Candle formations

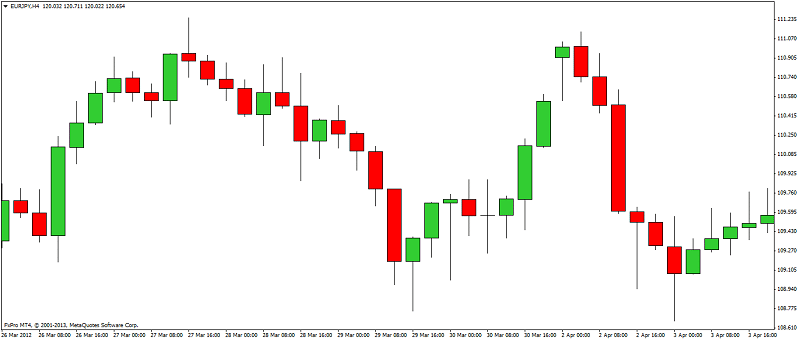

A candlestick chart is the type of chart that provides the trader with the most information about the state of the market. For this reason, it is most popular with technical analysis traders, thanks to the candlestick patterns that appear on the chart. However, it should be remembered that the candles themselves should not be a signal to open / close a position and it is best to always combine them with an additional technique that will confirm the signal. Also, in addition to the appearance of the candles, the place of the formation on the chart is very important. They can be divided into two main types: reversing the trend and continuation of the trend. In our opinion, the most frequent and strongest candle formations have been selected in the list below.

Candlestick patterns: trend reversals

Hammer

A candle with a clearly long shadow, where the closing price is close to the price High. The color of the body is irrelevant (it can be a rising or falling candle). The bottom shadow shows the weakness of sellers and buyers who displace them, suggesting a change of direction and an upward turn, if it occurred after an ongoing trend a downtrend or a downward correction in an uptrend.

Inverted hammer

Formation very similar to the hammer with the only difference that the shadow of the candle is not directed down but up. It announces the reversal of trends and the start of increases.

Falling star

Formation analogous to the hammer, occurring at the end of the upward trend, which suggests the beginning declines and weaker buyers' strength. A candle with a small body (rising or falling) and a long, top shadow.

Penetration

Penetration occurs after the end of the upward trend. Formation consists of two candles, where the first one is black, where the power of sellers is shown, and the second opens with a gap (or at the closing price) and is a growth candle with a body of at least 50% of the previous black candle, which indicates that the buyers began to dominate.

A curtain of a dark cloud

The candlestick formation of the dark cloud veil is the opposite of diffusion. It consists of two candles, where the first one shows an upside of buyers while the second one opens above the gap (or after the previous closing price) and is a downtrend where the wick is at least 50% of the previous white candle. This suggests that sellers are starting to crowd out buyers and that declines can be expected.

Covering the bull market

This pattern is close to penetration, except that the rising candle completely covers the body of the preceding bearish candle. The opening of the second candle must be lower than the closing of the first (gap down), which still suggests a desire to decline, and in the end, the buyers win the battle and raise the rate above the opening of the first candle. The formation heralds the start of rises.

Coverage of the bear market

Analogous formation to cover the boom, where the first candle is growing while the second, inheritance, in its entirety covers the previous one. The opening of the second candle must be higher than closing the first one (gaping up), which informs us about the willingness to fall, but then the seller dominates by bringing the course clearly down, lower than the closing of the first candle. Formation heralds the beginning of inheritance.

Morning Star

Formation 3 candle, where the first is a long fall candle, the second candle with a small body (no matter whether it is up, down or doji), while the last is a growth candle with a longer body, which closes higher than the opening price of the first. The middle candle indicates that the declines have been stopped, and the third shows that the buyers enter and displace the supply, which heralds the start of increases.

Evening star

A similar formation to the morning star. It announces the beginning of declines. The first candle is upward, the middle candle has a small body of any color and the third is downward. It has a long body that closes below the opening price of the first candle.

Candlestick patterns: continuation of the trend

Three bull market

The formation consists of 5 candles. The first is upward with a longer body, followed by a small correction from three candles where the second and fourth in the pattern are downward. The third is irrelevant (it can be up, down, or doji), but with a total range no greater than the first candle. The last candle is a large body rising candle that extends beyond the first candle. This shows the end of the correction, the dominance of the demand in the market and the return to further increases.

Three bearings

Equivalent to a XNUMX formation bull market. It is five candles, where the first is a high-bodied downturn, then a small bullish, third is insignificant, the fourth is a small upswing (together they do not exceed the opening price of the first one), and the fifth is a downtrend with a large body exceeding the closing price of the first candle. This pattern shows a correction after declines. It ends with the formation of the fifth candle showing the strength of the supply and the return to the lows.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)