Macroeconomic data: What is the money supply?

The money supply is one of the issues not fully understood by "Average Smith". This is due to a significant simplification that can often be found, it can be characterized as: increase in money supply = increase in inflation. This is a significant and harmful simplification. The article presents basic information about the money supply.

The money supply is the total value of money in circulation. Of course, this is not only cash, but all its derivatives. In order to facilitate the analysis of individual aggregates, measures are adopted M0, M1, M2 and M3. In the further part of the article, individual components will be briefly characterized.

Money supply - formula

Analysts and economists follow the central bank's policy of controlling inflation and the real one interest rate. The analysis of the money supply is important because in some situations it may translate into the price level in the economy. While in the twentieth century in some periods there was a correlation between the price level and the supply of money, after 2000 this relationship became "unstable". In order to understand how the money supply is calculated, it is necessary to get to know its components, also known as "aggregates".

The basic aggregate is M0

The said aggregate is the sum of cashless money accumulated on accounts at the central bank and cash in circulation outside banks. M0 is often referred to as the monetary base or money of great power. This is the narrowest definition of money. According to data collected by National Bank of Poland (NBP), in May 2021 the monetary base amounted to PLN 412 billion and increased by 29,4% during the year.

Aggregate M1

It is a bit broader than M0. It is cash money and current deposits (deposits in banks and other financial institutions) payable on demand (a vista), which belong to private persons, enterprises, financial institutions other than banks, local government institutions or the Social Insurance Fund. So it is a much broader concept than the monetary base. Sometimes M1 is also called transaction money because it can be used to immediately complete a transaction. According to data collected by the National Bank of Poland in May 2021, the monetary aggregate M1 amounted to PLN 1622,8 billion, which meant an increase by 21,3% over the year.

Aggregate M2

The aggregate M2 consists of all components belonging to the aggregate M1 and term deposits in commercial banks with an expiry date of up to 2 years and short-term promissory notes or money bills. Due to the fact that such deposits have lower liquidity (transactions can only be paid for after termination of the contract), this aggregate is much less liquid than the components of aggregate M1. In its report, Narodowy Bank Polski indicated that in May 2021 this aggregate was worth PLN 1866 billion. During the year, the said aggregate increased by 9%.

Aggregate M3

It covers the widest group of assets. It is also the least liquid monetary aggregate published by the National Bank of Poland. Goes into his the composition of both the M2 aggregate and debt obligations with the original maturity of up to two years and participation units in domestic money market funds. According to In May 2021, the NBP mentioned aggregate was worth PLN 1872 billion and increased by less than 9% during the year.

Monetary policy of the central bank

The said aggregates are published monthly by the National Bank of Poland. As a result, analysts do not have to collect information about the money supply themselves. The central bank can regulate the money supply in the market. Both through a change in interest rates and through a change in the required reserve rate, or through open market operations. A central bank's monetary policy can be expansionary, restrictive or neutral.

Increasing the money supply

This is a situation where a central bank tries to increase the amount of money in the economy. The central bank can do this by lowering the cost of money in the economy (reducing the rediscount rate). Cheaper capital may help to create more debt, which will translate into an increase in aggregates such as M3. Another idea is to lower the reserve requirement ratio, which can help create "extra money" through the banking system (more credit -> more investment and consumption -> more economic growth -> more deposits). When does a central bank care about increasing the money supply? This may result, for example, from the weakening economic situation in the country and the efforts of the central bank to alleviate this situation.

Reduction of the money supply

It is a restrictive policy of the central bank. In such a situation, the central bank may increase the cost of money, which will lead to a "natural" reduction in credit in the economy. Another option is to raise the reserve requirement ratio. This will lower the money creation multiplier, which may reduce the M3 aggregate. The reason for introducing a restrictive monetary policy may be the desire to "cool down the economy" or to reduce the inflation rate.

Money supply and inflation

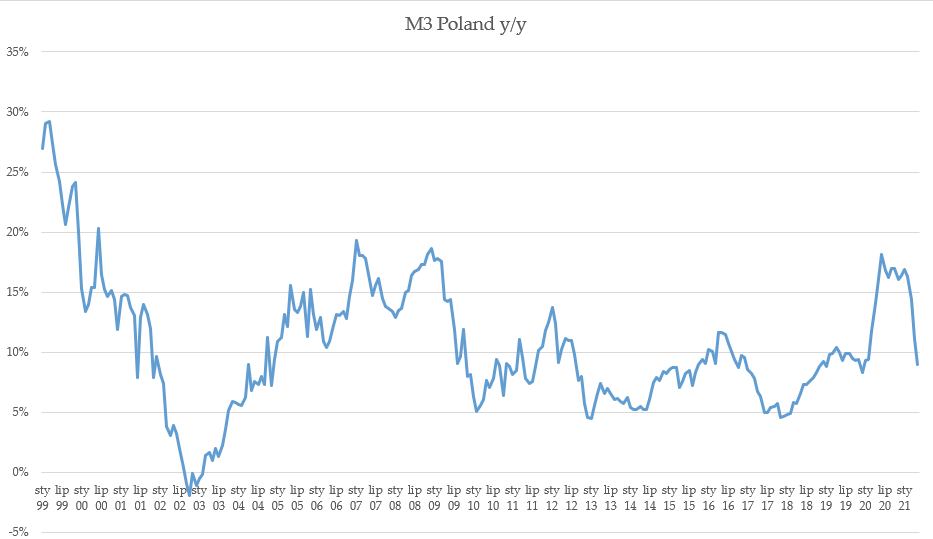

In the nineteenth century, it was believed that an increase in the money supply translated directly into an increasing price level (inflation). However, over the last dozen or so years no correlation has been observed between the change in money supply and the level of inflation. For the price level, it is not the size of the aggregates that matters, but what happens to them and where they "end up". If they do not go directly to the economy (in the form of investments, consumption), then no significant increase in prices should be expected. In addition, if there is an "advantage" of the supply of goods and services over demand, even an increase in aggregate demand, which is stimulated by "expansionary" monetary and fiscal policies, will not cause prices to rise sharply. As can be seen, most of the time, the M3 aggregate in Poland grew at a rate of 5-15% per year. In turn, Polish inflation rates were much lower than the size of the M3 money supply itself.

Own study based on data National Bank of Poland.

Sometimes the increase in the money supply is caused by rising public debt, which is supposed to moderate the impact of the economic downturn. A perfect example is the reaction of the United States or European countries (including Poland) to a sudden economic slowdown. Increasing debt during an economic downturn or collapse is standard government "practice". They use future income streams to ensure that consumption levels are "smoothed out" today to prevent major imbalances.

Another engine of money supply growth was also the expansionary monetary policy of central banks. The aforementioned reaction of governments and central banks prevented demand in the economy from collapsing. At the same time, inflation did not rise above the "dangerous level". Of course, this does not mean that if the rulers and central banks do not have to worry about the level of the money supply and debt. If the brakes fail, countries may start to struggle with inflation and a hump of debt.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)