FOMC - What is the Federal Open Market Committee

One of the world's most important institutions is Federal Reserve System (FED). The American central bank has a great influence on the shape of world monetary policy. Responsible for the monetary policy of the US central bank Federal Open Market Committee (FOMC). The article will present what exactly the FOMC does.

What is the Federal Open Market Committee

The Federal Open Market Committee is a body of the Federal Reserve System. He is responsible for shaping monetary policy (monetary). FOMC members meet eight times a year to discuss what monetary policy should look like in the near future. As a rule, the policy of the central bank depends on the economic situation, the unemployment rate and the level of inflation. An important factor shaping the policy of this body is the beliefs of the members of this committee. As a rule, the members are divided into three groups: hawks, pigeons and the center. Hawks prefer a more restrictive monetary policy. This means that they are usually reluctant to rate cuts interest rates or increasing the balance sheet total of the central bank. On the other hand, members with a "dovish" bias suggest a more expansionary policy of the central bank (eg through quantitative easing) and are skeptical about raising interest rates. Members considered to be the center do not have a clear opinion on the current situation and on some topics they share the opinion of pigeons, in others they are for hawks.

FOMC members

The Federal Open Market Committee consists of 12 members. They include:

- Members of the Board of Governors

- President of the New York Federal Reserve District

- 4 of the 11 governors of the other regional Federal Reserve chapters

The Board of Governors has the task of managing the Federal Reserve (Fed). Its members are nominated for 14-year terms by the President of the United States. The Board of Governors consists of 7 members. The term of office of one of the Governors expires every two years. Such a structure causes the council to change smoothly and reduces the risk that the Fed will be politicized by means of an "express change" of all members of the Board of Governors. The board is chaired by the chairman, who is elected for a four-year term.

The chairman of the regional branch of the Federal Reserve in New York has a permanent seat on the FOMC. This is because it is the largest regional branch of the FED. The Federal Reserve Bank of New York is one of the FED's 12 regional branches. Its history dates back to 1914. For the first 14 years, the president was Benjamin Strong Jr. Currently, the president of the New York branch of the Fed is John Carroll Williamswho has been performing this function since 2018.

The remaining four seats are rotated among the remaining 11 presidents of the FED regional branches. It is worth mentioning, however, that all the governors of the Federal Reserve's regional chapters may attend FOMC meetings. However, only 5 of the 12 CEOs (New York + four rotating CEOs) have a vote.

What does the FOMC do?

To put it simply, the FOMC deals with shaping the monetary policy of the Fed. The Committee's task is to regulate the level of money in circulation by means of special operations and to implement the basic objectives of monetary policy - to support the achievement of full employment and to stabilize prices..

Before the FOMC meeting, reports are prepared on the current economic situation and the condition of the financial market. At the same time, written reports on the economic outlook for the US economy are being prepared. Reports on open market operations conducted since the last meeting are also prepared.

After reading the materials, the topics of prices, wages, employment, industrial production and retail are usually discussed during the meeting. In addition, the "wallpaper" analysis of monetary aggregators, the monetary policy of major central banks and the fiscal policy in the United States.

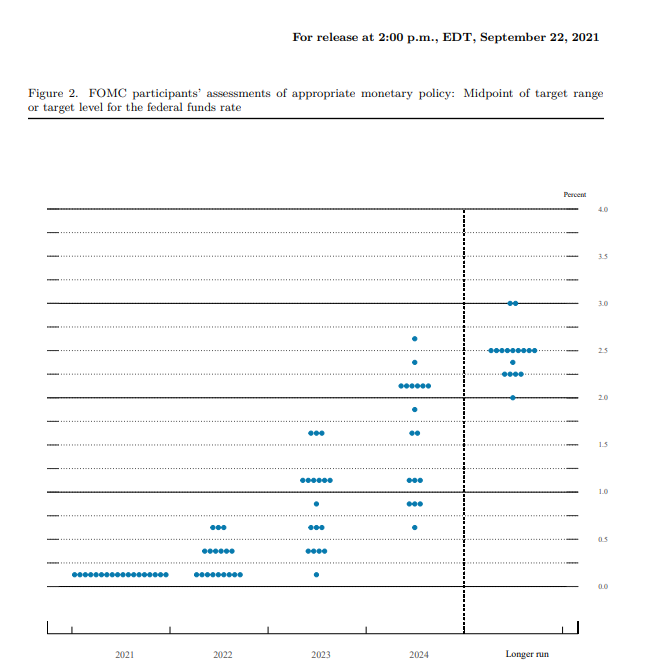

Finally, during the discussion, there is a consensus among the members of the FOMC. It is followed by a communiqué from the FOMC meeting, which will define the short-term policy of the central bank. The second component of the FOMC messages is the "dot chart", which defines the FED's predictions on the shape of the interest rate changes in the coming years. Movements in this chart can trigger movements in the stock, bond and currency markets.

Source: www.federalreserve.gov

It should be noted, however, that the FOMC itself does not conduct open market operations, the tasks outlined by the Federal Open Market Committee are performed by the FED.

What are open market operations

It is one of the instruments of monetary policy that is used to regulate the amount of money in circulation. The operations consist of the purchase or sale of securities by a central bank. If securities are purchased, the central bank increases the liquidity of commercial banks. When securities are sold, liquidity is "pulled" from the banking sector. Open market operations can be divided into unconditional and conditional.

In the case of outright open market operations, the central bank repurchases or resells the securities without any additional obligations. Conditional open market operations assume a reverse transaction in the future. Examples of such transactions are repos and reverse repos.

- Repo transaction indicates a repurchase agreement. The central bank buys securities from commercial banks subject to their later repurchase by commercial banks. This means that a repo operation is a short-term security loan granted by a central bank.

- Reverse repo transaction (reverse repurchase agreements) means that the central bank sells securities to commercial banks subject to their later repurchase by the central bank. This means that a reverse repo operation is a loan granted by commercial banks to the central bank against securities.

Influence of the FOMC on financial markets

On the day of the FOMC meeting, investors are waiting for the official announcement. After its publication, investors try to find out what the Fed's attitude is for the next weeks and months. If the communiqué is more dovish than market expectations, then generally equities and bonds should rise and the dollar should weaken. In the case of a more hawkish communiqué, the market usually reacts with a sell-off of stocks and bonds as well as a strengthening of the dollar.

However, it should be remembered that the so-called "narration". If the market wants to grow, even in the hawkish statement, it will find a reason for an increase in the stock market. It may be, for example, confirmation of strong and stable economic growth, which gives the central bank room to tighten monetary policy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response