How to combine trading with full-time work - the "At the End of the Day" strategy

There are several philosophies on how to "do" trading in the i market what time frame (TF) is the best for it. Beginning traders often face the dilemma: on what interval to observe the chart and on what basis to make investment decisions. It also happens that they are absorbed in everyday "life", they simply can not spend several hours a day analyzing charts.

How to combine trading with full-time work and daily duties? The strategy can be a way out of this situation "at the end of the day".

Be sure to read: Bull's embrace - What is it and how to use it in trading

Assumptions of the methodology and trading

Strategy at the end of the day based only on the analysis of day candles. Of course, you can from time to time help you with lower intervals such as H4, looking for additional confirmation for a particular setup. The basic assumption and starting point, however, is closing the session in New York, that is, closing the day candle. One of the main advantages of the methodology are a bit "Pronounced" signals. I do not deny the typical intraday approach (during the day), but when trading in this way, it is often necessary to devote a lot of time to the analysis of individual assets. Trading based on the analysis of day candles, allows you to remove unnecessary noise that often appears at lower time intervals. You can also find out that this type of trading is less stressful, because we have more time to react and we do not have to "wade through" less important price actions.

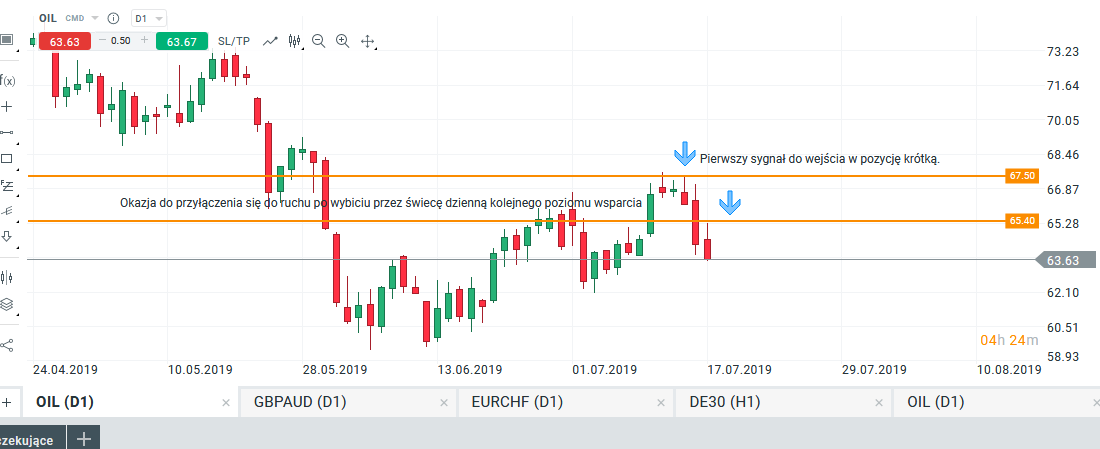

Individual charts show the same value, but at other time intervals. You can see that there is much more noise on the smaller TF, and for an untrained trader, the picture of the market may not be sufficiently clear. On the daily chart, the shape of the candles clearly showed that it is more likely that the price will go down.

Market image on the chart. Brent oil, M30 interval. Source: xNUMX XTB xStation

Market image on the chart. Brent oil, D1 interval. Source: xNUMX XTB xStation

Another aspect in favor of the approach "at the end of the day" it saves time. For many traders, investing is an additional occupation and they do not have several hours a day to analyze the charts. If we trade on the basis of closing in the US, we can calmly analyze the market in the evening, without thinking whether we have time to enter the position or not. At the same time, this approach protects us against unnecessary overtradingbecause the potential signals will be less than trading day-trading.

Entering the position

Using the discussed strategy after the candle analysis, we have two options. Either we have a signal or not. If the signal occurs, we stick to our trading account and enter the closing position or set a pending order. The strategy works very well, if we like to wait for the elimination of certain levels, or we plan to enter closely on support or resistance.

Examples of places to enter the position. Brent oil, D1 interval. Source: xNUMX XTB xStation

The basic plan for determining a potential setup is as follows:

- we choose a specific market / value on which we look for opportunities to enter,

- we set key support and resistance levels based on the daily chart,

- analyzing the day candles, we determine whether there has been a breach or not,

- if the price does not reach the level we are interested in, or there is no puncture / breach, we will refrain from entering the position.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)

Leave a Response