the United Kingdom. A big asset that Peter Sutherland had were contacts in the world of politics and experience working on the side of the "regulator" of the European internal market.

Mario Draghi - from banker to prime minister

Another person who is an example of an exchange between the government and Goldman Sachs is Mario Draghi. He is an economist and politician who has been the face of the monetary policy of the European Union for many years. However, before he became the President European Central Bank, for many years he held the position of Director General at the Italian State Treasury. He held that role from 1991 to 2001. Mario Draghi was a supporter of the privatization of some state-owned companies. It fit perfectly in the 90s, when the time of privatization and deregulation came in many countries around the world.

In 2002, Mario Draghi became Vice-Chairman and Managing Director of Goldman Sachs International. He held his role until 2005. While working at the subsidiary Goldman Sachs, he was responsible for the investment strategy in Europe. During this period, he also had contact with many European regulators. Mario Draghi was a very valuable asset for Goldman Sachs. This was due to his intellect, diligence and... the network of contacts he acquired while working for the Italian State Treasury. Some political opponents of Mario Draghi used the period of work to slander the politician. He was reminded that during his tenure, Goldman Sachs brokered swaps used by Greek governments to manipulate debt statistics. The person concerned mentioned that “knew nothing”.

After leaving in 2005, Mario Draghi was elected President of the Bank of Italy, which was the central bank of Italy, but had a supporting role to the European Central Bank after the adoption of the euro. Draghi was highly respected at the time and in 2006 he was elected president of the FSF (Financial Stability Forum). It is an organization that brings together the governors of central banks and finance ministers of the largest members of the G20. After the reorganization in the years 2009 - 2011, he was the chairman of the FSB (Financial Stability Board), i.e. the heir to the FSF.

However, for Draghi, the highest point of his career was his position as President of the European Central Bank. During his presidency, the ECB had to face the greatest crisis in its history - the problems of the "Southern countries" of the EU, which were dubbed Pigs (Portugal, Italy, Greece, Spain). His words from the conference that took place in 2012 have gone down in history. It was in 2012 that the biggest bears believed that the eurozone would fall apart because the debt crisis was unbearable for the countries of the south.

At the famous conference, the words were spoken:

“is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”.

“Whatever it Takes” has become a catchy slogan in the financial markets. This reassured the markets as they were confident that the European Central Bank was determined to ensure macroeconomic stability in the European Union and to solve the Eurozone debt crisis. After leaving the post of ECB president, Mario Draghi did not remain unemployed for a long time. He held the post for over 600 days Prime Minister of Italycreating the so-called "Draghi's Cabinet". He served as prime minister between February 13, 2021 and October 22, 2022.

Long list of politicians in Goldman tenure

Goldman Sachs International was the place of employment for many politicians from Europe. Among the people active in politics and somehow connected with the investment bank, the following can be mentioned:

- Antonio Borges (France),

- Karel van Miert (Belgium),

- Mario Monti (Italy),

- Otmar Issing (Germany),

- Lucas Papademos (Greece),

- Petros Christodoulou (Greece).

However, this is not the end. He got a job at Goldman Sachs International as chairman Jose Manuel Barroso, who was president of the European Commission for two terms. The fact that Mr. Barroso's views were left-wing (he was the president of the PSD, the Portuguese Social Democratic Party) adds flavor to this case. His joining Goldman Sachs sparked outrage from some European politicians. There were even requests to take away the right to a "pension" paid for holding a position in the European Commission.

Goldman Sachs' relationship with the US government

As in the European Union, in the United States, too, an investment bank sought to "secure" its interests. It is the USA that is the cradle of lobbyists, i.e. people whose task is to "convince" specific changes in legislation in favor of a specific social group. Very often, former Senators or Congressmen become lobbyists, who, thanks to their network of contacts, are a useful tool in the hands of corporations or investment banks. Of course, lobbyists can also work for the poorer part of society. Lobbying is an integral part of the “color” of policy making in the United States. American investment banks have used their services more than once to "to watch" laws regulating the financial sector.

Goldman Sachs also had another idea to protect its interests in the US. It was the transition of GS employees to work for the government. Opponents of such transfers believed that there was a risk of "imposing" the will of the banks on political decision-makers through former employees of the financial sector employed in the government. Defenders of such practices believed that the transition to a government of "market practitioners" made the laws more in line with reality. In the next part of the article, we will look at who of the former Goldman Sachs employees found their way to Washington.

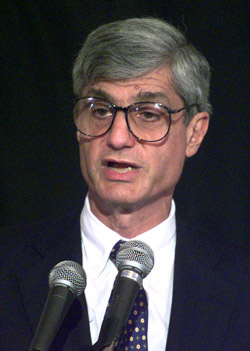

John C. Whitehead - paving the way

He was the first known person to move from a high position in an American investment bank to the American government John Cunningham Whitehead. John C. Whitehead worked for Goldman Sachs for 38 years. He started as an assistant in the investment banking department. Thanks to his intelligence and diligence, he quickly became a partner. Over time, his position rose to the position of co-chair and senior partner. As a result, he was responsible for developing and implementing Goldman Sachs' strategy. In 1984 John C. Whitehead left Goldman Sachs. A year later, he began serving as Deputy Secretary of State under Ronald Reagan. He held this position between 1985 and 1989. It was the first foothold Goldman Sachs made in the White House. In the following years, there were further "transfers" between the investment bank and the US government.

Robert Rubin - Clinton adviser

From the 90s, a long period began when many top managers of Goldman Sachs, after leaving the bank, held key positions in public administration. Robert Rubin, who worked at Goldman from 1966 to 1992, can be cited as an example. In the last years of his career, he held the position of Co-Senior Partner, where, together with Stephen Friedman, he was responsible for setting the bank's development strategy.

In 1995, Rubin became the 70th all-time Secretary of the Treasury. He held this position until 1999. However, Robert Rubin had already begun working with the Clinton administration. In the years 1993 – 1995 he was an economic adviser to Bill Clinton. Was "one of the chief architects" the 1993 deficit reduction plan.

At the turn of 1994 and 1995, Robert Rubin encouraged the Clinton administration to propose measures to Mexico to help overcome the debt crisis in the southern neighbor of the United States. The government offered a $20 billion loan to pay off Mexico's foreign debts. The fact that Goldman Sachs was one of the distributors of Mexican government bonds adds spice to the case. Rubio's actions did not sit well with some Republicans, who believed that taxpayer funds were used to benefit Goldman. Robert Rubio denied the allegations, claiming that the loan helped stave off the much worse threat of a deeper financial crisis in Mexico. This, in his opinion, would increase the illegal immigration of Mexican nationals to the United States.

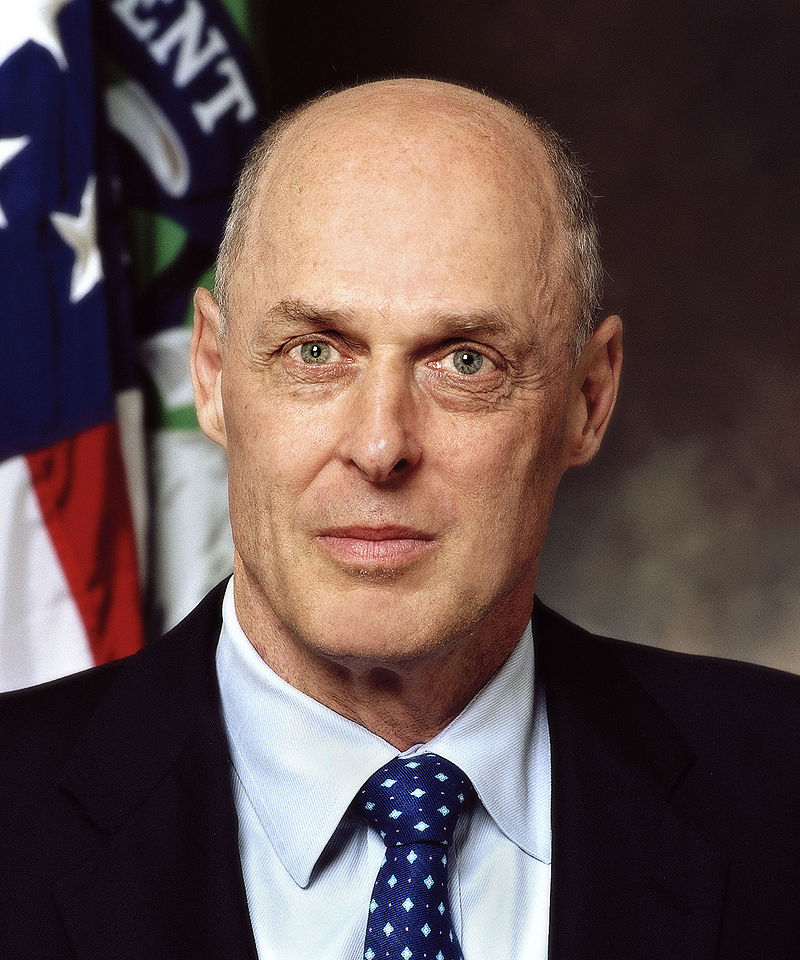

Henry Paulson - former banker with a bank rescue plan

This was not the only case where a high-ranking bank manager moved to the "government" for a prominent position. Another was Henry Paulson, known from the bubble bursting period as the creator of the famous Paulson Plan. Henry Paulson left Goldman Sachs in 2006 after more than 30 years at the bank. On May 30, 2006, he was nominated by George W. Bush for the position of United States Secretary of the Treasury. Paulson was forced to sell all Goldman Sachs shares to avoid being accused of a conflict of interest. In 2006, his stake was valued at $600 million.

Henry Paulson was the 74th United States Secretary of the Treasury. Due to his career in banking, he was highly valued in the banking sector. His close relations with the Chinese elites of the time were also an open secret. He won them during numerous visits to the Middle Kingdom, which resulted from the efforts of Goldman Sachs to increase its share in the local financial market.

During his time as secretary, Henry lulled the vigilance of the market. In the spring of 2007, he mentioned that the growth of the US economy was healthy and the real estate market was about to "rebound". He was also convinced that the fundamentals of the American economy were very solid. In a May 2008 interview with The Wall Street Journal, Paulson mentioned that:

“I believe the worst is behind us”.

The collapse of Lehman Brothers meant that the American banking system was on the brink of collapse. Measures were needed to restore confidence in the financial sector. US financial institutions themselves were too heavily leveraged to be able to ensure the stability of the financial sector alone. An injection of fresh capital was needed.

In late September, Henry Paulson submitted to Congress a plan to provide liquidity to the banking sector and key US insurers. The program was named TARP, which was short for Troubled Asset Relief Program. However, it was often called the Paulson Plan. The assumption was that the collected funds were to be used for the purchase of toxic MBS (mortgage-backed securities) and the purchase of preferred shares from key financial institutions. The value of the program amounted to USD 700 billion. Aid funds were allocated to many projects, including:

- $205 billion for the purchase of shares in key banks under the CPP (Capital Purchase Program),

- $40 billion for the purchase of shares in Citigroup and Bank of America (each of the banks was credited with $20 billion),

- $68 billion in liquidity assistance to AIG (American International Group) and the 10 largest US banks,

- $80 billion in loan assistance to the car industry,

- $22 billion purchase of toxic securities related to the real estate market.

Paulson's plan was criticized by the opposition for its ties to the financial industry. He was accused of putting the interests of financiers above taxpayers as the former CEO of Goldman Sachs. Moreover, Goldman Sachs' participation in the TARP program and the manner in which AIG was bailed out fed conspiracy theories. Ultimately, TARP provided liquidity at a crucial time in the financial crisis. The aid was designed in such a way that the beneficiaries of the program had to return the aid with interest.

As a result of the large number of "transfers" of former Goldman Sachs employees to the US government, a password was coined “Government Sachs”. It is also worth adding that a well-known lobbyist also cooperated with the investment bank Mark A. Patterson. He was employed as Vice President (2004-2007) and Managing Director (2007-2008). Petterson left Goldman Sachs in April 2008. In February 2009, he became the head of the Treasury Secretary Timothy Geithner's office. He held this position in 2013.

Goldman Sachs scandals

Investment banking is presented as an ethical business to help better allocate capital in the economy. Certainly, these were the goals of banking at the time of its creation. But over the years, ethics has been sacrificed on the altar of profit. While the role of the bank in the outbreak of the subprime crisis has been widely commented on, in today's article we will look at two major scandals: manipulating the Greek debt and embezzlement of funds from the Malaysian state fund. As you can see, close relations with politicians can result in a chance for big profits.

Pretending to be Greek about debt

Goldman Sachs was also involved in the debt crisis in the European Union. The bank has been criticized for its involvement in helping Greek governments falsify debt statistics. Thanks to these practices, Greece was able to borrow to much greater levels than would have been possible without these manipulations. How did it happen?

At the beginning of the 60st century, Greece joined the single currency, the euro. Theoretically, all countries had to meet the Maastricht criteria regarding the amount of debt (3% of GDP) and the maximum deficit to GDP (100% of GDP). Greece did not meet the first criterion because its debt to GDP ratio exceeded XNUMX%. it was also a problem to keep an eye on spending to stay within the debt limit. In those years, it was the practice of countries such as Greece or Italy creative accounting. Various accounting tricks allowed to reduce the debt-to-debt ratio somewhat.

In 2001, Greece decided to sign agreements with Goldman Sachs to create a financial structure that could reduce debt in the short term. The aforementioned financial structure was currency interest rate swapwhich allowed Greece to artificially reduce its debt. Thanks to the swap, Greece exchanged its dollar and yen debt at an artificially low exchange rate. Such a trick resulted in an accounting reduction of the debt. Goldman and the Greek government knew that the swap would work against Greece in a few years. However, in the short term, the debt-to-GDP ratio fell by around 2%. Lower debt means a better credit rating, which allowed Greece to issue bonds at attractive interest rates. Swap transactions were off-balance sheet, which allowed to artificially lower the debt. The swap deal was de facto "off-balance loan" worth €2,8 billion. As a result of subsequent amendments to the contract and falling interest rates, by 2005 the swap liability had increased to €5,1 billion.

The following years are history. Greece had to be saved by the European Central Bank. It is worth adding that he was the president of the ECB for a considerable period of time "Greek Tragedy" was Mario Draghi, who worked in the early XNUMXs at… Goldman Sachs.

Big Malaysian scam

One of the biggest scandals Goldman Sachs was involved in was the case 1MDB (1Malaysia Development Berhad). 1MDB was founded on the initiative of the Prime Minister of Malaysia Najib Razak. It was intended to act as a sovereign wealth fund (SWF – Sovereign Wealth Fund). 1MDB has become a "textbook" example of money laundering, corruption and money laundering. Goldman Sachs brokered $6,5 billion in funding in 2012 and 2013. In return, he received approximately $600 million in commissions. That alone was a sign of a strange relationship between 1MDB and the bank. More than 9% of commissions for brokering financing aroused suspicion. Moreover, the bank did not report these transactions in violation Bank Secrecy Act.

1MDB was to invest funds in the development of projects that help raise the level of human development in Malaysia. However, it became "financial Sodom and Gomorrah". Billions of dollars "dissolved" through officials and the country's Prime Minister Najib Razak. Instead of schools, roads and hospitals, funds were allocated to real estate, works of art or jewelry. The former Malaysian prime minister himself was sentenced to 12 years in prison over the scandal. He was a villain at Goldman Sachs Tim Leissnerwho was head of the Southeast Asia branch at the bank. He was involved in the 1MDB scandal. Sam led to the embezzlement of $ 200 million, which went to his account. Not only that, he broke the rules of the FCPA (Foreign Corrupt Practices Act) because he was corrupting Malaysian officials. He was fined $43 million by the SEC and sentenced to 25 years in prison.

As a result of the settlements, Goldman Sachs had to return $ 600 million to Malaysia for an unfairly collected commission and a $ 2,3 billion fine imposed on the company by the Department of Justice. Fines were also imposed by regulators in the United Kingdom, Hong Kong and Singapore. According to investigators, Goldman Sachs employees misled investors when preparing the bond offer. What's more, Malaysian branch of an investment bank "knowingly and voluntarily" gave bribes. The settlement signed by Goldman Sachs was aimed at saving the bank's reputation. Its loss could result in an exodus of wealthy clients who would not like to be associated with the American investment bank. In an effort to save its reputation, Goldman Sachs has mentioned that it intends to recover $174 million from senior managers who were unfairly awarded bonuses for the investment bank's financial performance. The scandal cost the bank a total of about $5 billion.

Other “minor” scandal

Goldman Sachs has been involved in numerous scandals more than once. However, the list of them is really impressively long. Of course, this does not mean that the entire activity of the bank is one big scam. However, this certainly means that this is a large organization that sometimes has a problem with discipline of its employees.

One example is the case of Robert M. Freeman, who was a partner at Goldman Sachs. He was the head of the arbitration team at an investment bank. Robert Freeman was involved in insider trading. He was arrested in 1987. In 1993, he signed a settlement with SEC where he agreed to be suspended from working in the investment industry and returned $1,1 million related to the transaction on the leveraged buyout of Beatrice Companies by KKR (Kohlberg Kravis Roberts).

In 2003, Goldman Sachs, Lehman Brothers and Morgan Stanley signed a settlement agreement related to the manipulation of the RSL Communications price through misleading analytical reports. The settlement cost the banks $3,38 million.

Goldman Sachs was implicated in an IPO underpricing investigation (IPO) to convince institutional clients to continue cooperation with investment banks. The owners of the IPO companies paid for the discounted price. They received a lower valuation for their companies than would have been possible under market conditions. The case gained publicity due to the debut of eToys.com in 1999.

In May 2009, Goldman Sachs agreed to pay $60 million in a settlement that involved the bank's promotion of fraudulent mortgage loans. Under the agreement, the investment bank covered part of the payments of 714 Massachusetts residents who used these financial products.

Summation

Goldman Sachs is one of the largest financial institutions in the world. It is a very well-known and respected investment bank. However, acting on the borderline of business, politics and finance has always been risky. Employing hundreds of employees requires an efficient internal audit department. If it is missing, there are scandals such as 1MDB, manipulation of the IPO price or market rates.

This article does not cover all the scandals related to the operation of the investment bank. It is an institution that also played a significant role in the development of the bubble on the subprime mortgage market, and the entire history of the bank is suitable for a good series lasting several seasons. Netflix, are you reading this? 🙂

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response