Debut of the Robinhood company - how to earn on a broker for the retail? [Guide]

Robinhood it is a company that became one of the heroes of January's growth in such actions as GameStop or AMC. The company thanks to the fact that it offered free stock trading, ETFs or options attracted a large group of investors of the young generation. Many small investors have hooked up to "Squeezing short positions" on GameStop and AMC actions. The company's mission is "Democratization of finance for all".

A few words about the US capital market

According to data prepared by JP Morgan in September 2020, about 15% of the volume on the stock market is generated by individual investors. In the following months, the share of individual investors fell to around 10% (for the companies included in the Russell 3000 index). For such a well-developed capital market, this is quite a high value. It is also worth mentioning that, according to the analysis by Daniel Fannon, in January individual investors accounted for 32% of the daily volume on the US stock market. For comparison, Euronext estimates that the share of individual investors on the main European stock exchanges in 2020 is around 5%.

It is normal for most Americans to own a stock or unit of funds as an asset. According to data compiled by Gallup, between 2010 and 2020, the percentage of Americans who owned stocks, shares in funds or managed a 401 (k) or IRA account was 55%. In 2020, 84% of households earning over $ 100 a year were investing in the capital market. By contrast, for households with earnings below $ 40, the figure was just 000% In the case of the population aged 18-29, the percentage of people not investing in the capital market was as high as 68%. So there is a group of potential customers who are not developed. The Robinhood app was created for such investors. The broker boasts that half of the platform users declare that it is their main brokerage account (with the largest deposited funds). According to Charles Schwab, the value of the assets of all retail investors is approximately $ 50 trillion. So there is something to fight for.

Basic information and history

Robinhood Markets Inc. is a company that provides brokerage services. The company is best known for offering no-cost trading in stocks, ETFs and options via a mobile app. The beginnings of the company date back to April 2013. The founders were Vladimir Tenev and Baiju Bhatt. The aforementioned creators came up with the idea in 2011, shortly after the "Buy Wall Street" movement. They wanted to create an offer of no-cost stock trading for individual investors. It was a revolutionary idea because it was normal at that time to pay heavy charges in the US market. The idea of Taneva and Bhatta was to create a simple and free offer that was to reach a new generation of consumers.

However, the beginnings were not easy. Many VC (Venture Capital) companies felt that the idea was pointless as the company would not be able to generate enough revenue. At the same time, many fund owners believed that potential clients would not have too wealthy wallets, which would make their further monetization difficult.

Despite objections from most of the funds, Vladimir and Baiju attracted the first investors. One of them is Tim Draper. The company was founded in 2013 and it took two years to develop its service. In 2015, 80% of the company's customers were millennials under the age of 36. The company was constantly "on the line". This was due to the fact that the scale of the company was small and the initial costs were very high. Because of this, Robinhood was in constant need of an inflow of cash. In the first five years, the company raised approximately $ 500 million. However, despite the enormous funds, the company continued to struggle to achieve profitability.

If the company did not charge a commission, how did it generate income? Initially, most of the revenue was generated from interest on borrowed funds and subscriptions ($ 10-2000 per month), which allowed for increased trading limits. A very affordable offer for individual customers resulted in a significant increase in the number of users. At the end of 2016, the company had over 700 customers. After two years, the number of users increased to 3,3 million. In the same year, there was an option to trade options on the platform. After a year, the offer was extended to trading in cryptocurrencies. The "free" cryptocurrency trading offer currently applies to 7 cryptocurrencies: Bitcoin, Bitcoin Cash. Bitcoin SV, Dogecoin, Ethereum, Ethereum Classic and Litecoin. At the same time, Robinhood offers access to real-time quotes for 10 cryptocurrencies. In February 2021, the company raised $ 5,6 billion from investors. The company's valuation exceeded $ 40 billion.

Robinhood offer

Robinhood allows you to trade American stocks and ETFs. Investing in foreign companies is possible by trading 650 shares traded in the form of ADRs. It is also possible to trade fractional shares or ETFs.

The company also offers a monthly subscription called Robinhood Gold which costs $ 5 per month (free first 30 days). At the end of Q2021 1,4, Robinhood had XNUMX million paying subscribers. That's $ 84 million in annualized revenues. It is worth mentioning that the subscription is used by slightly less than 8% of active customers. The subscription fee is automatically charged to the customer's funds on their account. The subscription user receives:

- Access to a $ 1000 margin, the use of which is included in the subscription price. If a user draws more than $ 1000 on the "credit line", they will pay interest of 2,5% per annum on the amount above $ 1000. Interest is accrued daily and deducted from your account.

- Robinhood Gold subscribers also have access to "instant deposit" which ranges from $ 5000 to $ 50. For example, an investor who has $ 000 on deposit has a maximum of $ 6000 for "instant withdrawal". The remaining $ 5000 will be available for withdrawal within 1000 business days.

- Another feature is access to the quotes included in Nasdaq Level II. This gives subscribers a better view of the available market orders.

Thanks to subscription Robinhood gold users can take advantage of unlimited access to analytical reports prepared by Morningstar. There are approximately 1700 shares on offer. Analytical reports are updated frequently, allowing you to track fundamental changes in companies (the update usually follows quarterly results). Each report contains a description of the business, the "moats" that companies have over the competition, risk analysis and company valuation.

The broker also provides educational materials under the name Robinhood Snacks, which had 2021 million subscribers in March 32. At the same time, daily podcasts were downloaded 40 million times in 2020.

Robinhood also provides a very extensive educational offer. The company boasts that by the end of March 2021 it had over 7 million visits. The educational offer consists of over 650 articles, which include, among others guides, tutorials on solutions on the platform or a financial dictionary. Thanks to this, platform users can deepen their knowledge of finance in one place.

Another functionality is Newsfeed, which was used by approximately 2020 million users at the end of 6,4. The offer applies to access to premium news from places such as Barron's, Reuters and The Wall Street Journal.

The company also has products related to Cash Management. Investors' uninvested cash is deposited in FDIC-protected banks. This allows Robinhood to offer its clients a competitive interest rate.

In addition to a low commission, the company also offers a fairly high protection of the accumulated funds. Robinhood is a member of SPIC (Securities Investor Protection Corporation). As a result, it offers asset protection up to $ 500, including cash up to $ 000. In addition to the standard SPIC protection, which provides a total of $ 250 million of coverage. Additional protection covers up to $ 000 million in cash and up to $ 100 million in shares per customer.

Operational data

As a result, Robinhood has over 18 million accounts in which funds have been deposited and MAU (monthly active users) 17,7 million. The company informs that the average period of "payback" of customers is 13 months (revenue for customer acquisition). At the end of March 2021, the company declared that its clients had accumulated assets of $ 80,9 billion. This was about $ 4500 in assets per fundend accounts. It is worth mentioning that 2020 was a "golden year" for the company. At the end of Q2020 19,2, the company had $ 2670 billion in assets, which was $ XNUMX on account.

If you look at the structure of customer assets, in 2021 equities ($ 65 billion) and Cryptocurrencies ($ 11,6 billion) dominated. Although shares are the largest component of clients' assets, options generate the largest PFOF. For this reason, the company should encourage clients to trade more in the options market.

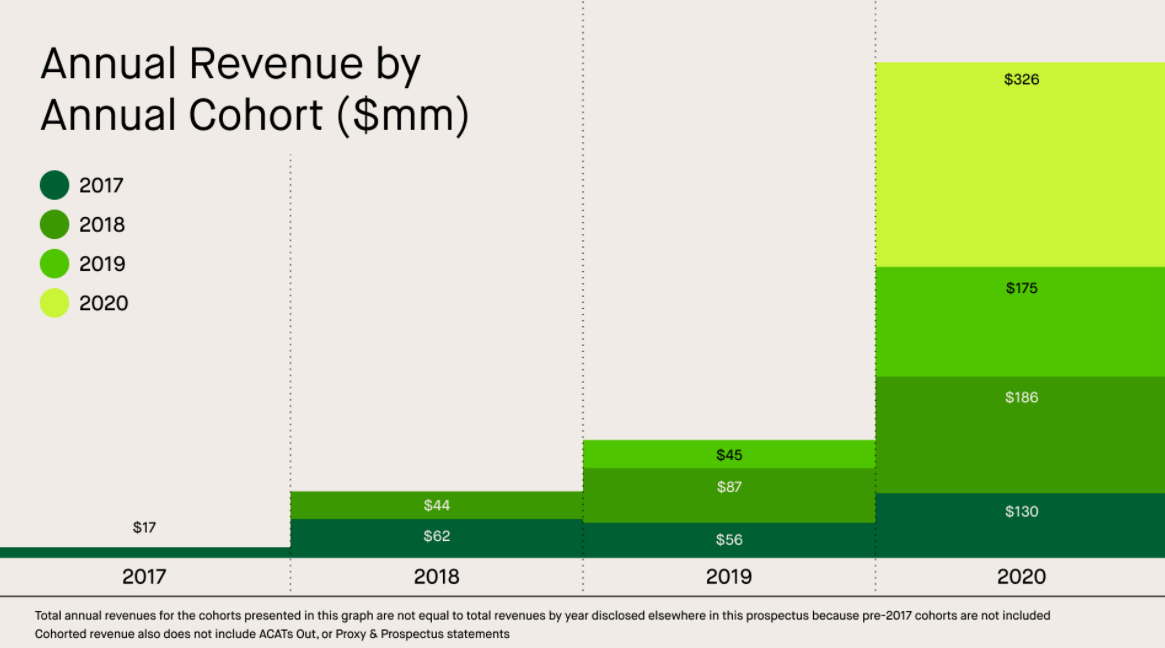

Customer cohorts are very important in order to understand the mechanics of the business. The longer the "life" of a given cohort is, the healthier the company's business model is. However, keep in mind that the revenue is generated from the turnover which is correlated with the higher turnover. For this reason, 2020 and the beginning of 2021 were exceptional years ”, which conquered the turnover of the older cohorts.

It is also worth looking at churn, which in 2019 amounted to 700, which corresponded to 000%. In turn, in 21,2, chur amounted to 2020, which corresponded to 900% of active clients in 000.

It's also worth looking at Average Revenue Per User (ARPU), which was $ 2020 in 108,9. In 2018 and 2019, ARPU was $ 66,5 and $ 65,7, respectively.

The financial data

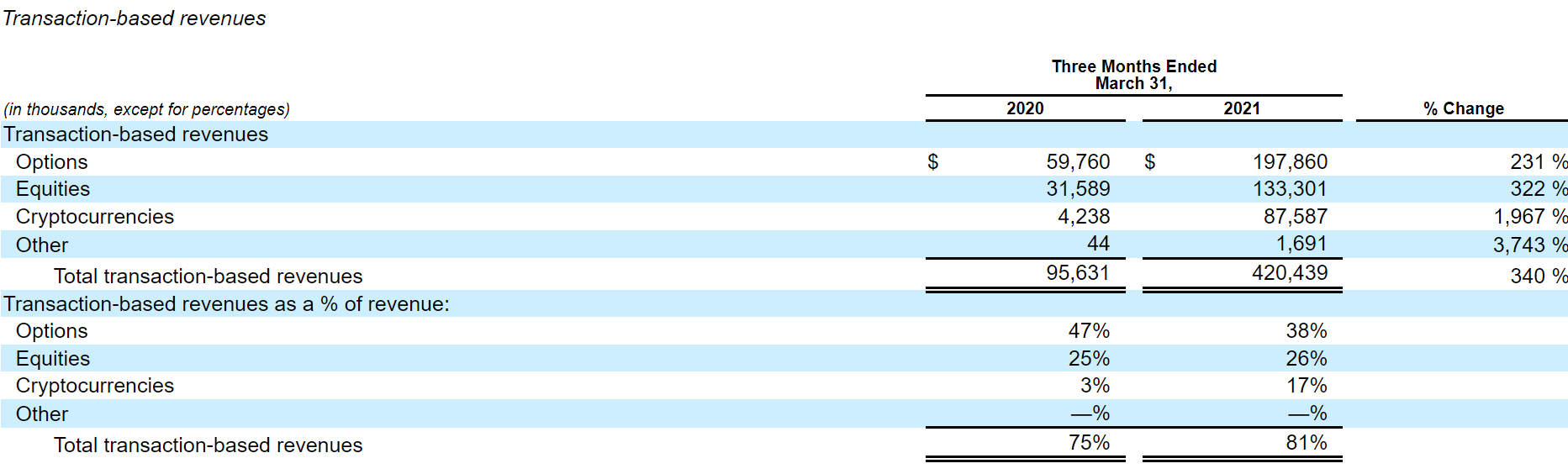

In Q2021 522, the company generated over $ 80 million. The company makes money by receiving PFOF (payments for order flow), in which Robinhood receives "commissions" from market makers for directing customer traffic. The commission is part of the bid-ask spread. When trading Cryptocurrencies, Robinhood gets "transaction rebates". Over 2020% of revenues are generated from PFOF. In 46, approximately 26% of revenues came from PFOF generated from transactions on the options market. Another group of revenues was PFOF on the stock market (2021% of revenues). However, in IQ 420, approximately $ XNUMX million in revenues from PFOF was generated.

Net interest revenues

In addition to income such as payments for order flow, the company also earns on "interest". Interest income is mainly from the lending of securities ($ 35 million) and the lending of capital to investors ($ 27 million). In Q2021 62,5, the company generated $ 12 million on this account, which corresponded to approximately XNUMX% of the revenues generated by the entire Robinhood company.

Other revenues

For other revenues, these include user fees for using the Robinhood Gold offering. In Q2021 13,8, they generated an annual increase of $ XNUMX million. On the other hand, another $ 12,6 million increase came mainly from ACATS fees charged to users for facilitating the transfer of their account to another broker.. In Q2021 39,2, the company generated $ 7,5 million on this account, which corresponded to approximately XNUMX% of the revenues generated by the entire Robinhood company

Company costs

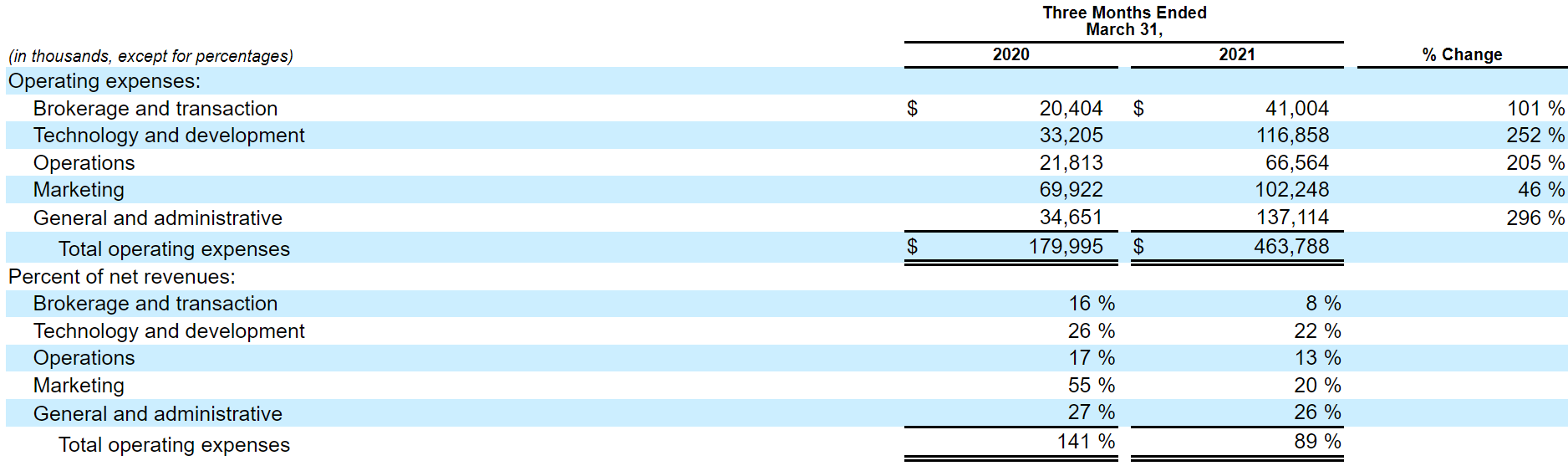

Costs included in "Brokerage and transaction" increased by $ 20,6 million y / y. Approximately $ 4,9 million of the increase came from costs attributable to market data access fees. The increase of $ 4,2 million was related to bank charges. In turn, the annual increase in clearing fees amounted to $ 1,1 million. The remaining increase in costs concerned, inter alia, employee salaries and bonuses (an increase of $ 1,5 million) and losses due to fluctuations in market prices that affected transactions in fractional shares (increase by $ 5,7 million).

The next cost group was costs technological and developmentalwhich grew by 252% annually. The largest increase in costs was related to the cloud and cloud infrastructure, which was responsible for the annual increase in this expenditure category by $ 48,2 million. On the other hand, employee costs (salary and bonuses paid in stocks, derivatives and cash) pushed costs up to $ 33,2 million annually.

Costs associated with operations increased by over 200% ($ 44,8 million) during the year. The $ 16,6 million increase in costs was due to an increase in salary and bonus spending. This was due to the increase in employment of the person responsible for customer support and operations by 286% y / y. Another increase of $ 14,9 million during the year was due to higher costs of "external" customer service. Part of the increase in operating expenses was due to an increase in loan loss provisions from $ 9,9 million to $ 16,4 million. The main reason was the increase in the number of accounts credited to "Fraudulent Deposit Transactions".

costs marketing, increased by $ 32,3 million over the year. This was mainly related to the increase in costs related to the Robinhood Referral Program. The program is based on "recommending" the broker's services. If an invited friend opens an account via a link, both the new customer and the referrer get an allotment of free shares that they can sell. The maximum amount that can be received from referrals is $ 500. Most often, a one-time reward is worth from $ 2,5 up to $ 10.

The significant increase in market volatility and the inflow of new customers meant that the "clean" net profit (the change in the fair value of liabilities in the form of convertible bonds and warrants) was positive in three out of the last four quarters. This means that Robinhood may achieve sustainable profitability in the future. Maintaining revenues in the form of PFOF seems to be a sine qua non condition.

For a company valued at approximately $ 40 billion, it is imperative to assume continued growth in revenues and profits. How does the company want to increase the scale of operations?

- Attracting new American consumers - due to the fact that customer cohorts "mature naturally" and their organic growth is usually single-digit, it is necessary to attract more American customers. This does not necessarily mean prohibiting "all exchange assets" held by a client with another broker. It is worth remembering that the average assets of a Robinhood client do not exceed $ 5000. So there is a lot of room for growth.

- Growth with existing customers - if the clients' assets grow, the client's turnover on the platform (in terms of value) will most likely increase. This, in turn, will translate into a larger PFOF.

- Geographic diversification - the capital market is not only the United States. Most likely, the company will also look for growth outside the country. The "natural" direction of expansion seems to be Canada, Australia, New Zealand and European countries.

- Extending the product offer - due to the fact that PFOF dominate in total revenues, it is necessary to expand the product offer. An interesting solution is the subscription offer (which can still be developed) and entering the cryptocurrency market. In the following years, the company may go into greater analytical coverage or create a more extensive platform with more extensive functions.

Competition

The company does not operate in a vacuum. The US stock broker market is very competitive. The largest competitors on the American market include E-trade, Interactive Brokers, Schwab, and TD Ameritrade. Some of these brokers are listed on the stock exchange.

Charles Schwb

It was founded in 1971 and is one of the largest brokers in the United States. At the end of 2019, customer assets exceeded $ 4,04 trillion. It is worth adding that the number of active brokerage accounts amounted to 12,3 million. This amounted to less than $ 330 in assets per active brokerage account. As you can see, Charles Schwab groups clients with much thicker wallets. Competition from other brokerage firms resulted in the commission being reduced from $ 000 to $ 2019 for US and Canadian stocks and ETFs from October 4,95. In turn, the commission for trading options is still $ 0,00 per contract. Currently, there are no account management costs and no minimum amount needed to open an account.

e-trade

It was founded in 1982. It is one of the most famous American brokerage firms in the country. At the end of February 2020, he had 5,2 million brokerage accounts opened with assets in excess of $ 360 billion. This gave less than $ 70 in assets per brokerage account. Also, E-trade has significantly reduced transaction fees. For US stocks, ETFs and treasury bonds, E-Trade does not charge a commission. Trading options, on the other hand, costs a maximum of $ 000 per contract. There is also a fee to enter into a futures contract ($ 0,65 per contract) and a bond ($ 1,5 per bond, minimum $ 1 and maximum $ 10).

TD Ameritrade

It was founded in the seventies of the twentieth century. According to data provided by the company, they have over 11 million brokerage accounts. Clients had assets accumulated on them that exceeded 1000 billion. This meant that, on average, a client had over $ 90 in assets in their account. TD Ameritrade was also "forced" to lower the commission. They are similar to E-Trade ($ 000 for US stocks and ETFs) and $ 0 for one option contract and $ 0,65 for a futures contract.

Interactive Brokers

It is a very famous provider of brokerage services. Not only in the United States, but also in Europe, Asia and Oceania. The platform offers access to 135 markets in 33 countries. You can make transactions in 23 currencies on the platform. Therefore, it is an offer addressed to the investor for whom the breadth of the offer matters. Interactive Brokers offers cheap access to stocks (American investors are free to trade American stocks and ETFs). Users of the Interactive Brokers offer also have access to the TWS platform, which allows access to financial data of companies or analysts' forecasts. Over 1,33 million customers use the Interactive Brokers offer.

Interactive Brokers chart, interval W1. Source: xNUMX XTB.

Where to invest in stocks

Below is a list of selected offers Forex brokers offering an extensive stock offer.

| Broker |  |

|

|

| End | Poland | Denmark | Poland |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 1 - stocks + CFDs on stocks 5 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Robinhood IPO - Summary

Robinhood will surely be one of the "hot" debuts in the US market. The platform is very famous among millennials and generation Z and was one of the short squeeze "heroes" at GameStop and AMC. Despite the huge number of customers (18 million), the assets accumulated on the platform are small compared to the competition. This is because the target group for the time being are "novice investors" who deposit little money into their first brokerage account. For this reason, the average assets per client are more than 20 times smaller than in the case of other brokers.

The main source of income is PFOF, which, in simple terms, is a "discount" for directing customer traffic. This allows Robinhood to offer "free" stock trading. The company tries to diversify its offer (crypto) and sources of income (subscriptions). Due to the fact that price competition is a short-term strategy, the company tries to somehow "tie" the customer to itself. However, keep in mind that transferring assets to another brokerage account is currently not that complicated, which undermines the stickiness of the offer a bit. On the plus side, it can certainly be emphasized that LTV to CAC is quite favorable and currently the client "pays off" on average after 13 months. However, it should be remembered that the company is exposed to a decline in revenues when spreads are reduced, rebates and the regulator prohibits PFOF practices. The estimated valuation (over $ 40 billion) already includes the realization of part of the optimistic scenario.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Debut of the Robinhood company - how to earn on a broker for the retail? [Guide] debut robinhood ipo](https://forexclub.pl/wp-content/uploads/2021/07/debiut-robinhood-ipo.jpg?v=1626157526)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Debut of the Robinhood company - how to earn on a broker for the retail? [Guide] xtb shares number of clients](https://forexclub.pl/wp-content/uploads/2020/02/xtb-ilos%CC%81c%CC%81-kliento%CC%81w-102x65.jpg?v=1580833276)

![Debut of the Robinhood company - how to earn on a broker for the retail? [Guide] payout binance](https://forexclub.pl/wp-content/uploads/2021/07/binance-wyplaty-102x65.jpg?v=1627564109)