What is the platform and how does it work eToro? Social trading is constantly gaining popularity, and eToro is a tailor-made solution for people looking for alternative ways to invest.

The development of modern technologies, as well as social networking, has contributed and at the same time inspired investors to create the so-called social trading, i.e. social trading. Although this way of investing is present on Forex / CFD market It has been developing for a good few years and its success has not waned. It is also the result of the times we lived in, i.e. the popularization of mutual services, such as Uber or Air BnB.

About eToro

eToro is currently one of the dominant players in the social investing segment. The company was founded in 2006 by the Israeli brothers Yoni and Ronen Assia, and David Ring. eToro has been operating under Cypriot regulations since 2010 (CySEC license No. 109/10), and later also obtained British regulations (FRN 583263). It also has a notification from the Polish Financial Supervision Authority.

At the moment, the company employs over 350 people and is present all over the world. Its main goal is to connect two camps with each other - traders, commonly known as signal managers or providers, and investors, i.e. people who would like to invest their capital without having to specialize in this field. Is this the right idea? Well, how many arguments za, the same against. Is it legal? About this later in the article.

What is trading in eToro?

Investors from all over the world, various investment styles, approaches to trading, strategies and a whole host of instruments - all in one place. Exactly that social trading on eToro. But how does it work?

The user-investor has the ability to track the play of other trader-managers and, as a last resort, to duplicate their actions. This process is done automatically. It is based on the fact that if Trader X opens a long position on 1.0 lot on EUR / USD, then the same will happen on the tracking account with one small difference. The volume of items on the observer's account will be adjusted to his capital. This position will be closed when the trader-manager closes it on his account. Simple right?

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Thanks to this model, investors with much less knowledge, skills or time resources can enter the capital markets without making independent investment decisions, relying - at least in theory - on more experienced traders. In practice, it can be different and not necessarily as colorful as it might seem. Only statistics from his account can help us in choosing the right provider. But as you know, past performance does not guarantee that it will be repeated in the future.

You can read more about education on Social Trading in the appropriate section on our website.

Investing by eToro

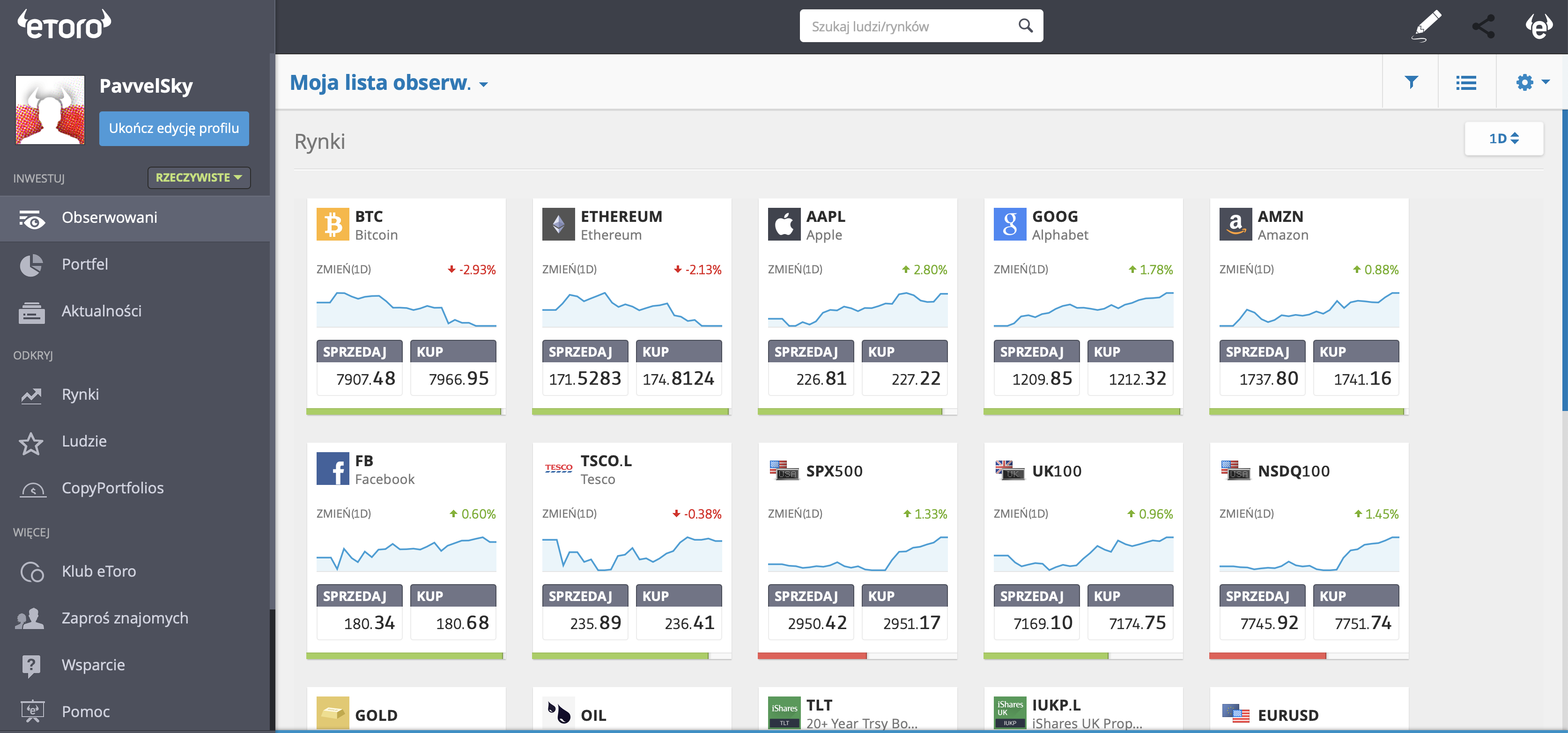

Simplicity. This one word best describes what we are dealing with. Large fonts and clear buttons allow you to easily locate the function you are looking for. The filtering options are also sufficient and allow you to quickly find the market, instrument, trader or group of traders that meet certain conditions. To start copying the manager's actions, all you need is a few mouse clicks. A trivial matter.

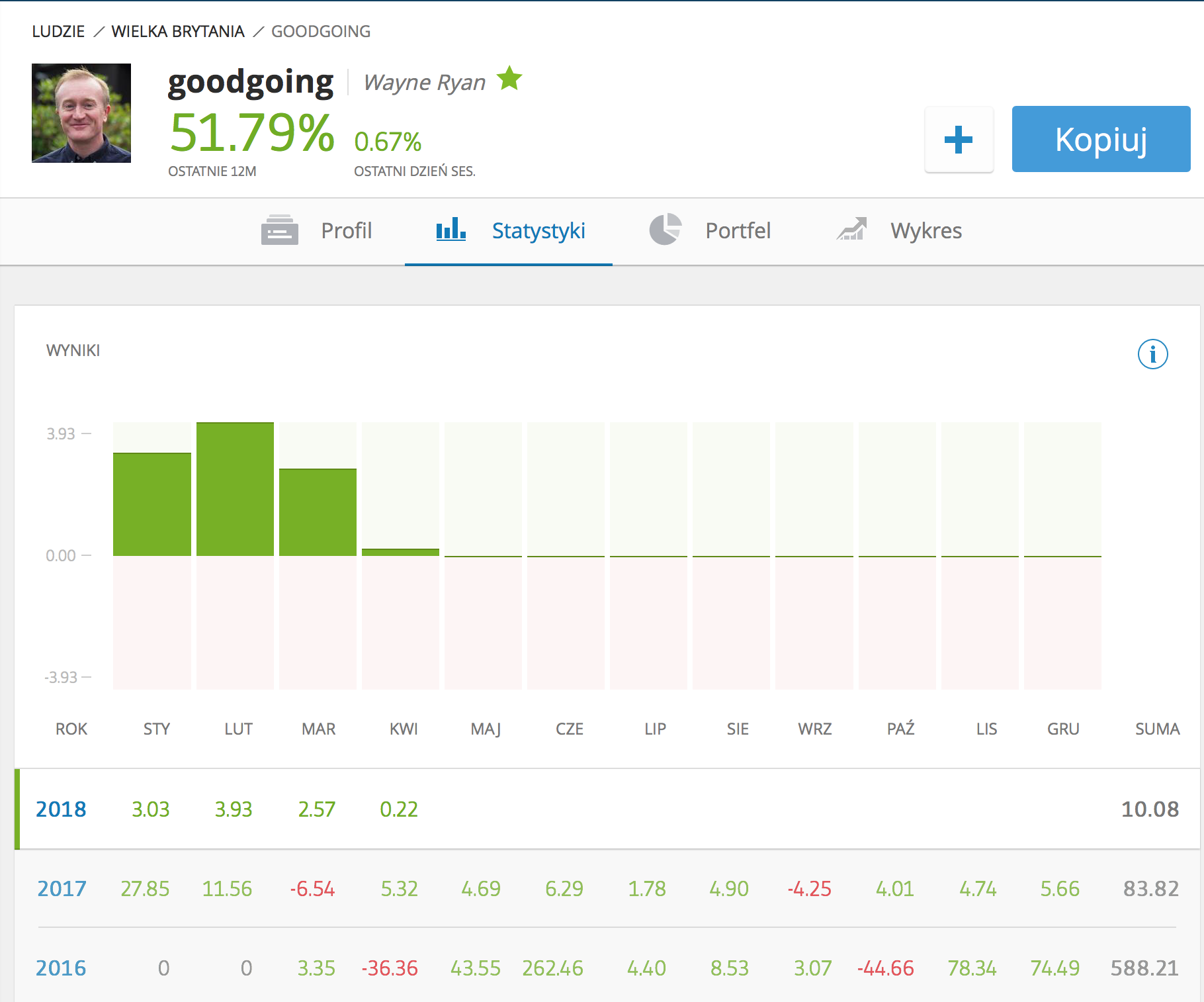

User profiles and statistics

In the profile of each user, we will find his "board", where he can publish various content, and his social activity (comments, mentions, etc.). And it is the least important element of the profile. More important are his results and statistics. We will find information such as the rate of return broken down by months and years, the number of transactions broken down by instruments and their entire groups, information on recent activities and the current portfolio statement. In the additional "chart" tab, you can also see the change of the capital curve over time.

Everything looks very neat and clear. However, I have little attention. While the statistics look nice, in my opinion they could be more extensive. One can not resist the impression that eToro only shows what less experienced investors expect, and nothing more. For example, there was no possibility of personal data processing (period selection).

As at the date of writing this article (April 19, 2018), there are 1204 signal providers from around the world, including Poland (13, one of which was active last week). Even Yoni Assia, the CEO of eToro, with over three million followers is available in visible profiles :-). You can check his statistics HERE.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Social Trading Portfolio

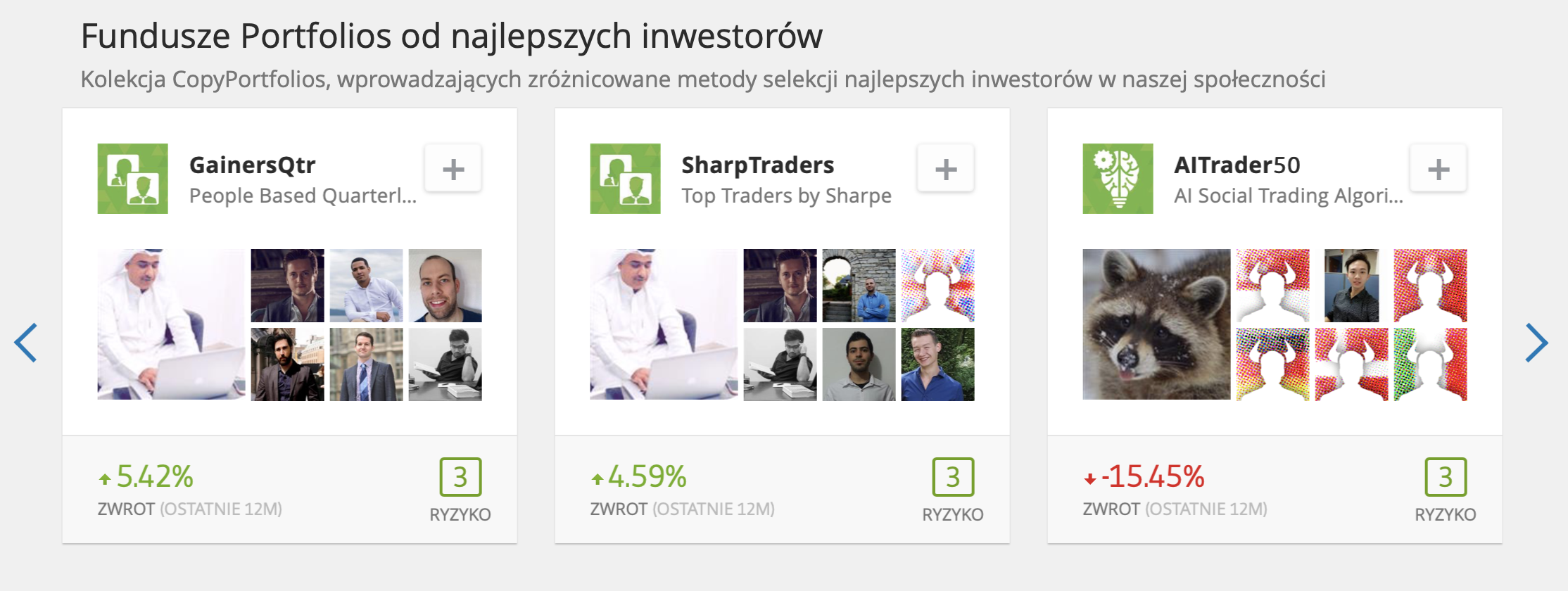

CopyPortfoliois a separate tab on the platform. What is that?

Quoting the service:

“They are a portfolio management product. An investment in CopyPortfolio automatically copies multiple markets or investors based on a specific investment strategy. CopyPortfolio should not be considered an ETF or an investment. "

So you can say that they are "Social-trading portfolio" - a real innovation! These are groups of traders with specific results and diversified strategies from across the community that have been selected by eToro. Traders' actions are also monitored on an ongoing basis by algorithms and the so-called effectiveness measures to maintain a rational level of risk and satisfactory results in the long term.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

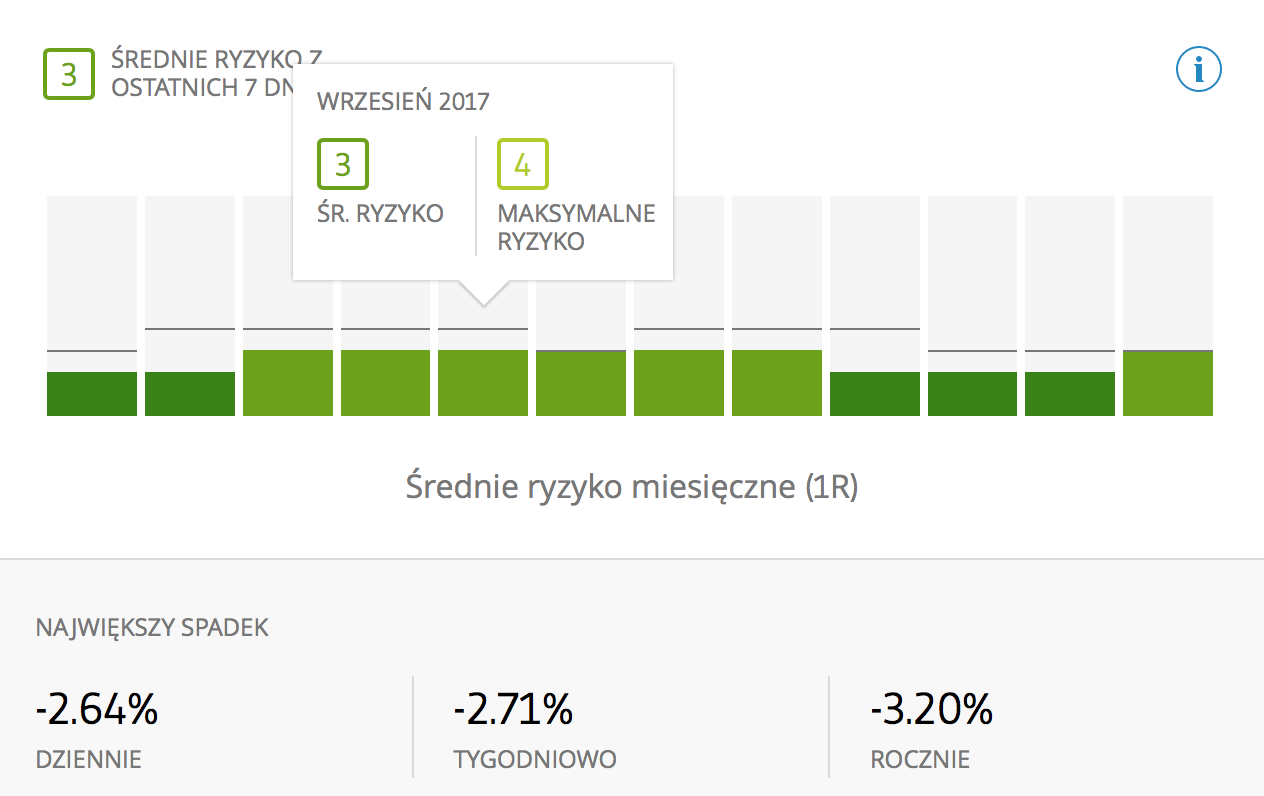

Investment risk

Each investment involves risk - let's not delude ourselves that it would be otherwise in this case. However, there is always a process of estimating its scale. eToro has developed its own risk assessment model for its users. Every trader is awarded "Scoring" on a scale from 1 to 10, where 1 is the lowest level of risk taken and 10 the highest. There are three scores - from the last 7 days, the average monthly value and the maximum. The formula developed by eToro is responsible for determining the scoring of a given trader. Elements such as:

- total portfolio allocation,

- leverage used,

- traded instruments,

- correlation between these instruments.

The formula used is no secret - eToro presents it with all explanations on your website here. All this is to help investors in the process of estimating the potential degree of risk resulting, one could say, from blindly copying the games of strangers.

There is one more safeguard. The user can determine the level of loss at which his account will be automatically disconnected from the trader generating non-profit transactions.

How much is it?

The method of settlement is transparent and clear to both parties. You could say that using eToro is free, but it would be a slight abuse.

How it's working. The person who copies the games of other players covers only the transaction spread - this is his only cost. Meanwhile, the trader receives remuneration for the transaction made. How much? It depends on the volume and the instrument traded. The payment is transferred to the manager by eToro to his account. Where does the company get the funds to finance its remuneration? From the spread of both trading parties (trader and investor), which deviates from the standards to which we are used by brokers ... But something for something.

Personally, the remuneration depends strictly on the result. And this is the accent we go to legal issues.

eToro - is it legal?

There is no indication that it would be illegal. eToro has appropriate regulations and operates in many countries around the world. But this argument can not convince everyone. So let's take a closer look.

The company website reads:

"Trealty available on the eToro community investment platform is generated by members of its community and does not include advice or recommendations by eToro - Your Social Investment Network or advice or recommendations formulated on behalf of eToro - Your Social Investment Network".

With this provision, eToro relinquishes responsibility for any decisions made by traders and investors. But what about the responsibility of the traders themselves? After all, it is well-known that the management of third-party capital, or recommending them to enter into any transactions, is forbidden in Poland, for example, and threatened by a financial penalty up to PLN 5. Unless we have an investment adviser license and appropriate permits.

And we're getting to the point. From a technical point of view, a trader who is a popular investor does not recommend anyone to duplicate his trades. In fact, he trades alone all the time, on his own account and gives the opportunity to duplicate his actions. It does not operate with third party funds, nor does it have any influence on whether they attach to it or not. All the time he only trades on his own account, where, at least in theory, his goal is to achieve regular, stable profits.

However, it must be admitted that receiving remuneration for transactions concluded by other users who copied the trades from the trader is already a very sensitive topic. And probably the salary model is crucial here. Fee performance, i.e. the percentage on profits would certainly not pass here, while the receipt of the part of the spread falls within the limits of legality. For now.

Interestingly, eToro services are not available to US citizens.

Platform capabilities

The application is as simple as possible. After all, its goal is to connect traders and investors with each other, and not to provide spectacular solutions in the field of market analysis. The platform is available in a browser (non-installation) and mobile version. The configuration options are very limited. The most options for selecting settings concern various types of notifications so that we do not accidentally miss anything.

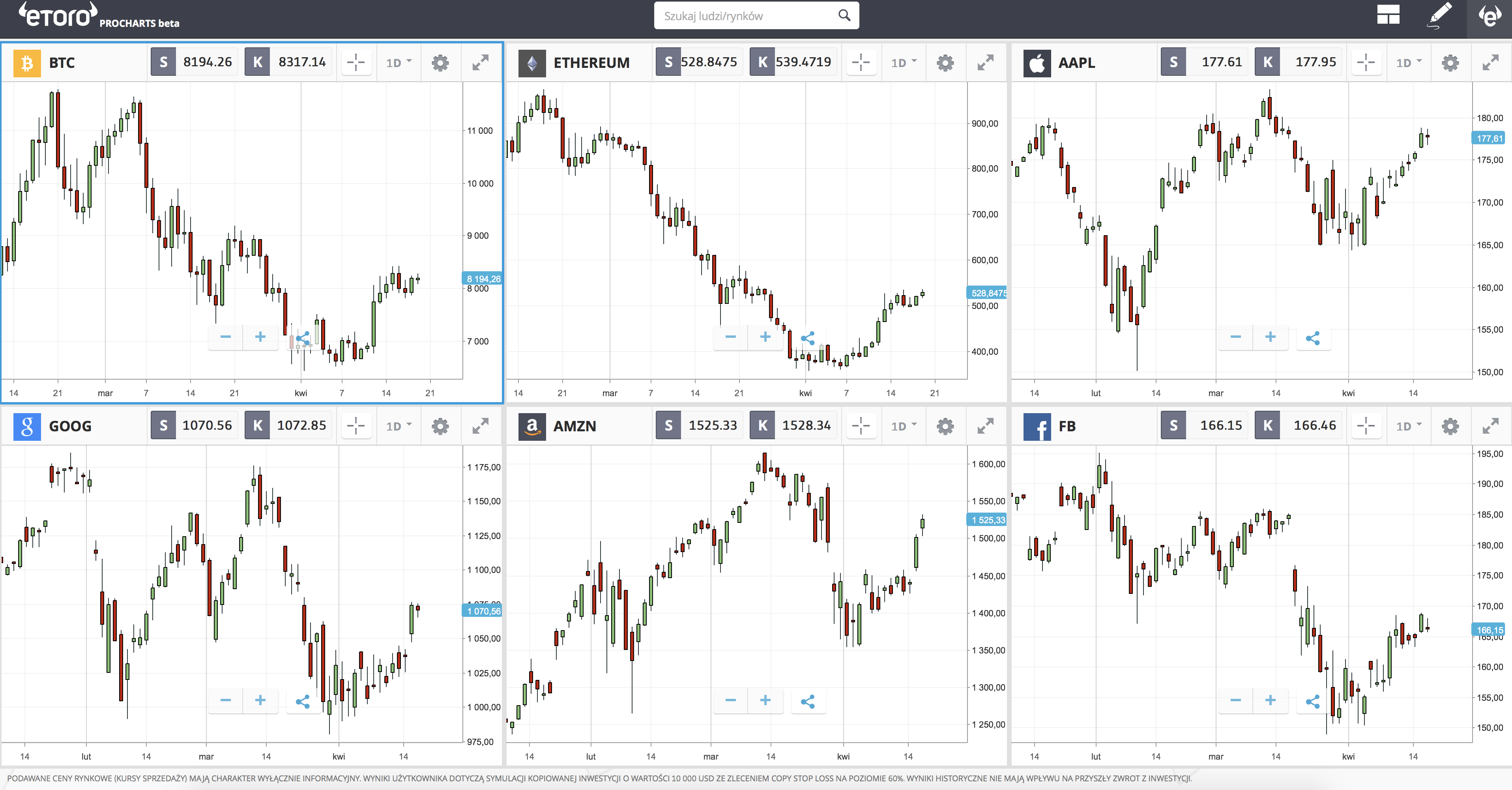

Diagrams. They are available and in the main eToro application window. But probably the site's creators noticed that this hinders the process of placing orders and introduced a novelty. The charts have been additionally drawn to the application Prochartswhich is currently marked as Beta. Everything works as it should and actually offers the same possibilities as the charts available in the eToro app. The functionality of the solutions made available is at best at an average level. We have access to indicators, AT tools and a few configuration options, but using this is impractical (all elements are available in a separate settings window). Honestly, it is better to perform analyzes on an external platform such as MT4 or cTrader. But one must admit - everything looks very neat and transparent.

Transactions. Exaggeratedly large buttons, selection of transaction page, volume, possibly adding Stop Loss or Take Profit. And that's it. As a result, signal providers have limited room for maneuver. Due to the fact that they must enter into transactions on the eToro platform, they lose the ability to use any scripts, machines and other trading support tools. Actually, they have basic types of orders and a simple chart. Unfortunately, the chart does not show any transactions, so it is difficult to view the current situation.

Available instruments

The range of instruments offered is quite wide. We have access to the Forex market, commodities, indices, shares and ETFs. In total, there are over 1000 different instruments available. Pretty good.

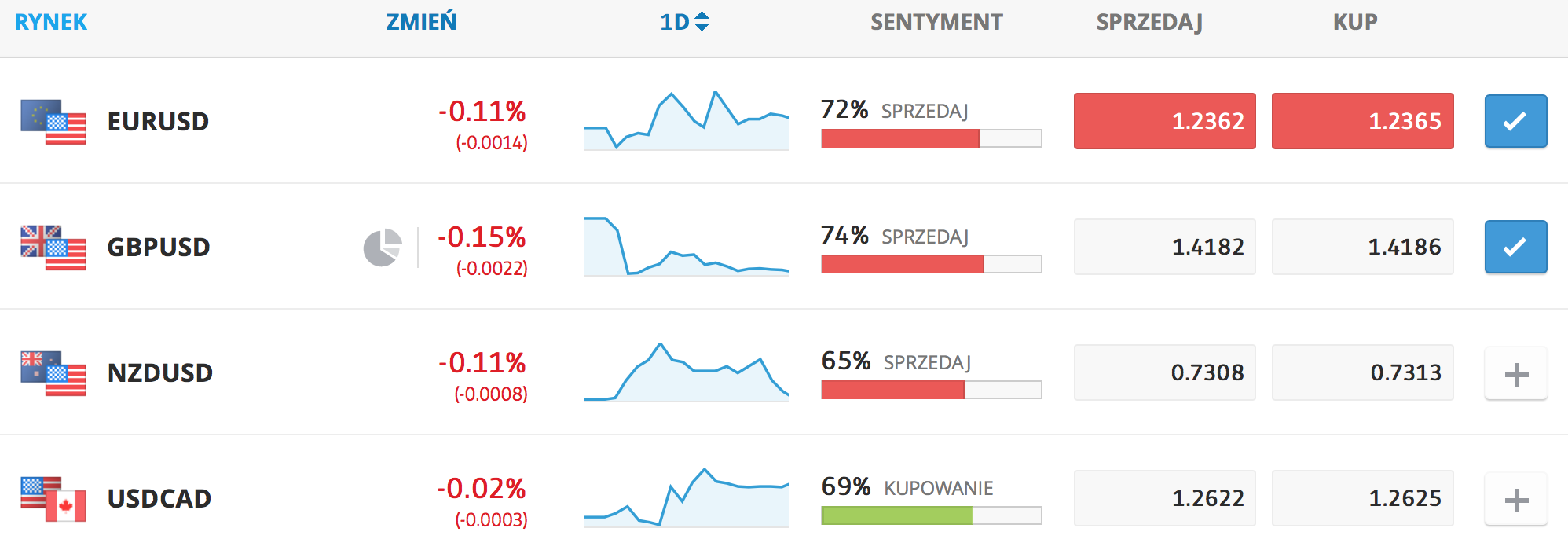

When quoting all instruments, we can see the sentiment among eToro users. The results are often very extreme (values close to 100% for one side), which may indicate a low statistical sample, so it is not always a good idea to suggest their indications.

It is worse with spreads, which we would rather forget as soon as possible. Spread on the EUR / USD pair at 3.0 pips is the value that was available to Forex brokers in the 2006 year. But the amount of fees is precisely due to the settlement model, thanks to which access to the service is free of additional fees in the form of a subscription subscription, access to the portal, profit commission or deposit paid.

Examples of spreads in eToro:

- EUR / USD - 3.0 pips,

- GBP / USD - 4.0 pips,

- AUD / USD - 4.0 pips,

- DAX30 - 2.00 pips,

- OIL – 5.0 pips.

Summation

It's a pretty successful platform that is fun to use. There is one condition - only if we are investors. Traders have a hard time. Handling charts or placing orders, as long as they are simple, do not provide too many opportunities. And that's probably eToro's weakest side. Being a signal provider, I cannot imagine fully relying on this platform. It is even necessary to use the application of another broker, which will be used for analysis and making investment decisions. This makes eToro a non-comprehensive solution.

However, many things are downright brilliant. Copy Portfolio, clear user profiles, ease of use and interface, global reach of the community ... One could be tempted to call eToro Facebook Trading. Fees calculated in the spread cause that immediately in the balance of the account we can see how we go out on our investments.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)