EBITDA - fraud or investor indicator?

When browsing financial publications, you will often find an acronym EBITDA. In today's article, we will present what the indicator is and what its advantages and disadvantages are. Opinions about the indicator are divided even among professionals. Warren Buffett is known to be skeptical about one of the "financial innovations" of the second half of the 2013th century. Buffett, who in a letter to investors summarizing XNUMX mentioned:

"When Wall Street people talk about EBITDA as a measure of value, hide your wallet."

The skepticism stemmed from the fact that, according to the "Oracle of Omaha", EBITDA falsifies the true profitability of the company. On the other hand, the defenders of the indicator emphasize its universality, which allows to compare companies from different countries and with different debt levels.

Crazy XNUMXs - EBITDA hits the showrooms

EBITDA is an acronym for: Earnings Before Interest, Taxes, Depreciation and Amortization. Translating into Polish, it is a profit before interest, taxes and after deducting depreciation.

EBITDA became very popular in the XNUMXs, when LBO transactions (the so-called leveraged buyout) exploded. Briefly, the LBO transaction consisted in the fact that the acquirers used the debt. The high leverage increased the investment risk. The purchased companies very often had problems with achieving profitability, had large assets and large debt. Analysts working on the transaction needed an indicator that showed such companies from the better side. Ideally, the indicator should deduct depreciation and interest on debt. The EBITDA result was popularized, which significantly improved the company's profitability. Banks credited transactions because they knew that most of the EBITD would come back to them in the form of principal and interest installments. The brokers in the transaction also earned money, and after completing the transaction, they received substantial commissions. Thus began the fashion for EBITDA, which continues to this day.

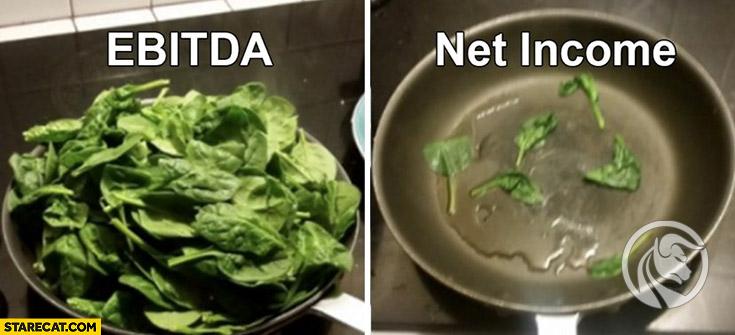

Source: starecat.com

The advantages of EBITDA

According to many analysts, EBITDA has a number of advantages. They are:

- deduction of "non-cash costs",

- is insensitive to leverage,

- allows you to compare companies operating in different tax jurisdictions,

- assesses the potential debt repayment capacity.

Deduction of non-cash costs

According to supporters of this indicator, EBITDA deducts "non-cash" costs such as depreciation. Thanks to this, it allows you to compare different companies with each other. Depreciation is the accounting cost of "wear" of fixed assets. For example, the purchase of a machine (the so-called CAPEX) for PLN 1 million cannot be booked in the statement on the cost side. In order not to disturb the profit and loss account, the said purchase cost is spread over time equal to the expected useful life. If this period is 5 years, then the depreciation cost will be equal to PLN 0,2 million. Summary of this transaction:

| Skirt | Depreciation | CAPEX (investment expenditure) |

| The moment of purchase | 0 | PLN 1 million |

| 1 | 200 zł | 0 |

| 2 | 200 zł | 0 |

| 3 | 200 zł | 0 |

| 4 | 200 zł | 0 |

| 5 | 200 zł | 0 |

source: own study

As you can see, depreciation is the recognition of the historical purchase cost of a machine. This reduces profits, but in Years 1-5, depreciation is a "non-cash expense" that reduces the company's actual ability to generate cash.

To illustrate such a situation, let's use an example. The analyst compares two companies (A and B). Both generate revenues of PLN 10 million and an operating profit of PLN 2 million. Enterprise A has a new machinery park worth PLN 10 million, which is amortized in 5 years. Company B, on the other hand, operates in the same industry, but has an old machinery park that is already "amortized". Despite the fact that the operating margin of both companies is 20%, the new machinery park "lowers profits". In effect, minus depreciation, firm A's potential profitability is much higher than that of firm B. Below is a summary in tabular form:

| Company A | Company B | |

| revenues | PLN 10 million | PLN 10 million |

| operating costs | PLN 8 million | PLN 8 million |

| including depreciation | PLN 2 million | PLN 0 million |

| operational profit | PLN 2 million | PLN 2 million |

| EBITDA | PLN 4 million | PLN 2 million |

| EBITDA margin | 40% | 20% |

source: own study

Due to the deduction of depreciation, the indicator is insensitive to "Manipulating the economic useful life". If the company from the previous example extends the depreciation period to 10 years, the depreciation cost will drop from PLN 2 million to PLN 1 million. This will raise the operating profit to PLN 3 million. However, EBITDA will not change.

Insensitivity to leverage

Another advantage of EBITDA is its “insensitivity” to the level of the company's debt. This is because the indicator deducts the amount of interest paid. Thanks to this, it enables the comparison of the "real" profitability of the business. A hypothetical situation is created in which the company does not have to pay off its debts.

We will expand the previous example with financial costs. Due to the expansion of the machine park, company A had to issue 3-year bonds worth PLN 10 million, with an interest rate of 10%. In the first year, it has to pay PLN 1 million in interest. In turn, company B has annual financial costs of PLN 0,5 million. The difference in financial costs brings company A's gross margin before tax to be 10%, while company B's margin is 15%. However, after deducting depreciation and interest costs, Company B still has a lower EBITDA profitability than its competitor.

| Company A | Company B | |

| revenues | PLN 10 million | PLN 10 million |

| operating costs | PLN 8 million | PLN 8 million |

| including depreciation | PLN 2 million | PLN 0 million |

| operational profit | PLN 2 million | PLN 2 million |

| interest costs | PLN 1 million | PLN 0,5 million |

| profit before tax | PLN 1 million | PLN 1,5 million |

| EBITDA | PLN 4 million | PLN 2 million |

source: own study

Various tax systems

Another advantage of EBITDA is tax deduction, which allows you to compare companies operating in different tax systems. For example, in Poland, the corporate income tax is 19%. In contrast, in Belgium it is 25%. Additionally, different companies may receive "tax deductions" such as losses from previous years. For example, in Poland you can deduct a loss in five consecutive years. However, 50% of the loss can be deducted in a maximum of one year. Occasionally, preferential tax rates can be used if the company undertakes investment or research and development activities.

Once again, we will compare company A and company B. This time, company A has a zero tax rate because it uses investment incentives and settles losses from previous years. Company B, on the other hand, has to pay 33% tax.

| Company A | Company B | |

| profit before tax | PLN 1 million | PLN 1,5 million |

| taxation | PLN 0 million | PLN 0,5 million |

| net profit | PLN 1 million | PLN 1 million |

| EBITDA | PLN 4 million | PLN 2 million |

source: own study

Assessment of the company's ability to service its debt

Bank analysts are also fond of EBITDA because it allows them to estimate the company's short-term debt service capacity. As EBITDA deducts depreciation, this ratio can be a substitute for cash flow. Banks assume that in the short term, the indebted enterprise may delay capital expenditure (CAPEX). As a result, depreciation is indeed a non-cash cost, because the indebted company will suspend for several quarters maintenance expensesto pay off your debt. As a result, EBITDA is potentially the maximum amount that the company can spend on debt repayment. Analysts most often use the ratio of net debt to EBITDA when assessing the company's creditworthiness. Net debt is interest debt less cash and cash equivalents (e.g. deposits). A safe ratio is net debt to EBITDA at the level ofbelow 3. The higher the ratio, the higher the company's credit risk.

"Cleaned EBITDA" - when EBITDA alone is not enough

Source: starecat.com

Sometimes “clean” EBITDA indicators are also created. This is to normalize the index. Of course, the cleaned EBITDA is only accidentally higher than the normal EBITDA. The most common subtraction is costs paid in shares (so-called Share-based compensation), post-operative result, procedural expenses, and the effect of the exchange rate on the results.

Sometimes new ratios are created based on EBITDA. Examples include EBITDAR (EBITDA increased by rental costs) and EBITDARM (EBITDA increased by rental costs and management costs).

EBITDA - far from ideal

Basing the valuation solely on EBITDA can be very dangerous and lead to a misperception of the company. The EBITDA results look much better than in reality. The "world of EBITDA" is a magical place where debts do not have to be paid off, there are no taxes and fixed assets do not wear out over time.

Ignoring depreciation can be deceptive, especially in companies operating in the mining or manufacturing industries. The “non-cash” nature of depreciation is a pipe dream when the company has to incur capital expenditure (CAPEX). After all, when an old machine gets worn out, it needs to be replaced with a new one. So, as a rule, amortization is an "echo" of past expenses. For this reason, some investors agree with Warren Buffett that:

"EBITDA can only make sense if the Tooth Fairy covers Capex expenses."

Another disadvantage is also an advantage for some. EBITDA ignores expenses incurred on debt servicing (interest expense). In such a situation, a company whose interest costs "overextend" most of its operating profits looks much better when we apply the EBITDA ratio. However, it is creating an alternate reality. The company must service the debt or it will have to file for debt restructuring or bankruptcy.

Another aspect that is not visible in EBITDA is changes in working capital. For this reason, this ratio is a poor substitute for cash flow. Due to the specifics of their business, many companies have to invest huge sums in inventories that consume the company's free capital. At the same time, after a sale, many businesses have to wait weeks or even months for money to be paid after selling a good or service. The sale is booked, the profits are as well, and the cash has not yet arrived. This is how receivables arise, which are always a risk for the company, as they may not be repaid by the contractor.

Most often, companies go bankrupt not because of the nominal debt level, but when they lose liquidity irretrievably. You can lose liquidity, for example, by having goods in warehouses that no one wants to buy, or by selling goods to an unreliable contractor who does not honor their debts.

The dotcom bubble - when EBITDA fails

The disadvantages of EBITDA were used by the management boards of many companies to “colorize the results”. An example would be cablevision, which reported in 2000 that it had achieved $ 1 billion in EBITDA. The company's revenues for the same year amounted to $ 3,9 billion. This resulted in a high EBITDA margin. Moreover, in the previous years, the EBITDA result continued to improve. However, these were gains from an alternate reality. In fact, Cablevision was unable to generate cash from its own operations. Operating cash flow was approximately $ 100 million. At that time, capital expenditures consumed $ 1,3 billion. At the same time, the company spent over USD 550 million on debt servicing. However, as long as capital flowed into the market, the company had no problems borrowing money for dynamic business development. However, when the dotcom bubble burst, the “EBITDA value” was verified. The company ran into financial problems that affected the share price. At the beginning of 2001, the price of one share was over $ 80. After more than a year, the price of 1 share fell below $ 6.

Summation

EBITDA is one of the most popular financial ratios. Credit analysts like to use it, who can assess the company's debt service ability. It allows you to compare companies with different debt levels and with a different structure of assets. However, the downside is that EBITDA is a poor substitute for cash flow. It ignores the necessary capital expenditure and the need for working capital.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)