Macroeconomic data - to use or avoid?

A rigid division into technical and fundamental traders for traders Forex / CFD slowly becoming a thing of the past. We can find a lot of tips and advice about trading on various websites and blogs. Often (by the way of this "technical" content) we will find information to focus entirely on the chart and let go of trading when important data is published on the market.

However, when looking at professional traders (from investment banking and hedge funds), although they use technical signals and analyze the market, enter and conduct transactions, they use macroeconomic data for their trading. Why should you analyze their trading styles? Despite the fact that we will never know their strategy 100% for the simple reason that it is simply a secret, it is convincing to argue that this 5% group of all traders generates practically 95% volume in the market. Therefore, in order to trade like a professional trader, it is worth adopting the habits that they follow. Among them is the fundamental preparation for trading, which I want to write a little more about today.

Normal tools for unusual trading

Why is macroeconomic preparation so important to make amateur trade more orderly? Principle "The trend is your friend" is widely known. Where does the trend come from? How many professional traders, so many theories. Nevertheless, everyone will rather agree that it is correlated with macroeconomic data and geopolitical events, which cannot be forecasted due to their impulsive specificity.

It is completely different with macroeconomic data. Generally, everyone has access to them. We could even simplify this reasoning to just have a tab with a macroeconomic calendar. Is it enough? Not necessarily. We should use a source where we have access to current events and information. I personally use Reuters due to the possibility of creating templates (which I will talk about later) and having everything in one place. If you do not want to pay for "extra" trading extras at the beginning of your trading adventure, you can search for this information on several different pages. The downside of such own research is, of course, a few tabs that we have to browse through, and filtering and categorizing the information received in such a way as to focus only on the most important. No matter what we decide on, what is important in all this is the systematic and methodical activities that we will perform through selected websites and portals.

What to analyze?

A professional trader prepares for his trading systematically and methodically. We mentioned this above. For our actions to have arms and legs, it is worth planning them once, but thoroughly. If we do not want to incur additional costs at the beginning of trading due to the use of paid analytical tools, we must prepare to break down "tasks" into different portals and ... MT4 / 5. I would like to point out a bit my own preparation taken from institutional trading, which I have modified for my needs. You may as well further upgrade this list for yourself according to your trading style, the instruments you trade and the market.

# 1. Major currency pairs

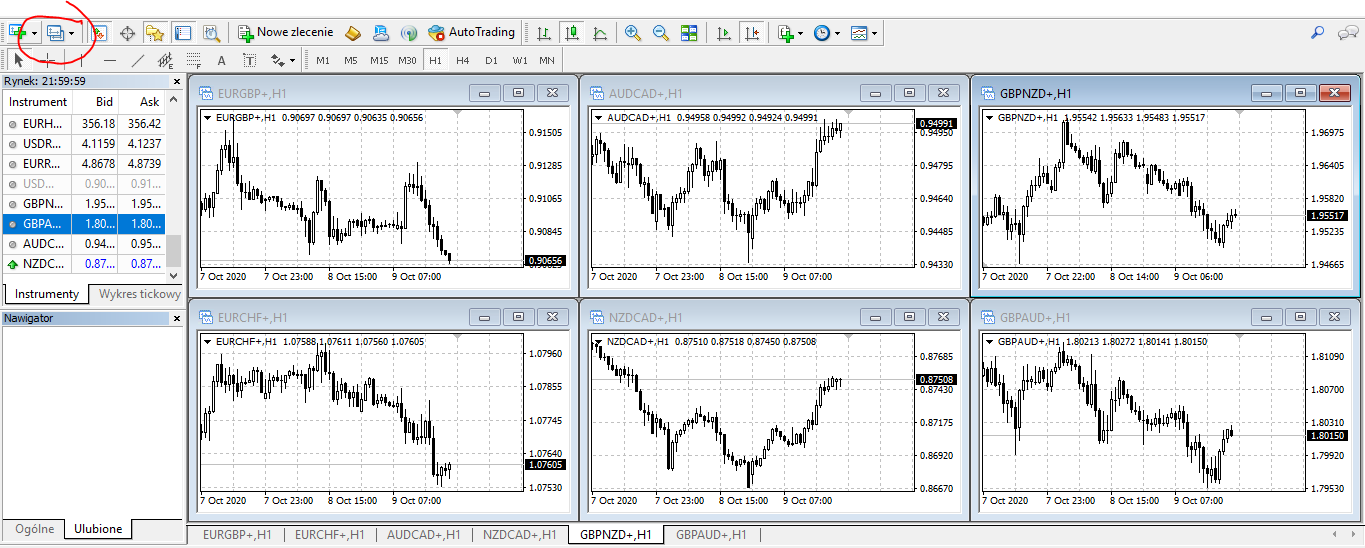

On your own "Overview panel" I have 6 currency pairs added which I set myself according to their correlations. Even if I would not trade on the majors, a quick glance at the trends and movements taking place there tells a lot about the sentiment prevailing on the stock exchange. To make it more convenient and efficient to move around MetaTrader 4 / 5 you can save a "clean" template, which you can use to re-work with any modifications to the chart.

The second step in following the major currency pairs (I don't have NZD) is to spot major moves and take a quick look at the news to find out what caused them. Without advertising any of the news sites, the choice of the place where we will search for this information is free. It is worth looking for an information portal that will have market information grouped thematically.

# 2. Determining directions and levels on main and cross pairs

In the first step, I focused only on the proverbial glance at the charts to catch the trend and bigger traffic. I also looked for information on the most important events that determined them. So I know the market sentiment and the fundamental impulses that created them. This usually takes about 20 minutes.

In MT4 it is possible to save templates. In the graphic above, we have marked this option with red underline. In addition, the overview panel with cross pairs is shown above, on which we also define trends and levels in which the price is subject to a clear reaction. It still happens a little in the ether. It is true that the levels can be plotted on the chart. Personally, I only do it on point three.

# 3. Technically

The third point is the analysis of the selected currency pair at different time intervals. Importantly, the decision interval for this example up to H1. I break a few into charts Monthly, Weekly, Daily and H1. On each chart I have a trend marked and important resistance support points. I do this to determine the short-term price response. If the H1 chart fits into the overall picture (obtained from other intervals), i.e. de facto trend, for me it is a good opportunity to look for a place to enter a position.

# 4. Foundations for today

The next step is to look at the macroeconomic calendar for today. Thanks to this, I try to focus on instruments that will be more volatile. I can also relatively estimate the time to trade. If the relevant data comes out at 14:00 PM, I plan my time in such a way that by this time (if I want to play against this data) I have precisely open positions, according to my strategy.

What do I gain by combining foundations with technology?

This routine and methodology has many benefits. First of all, by going through a few steps, which on average take about 40-60 minutes, I know the following:

- what happened in the market yesterday,

- what is the sentiment

- what is happening on financial instruments that interest me,

- what is my plan for today, assess the trading potential,

- what will happen today and when

- what currencies should I focus on.

How to analyze fundamental data? We wrote about it in several previous texts on macroeconomic indicators that you will find HERE.

As far as additional and useful tips regarding the fundamental and technical preparation for trading are concerned, I would like to add that a separate and equally important issue is to observe the policy of central banks. Their decisions largely drive market trends.

There are many factors to be analyzed. Organizing your work with charts is extremely important. Not only does it automate trading in some way, but also disciplines our activities and leads us on the path of greater professionalism.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)