Debut of Answear.com - what is worth knowing before the debut? [Guide]

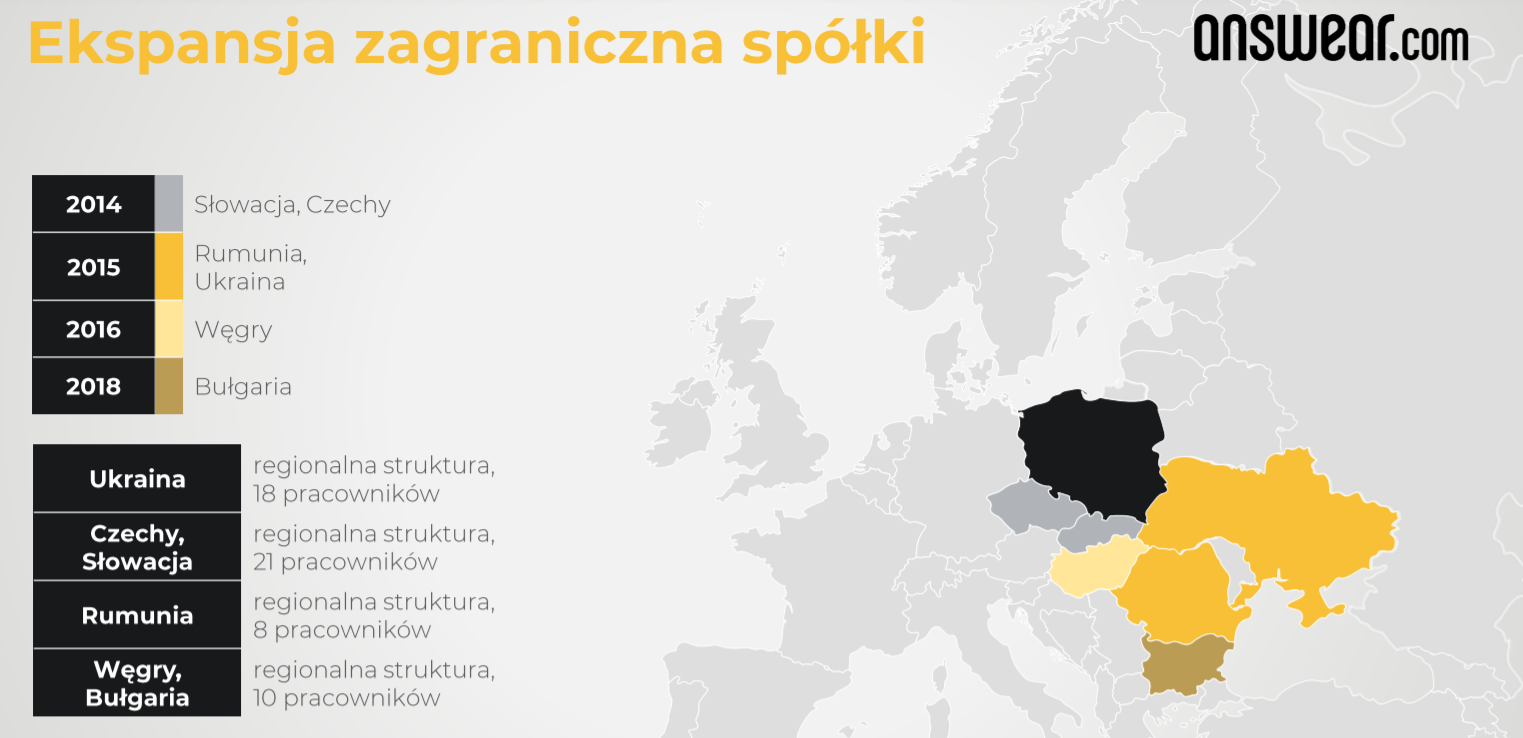

Answear.com sells clothing, footwear and accessories exclusively via the online channel. For this reason, it does not incur costs related to the maintenance of stationary points of sale (rent, employee salaries). The introduced trade restrictions (e.g. lockdown) had a smaller impact on the company than on other companies selling mainly in the offline channel. The company operates in Poland and in some countries of the CEE region.

Source: company presentation

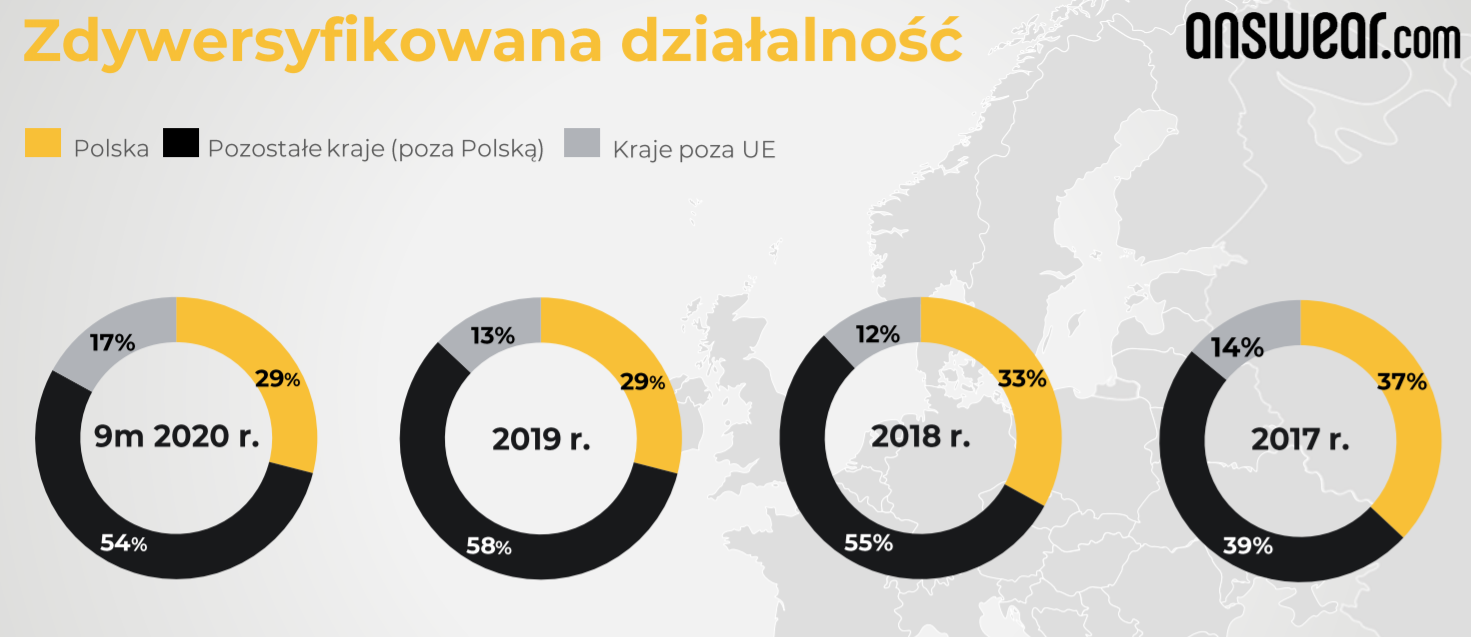

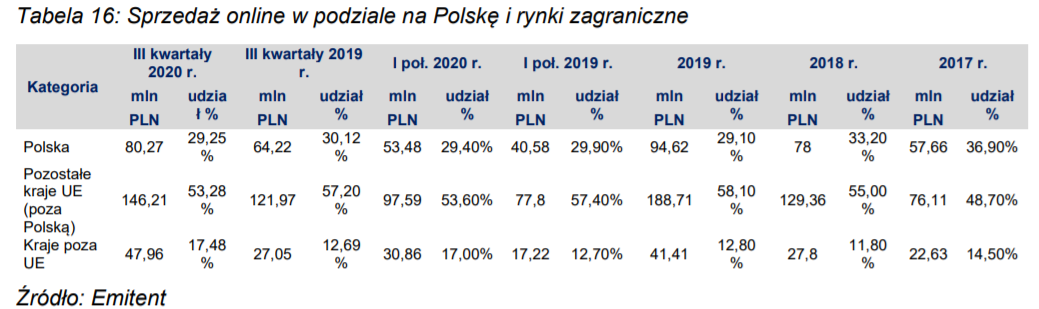

None of the company's markets exceeds a 30% share in total revenues. However, Poland is still the largest market for the company.

Source: company presentation

The company's history began in February 2011, when the official launch of the online store www.answear.com took place. In 2012, the website and other assets were brought to the company Wearco sp. Z oo, founded by Krzysztof Bajołek and Arkadiusz Bajołek. In 2013, the MCI.TechVentures fund invested in the company, taking up minority shares in the company. The funds collected from the financial round were used for foreign expansion. Over the next 3 years (2014-2016), the company expanded its operations to the Czech, Slovak, Romanian, Ukrainian and Hungarian markets. In 2020, the company changed its name to Answear.com SA

IPO offer

The company planned to issue 1,84 million shares. The maximum price in the offer was PLN 36,5. As a result, Answear.com planned to collect about PLN 65 million net from the market. At the same time, one of the minority shareholders (MCI.TechVentures) intended to sell 2,52 million shares.

The offer of shares was not met with enthusiasm by institutional investors. The issue price was set at PLN 25. It is 31,5% lower than the maximum price. The lower price meant that MCI.TechVentures limited its share offer from 2,52 million shares to 1,38 million shares. Due to the lower issue price, the company will collect approximately PLN 45 million net from the market. This is 20 million less than the company's investment plan. The company was valued at approximately PLN 430 million.

Answear.com - product offer

The company focuses on selling recognizable brands. The offer includes a wide selection of women's, men's and children's collections. At the end of Q2020 80, Answear.com had over 000 products from over 350 global brands. In 2017, the company offered 55 products.

Answear.com offers:

- popular clothing brands such as Mango, Vero Moda,

- recognizable brands of footwear and sportswear, e.g. Adidas, Nike, New Balance,

- "denim" brands, e.g. Levi's, Lee, Wrangler,

- brands included in the premium category, such as: Diesel, Guess Jeans, CK, Tommy Hilfiger, Valentino, DKNY.

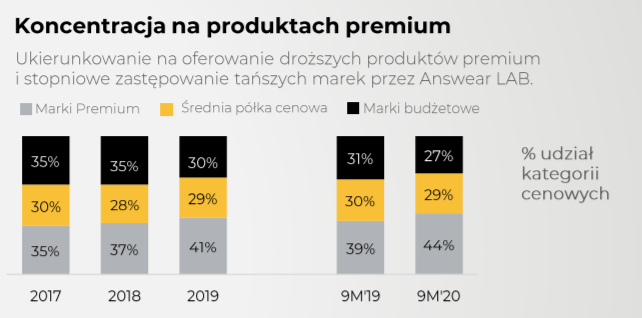

The sale of premium brand products is important for the company's business model. This is mainly due to the high unit price. It ensures a high average value of one order (basket) and improves the profitability of the transaction. The offer of low-end products is mainly based on products "Own Brand" and the Medicine brand.

According to the information contained in the prospectus, the best-selling brands include: Guess Jeans, Tommy Hilfiger, Calvin Klein, Mango, Desigual, Polo Ralph Lauren, Karl Lagerfeld, Medicine, Emporio Armani, Liu Jo, Adidas, Nike and Own Brand. No brand accounts for more than 8% of the company's revenues. The top 5 brands generate slightly less than 30% of total sales.

Source: company presentation

Own brand

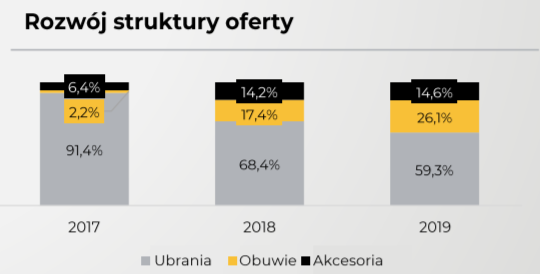

The company created its own brand in 2016. Initially, it operated under the name ANSWEAR. Currently, the own brand is sold under the name Answear LAB. According to the data presented by the company, over 6 jobs are sold under its own brand. assortment items (SKU). In 2019, over 7% of the company's revenues came from private label sales. At the same time, sales of this segment increased by 2019% y / y in 80. The private label belongs to the lower price segment. The company widens the offer. The product structure is also changing. At the beginning of the brand's operation, over 90% of its products were clothes. At the end of 2019, it was just over 59%.

Source: presentation of Answear.com

target group

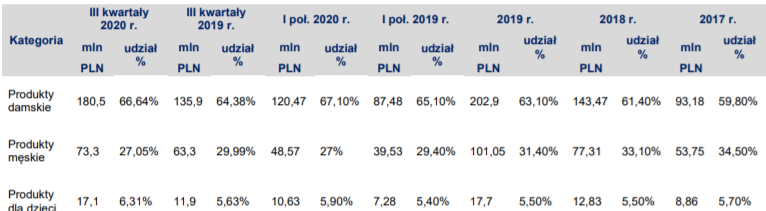

The company tries to position its products to make them an attractive offer for the target group, which are young people (20-40 years old). Answear.com's goal is to attract customers with income above the national average, who are willing to spend over PLN 250 in one order. The "ideal" customer should make such purchases several times a year. According to the data included in the prospectus, 66,6% of orders were made by women. Men's products accounted for 27% of the sales value. Slightly over 6% of revenues came from children's products.

Source: Answear.com's prospectus

Marketing

Marketing expenses are to help attract traffic and increase customer loyalty (increase the value of the basket and the frequency of purchases). The company conducts most of its marketing expenses in the online channel. It is about 80% of the advertising budget. Most of the expenses in the online channel are related to SEM, performance and display / programmatic. According to the company, spending on marketing in the online channel brings a faster return on investment than offline advertising.

Answear.com spends a significant part of its marketing budget (33% in 2019) on SEM (Search Engine Marketing). Mainly funds are allocated to Google Ads, video campaigns (eg Youtube, VoD services or social media) and Facebook Ads.

39% of the budget is spent on expenses classified as "performance". These include affiliations, retargeting, i.e. activities aimed at encouraging users who have visited the website or made purchases before. About 8% of the budget goes to activities in the field of automating advertising campaigns and their personalization (the so-called Programmatic buying).

The offline channel, which accounts for approximately 20% of marketing expenditure (as of 2019), is dominated by advertising expenditure on TV and radio. Simultaneously, SMS campaigns and influencer-based marketing are carried out.

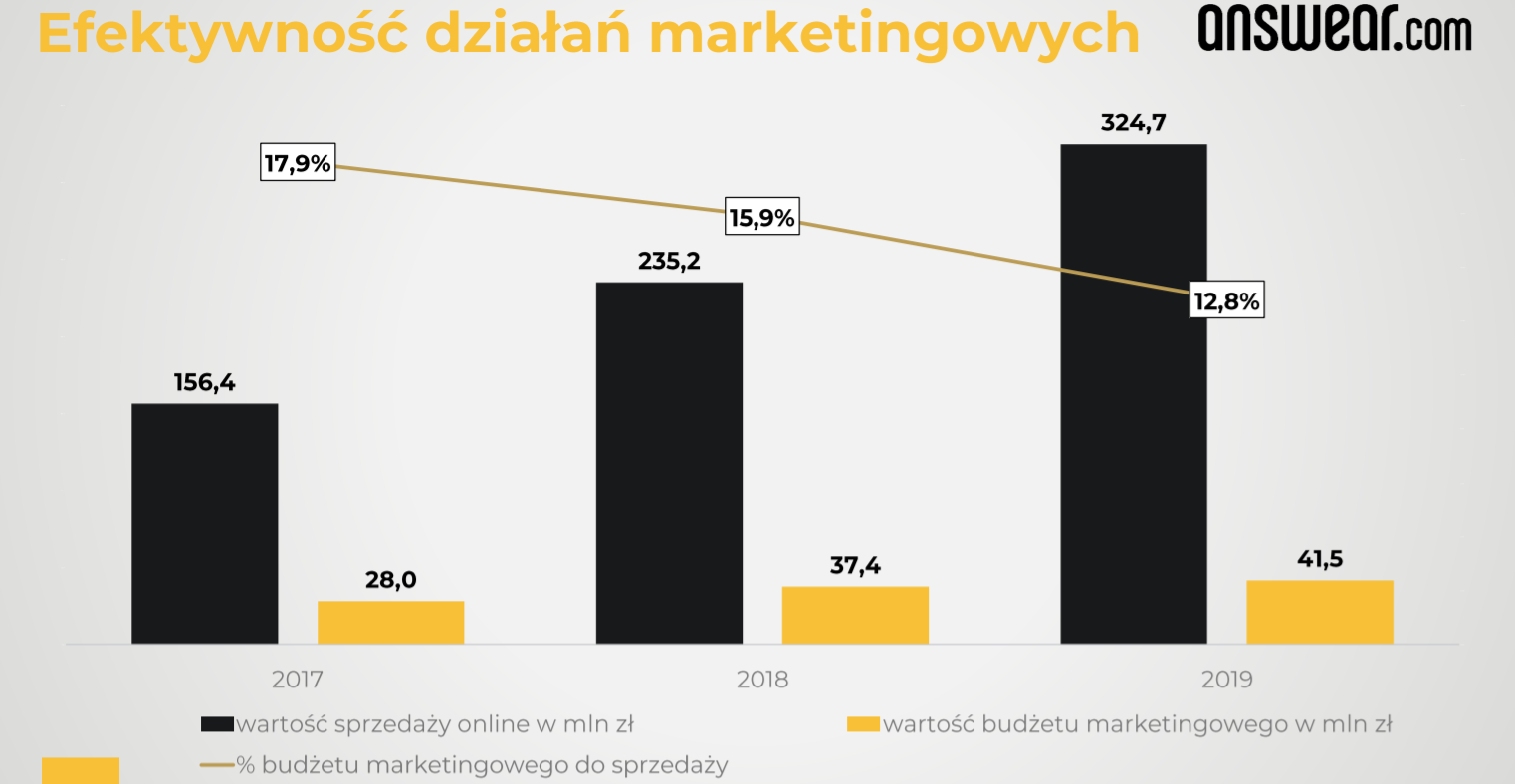

Increasing the scale of operations requires increasing marketing expenses. Between 2017 and 2019, marketing costs doubled. At the same time, the dynamic increase in revenues caused the ratio of marketing expenses to revenues to decline. In Q2020 11,3, marketing expenses accounted for approximately XNUMX% of sales.

Source: company presentation

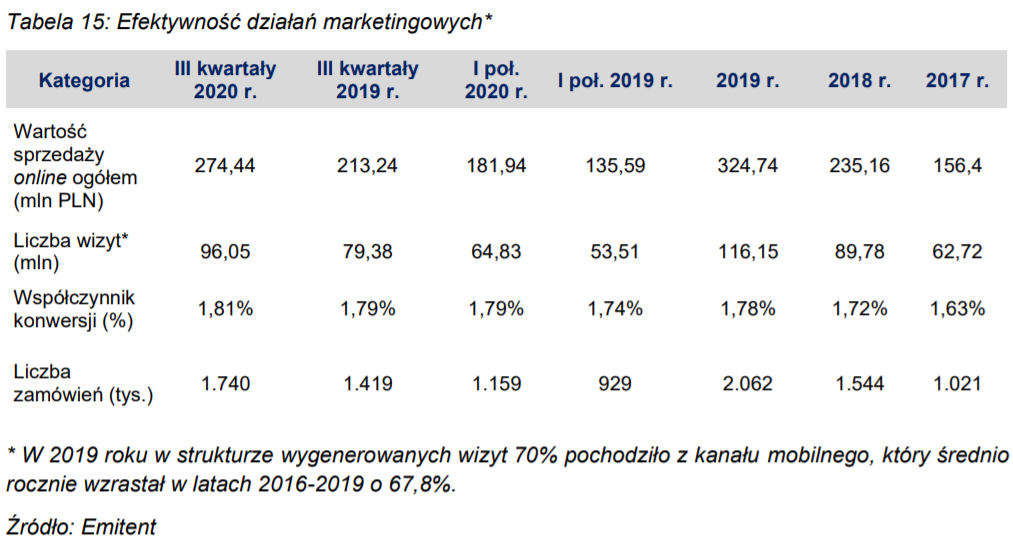

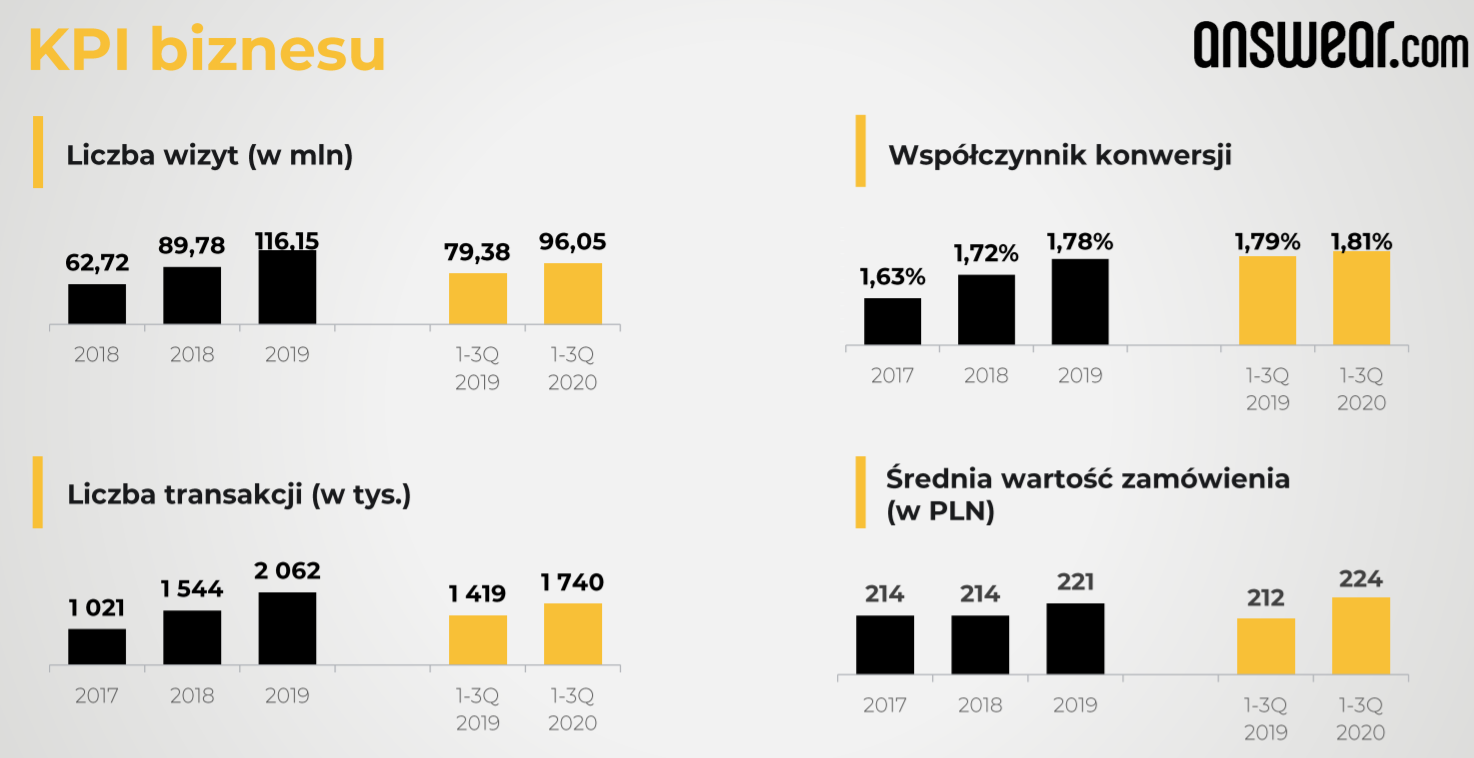

Marketing efficiency is also improving. This can be seen in the improving conversion rate. It is the relationship of the people who make the purchase to the users who have entered the site.

Source: Answear.com's prospectus

Answear.com - additional issues

From the beginning of the online store, an external company was responsible for the implementation of the system - MediaAmbassador.com sp. Z oo The Polish and Ukrainian online store is still based on an external system.

In 2017, the company decided to build its own e-commerce platform. A development department responsible for the implementation of the project was created. From 2018, the migration to the new system took place at Answear.cz (Czech Republic), Answear.sk (Slovakia), Answear.ro (Romania), Answear.hu (Hungary) and Answear.bg (Bulgaria).

The company announced that the migration to its own sales platform in the Ukrainian store is planned for January 2021. The completion of the migration of the Polish website (Answear.com) is planned for the end of March 2021.

Answear.com mentioned in its prospectus that creating your own sales platform will increase flexibility and accelerate the introduction of new functionalities. Additionally, the company believes that the security of the created systems will increase and the costs of system operation will be reduced in the future.

Own photo / video studio

Answear.com individually makes new product sessions. At the same time, it adds video content to many, which increases the attractiveness for customers. According to the company, this improves the conversion rate. Ansewear.com has its own photo / video studio. Its area is 500 square meters. A team of 24 people works with the company. It includes, among others photographers, graphic designers and stylists.

Distribution center, suppliers, logistics

The products sold by the company go to the warehouse. Only after ordering a given product, it leaves the warehouse and is delivered to the customer via suppliers. Since 2019 Answear.com has been operating from a warehouse in Kokotów near Kraków. The current warehouse replaced a smaller building located in Skawina. All local markets are served from one warehouse located in Kokotów. Currently, the company uses less than 20 thousand. m2 (floor area). The remaining part was sub-leased to external entities (contracts until July 2023 and July 2026) and a related entity (BrandBQ Sp. Z oo).

Source: investor presentation of the company

Agreements with suppliers

Answear.com cooperates with owners or exclusive distributors of brands in the markets in which the company operates. Answear.com cooperates with the brand headquarters for brands such as Tommy Hilfiger, Calvin Klein or GAP. Sometimes contracts are concluded with Polish branches. This is the case with brands such as Adidas, Nike, Wrangler and Lee. Some brands are available through contracts with exclusive distributors. The company purchases New Balance products from a Tarmax distributor.

Depending on the brand owner's policy, the company concludes individual commercial agreements or cooperates on general terms. For some agreements, the company has credit limits secured, which improves the company's liquidity. According to the data presented by the company in the prospectus, around 70% of orders are placed using the contracting system. The rest of the goods is replenished on a regular basis, depending on the sales results.

Traditionally, the largest number of deliveries takes place during the replacement of the collection for the new season (in the early spring and early autumn periods). For some brands, Answear.com provides itself mechanisms to minimize the risk of inventory deposits (unsold products). These include guarantee of the right to return some or all of the surplus goods, the possibility of replacing the goods from the old goods with new ones or participation in the sale.

Delivery

Shipments from Poland are sent by transport companies. After reaching the nearest warehouses of global courier companies, it is handed over to the courier company delivering the parcel directly to the customer (last mile delivery).

The company states in the prospectus that delivery in Poland is in most cases delivered within 24 hours. Shipments in the Czech Republic, Slovakia and Hungary are delivered within 24-48 hours. Delivery to Ukraine takes the longest (from 2 to 7 business days). Answear.com reports that about 90% of orders are carried out on schedule.

Source: company presentation

Financial and operational data

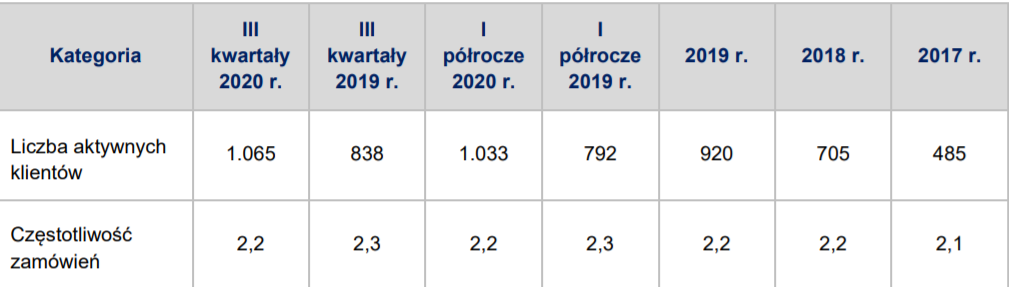

Answear.com has significantly increased the scale of its operations in recent years. This is clearly visible in the number of active clients who exceeded 2020 million after Q1 XNUMX.

Source: Answear.com's prospectus

At the same time, the company's operational efficiency indicators are improving. We are talking about conversion rates and the average value of the order (basket).

Source: company presentation

In line with the increasing number of active clients, the company's revenues also grew. This applies to all regions to which the company divides its sales (Poland, other EU countries, countries outside the EU).

Source: Answear.com's prospectus

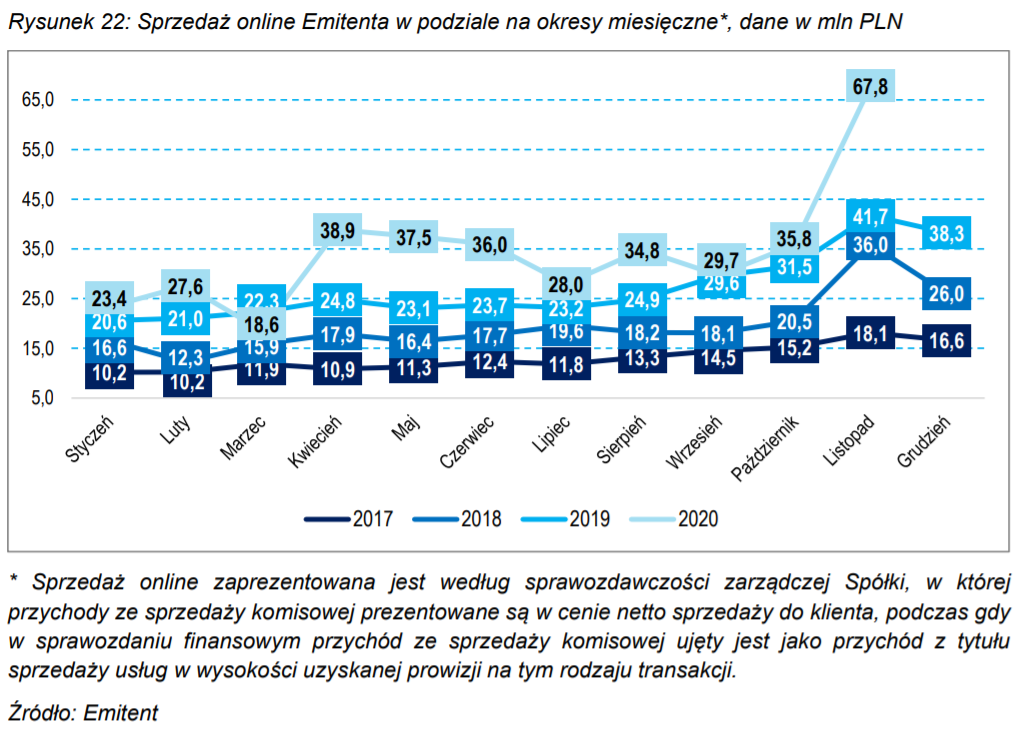

The annual improvement in sales volume is also visible on the monthly data. The situation in March 2020 was due to a supply chain disruption due to the influence of the coronavirus. Very good sales in the period April - June resulted from the "shift" of expenses on clothes and shoes from the offline channel to the online channel. The beneficiary was, among others Answear.com.

Source: prospectus

Customer cohorts

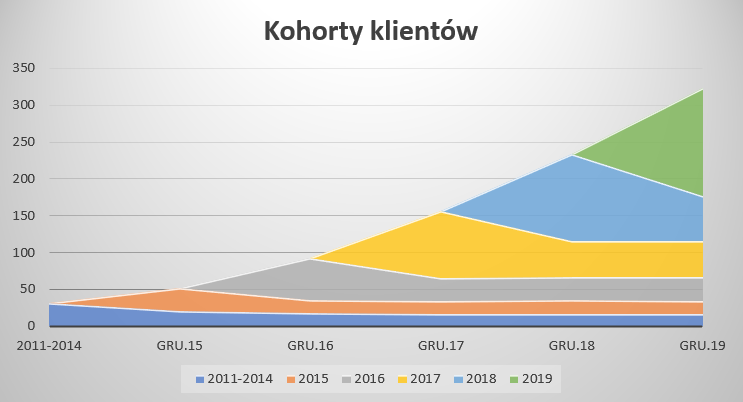

The company does not publish in its prospectus data on customer retention and the development of monetization of loyal customers. The only data presented by the company are the revenues of individual cohorts. Looking at individual cohorts, one can draw a conclusion that old clients are slowly "chipping off". An example can be the cohort from 2015 (clients acquired this year). In the first year, the company generated revenues of PLN 31 million on these clients. In the following years, customers acquired in 2015 generated between PLN 17-18 million per year. For now, however, each subsequent cohort is better than the previous one. In 2016, the cohort generated PLN 57 million in revenues. In the following years, the revenues of this group of customers oscillated around PLN 32-33 million.

Source: own study based on data from the prospectus

The financial data

With the increase in the scale of operations, the profitability of the business also improved. Below is a summary of Answear.com's financial results:

| in PLN million | 2017 | 2018 | 2019 |

| revenues | 145,0 | 220,8 | 311,2 |

| Operational profit | -7,8 | -7,0 | 4,3 |

| Operating margin | -5,4% | -3,2% | + 1,4 % |

| Net profit | -8,9 | -8,3 | 10,8 |

Source: own study based on data from the prospectus

The reason for the improvement in revenues in 2019 was the increase in the number of orders to 2 million (1,5 million in 2018). At the same time, the average order value increased to PLN 221 from PLN 214.

Results for 9 months below:

| in PLN million | 9M 2019 | 9M 2020 | YoY change |

| revenues | 205,7 | 263,4 | + 28,1 % |

| Operational profit | 0,9 | 12,1 | + 1244,4 % |

| Operating margin | + 0,4 % | + 4,6 % | +4,2 pp |

Source: own study based on data from the prospectus

The reason for the increase in revenues was the increase in the number of orders (from 1,42 million to 1,74 million), also helped by the better conversion rate which increased from 1,79% to 1,81%. At the same time, in 9M 2020, the average value of the basket increased by PLN 12 y / y to PLN 224.

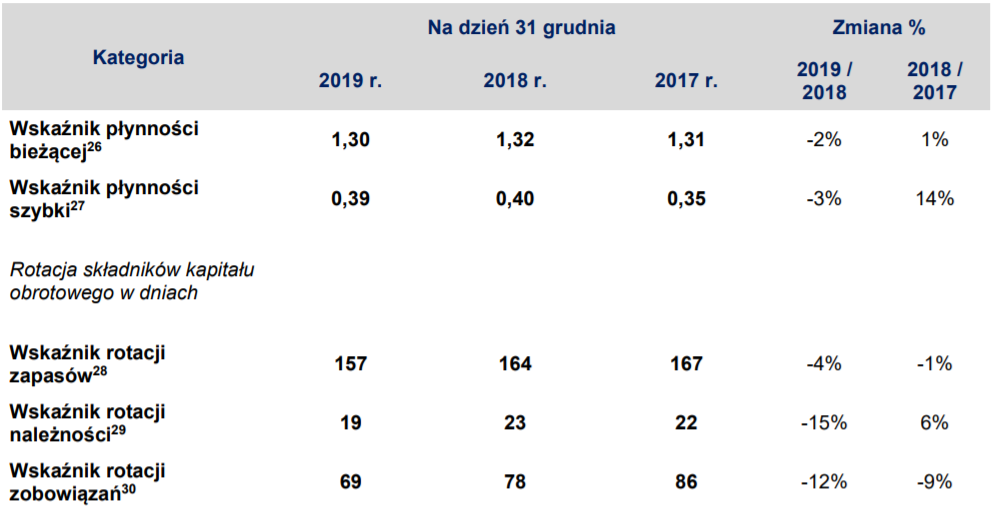

Rotation indicators

The business model requires high inventory levels, which requires a high demand for working capital. In 2019, it caused a cash outflow of PLN 6,1 million. In 2019, the company generated negative cash flows from operating activities in the amount of PLN 2 million. A year earlier, cash flows from operating activities amounted to PLN -14,8 million.

At the end of 2019, inventories amounted to approximately PLN 88 million. The average inventory turnover is over 5 months. The advantage is the quick collection of receivables, which takes about half a month. As a result, the entire operating cycle (from purchase of goods to collection of receivables) in 2019 was almost half a year (176 days).

Source: prospectus

Purpose and strategy

The company planned to collect PLN 65 million from the IPO. The funds were to be allocated to:

- extension of the offer - PLN 25 million

- private label development - PLN 5 million

- marketing activities - PLN 20 million

- international expansion - PLN 10 million

- infrastructure development - PLN 5 million

Extending the product offer

The company plans to increase the number of brands to 500. At the same time, the assortment is to increase to 2024 by 150. SKU. Increasing the available offer is to lead to an increase in the conversion rate, frequency of purchases and the value of a single basket.

Own Brand Development

The goal is to achieve over a dozen percent of sales from Answear LAB (Own Brand) products. Own brand should increase gross margin. Increasing the unique assortment is to contribute to increasing the number of new customers.

Marketing activity

Increasing sales in the existing markets requires an increase in marketing expenditure. Increasing brand recognition is to result in better conversion and an increase in the average value of the basket.

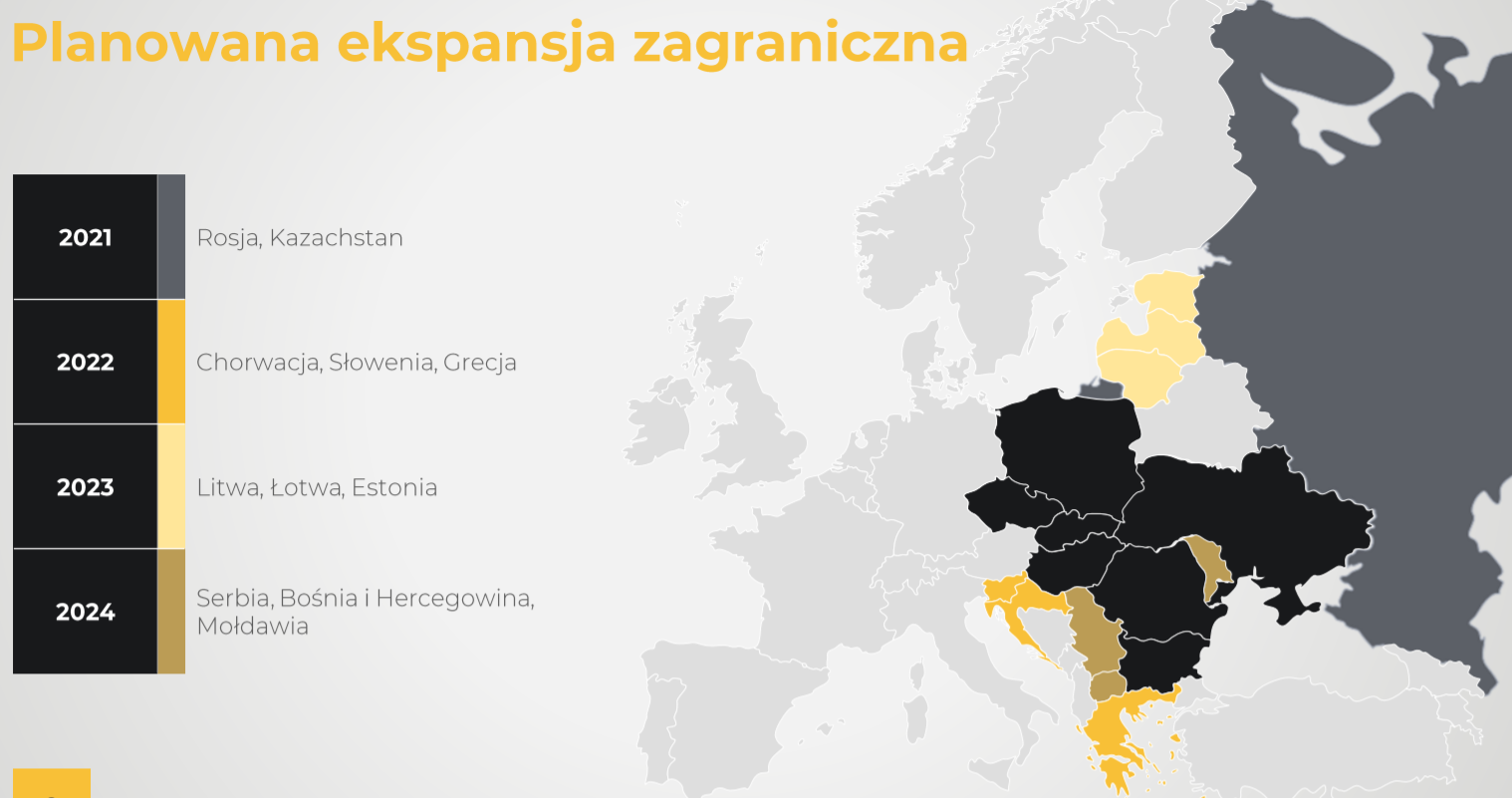

Development of new markets

Further international expansion is to lead to an increase in revenue dynamics. Below is the expansion schedule presented by the company:

Source: company presentation

Development of infrastructure

Sółka planned to allocate PLN 5 million to several projects. They are, among others expansion of the photo / video studio, development of the mobile application, development of the IT system and additional warehouse equipment.

Competition

The company does not operate in a vacuum. Answear.com competes with larger companies in many markets. The company's biggest competitors are Zalando, Allegro, e-shoes, Bon Prix and About you.

Zalando

It is a German company operating on the e-commerce market. Zalando has a very wide range of footwear, clothing and accessories. It operates in Western Europe, Poland and the Czech Republic. It is a company listed on the German stock exchange.

Zalando stock chart, D1 interval. Source: xNUMX XTB.

Allegro

The largest e-commerce platform in Poland. The number of platform users exceeds 14 million. On Allegro platform various products are sold incl. clothing and footwear. For this reason, it is a competition for specialist platforms such as Answear.com.

Allegro stock chart, interval H4. Source: xNUMX XTB.

e-shoes

It is a subsidiary of CCC. e-footwear sells footwear, accessories and handbags. The website includes products of domestic and foreign brands. It is present in all markets where Answear.com operates.

CCC stock chart, interval D1. Source: xNUMX XTB.

Good price

It is an online store offering women's, men's and children's clothing. The offer also includes products for households. This is competition on all markets in which Answear operates. Bon Prox is part of OTTO Versand.

about you

German online store. The offer includes clothing, accessories and footwear from several hundred brands. It conducts activities competitive on the Polish, Czech, Slovak, Romanian and Hungarian markets.

Wildberries

Russian company operating in the e-commerce market. The website offers, among others accessories, shoes and clothes. It operates on the Russian, Polish, Slovak, Belarusian, Ukrainian and several countries of the former USSR.

Risk factors

The company operates in a very competitive market, therefore the ability to retain customers is essential. It is therefore necessary to create an attractive offer, which will make Answear.com different from the competition. If a company chooses a strategy to compete solely on price, it will be damaging to the company's profitability. The quality of service must be constantly improved so that satisfied customers do not have to look for other alternatives on the market. A large base of loyal customers is crucial for an e-commerce business as customer retention is more cost-effective than acquiring a new customer.

In running an e-commerce business, it is important to spend money on advertising effectively. Brand recognition is necessary to maintain a market position and attract additional traffic to the website. There is a risk that, despite the successes in the past, investments in marketing will turn out to be ineffective in the coming years. In such a case, it would have a negative impact on the company's future financial results.

Another risk is the impact of exchange rates on the company's results. Currently, 30% of the company's revenues are generated in the national currency. Continued foreign expansion will most likely cause the share of revenues generated in the domestic currency to decline. This will increase the exchange rate risk on the company's operations.

Another significant risk is logistic efficiency. Currently, the company operates from one central warehouse. However, geographic expansion in the future will require shortening the distance between the product and the end customer. The company has not faced such logistical problems so far.

Where to buy Answear.com shares

Answear.com will debut on the stock exchange in the next few days. Subscriptions for shares ended on December 17, 2020, therefore only the secondary market remained available to new buyers. Below is a list of selected offers Forex brokers offering both an extensive stock offer and CFDs.

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 3 - CFDs on stocks 16 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MT5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Answear.com has in recent years become one of the leading companies operating in the online clothing and footwear market. At the same time, over the past few years, the company has significantly increased the scale of its operations both on the domestic and foreign markets. Moreover, the company operates in a market that will develop dynamically in the coming years. Answear.com, as well as other companies in this industry, will be assisted by the increasing transition of trading to the online channel. This is another debut of a company operating on the e-commerce market in Poland. The previous major debut belonged to Allegro.

It should be remembered that the company does not operate in a vacuum and will have to repel the "attacks" of competitors that conduct a much larger scale of operations. Institutional investors approached the company's IPO with a distance, which resulted in a lower issue price, which was over 30% lower than the maximum price. As a result, the minority shareholder (MCI.TechVentures) reduced the number of shares sold.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Debut of Answear.com - what is worth knowing before the debut? [Guide] answear debut](https://forexclub.pl/wp-content/uploads/2020/12/answear-debiut.jpg?v=1609337176)

![Is index investing for everyone? [Debate] globalconnect gpw](https://forexclub.pl/wp-content/uploads/2022/11/globalconnect-gpw-300x200.jpg?v=1667553873)

![Debut of Answear.com - what is worth knowing before the debut? [Guide] The situation on the markets after the new year](https://forexclub.pl/wp-content/uploads/2021/01/Sytuacja-na-rynkach-po-nowym-roku-102x65.jpg?v=1609751190)

![Debut of Answear.com - what is worth knowing before the debut? [Guide] raw materials 2021](https://forexclub.pl/wp-content/uploads/2021/01/surowce-2021-102x65.jpg?v=1609828374)