Gazprom - natgas, oil and politics [Guide]

Rising gas prices on the European market once again drew attention to the largest player on the gas market in Europe - Gazprom. For many years, the company had exclusive rights to export gas outside Russia. Gazprom is the largest energy company in Russia. It is worth mentioning that this is not a private concern. The most important shareholder of the company is the Russian government, which through its bodies controls over 50% of the company's shareholding (through the Russian State Treasury and Rosneftgaz). According to Forbes magazine, Gazprom is the 32nd largest company in the world in terms of revenues (among public companies). It is also the largest company in Russia in terms of revenues. Where did the name Gazprom come from? It is short for га́зoic promы́шленность (pl. gas industry).

Be sure to read: Natgas - how to invest in natural gas? [Guide]

Gazprom is a vertically integrated company that explores, extracts, processes, transports and sells natural gas. In 2018, the company was responsible for approximately 12% of the global extraction of this raw material. In 2020, this share dropped to 10,9%. It is also worth mentioning that the company currently has 15,6% of the world's reserves of this raw material. Gazprom also has an oil production segment. Neft gas is the third largest oil producer in Russia (after Rosneft and Lukoil). The company produces approximately 41 million tons of crude oil and has reserves of this raw material estimated at 2 billion tons.

Gazprom sells natural gas to the Russian market and exports to foreign markets. Decades of cooperation between Russia and gas consumers, which are the countries of Eastern, Southern, Central and Western Europe, have resulted in most of Russia's gas infrastructure being "westward" oriented. The raw material is exported, among others via gas pipelines: Yamal, Nord Stream, Turecki and Soyuz. Recently, the creation of a new outlet has started, namely the "Power of Siberia" gas pipeline, which opens up an absorptive Chinese market for Gazprom.

Throughout its history, Gazprom has succumbed to pressure from Russian politicians more than once and was involved in political disputes. An example is the suspension of gas supplies to Ukraine in 2006 and 2008.

The history of Gazprom

The beginnings of the gas industry in Russia date back to World War II. In 1943, the government of the Union of Soviet Socialist Republics began to develop the extraction of natural gas and use it as an energy resource in the USSR. In 1965, the exploration, production and distribution of natural gas was concentrated in the hands of the Ministry of Gas Industry.

In the seventies and eighties, huge gas deposits were discovered in Siberia, in the Ural regionThese discoveries contributed to the explosive growth of the gas sector in the Soviet Union, which became one of the major players in the global natural gas market.

The origins of Gazprom date back to 1989, when it emerged from the structures of the Soviet Ministry of Gas Industry. It was the first state-owned corporation in the Soviet Union. After the collapse of the USSR, the enterprise was split. As a result, regional "national" companies, such as Ukrgazprom or Turkmengazprom, were created. Gazprom has become the heir of Russian production, distribution and exploration assets. As a result, it has become a monopoly on the Russian gas market.

In 1993, the company was privatized. A model was chosen in which Russian citizens received vouchers that could be converted into company shares. About one-third of the shares were allocated to approximately 750 Russian citizens. The Russian government retained 000% of the company's shares. The remainder was allocated between Gazprom employees and private investors. However, none of the foreign investors could own more than 38% of Gazprom's shares. In 9, 1996% of shares in Gazprom was additionally issued to foreign investors using GDRs (Global Depository Receipts). A year later, the trust that foreign investors had in Russia and Gazprom allowed for the closing of the bond issue worth $ 1 billion.

Vladimir Putin, source: DW

After the crisis in 1998, the concept of re-nationalization of the concern appeared in government circles. After Vladimir Putin took presidential power, there was greater control over the actions of Russian oligarchs, and more attention was paid to controlling the operational activities of state-owned companies. At the beginning of the XNUMXst century, the Russian government continued to increase its stake in the company.

There have also been changes in the management board of Gazprom. The long-standing CEO of the company said goodbye to work - Rem Wachyirew, who held this position in the years 1992 - 2001. Viktor Chernomyrdin, who had been associated with the gas industry since 1985 (as the Minister of the Gas Industry of the USSR), also left his job at Gazprom. He was also prime minister of Russia in 1992-1998. They were replaced by the later prime minister and president of Russia, Dmitry Medvedev and Alexei Miller. The main goal of this duo was to reduce corruption in the company and recover the company's assets that were illegally in the hands of other companies. Some of these activities have had an effect. For example, Gazprom managed to recover its gas assets from Itera for free.

Alexei Miller, source: wikipedia.org

In 2001, Gazprom bought NTV, which was the largest private television in Russia, from the Russian media magnate Vladimir Gusinski, who had fallen into conflict with the new government a few months earlier. To this day, NTV belongs to one of Gazprom's subsidiaries.

In 2005, another important event in the company's history took place. Gazprom's subsidiaries (Gazprombank, Gazpromivest Holding, Gazfond and Gazprom Finance B.V) sold a 7% stake in Gazprom for $ 10,74 billion. The buyer was the government company Rosneftgaz. As a result, the government regained majority control of the company. At the same time, the law forbidding foreign investors to own more than 20% of the company's shares was abolished. In September 2005, Gazprom acquired 72,6% of shares in Sibneft. It cost the company $ 13 billion, of which $ 12 billion was financed by loans.

In 2006, the “On Gas Export” law came into force, which gave Gazprom the exclusive right to export gas from Russia. Another breakthrough in the company's history was 2014. In 2021, Gazprom signed a contract with China National Petroleum Corporation worth $ 400 billion, which is expected to last 30 years. Under the agreement, Gazprom was to deliver 38 billion cubic meters of gas annually from 2018. The deliveries were to be made via the "Strength of Siberia" gas pipeline.

It is also worth mentioning that due to historical events, Gazprom largely controlled the distribution of natural gas from Central Asia. For example, in 2008, Gazprom bought 75% of the gas sold by Turkmenistan. This gas was then re-exported to Ukraine at a higher price.

Gazprom is listed on the stock exchanges in Moscow, London, Karachi, Berlin, Frankfurt am Main and Singapore. It is also worth noting that, as one of the most important Russian companies, Gazprom is a component of such indices as MICEX i RTS.

Check it out: How to trade the Moscow Exchange (MOEX) Index? [Guide]

Gazprom is also investing a lot of money in advertising. He spends a large part of his funds on football. He is one of the main sponsors of the Champions League, financially supports Zenit Saint Petersburg and is a sponsor of clubs such as Crvena zvezda and FC Schalke. It was also one of the sponsors of the FIFA World Cup in Russia (2018). Gazprom is also the title sponsor of the Gazprom Arena stadium in Saint-Petersburg, which can accommodate over 68 spectators.

What's with high gas prices?

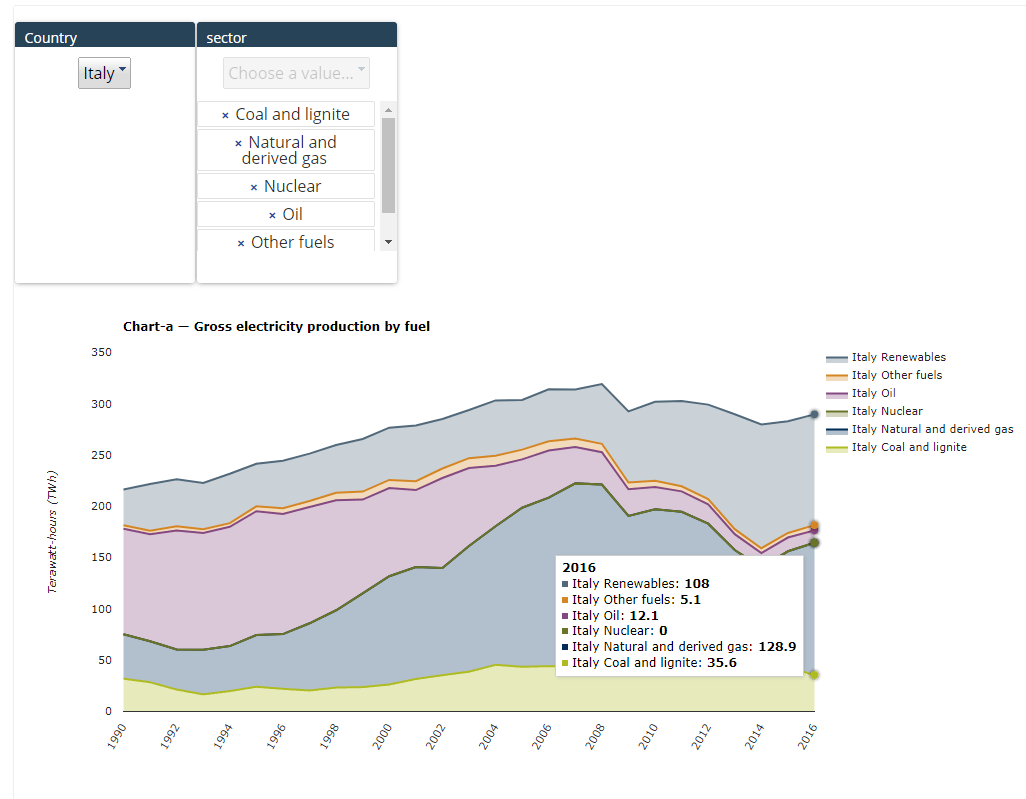

At present, gas plays a very important role in the energy mix in the European Union. In Germany, throughout 2020, gas-fired power plants were responsible for 12% of electricity production (according to the Fraunhofer Institute for Solar Energy Systems ISE). In Italy, around 45% of electricity production came from gas-fired power plants.

In the case of Spain, it is over 20%. France is in a very good situation, as it bases its energy mainly on nuclear power.

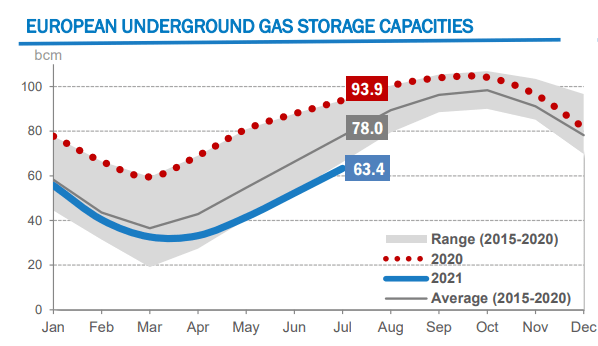

Gas is also used to heat many apartments and industrial buildings in winter. Therefore, there is an annual "cycle". In late spring and summer, gas storage facilities (UGS - gas storage points) are replenished in order to use up some of the reserves during the winter periods. This is necessary because the gas transmission in winter does not always meet the current demand.

Currently, Europe has a problem with gas reserves. The shortage arose as a result of a relatively cold and long winter. This contributed to the increase in gas consumption for heating buildings. The heating season also began faster - October 12. In the previous few years, the heating period was October 20-26. As a result, around 66 billion cubic meters of natural gas were pumped out of European reserves. It is worth mentioning that the gas reserves in 2020 amounted to approximately 82 billion cubic meters.

The level of stocks was very low, but it was assumed that the stock shortages could be replenished in the spring and summer period. However, this did not happen. In the summer, the demand for air conditioning and cooling units increased, which consumed a lot of electricity. As already mentioned, gas is also used to produce electricity. At the same time, wind farms produced less energy this year than expected. For example, in Germany, in the first half of 2021, offshore wind farms generated 11,5 TWh of electricity, 16,3% less than a year earlier. The problem concerned both wind farms located in the North Sea and the Baltic Sea. The problem also concerned onshore wind farms, which produced 47 TWh (22% less than in the previous year).

Another problem was how to reserve gas supplies. Many countries have not signed long-term contracts for the supply of liquefied natural gas (LNG) to diversify supplies. These countries preferred to buy gas in an auction model. However, suppliers of this type of gas chose Asian markets, which offered higher prices. These deliveries would not solve the problem, but would allow a bit more time to find a solution.

As a result, gas storage facilities accumulated around 63 billion cubic meters of this raw material in July. 30 billion less than a year ago. According to Gazprom, out of 66 billion cubic meters of gas, only 27,6 billion have been replenished.

At the beginning of September, the European UGS were only 66% full. For comparison, the year before the warehouses were 91,4% full. Gazprom also has a network of UGS located in Germany, Austria and several other European countries. In Germany, Gazprom Germania controls approximately 30% of the storage capacity. As a result of the reduction in gas supplies through the gas network (including through the Yamal pipeline), Gazprom began to fulfill its contractual obligations by supplying gas from its own European storage facilities. Currently, Gazprom has stock levels below 20% in its warehouses (the lowest level in 8 years). Low inventory levels put many European countries in a difficult situation as there is no guarantee that the warehouses will be replenished by the end of October.

The gas market shortages caused spot prices on the gas market to start rising. It was not that expensive in Europe, even at the height of the resource bubble in 2007–2008, or in the Fukushima nuclear accident in 2011. In June, September gas contracts were around $ 316 (TTF). As early as August 30, the price of gas rose to over $ 600 per 1000 cubic meters. Already on September 14, the price on TTF increased to $ 800.

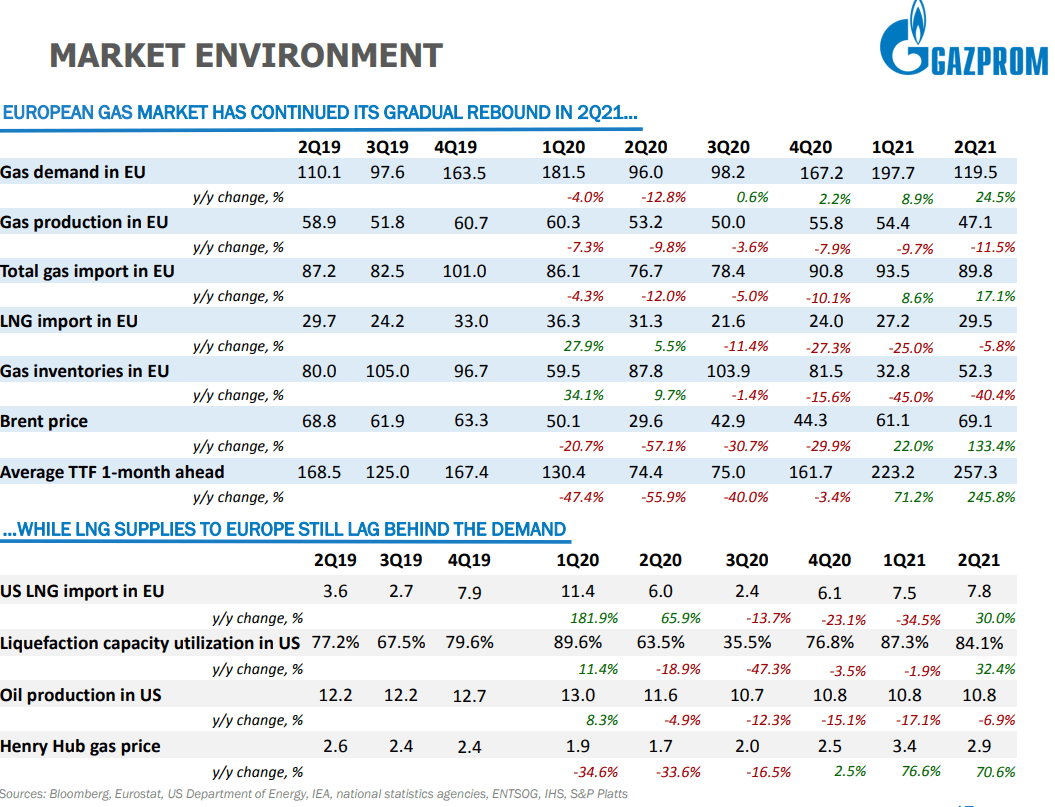

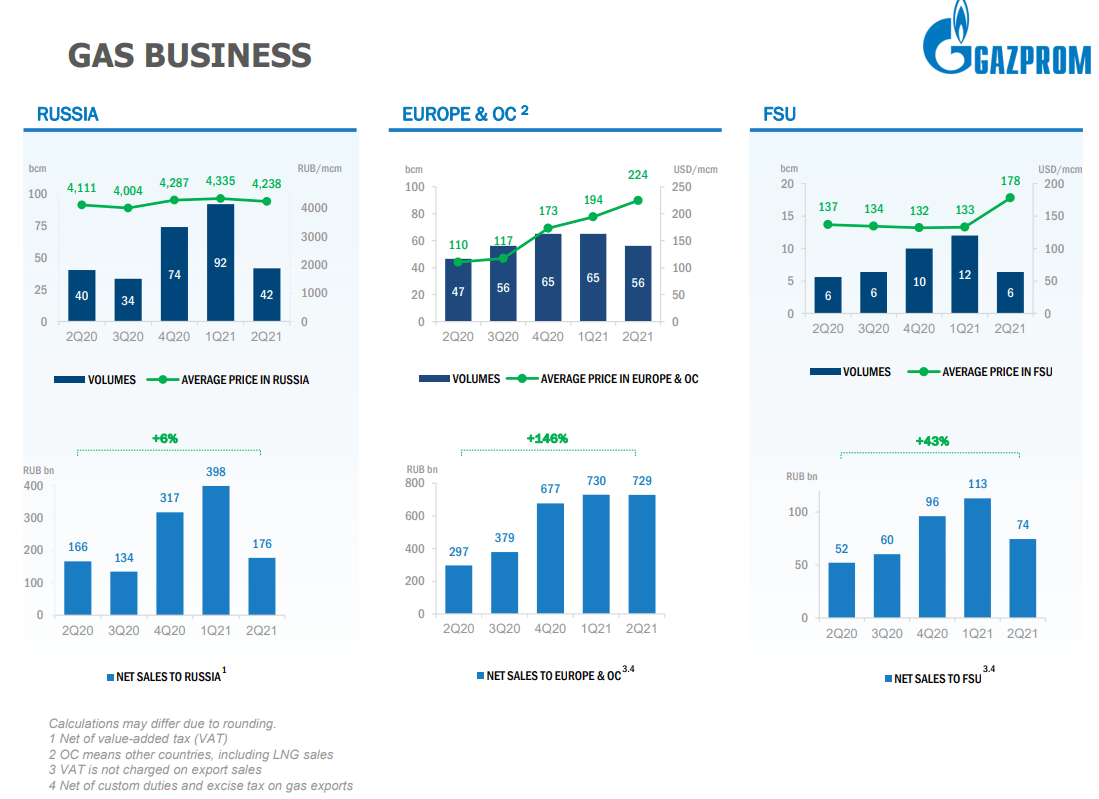

To understand the above dependencies more easily, see the summary prepared by Gazprom. The information was published in the investor's presentation for the first half of 2021:

As you can see, the demand for natural gas increased by 24,5% in Europe. At the same time, domestic production decreased by over 11%, and LNG imports by 6%. As a result, at the end of Q2021 40, gas inventories decreased by 52,3% y / y to the level of only 35 billion cubic meters (by XNUMX billion less than in the previous year).

It is worth noting, however, that the gas shortage on the European market is not due to problems with the extraction of this raw material in Russia. Gazprom confirmed that oil production will increase by 2021% y / y throughout 12 to 510 billion cubic meters. However, it does not intend to increase exports to European countries. Gazprom assumes that exports to Europe will amount to 183 billion cubic meters (16,5% less than the year before).

Gazprom is the largest supplier of natural gas in Europe. Its share has been declining in recent years. In 2018, the Russian company had a 36% share in the European gas market, currently it is 32%. More detailed information is provided in the chart below:

Chart - Natgas

The background to the whole situation is the negotiations between the European Union and Russia on mutual trade relations. The problem concerns the 2rd energy package and the dispute over Nord Stream XNUMX (the second line of the gas pipeline running on the bottom of the Baltic Sea).

This is a specific emphasis of Gazprom, which "encourages" European regulators to faster certify the Nord Stream (II) gas pipeline, sign long-term contracts that will ensure the 100% use of Nord Stream 2 by the Russian company. According to the 50rd energy package, XNUMX% of the gas pipeline's capacity is to be reserved for independent entities.

High gas prices have contributed to a series of bankruptcies of companies that purchase gas at market prices (spot) and resell them to customers at prices set in annual contracts. The sudden jump in price meant that the companies were selling gas at a considerable loss. By the end of September, 9 such companies in the UK had gone bankrupt and customers had been transferred to other suppliers. A similar example was in Germany, where Deutsche Energiepool broke the contracts.

The increase in gas prices also causes an increase in electricity prices. In Italy, prices increased by 40% and gas by 30%. The government has announced that it will subsidize the bills for the poorest, which will cost them € 3bn. Rising energy prices also contribute to increasing inflationary pressure, which may result in the need to raise interest rates or reduce non-standard liquidity tools to the financial sector.

In addition to rising costs for households, rising production costs are another problem. They cause a decline in the competitiveness of European companies on world markets. Manufacturers of fertilizers such as CF Industries and Yatra are limiting production.

Gazprom - operational data

As has already been mentioned, Gazprom is one of the most important companies on the Russian energy map. Although most of the revenues are generated from the sale of hydrocarbons, the company has a number of subsidiaries operating in various industries (including the media branch, Gazprombank, or the majority stake in the Zenit club).

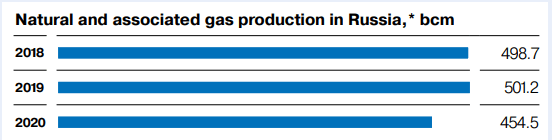

Natural gas production

Gazprom is the largest player on the natural gas market and a key energy company in the world. Before the coronavirus, natural gas production was around 500 billion cubic meters. In 2020, production decreased by approximately 10% y / y. The company concentrates its production in the Ural Federal District. In 2020, production in this region amounted to approximately 417 billion cubic meters.

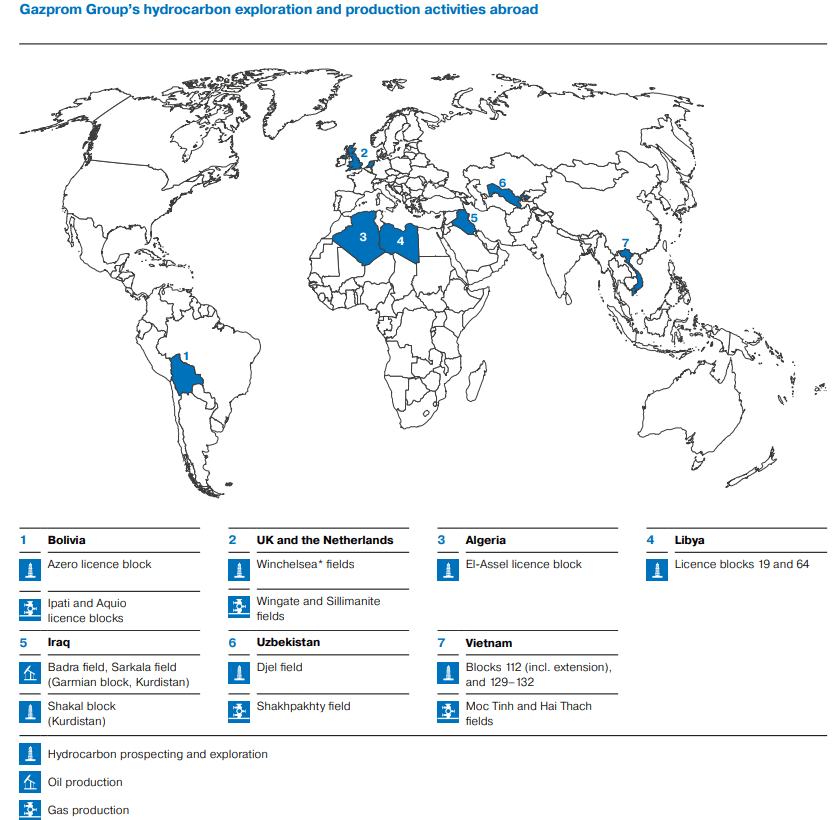

Gazprom diversifies its production geographically. The company also has operations in such countries as Great Britain, the Netherlands, Algeria, Libya and Iraq. Below is a detailed map showing offshore production assets.

Other information

In 2020, the largest customers are Germany (41,6 billion cubic meters). Other important recipients are Italy (20,8 billion), Turkey (16,4 billion) and Austria (10,6 billion). This year Poland bought 9,7 billion cubic meters of gas.

While Gazprom has a de facto monopoly on gas exports to Europe, it does not have such a strong position on the local Russian market. It should also be noted that Gazprom is not the only supplier of natural gas in Russia. In the years 2016 - 2020 it was responsible for 65% - 68% of domestic production. Other players on the domestic market are Novatek, Rosneft and Lukoil.

It is also worth mentioning that Gazprom is also a significant producer of electricity in Russia. In 2020, the company's share on the Russian energy market was 12,5%. Gazprom is also the third largest oil producing company in Russia (after Rosneft and Lukoil). Its share in domestic extraction in 2020 was 12,4%

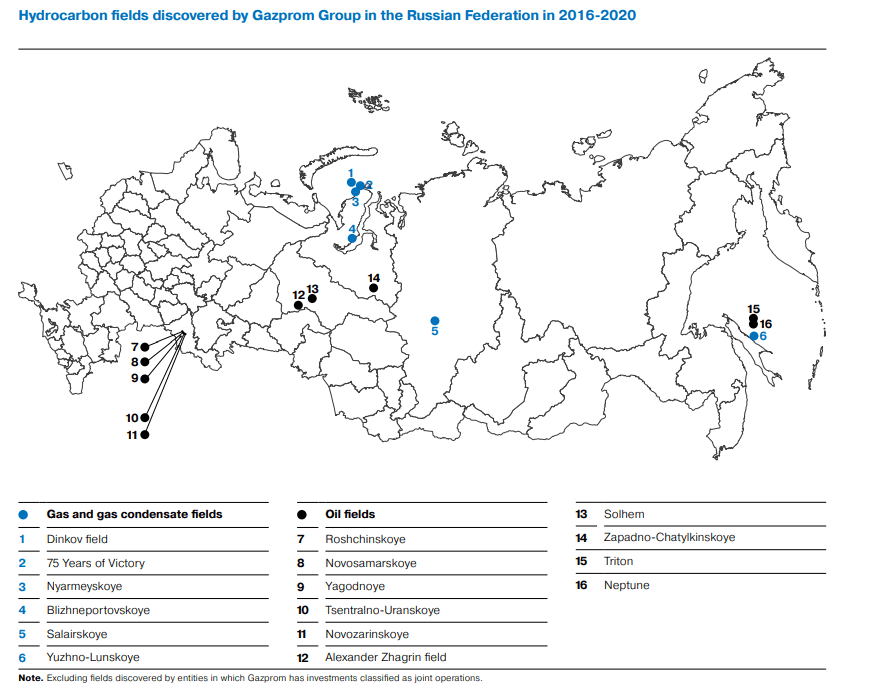

Gazprom is also looking for new deposits in order to be able to maintain the current level of production. In 2016-2020, the company managed to locate 6 new natural gas deposits and 10 deposits oil.

The company also has 35 gas storage facilities, including 9 abroad (the Netherlands, Austria, Germany, Czech Republic, Serbia, Armenia). At the same time, the company is building another 5 warehouses in Russia.

Market prospects

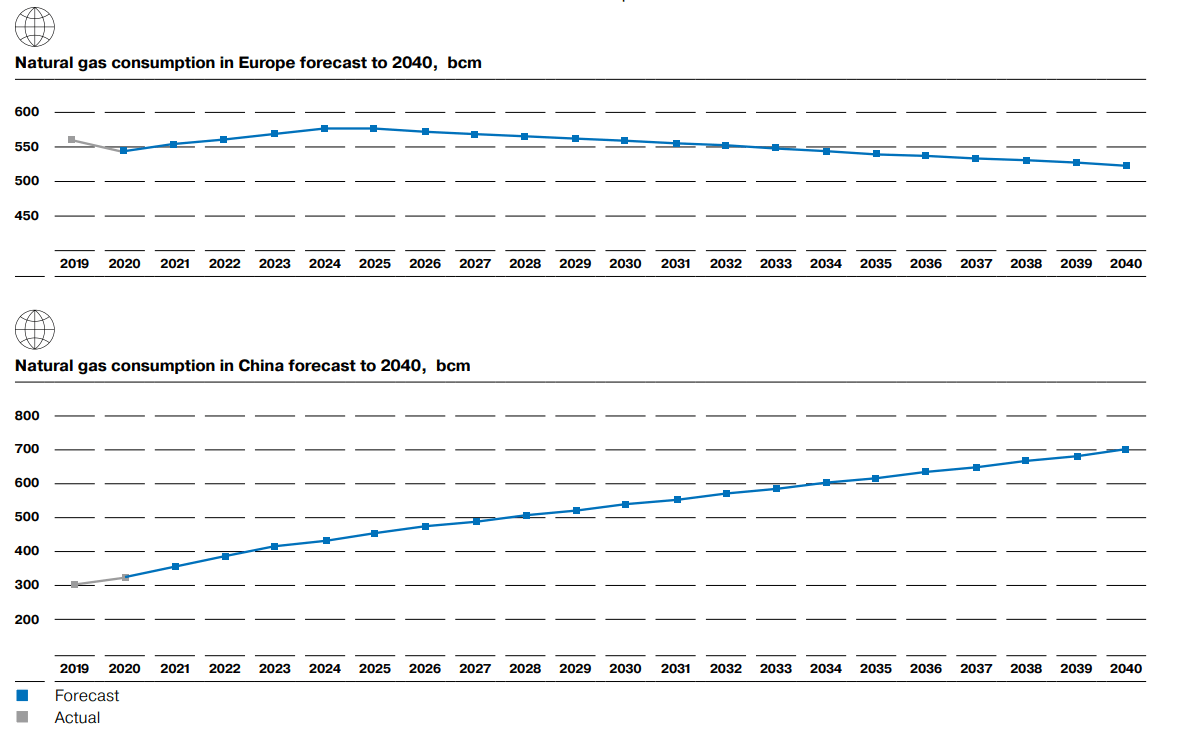

Over the next two decades, the importance of the European gas market for Gazprom should decrease. China will have much greater sales potential. According to the company's forecasts, around 2030-2031 natural gas consumption in China will be higher than in Europe. This can be seen in the charts below:

For this reason, it should be expected that Gazprom's interest in the European market will decline every year. On the other hand, the energy ties between Russia and China will increase. Therefore, Gazprom's investments in the "Strength of Siberia" gas pipeline are surprising.

Annual operating results

In 2020, the company generated 6 billion rubles of net revenue. Including 321 billion rubles were revenues from the sale of natural gas, and approximately 3 billion rubles were revenues from the sale of refined products. It is also worth mentioning the revenues from the sale of electricity and heating, which amounted to 050 billion rubles. Gas transportation services amounted to approximately 1 billion rubles. The company's total revenues decreased by approximately 800% y / y. It was the second consecutive year of decline in revenues.

The company failed to cut costs in 2020 as fast as revenues fell. Operating expenses decreased by 11,3%. As a result, the operating profit decreased by 45% during the year, reaching the level of 615 billion rubles.

Gazprom tried to reduce capital expenditure in such segments as gas transport (-46% y / y) and gas distribution (-31% y / y). On the other hand, the expenditure in the gas production segment slightly decreased (-2% y / y). The total CAPEX amounted to 2020 billion rubles in 1, which was a y / y decrease of around 494%. Free cash flow (FCF) amounted to approximately 18 billion rubles in 2020.

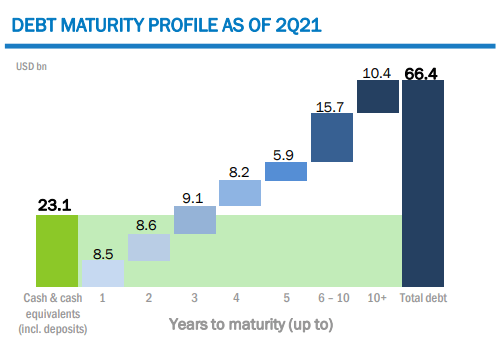

In 2020, the company's net debt increased by 22%, reaching 3 billion rubles. As a result, net debt to adjusted EBITD increased during the year from 872 to 1,7. The liquidity situation at the end of 2,6 was stable, as most of the debt had a maturity of over two years (2020% of the total debt).

H2021 XNUMX results

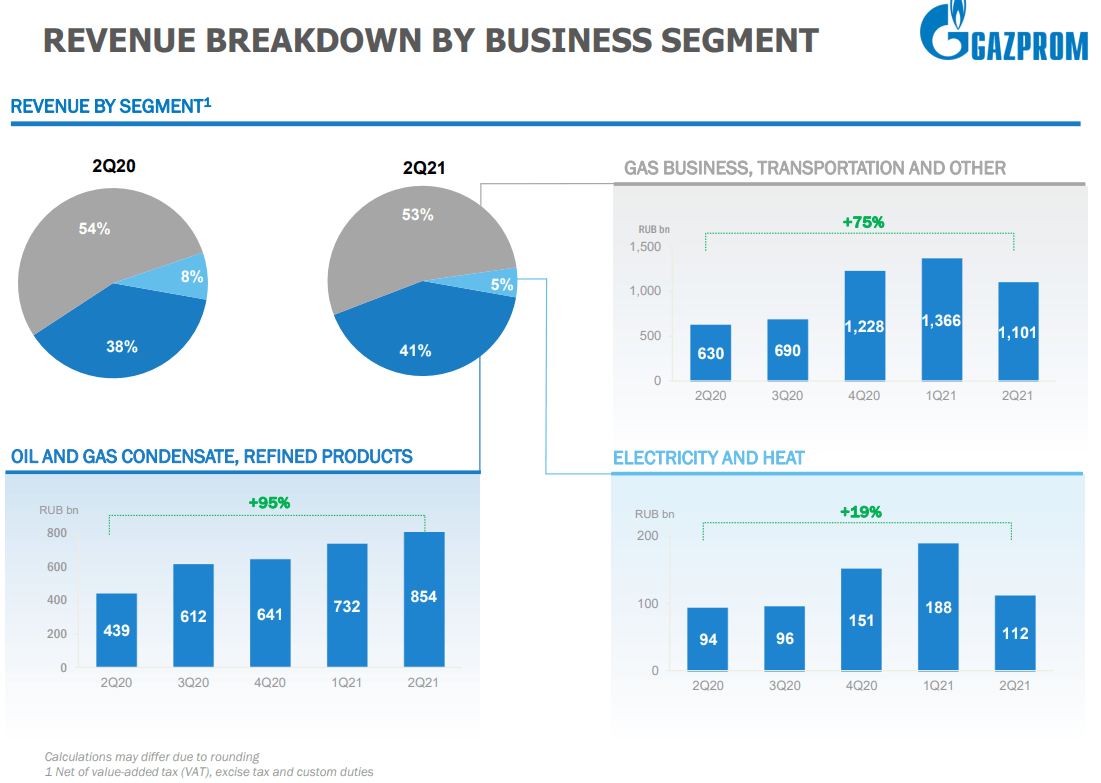

The first half of the year was very good for Gazprom, revenues increased by 78% to the level of 2 billion rubles. Most of the revenues were still generated by the gas segment.

Gas sales to Europe and countries outside the former Soviet Union (FSU) increased by 146% y / y. This was mainly due to the increase in prices, which was more than covered by smaller exports in terms of volume.

The company also managed to increase its net profit to the level of 521 billion rubles, i.e. by over 350% y / y. The company also managed to generate 132 billion FCF (FCF was below zero a year ago), despite raising capital expenditure levels by $ 117 billion.

At the same time, Gazprom managed to reduce the level of net debt by 10%, to 3 billion rubles. Gazprom's financial situation is stable, as can be seen in the chart below.

Chart - Gazprom

Where to buy Gazprom shares (GAZP)

An increasing number of forex brokers have a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Gazprom is a vertically integrated producer of gas, crude oil and refined products. It is also a significant producer of electricity in Russia. The current year is very good for the Russian company. Rising natural gas prices contributed to a significant increase in the company's revenues and profits. Importantly, the company diversifies its sales. In the coming years, an increase in the share of natural gas sales to China should be expected. Over the next two decades, it will be a much larger market than Europe. As a result, Gazprom's interest in the European energy market will slowly decline. The company was traded with low price-earnings ratios for many years. This is partly due to the fact that investors' discount is attached to the risk of investing in Russia and the government's potential influence on the company's business decisions (Gazprom has been shown many times as an example of using energy companies as an element of political pressure). The company's current capitalization is $ 121 billion.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Gazprom - natgas, oil and politics [Guide] gazprom shares](https://forexclub.pl/wp-content/uploads/2021/10/gazprom-akcje.jpg?v=1633685879)

![Gazprom - natgas, oil and politics [Guide] shibainu coin crypto](https://forexclub.pl/wp-content/uploads/2021/10/shibainu-coin-crypto-102x65.png)

![Gazprom - natgas, oil and politics [Guide] ism strengthened the dollar](https://forexclub.pl/wp-content/uploads/2021/10/dolar-amerykanski-saxo-bank-102x65.jpg?v=1633692059)

Leave a Response