Diageo - it's not only Johnnie Walker and Guinness [Guide]

Alcohol has been present in human history since the dawn of time. Some archaeological research suggests that the process of producing alcoholic beverages was already known in the Neolithic period. Some researchers have suggested that humans learned to make alcohol even 12 years ago. It is not surprising that companies whose main activity is the production of alcohol are listed on stock exchanges around the world. An example of such a company is the British company Diageo plc.

READ NECESSARY: How to invest in luxury alcohol [Guide]

The name Diageo is a combination of two words 'diēs', which in Latin means day, and the Greek root 'geo', which means world. The name is the same as the company's slogan "Celebrating Life, Every Day, Everywhere".

Diageo was established in 1997 as a result of the merger of Guinness Brewery and Grand Metropolitan. The combined capitalization of both companies was then £ 20bn. Interestingly, the combined companies included the Burger King chain. The fast food chain was sold in 2002 to Texas Pacific Group Capital for $ 1,5 billion (Goldman Sachs and Bain Capital participated in the transaction). Diageo is a company listed on the London Stock Exchange. It is also a component of the FTSE 100 index. At the end of the financial year 2020, the company employed 27 employees. In addition to its own operations, Diageo also owns 775% of Moët Hennessy (the remaining shares are held by LVHM). Moët Hennessy is known, among others, for Moët & Chandon champagne, Belvedere vodka and Hennessy cognac.

Diageo stock chart, interval W1. Source: xNUMX XTB.

Brands

Diageo is a world famous owner of high and low alcohol brands. It has the rights to over 200 brands. Its brand portfolio is divided into three main categories:

- global giants

- local stars

- Book

Global Giants these are the company's most recognizable brands. They are Johnnie Walker, Smirnoff, Bailey's, Captain Morgan, Tanqueray and Guinness. The aforementioned brands have the largest share in total revenues. According to the 2020 report, these brands accounted for around 39 percent of total sales.

The next group of products has been classified as local stars, i.e. brands with a very good position in individual countries or in a specific region. Examples include Shui Jing Fang (a well-known brand of strong alcohols in China, premium category), Yeni Raki (Turkish anise vodka) or Bundaberg (an Australian alcohol producer known for, among others, ginger beer). In the last full fiscal year, this brand group generated approximately 20% of Diageo's revenues.

The last group includes brands included in the category Book. These are brands that fall into the premium category. Examples include Lagavulin whiskey, Ciroc French vodka and Casamigos teguili. This segment also includes Blue and Golden Johnnie Walker. Reserve brands accounted for 21% of the UK company's revenue.

The company is aware that even having iconic brands does not guarantee maintaining its position on the market. For this reason, she is constantly trying to develop and let smaller brands such as Bulleit (brandy) or Roe & Co (Irish whiskey) grow. The company is also expanding its offer through acquisitions, an example of which is the purchase of Casamigos.

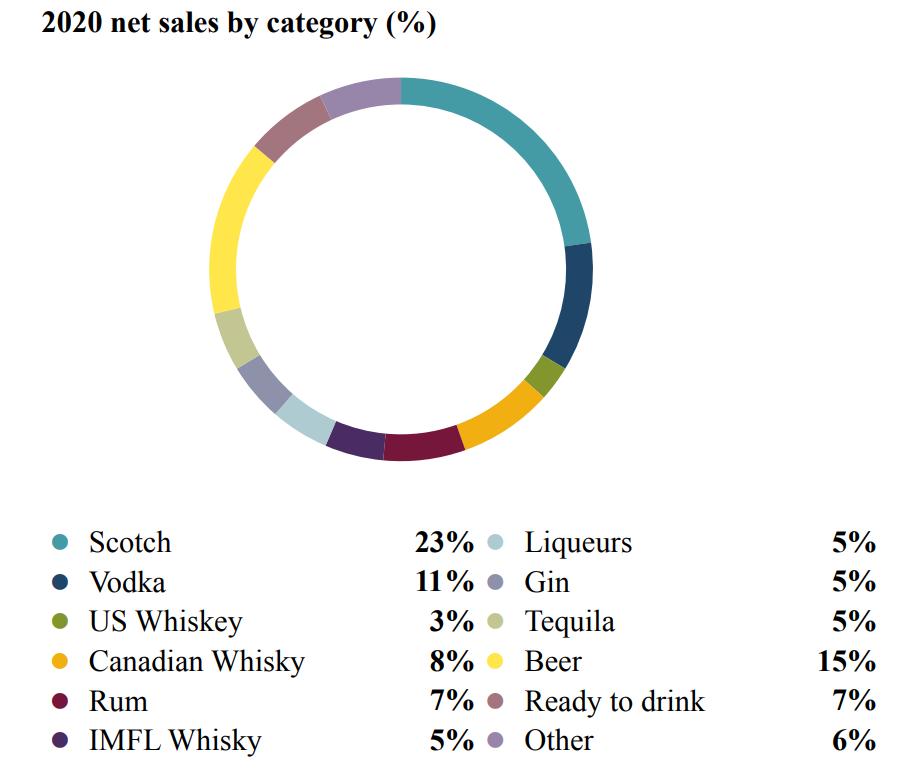

Products - general structure

The company also divides its sales into individual product groups. According to the data provided by the company, Scotch Whiskey (23%) has the largest share in the company's revenues. Beer sales are in second place, accounting for 15% of Diageo's sales. Vodka (11%) and other Whiskey groups (American, Canadian and IMFL) also have a double-digit share in revenues. The last group of products accounts for approximately 16% of sales.

source: company's annual report for the financial year 2020

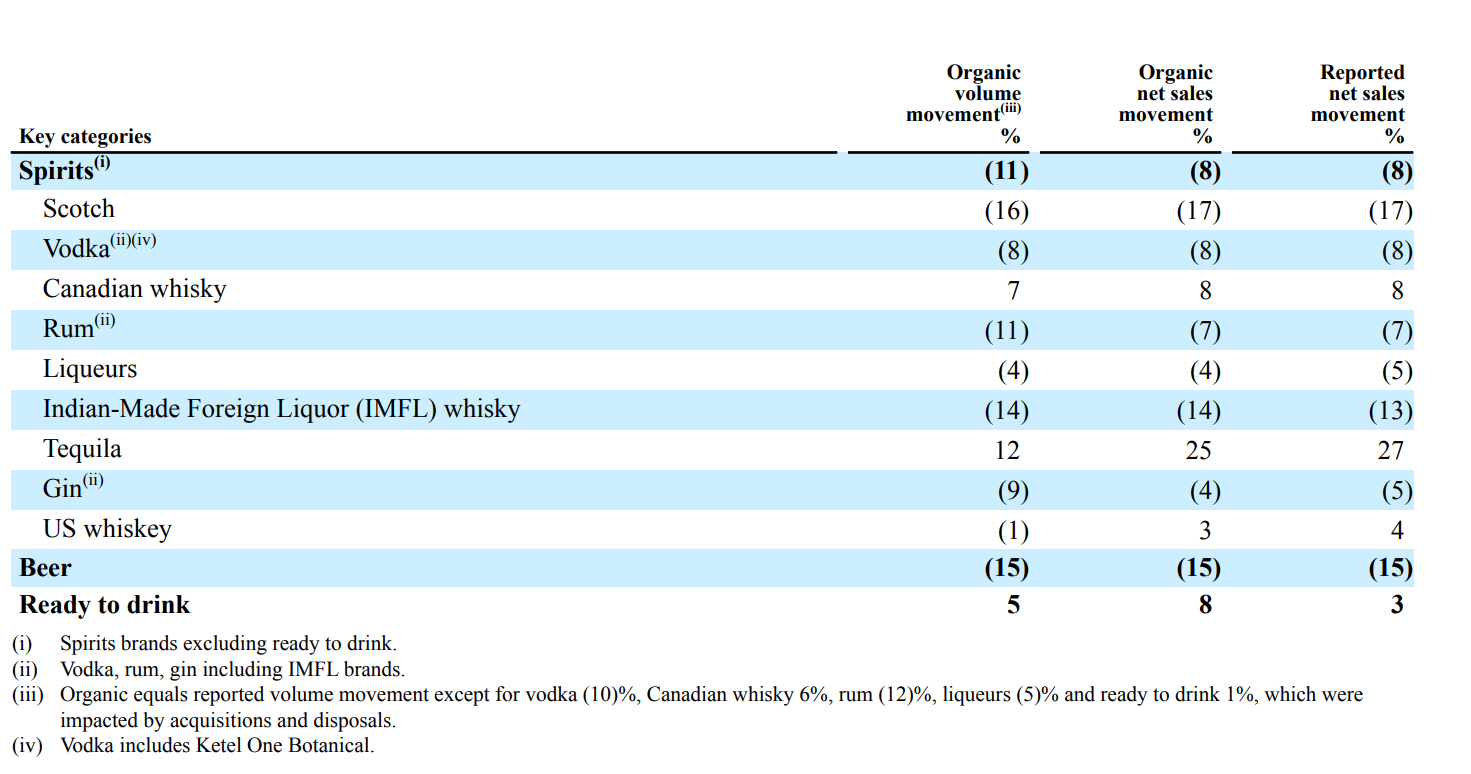

It is worth noting that despite the decline in the main product groups (beer, spirits), some segments recorded a significant improvement in revenues. An example is Tequila, whose organic revenues increased by approximately 25% y / y. Below is a detailed sales summary by product:

source: company's annual report for the financial year 2020

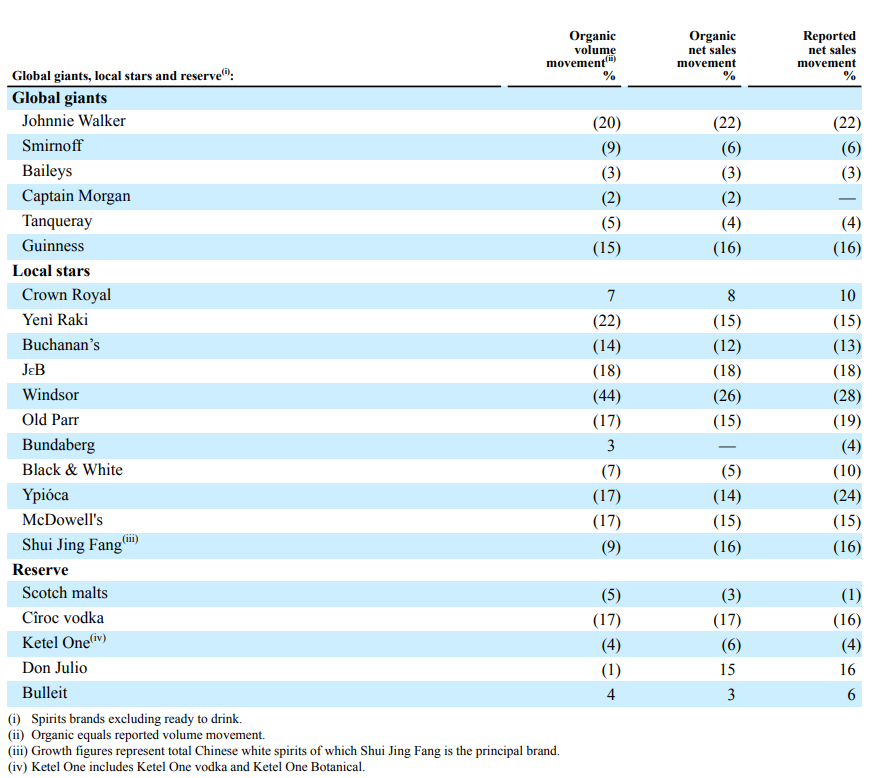

Below is a detailed summary of brands monitored by Diageo.

source: company's annual report for the financial year 2020

Among the brands included in global giants Guinness (-16% y / y) and Johnnie Walker (-22% y / y) performed very poorly. Captain Morgan rum was doing quite decently considering the difficult market conditions, sales of which remained at a similar level as in the 2019 financial year.

In brands localstars Brandies such as Crown Royal (+ 10% y / y) and Australian Bundaberg beer (-4% y / y) were doing well. Sales of Windsor decreased significantly (-28% y / y) and Ypioca spirits (-24%).

Brands defined as "Reserve" had their winners, such as Don Julio tequila (+ 16% y / y) and bourbon Bulleit (+ 6% y / y). Ciroc vodka sales dropped significantly (-16% y / y). It is interesting because Smirnoff vodka (classified as one of the global giants) recorded a 6% y / y decline in sales.

Production

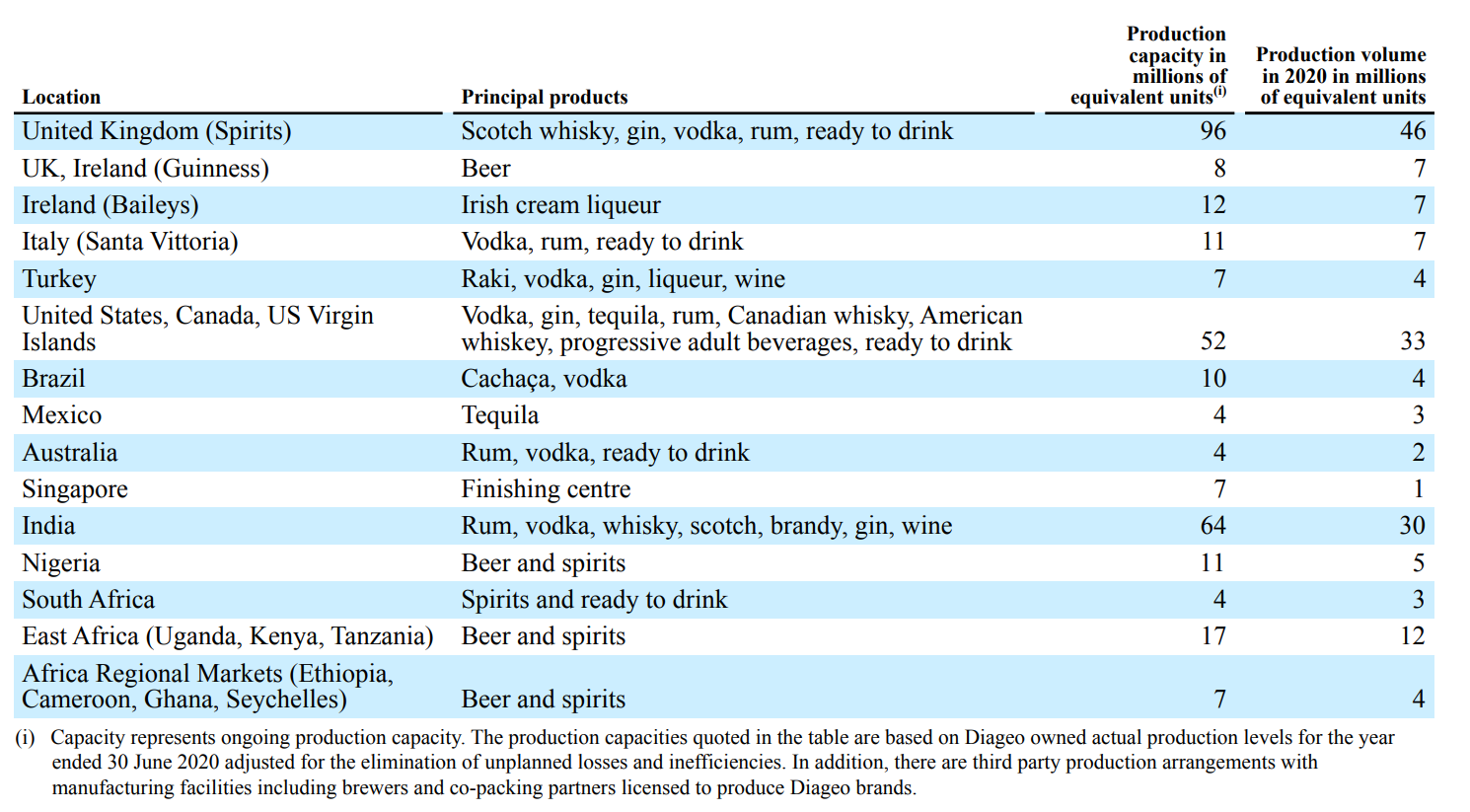

Diageo produces its alcohol on six continents. The largest production capacities are located in Great Britain, the United States and India.

source: company's annual report for the financial year 2020

Production and storage

In the case of strong drinks, the company produces them in its own distilleries located all over the world. In Scotland, Diageo operates 29 Scotch Whiskey Distilleries. The company also has two whiskey distilleries in Canada and the United States. Diageo produces "white alcohol" (Baijiu) in Chegdu, Sichuan Province (China). Raki, on the other hand, is produced in Turkey.

Alcohol matures in warehouses scattered around different countries. Scotch whiskey is stored close to the production site. More than 50% of the production is held in the Blackgrange warehouse. Canadian whiskey, on the other hand, is matured in warehouses in Valleyfield and Gimli. American whiskey is stored in warehouses located in Kentucky and Tennessee. Chinese products are stored at the production site, which is Chegdu in Szechuan.

The company's main brewery is located in St James Gate, Dublin. However, DIageo also has smaller breweries in African countries (including Nigeria, Kenya, Ghana, Cameroon, Ethiopia, Tanzania and Uganda). The company also has partnerships with smaller breweries. The partnership supplies about 1,8 million hectoliters of beer annually.

The company is also trying to sign long-term contracts for the supply of raw materials needed to produce alcohol. Thanks to long-term contracts, it minimizes the effect of short-term price changes.

Markets in which it operates plus additional information

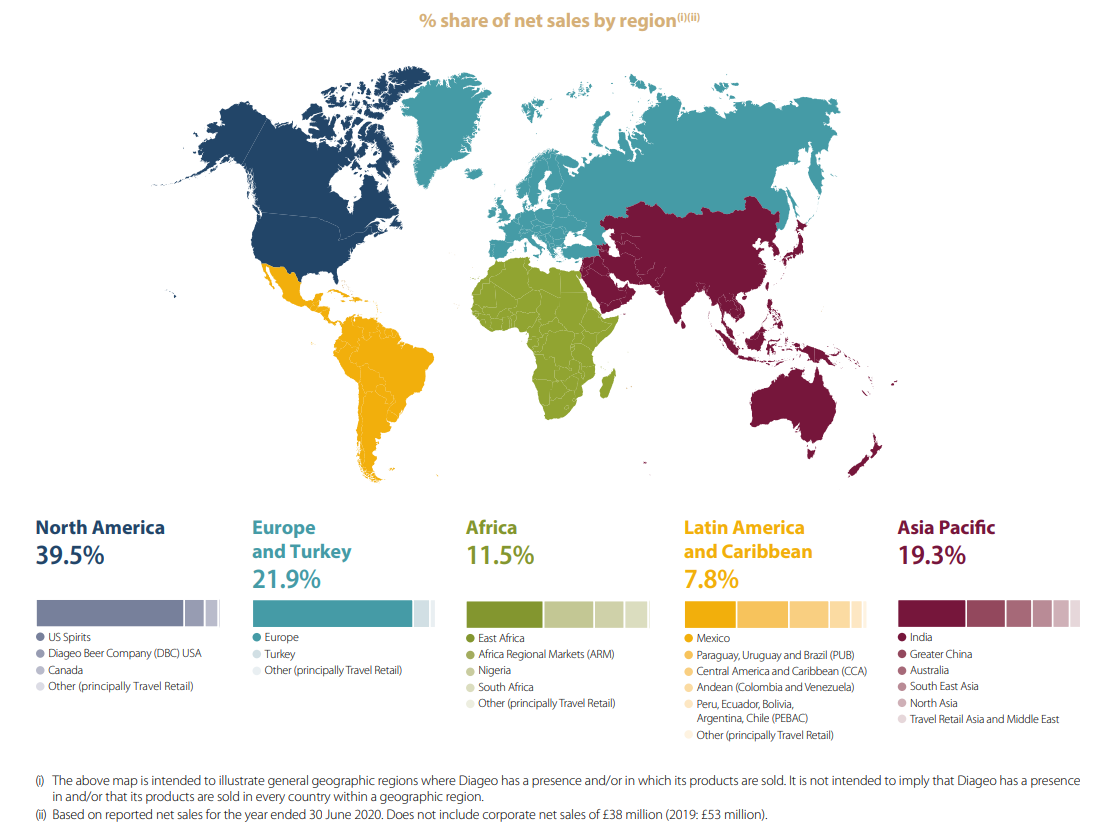

Diageo operates in over 180 countries around the world. The company reports its sales, among others, by geographical area. Diageo created 5 regions for its own needs.

source: company's annual report for the financial year 2020

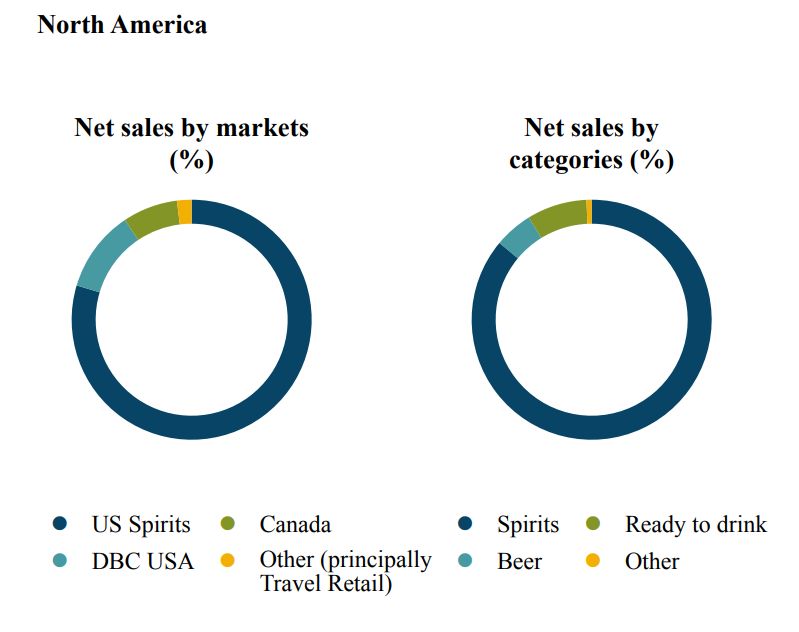

- Ameryka Północna - the company's net revenues in this region amounted to GBP 4,623 billion, an increase of approximately 4% y / y. The company also achieved better operating profit than a year ago, amounting to GBP 2,088 billion (+ 7% y / y).

source: company's annual report for the financial year 2020

As can be seen, the sale of spirits in the United States is dominant. Tequila's net sales increased by 36% y / y (Don Julio and Casamigos). Crown Royal sales increased by 8%. The category of Scottish Whiskey (-9% y / y) and vodka (Smirnoff, Ketel One and Ciroc) were weaker, where revenues decreased by 7%.

Revenue growth was driven by organic sales growth (+ £ 105m) and the positive impact of the weakening pound against the dollar (+ £ 101m). These two variables covered the fall in sales due to acquisitions and the sale of a portion of the business (-£ 43m).

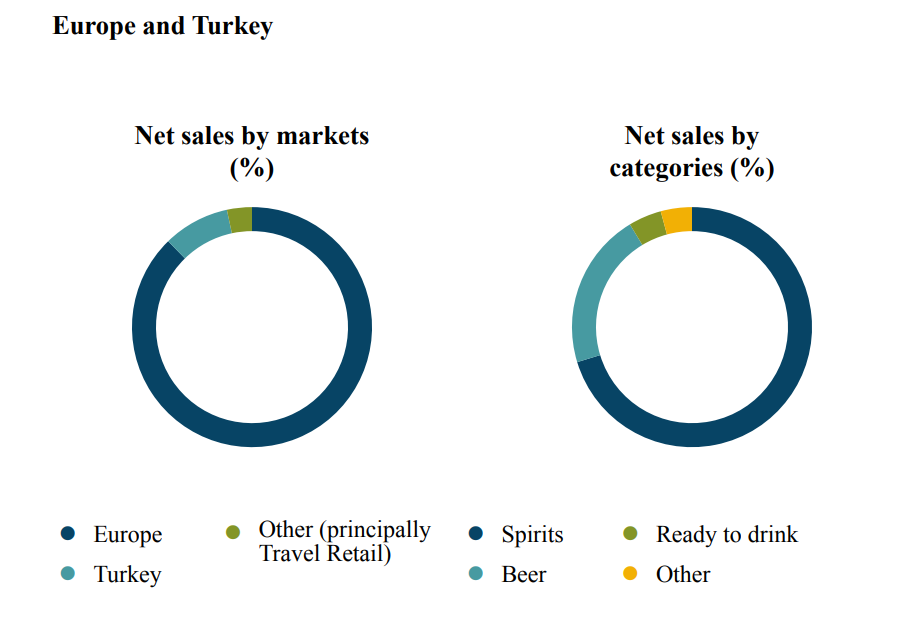

- Europe and Turkey - Diageo's revenues in this region amounted to £ 2,567 billion, down by approximately 13% y / y. The company also achieved a worse operating profit than a year ago, amounting to GBP 695 million (-30% y / y).

source: company's annual report for the financial year 2020

Organic revenues in Europe and Turkey fell by £ 358 million and negatively impacted by movements in the euro and Turkish lira exchange rates (-£ 23 million). Sales and acquisitions of businesses (+ GBP 9 million) had a positive aspect. In the financial year 2020, beer sales were doing very poorly (-21% y / y). In the case of high-percentage drinks, the decline was milder (-11% y / y). Brands such as Johnnie Walker (-21% y / y), J&B (-17% y / y), Yeni Raki (-15% y / y) and Tanqueray (-16% y / y) performed very poorly. Surprisingly, Captain Morgan rum sales increased by 6%.

Looking at the regions, the Northern Europe region performed very well, with net sales only declining 1%. Such areas as the Iberian Peninsula (-22% y / y) and Ireland (-20%) looked much worse. The drop in sales in Turkey, France, Russia and Central European countries was single-digit.

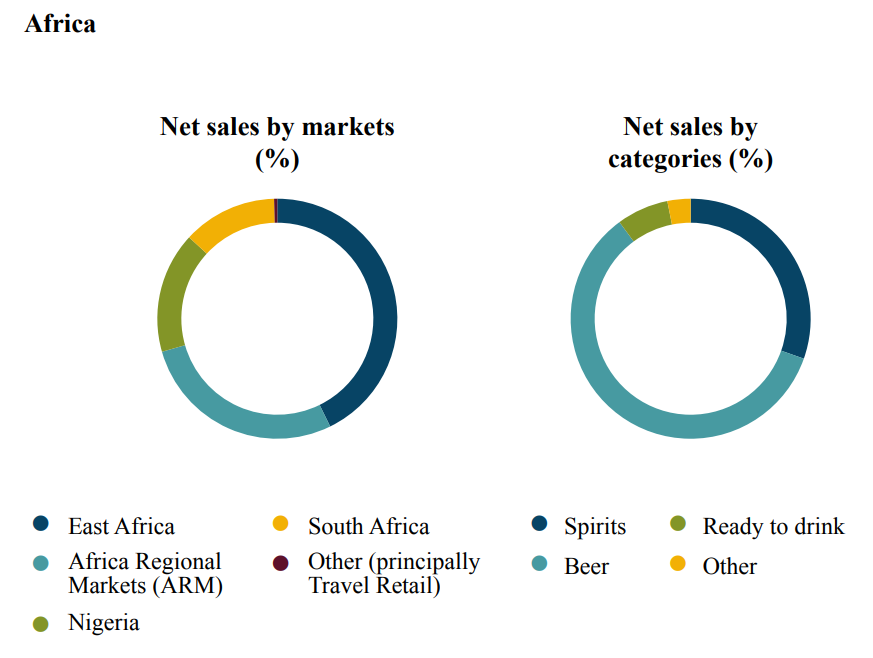

- Afryka - revenue for this region was £ 1,346bn. The decrease in 2020 was approximately 16% y / y. The company also reported an operating loss of £ 44 million. Adjusted for the effects of one-offs, operating profit was GBP 101 million (-63% y / y).

source: company's annual report for the financial year 2020

The company divides its sales in Africa into ARM regions (Ghana, Cameroon, Ethiopia, Angola and countries in the Indian Ocean), East Africa (Kenya, Tanzania, Uganda). Diageo has also separated sales to South Africa and Nigeria. The decline in revenues in the African market was due to shrinking organic sales (-£ 200m y / y), downsizing (-£ 41m) and the weakening of the South African Rand and Ghanaian Cedi (-10m GBP).

Strong alcoholic beverages performed very poorly, sales of which decreased by 15% y / y. The Smirnoff brand recorded a decrease in revenues by 25% y / y. Sales of Guinness (-16% y / y) and Johnnie Walker (-19% y / y) were also poor. Serengeti beer deserves a distinction, the sales of which increased by about 22% y / y during the year.

Looking at individual subregions, the largest decrease was recorded in South Africa (-33% y / y). The Nigerian market was also doing poorly (-19% y / y). The "strongest" was the market of countries included in East Africa, where revenues fell by 9% y / y.

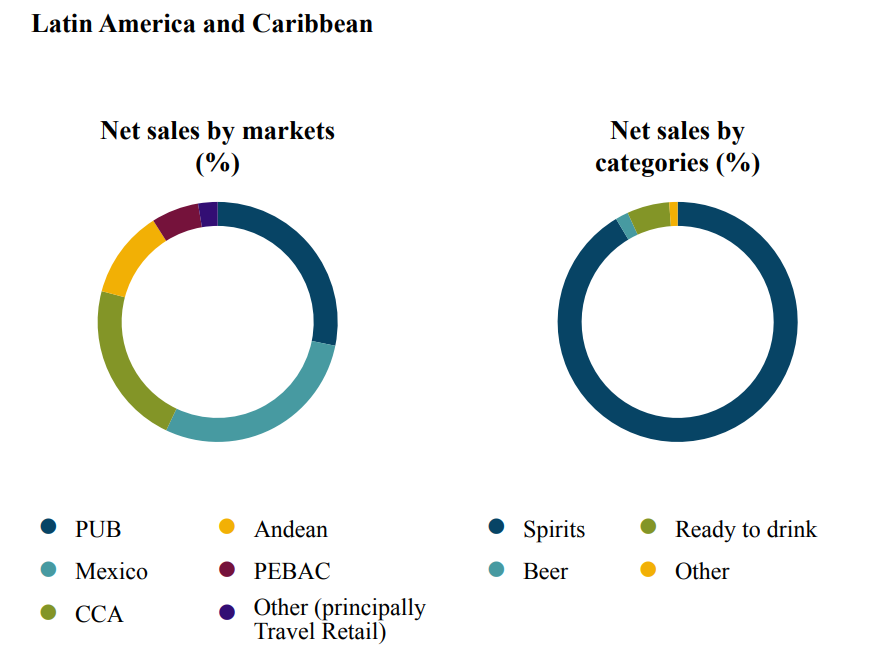

- Latin America and the Caribbean - Sales in this region were £ 908 million. This meant a reduction in revenues by about a fifth. The company reported a decrease in operating profit by 34% y / y to GBP 242 million.

source: company's annual report for the financial year 2020

The company divides the Latin America and the Caribbean market into sub-regions, which are: PUB (Paraguay, Uruguay, Brazil), CCA (Central America and the Caribbean), Andean (Colombia and Venezuela), PEBAC (Peru, Ecuador, Bolivia, Argentina and Chile), and Mexico.

The decline in revenues was due to the decline in organic sales (-£ 169 million) and the impact of the weakening Brazilian, Argentinian and Colombian pesos (-£ 42 million).

Johnnie Walker's sales fell by 33%, Old Parr (-20% y / y) and Black & White (-18%) did not much better. It's worth noting, however, that Tanqueray sales increased by 7% over the year. On the other hand, the decline in Smirnoff brand revenues decreased by only 2% y / y.

The largest drop in revenues was recorded on the PEBAC market, where sales decreased by 47% y / y. The Mexican market was also doing poorly (-21% y / y). Andean was the strongest market, with a decline of only 2%.

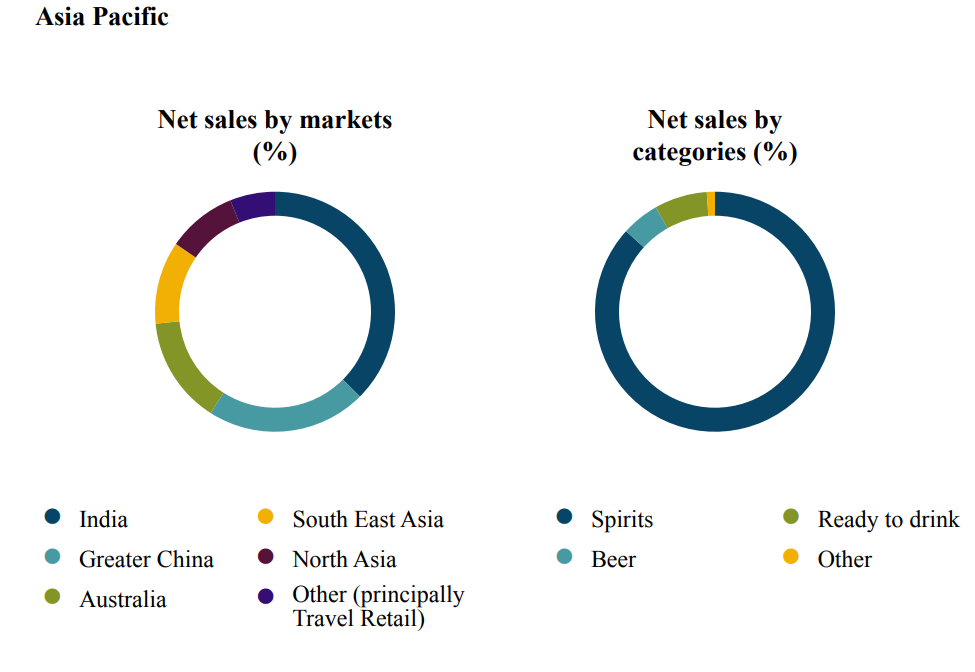

- Asia Pacific - Asia, Australia and Oceania regions recorded a 16% drop in revenues to £ 2,27 billion. The write-offs resulted in an operating loss of £ 697 million. After deducting them from the result, operating profit amounted to GBP 501m (-29% y / y). The write-offs, which reduced the operating result by GBP 1,2 billion, related to goodwill Windsor, Old Tavern and Bagpiper.

source: company's annual report for the financial year 2020

In the market classified as Asia and the Pacific, India has the largest share in sales (together with Nepal and Sri Lanka). The next countries are China (together with Taiwan, Hong Kong and Macau) and Australia (along with New Zealand). These three areas account for approximately 75% of revenues. Other regions are Southeast Asia (including Vietnam, Indonesia and the Philippines) and North Asia (Korea and Japan).

The decline in revenues in the Asia-Pacific market was due to lower organic sales (-£ 423m), which was partially offset by favorable movements in the Japanese yen, the Taiwanese dollar and the Indian rupee (+ £ 5m y / y).

Johnnie Walker recorded a decline by approximately 24% y / y. An equally strong decline was recorded for the Windsor brand (-28%). Chinese brand Shui Jing Fang reported a 16% drop in revenues. It is worth mentioning that The Singleton managed to increase sales by 2% y / y.

Australia was the only region to record a sales increase of 2% y / y. The Indian market fared much worse (-16% y / y) and countries included in Southeast Asia (-21% y / y). The Chinese market performed relatively strongly, sales decreased by only 7% during the year.

Financial results

Historically, the company generates approximately 40% of its annual sales in the last 4 months of the calendar year. The corporation has been hit hard by COVID-19. As a result of the lockdown, many pubs found themselves in a difficult financial situation. Diageo has created a $ 100 million fund to help pubs resume operations in cities such as New York, London, Edinburgh, Dublin, Belfast, Shanghai and Delhi.

Write-offs of £ 1,2 billion resulted in a significant drop in operating margin. However, should a return to 'normal' occur, the operating margin is likely to return to pre-pandemic levels. Prior to COVID-19, Diageo had a very profitable business, which was due to having strong consumer brands with "pricing power".

| billion GBP | 2017 | 2018 | 2019 | 2020 |

| Net revenues | 12,050 | 12,163 | 12,867 | 11,752 |

| Operational profit | 3,559 | 3,691 | 4,042 | 2,137 |

| Operating margin | 29,5% | 30,3% | 31,4% | 18,2% |

| Net profit | 2,772 | 3,144 | 3,337 | 1,454 |

| Equity capital | 12,028 | 11,713 | 10,156 | 8,440 |

| ROE | 23,0% | 26,8% | 32,9% | 17,2% |

source: own study based on the company's annual reports

Cash generated

The company generously shares the generated cash with shareholders. Over the past 3 financial years (2018-2020), Diageo generated approximately £ 6,70bn in free cash (cash generated from operating activities less capital expenditure).

The funds were used for: acquisitions (GBP 339 million), dividends (GBP 4,85 billion) and share repurchase (GBP 5,56 billion). As a result, there was a 'gap' of £ 4 billion that was covered by issuing debt.

| billion GBP | 2018 | 2019 | 2020 |

| Cash flows from operating activities | 3,084 | 3,248 | 2,320 |

| CAPEX | - 0,584 | - 0,671 | - 0,700 |

| FCF | 2,500 | 2,577 | 1,620 |

| Acquisitions (net) | - 0,590 | 0,370 | - 0,119 |

| Dividend (-) | - 1,581 | - 1,623 | - 1,646 |

| Share buyback (-) | - 1,507 | - 2,775 | - 1,282 |

source: own study based on the company's annual reports

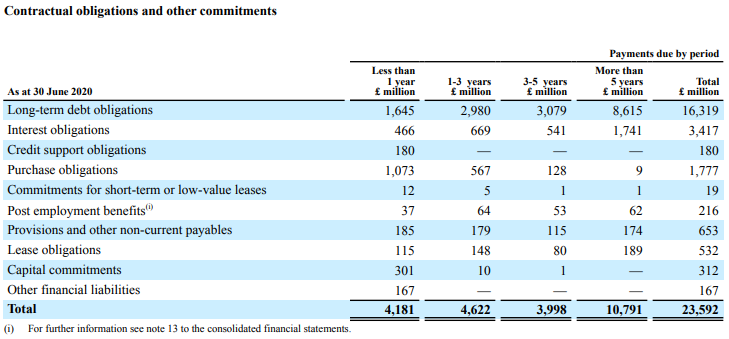

Debt structure

Diageo has over £ 16,3bn in interest debt. Interest on these bonds is estimated at £ 3,4 billion (calculated fixed interest rate and estimated floating rate). Debt classified as "Purchase obligation" are liabilities resulting from long-term purchase contracts (e.g. grain, glass, cans). Below is a list of potential liability payments:

source: company's annual report for the financial year 2020

Diageo does not report major off-balance sheet liabilities resulting from, for example, guarantees or contractual penalties.

Over the last 4 years, the company has significantly increased its debt, which is visible both in nominal terms and in terms of the ratio of net debt to EBITDA. The debt is well above the company's goal. (2,5-3,0). The reason was the simultaneous increase in debt and a decrease in EBITDA. Both factors were related to the tougher macroeconomic environment resulting from COVID-19 (closed pubs).

| billion GBP | 2017 | 2018 | 2019 | 2020 |

| Net debt * | 8,664 | 9,963 | 12,123 | 13,995 |

| EBITDA | 4,271 | 4,496 | 4,872 | 4,235 |

| Debt / EBITDA | 2,1 | 2,2 | 2,5 | 3,3 |

source: own study based on the company's annual reports

* net debt also includes pre-tax financial liabilities to former employees.

Competition

Competition on the alcohol market is very fierce, there are both companies with a wide portfolio of recognizable brands and a large amount of local competition (e.g. craft beers). Companies with recognizable brands, whose customers are not sensitive to price increases (premium brands) have an advantage. Many companies from the alcohol industry are listed on the stock exchange. Among them there are producers of both strong alcohols and beer. You can mention here, among others

Pernod Ricard

French producer of spirits. It is listed on the Paris Stock Exchange. He owns brands such as Ballantine's, Malibu, Jameson, Martel, Olmeca and Absolut vodka. The company's capitalization is around € 40,5 billion. In the last financial year (2020), the company generated € 8,4 billion in revenues and € 329 million in net profit.

Pernod Ricard stock chart, W1 interval. Source: xNUMX XTB.

BrownForman

It is an American alcohol producer. Its portfolio includes brands such as Jack Daniel's, Finlandia vodka, Tequila Pepe Lopez and Korbel wine brand. The company's capitalization is approximately $ 34,6 billion. In the last fiscal year (2020), the company generated $ 3,3 billion in revenues and $ 828 million in net profit.

Brown Forman stock chart, interval W1. Source: xNUMX XTB.

AB Inbev

The company was established as a result of the merger of InBev (Belgian-Brazilian company) with the American Anheuser-Busch. The company owns brands such as Budweiser, Beck's, Cass and Casle. The company's capitalization is around € 51,5 billion. In the last fiscal year (2019), the company generated $ 52,3 billion in revenues and $ 9,1 billion in net profit.

AB Inbev stock chart, interval W1. Source: xNUMX XTB.

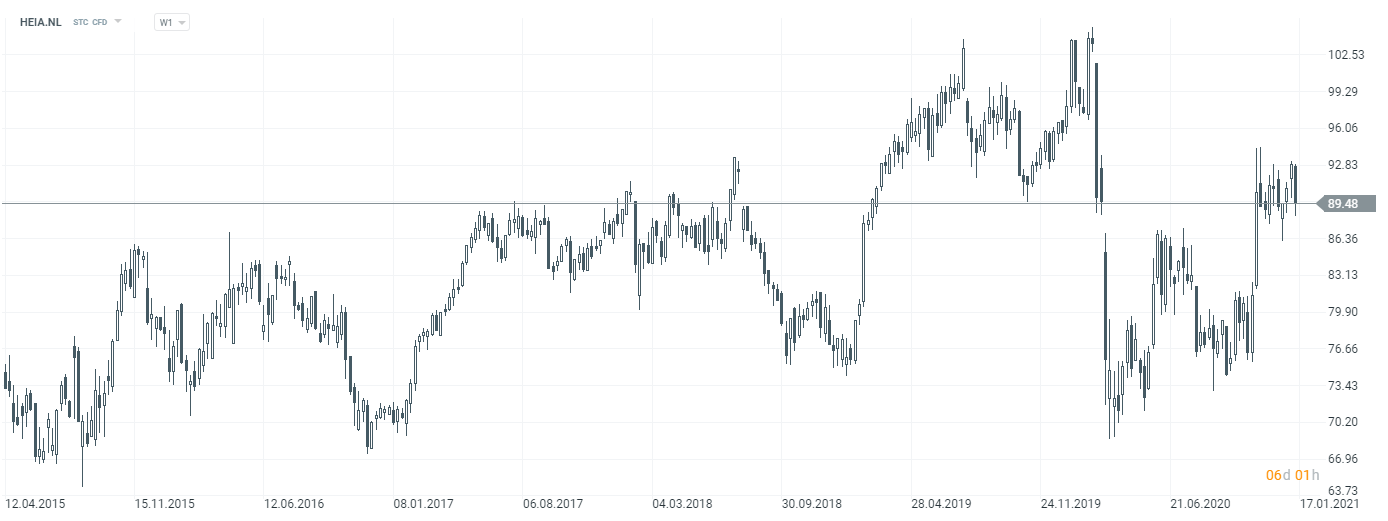

Heineken

A company listed on the Amsterdam Stock Exchange. He is the owner of, among others brands such as Heineken, Amstel or Desperados. It also has ciders such as Bulmers and Strogbow. The company's capitalization is around € 111,9 billion. In the last financial year (2019), the company generated € 23,9 billion in revenues and € 2,1 billion in net profit.

Heineken stock chart, interval W1. Source: xNUMX XTB.

Carlsberg

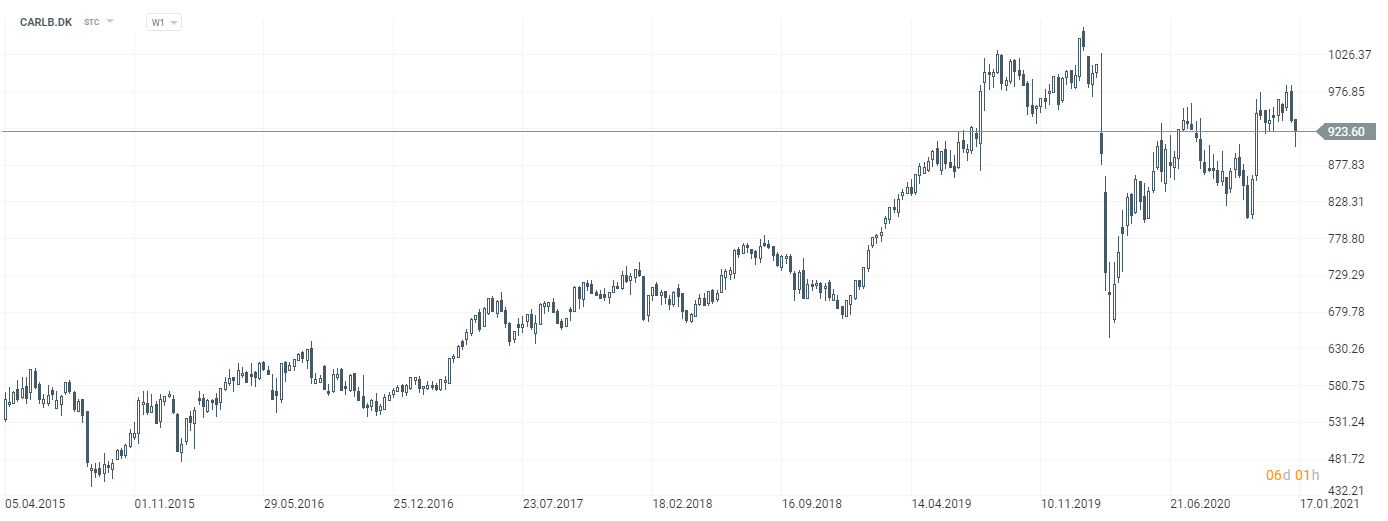

It is listed on the Danish Stock Exchange. The company owns brands such as Carlsberg, Somersby, Baltika and Zatecky. The company's capitalization is around 136,4 billion Danish kroner (DKK). In the last financial year (2019), the company generated DKK 65,9 billion in revenues and DKK 6,6 billion in net profit.

Carlsberg stock chart, interval W1. Source: xNUMX XTB.

Molson Coors Beverage Company

It is an international beer producer that produces its products in the USA, Canada and Europe. Its brands include Molson, Coors and Blue Moon. The company's capitalization is approximately $ 11,4 billion. In the last financial year (2019), the company generated $ 10,6 billion in revenues and € 241 million in net profit.

Mlson Coors Beverage Company stock chart, interval W1. Source: xNUMX XTB.

Asahi

It is a Japanese company that owns, among others Kompania Piwowarska (Lech, Tyskie) and has brands such as Grolsch, Pilsner and Peroni. In addition to the beer portfolio, it also offers ciders, spirits, soft drinks and food. The company's capitalization is approximately JPY 2 billion. In the last fiscal year (038), the company generated JPY 2019 billion in revenues and JPY 2 billion in net profit.

How can you invest in Diageo

The company is listed on the London Stock Exchange as one component of the FTSE 100 index. At the same time, corporate sponsored ADRs are approved for trading in the United States. In addition to investing in stocks, an investor can buy ETF with exposure to the British market. An example is iShares Core FTSE 100 UCITS ETF. As of January 14, 2021, Diageo had 3,7% of the weight in this ETF.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

According to data provided by the IWSR, retail alcohol sales worldwide have exceeded £ 854 billion, which is the equivalent of approximately 6 billion alcohol units. The alcoholic beverages market will grow in the coming years, as societies in the world become richer and the population grows. According to data from the World Bank, 2030 million new (adult) alcohol consumers will appear by 600.

Consumer habits are also changing in the world. Premium brands are becoming more and more popular as more and more shoppers prefer to follow the rule "Drinking better, not more". In the beer and wine belt countries, consumption of spirits is increasing. An example is the category of gin, which is more and more popular in Europe, Australia, South Africa and Brazil.

The aforementioned trends will favor the company. A particularly strong presence in India is important from a long-term point of view. A growing middle class will consume more and more mid-to-high-end alcohol, which should help companies like Diageo. Obviously, the competition in this market is fierce, so significant marketing expenses are required to maintain brand recognition. At the same time, popular brands such as Johnnie Walker or Guinness create a strong moat that protects against cheaper competition. As a result, the company has "pricing power".

Diageo is a stable company that usually grows at a single-digit growth rate. The company shares its profit with shareholders through share purchases and dividends. However, it should be remembered that the company is still exposed to Brexit risks.

However, it is worth remembering that even the best company should be properly valued. The company's capitalization as of January 15, 2021 was approximately £ 68 billion. This gives high price to profit (P / E) and price to free cash flow (P / FCF) ratios compared to 2019 and 2020 results.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Diageo - it's not only Johnnie Walker and Guinness [Guide] diageo actions](https://forexclub.pl/wp-content/uploads/2021/01/akcje-diageo.jpg?v=1610970600)

![Sin Stocks - when sin pays off [Guide] investing in sin stocks](https://forexclub.pl/wp-content/uploads/2021/03/inwestowanie-w-sin-stocks-300x200.jpg?v=1616996049)

![Diageo - it's not only Johnnie Walker and Guinness [Guide] energy and metals crops](https://forexclub.pl/wp-content/uploads/2021/01/uprawy-energia-i-metale-102x65.jpg?v=1610968652)

![Diageo - it's not only Johnnie Walker and Guinness [Guide] historical records on wall street](https://forexclub.pl/wp-content/uploads/2021/01/spolki-z-wall-street-102x65.jpg?v=1611125857)