Bitcoin - The most important information

Bitcoin, the most popular cryptocurrency that improves its valuation records almost every month. There is always a fierce discussion about whether we are dealing with a speculative bubble or a payment future, incomprehensible to the majority of society. Until recently, only a few people were interested in cryptocurrencies, mainly people related to the IT industry. Currently, it is a very dynamically developing market where the interests of large corporations, cryptocurrency exchanges, "miners" equipped with powerful computing power equipment, gray people treating BTC as a means of payment, and speculators focus on the interests of.

Let's get to the bottom of what Bitcoin really is.

The most popular cryptocurrency exchanges

Bitcoin - what is it?

Bitcoin is a kind of innovative payment network, a new type of money based on peer-to-peer technology, created in January 2009. It has no owner, no top-down regulator or issuer. The source code itself is open and transparent, and transactions are direct and immediate. Bitcoins cannot be blocked by anyone and transactions cannot be undone / canceled. Only a person with a private key has access to them.

All transactions are recorded in the form of a public register, which is why everyone can check the amount of exchanges. It is also visible the address of the sender and recipient Bitcoin, but nobody knows who it belongs to (except the owner). The register itself is decentralized and dispersed and named blockchain (block chain). The name results from the fact that transactions are grouped in the form of blocks (chronologically and linearly).

Bitcoin digging

Bitcoins are "generated" through trial and error searching for solutions to the so-called blocks (hashes). Depending on the computing power of the device (the so-called excavators), X attempts can be made in the Y time interval. Initially, ordinary computers could be used for "digging", but now the difficulty of extracting them is so great that it ceased to calculate and this task was taken care of "Miners' associations" with enormous computing power. There are also "miners" who use specially designed devices to mine Bitcoin - called ASIC, but despite everything, they cannot compete with the mining associations.

When designing the entire mechanism, the creator's idea was to introduce decreasing supply lasting several dozen years. The author of Bitcoin assumed a decrease in the prize for digging a given block. At first it was 50 BTC, then 25 BTC, and now 12,5 BTC. As you can see, the prize is reduced by half compared to the previous value. This happens every 210.000 blocks, or about every 4 years. The next fall in the prize is estimated for May 2020.

The supply of Bitcoin coins is limited in advance and is planned at 21 million. However, such an amount will never go into circulation due to lost or forgotten wallets from the early days.

Bitcoin cryptocurrency as a means of payment

In Poland according to the official position of the National Bank of Poland and the PFSA none of the cryptocurrencies have been recognized as "virtual currency". However, the world does not end in Poland. In an increasing number of countries, Bitcoin is becoming an acceptable means of payment and even has the status of real currency. It can also constitute a payment for the purchase of goods of significant value, such as real estate. The table below presents the official positions of selected countries in relation to BTC payments.

| End | Legal status and regulations in BTC |

| Germany | Legal currency, acceptable for private payments |

| Tajlandia | Transactions using BTC are illegal |

| Switzerland | Legal currency |

| Japan | Legal currency, acceptable in many stores and enterprises |

| Finland | Legal currency. Converting BTC to currency (and vice versa) is taxable |

How to buy Bitcoin

Until recently, there was no way out - we could invest in BTC only through exchanges. However, it must be admitted that this is still the most popular method. Each exchange offers us a different range of available cryptocurrencies, different fee levels, as well as tools and types of orders. There are only a few major cryptocurrency exchanges in Poland. The leader is definitely Bitbay.net which owns more than 70% of shares on the market. All exchanges in the world are currently around 300, and the full list is available HERE. Interestingly, Bitbay.net is in the top hundred, i.e. slightly higher than 1/3 of the global rate.

While trading through exchanges is widely recognized as safe, it is not without risk. The greatest threats are hacker attacks and the fraudulent use of funds. In January 2017, the Polish Bitcurex exchange suddenly "evaporated", and with it bitcoins with a value estimated at several hundred thousand zlotys. The chances of their recovery are slim.

The high speculative demand for BTC caused that Forex brokers also became interested in the subject. They have capital, appropriate licenses, transaction platforms and, above all, a customer base consisting mainly of speculators. It remains therefore to enter the offer CFD on Bitcoin (and other cryptocurrencies), which is being decided by an increasing number of brokers. Thanks to this, we get the opportunity to trade on cryptocurrencies through a regulated institution with an established market position, advanced platforms with the possibility of analysis, using financial leverage (most often in the range 1: 5 - 1:50). In addition, or perhaps above all, our deposit is covered by a capital guarantee up to the amount resulting from the broker's seat (and local regulations). Additionally, there is an opportunity to trade 7 days a week, which traders have not had any contact with so far.

You have to see: Forex Brokers Offering Bitcoin - Summary

Cryptocurrencies in the global trade

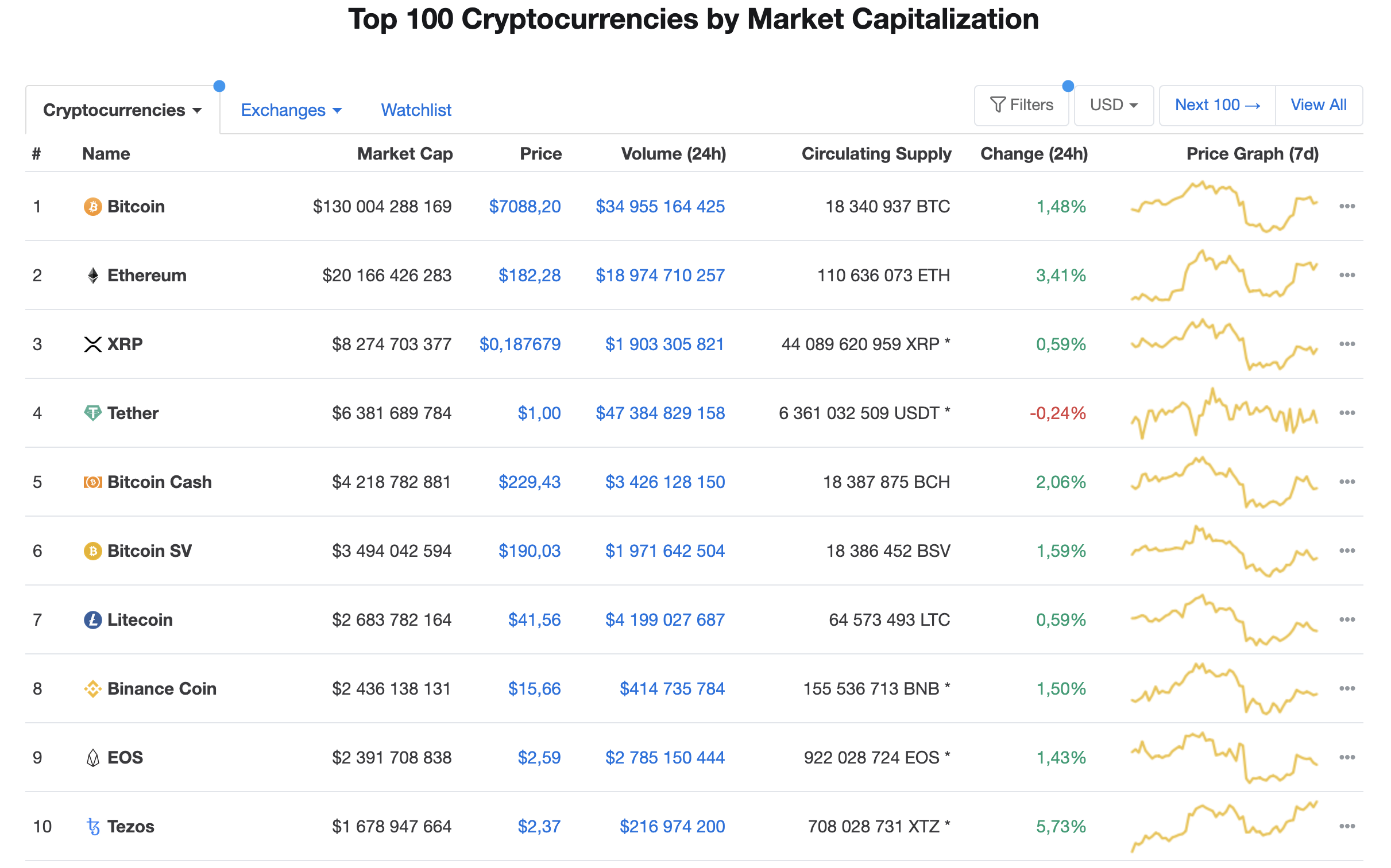

By site Coin Market Cap, there are well over 2000 different cryptocurrencies on the market (as of April 2020). The total market capitalization exceeds USD 200. It should be noted, however, that the top ten has as much as 000% share, of which about 000% belongs to Bitcoin (000% counting with BTC Cash).

Read: Bitcoin and company. How big is the cryptocurrency market?

Bitcoin in numbers

- Maximum number of coins: 21 million

- Mined coins: 16,249,406 BTC

- First block: 2009-01-09

- Number of blocks: 460,992

- Average time between blocks: 8m 52s

- Award in the block: 12.50 BTC

- Blockchain size: 130.07 GB

- Algorithm: SHA256

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)