Australian Dollar - AUD [Currency Foundations]

Australian economy

In this article, we will discuss issues related to the Australian economy that have a significant impact on the Australian dollar. You will learn in what size and share and with whom international trade takes place - where and from, and what Australia exports and imports, and how these connections affect the local economy and, consequently, the rate. After reading this article, it will be much easier for you to understand these dependencies and the processes behind them.

Export

According to data from the International Monetary Fund with 2017, Australia is 13 the world's largest economy in terms of Gross Domestic Product equal to 1,379 trillion dollars.

In terms of export value, Australia's economy is 20 the largest in the world with the value of goods sold at the level of 243 billion USD in the 2017 year. At that time, goods worth 199 billion USD were imported.

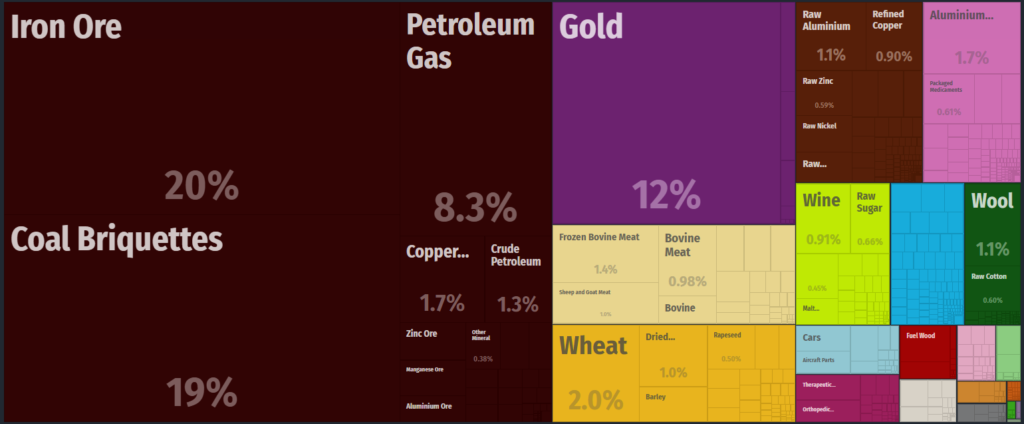

Here we go to the heart and key factors affecting the economy of Australia. The most important export commodity is iron ore, which in 2017 was up to 20 per cent. the value of all goods sent abroad. The value of ore sold exceeded 48 billion dollars. The second most important commodity is coal, and the third gold is 12 percent. exports.

From this point of view, the market prices, especially of iron ore, are very important for Australia's economy and, as a consequence, the Australian dollar itself.

This is illustrated by the long-term iron ore contract price chart and the AUDUSD rate. Of course, this is not a 100% relationship, but it is significant and positive, so you should often follow the quotations of the mineral, so important for Australia. At the time of writing this article, we are observing quite an interesting discrepancy - this in turn is related to the situation in Brazil and the smaller supply of raw material (we will not go into this topic now) - in the near future we will see what the market will do with this discrepancy.

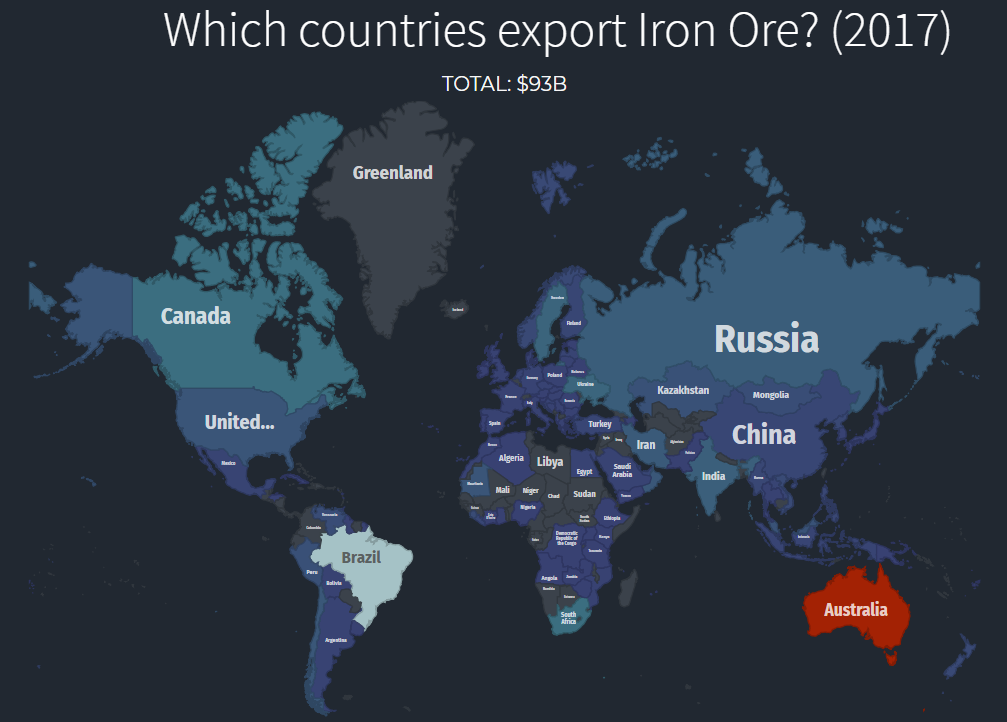

Australia is the largest exporter of iron ore in the world before Brazil, which was previously the leader in this market. Source: OEC.

Import

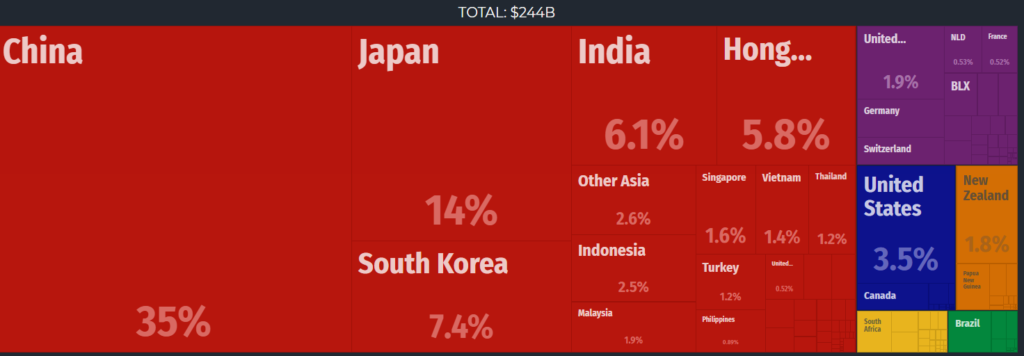

Let's move to the second part of the article. Knowing what Australia is exporting, i.e. from which it acquires money from abroad, let's see where it is sent, or who is the main trading partner and to what extent.

As it is not difficult to guess, due to geographical location, China is the largest trading partner for the economy of Australia. It is 35 proc that goes to them. all exports (85 billion USD) and from China comes 24 proc. total import (47 billion USD).

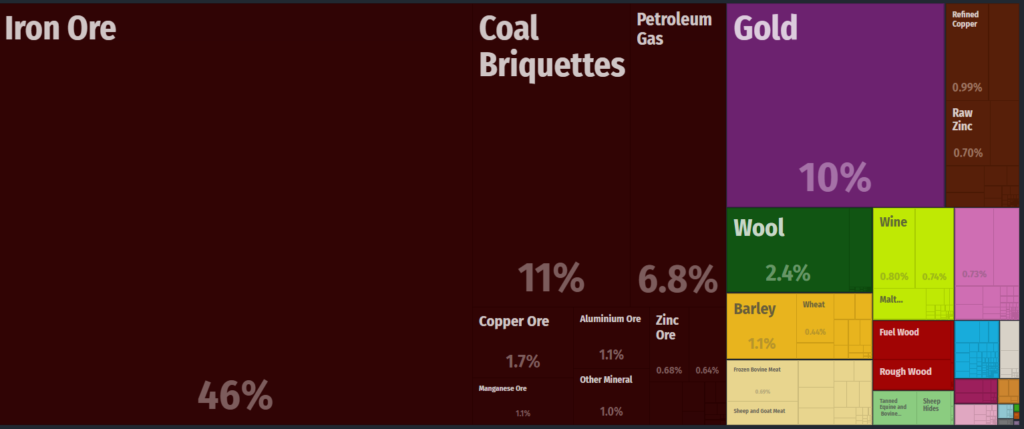

With 35 percent all exports to China 46 proc. is iron ore, and 10 percent. is gold, causing the Australian economy to be sensitive to any turbulence in the Middle Kingdom.

For this reason, all kinds of data from the Chinese economy are also very important for Australia's economy as the main trading partner. When analyzing the currency pairs with AUD, it is worth to follow the macroeconomic and political events concerning the Chinese economy as well.

In conclusion, it is said that Australia is the largest mine in the world and in fact it is. This country without minerals in the form of iron ore and coal or gold would not do so well. In addition, the geographical location favors the export of these minerals, because China is a market that absorbs all kinds of raw materials in huge quantities.

Now you know what else to pay attention to when analyzing the Australian dollar exchange rate from the point of view of the external environment.

The above commentary is not a recommendation within the meaning of the Regulation of the Minister of Finance of 19 October 2005. It has been prepared for information purposes and should not constitute a basis for making investment decisions. Neither the author of the study nor Conotoxia Ltd. are responsible for investment decisions taken on the basis of the information contained in this comment. Copying or reproduction of this document without the written consent of Conotoxia Ltd. is prohibited.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Australian Dollar - AUD [Currency Foundations] Australian dollar](https://forexclub.pl/wp-content/uploads/2019/02/dolar-australijski.jpg)

![Australian Dollar - AUD [Currency Foundations] binary options and forex comparison](https://forexclub.pl/wp-content/uploads/2015/02/forex_vs_opcje-102x65.jpg)

![Australian Dollar - AUD [Currency Foundations]](https://forexclub.pl/wp-content/uploads/2019/02/Jessie-Livermore-102x65.png)