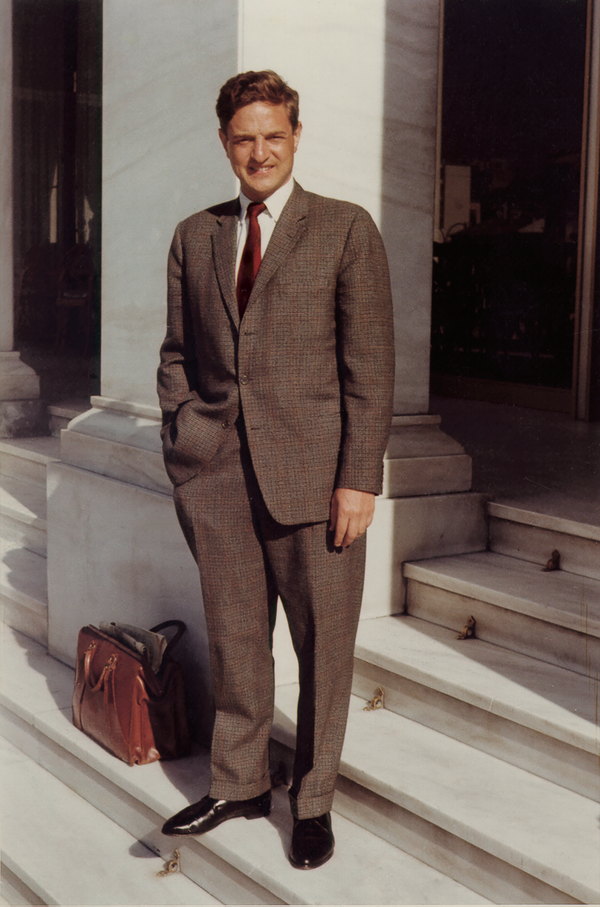

George Soros - speculator, philanthropist and public enemy

George Soros is a controversial figure. For some, it is one of self-made men for others, a financial manipulator who interferes with the politics of many countries. This article will present the history of this famous trader.

George Soros was actually born in 1930 as Gyorgy Schwartz. while Soros's father, Tyvadar, was a lawyer and one of the proponents of the Esperanto language. In turn, his mother - Erzsébet - she ran a silk shop. The family belonged to the upper middle class and were of Jewish origin. Due to the rise of anti-Semitic sentiments in Hungary, the family decided to change their surname to Soros, which in Esperanto means "soar". The family survived the German occupation of Hungary in the years 1944 - 1945. As a result of the victory of the communists in Hungary, young George Soros left Hungary and in 1947 he began his studies in London School of Economics. During his studies, George worked as a porter and waiter. In 1954 he obtained a master's degree in philosophical sciences.

Be sure to read: Paul Tudor Jones - or how to profit from the crash

Georege Soros: The Beginnings of a Career in Finance

Immediately after graduation, Soros began his career in finance at the trading bank Singer 7 Friedlander. He moved relatively quickly to the arbitration department. One of his associates (Robert Mayer) suggested that George join his father's brokerage firm, FM Mayer, which operated from New York.

After two years, Soros moved to New York and started working as an arbitrator-trader at FM Mayer. During three years of work, he traded on more and more popular European stocks. American institutional investors then began to look at this market with a friendlier eye. This was due to the start of European integration (the Coal and Steel Community), which was to contribute to faster economic development in the region.

In 1959 he moved to Wertheim & Co. Initially, he planned to stay at work for 5 years to raise half a million dollars and return to England. For four years of work in the company, he was an analyst of European equities. After leaving the company, however, he did not return to England.

In the years 1963-1973 he worked at Arnhold & S. Bleichroeder. Initially, he dealt with trade on the European market, but after its introduction Interest Equalization Tax, Soros' trading strategies began to lose sense. As a result, Soros started the experiment and in 1966 he invested $ 100 of the company's capital in "Inventions" market. Soros believed that the market moves not only on the basis of fundamental information but also on the views of market participants. As a result, sometimes the market overestimates the value of a given asset, and other times evaluates it below its intrinsic value.

In 1969 Soros, working in an investment bank Arnhold and S. Bleichroeder, set up a headging fund Double Eaglewho amassed $ 4 million in assets, including $ 250 paid in by Soros himself. The fund was established on the exotic island of Curacao. In 000, the fund raised $ 1973 million.

Soros Fund Management

In 1970, on the wave of popularity, George Soros founded Soros Fund Management. After three years, due to a potential conflict of interest, George decided to leave Arnhold and S. Bleichroeder and give investors in the Double Eagle Fund the option to transfer funds to the Soros Fund or stay in the existing structure without Soros. During this time, Soros was working with another famous investor, Jimmy Rogers.

After some time, the Soros Fund raised $ 12 million. Initially, he had a small share in the fund. However, some of the profits the fund generated (from performance fees) were reinvested. In 1981, the fund already managed $ 400 million. But with a 22% loss this year and the outflow of investors' capital, only $ 200 million is left.

George Soros had an aggressive approach to trading. For this reason, it sometimes suffered spectacular losses. In 1987, during the US stock market crash, Quantum Fund lost $ 800 million. Seven years later, losses in short positions in the yen led to an evaporation of $ 600 million. As a result of the Russian crisis, the assets of Quantum Fund decreased by one third. So history shows how many times George Soros was wrong. However, long-term investors were very satisfied with the rate of return generated by the fund. A hypothetical investor who entrusted Soros in 1969 with $ 100 at the end of 000 would have raised $ 1999 million. Below are two sample transactions made by Quantum Fund.

# 1. Trade on the German brand

One of Soros' associates in the fund was Stanley Druckenmiller. Stanley worked with Soros for twelve years (between 1988 and 2000). Druckenmiller started to focus on trading the German brand just a year after starting work. In 1989, the Berlin Wall fell and the integration of Germany with the GDR was more and more likely. As a result, many investors believed that the combination of these two economies would be a heavy burden on the German mark. As a result, the brand was in a strong downtrend. Stanley had a different opinion, he believed that the sell-off on the brand was too big and a market correction was preparing. He believed that political and economic risk was greatly overestimated. As a result, Stanley opened a multi-billion dollar position, assuming a trend reversal on the brand. Soros agreed with Druckenmiller and recommended a further XNUMX billion marks in position. The transaction turned out to be a success and allowed the Quantum fund to earn several hundred million dollars.

# 2. Breaking the Bank of England

It can be concluded that the real fame came not from the fund's fantastic long-term performance, but the incident in 1992, when George Soros led to "Breaking the Bank of England". The abovementioned British pound transaction was a joint project by Soros and Stanley Druckenmiller. The prelude to this event was the depreciation of the US dollar against the German mark. The brand's power reached its peak in September 1992. Both the pound and the mark belonged to the ERM mechanism, which required central banks to keep exchange rates within a certain range of fluctuations. This resulted in an overvaluation of the pound, which made the market expect its weakening. Many speculators started to borrow the pound, sell it on the market and buy the Deutsche mark. As a result, there was a pressure to weaken the pound. However, the real turmoil on the market was brought by the Quantum Fund. On September 16, George Soros and Stanley Druckenmiller decided to play against the pound. They threw 10 billion dollars into the market, which caused a panic reaction from the central bank. Bank of England made the decision to raise interest rate from 10 to 12 percent. At the same time, the head of the central bank announced that soon the interest rate could rise to 15 percent. However, the market decided that further rate hikes are unrealistic. Despite the rate hike, the pound continued to fall. As a result, at 19:00, Norman Lamont informed that Great Britain was leaving the ERM mechanism. Quantum made about $ 1 billion from the deal. The aftermath of the collapse of the Bank of England was the recession in Great Britain, which was caused by unnatural high interest rates.

Charity and writing activities

When mentioning Soros, it is impossible not to remember about his involvement in charity. George has been a philanthropist since the 2021s. At the very beginning, he organized to help black students enter the University of Cape Town (apartheid times). As of the end of March 8,3, George Soros owned $ 32 billion in assets. At the same time, he donated approximately $ 2019 billion to charity. Soros founded and supports a number of foundations whose statutory goal is to promote democratization in post-communist countries. One of them is the Open Society Foundation. In addition to OSI, there are also national organizations such as the Polish Stefan Batory Foundation (in 300 the Open Society Foundations paid $ 000).

One cannot forget the writing career that followed his youthful fantasies of becoming a writer. In his books, he covers many topics, ranging from speculation through economics to political science. His books include: "Underwriting Democracy", "The Bubble of American Supremacy: Correcting the Misuse of American Power", "Opening the Soviet System" or "The Alchemy of Finance".

Summation

Certainly, the results achieved by Quantum Fund's clients make Georg Soros one of the greatest traders in history. However, apart from his own, undoubtedly great skills, Soros was able to find market talents and give them space for development. It was like that with Stanley Druckenmiller. However, there is a patch on Soros "The man who broke the Bank of England." In addition to the fame he has gained, this story has created a patch market manipulator. He is also one of the main "enemies" of some political parties. An example is the Hungarian Fidesz. To sum up, George Soros is a colorful figure who, thanks to his diligence, talent and luck, has become one of the most famous traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)