Macroeconomic data and volatility in the Forex market

The foreign exchange market is undoubtedly gaining more and more popularity. One of the main aspects for which it is so interesting for investors is high volatility which prevails on it, relatively higher than, for example, on the stock market. Every day countless transactions are concluded on it. You can get the opinion that the market discounts everythingHowever, also macroeconomic data are undoubtedly one of the most important factors causing fluctuations in the exchange rate pairs. Just to mention memorable "Freeing the exchange rate of the Swiss franc"or even the first vote in the case Brexituto recall how the currency data reacted spectacularly. In this article, we will present the characteristics of the most important data and their impact on the markets.

The most important data in one place

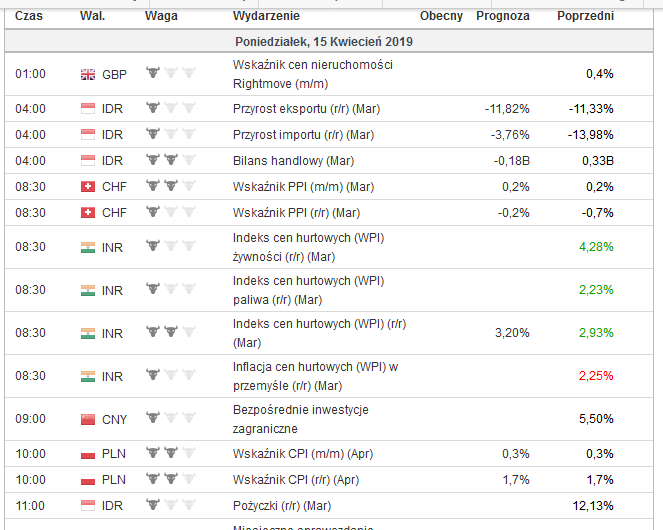

All the most important macroeconomic data, the administration is made public. The macro-economic calendar is a tool that allows you to collect all in one place. Calendars are available on many industry pages, an example can be found, for example, on the website Investing.com. Tradays by Metaquotes is also an interesting option - more about this application can be found under THIS link.

The most important thing that a novice investor should pay attention to is:

- time of publication,

- currency: country for which specific data applies,

- weight: impact of a given indicator on the market. In the example calendar: one bull is not significant, two bulls - figures moderately significant, three bulls - the most important data,

- event: name of a given macroeconomic indicator,

- forecast: predictions about the value of a given reading,

- previous: value of an earlier reading.

In practice, the most important thing is to pay attention to weight, the most important data usually cause the greatest volatility on the market, and on the difference of the current value relative to prognozy. In theory, a value higher than expected, should cause appreciation, ie strengthening of a given currency, while the opposite situation is its weakening, ie depreciation.

Be sure to read: Is it worth investing in the time of macroeconomic data

Macroeconomic data - Characteristics

Interest rate decisions - one of the most important data that have a direct impact on FX rates on the forex market. We know from today that interest rate, affects the attractiveness of the given waluty. If the currency is highly interest-bearing, investors are eager to invest their savings in it. This causes an inflow of capital / deposits to a given country and an increase in demand for the given currency. A low interest rate is in turn attractive to people who, for example, plan to take out loans in a given currency.

Retail sales - Retail sales refer to changes in sales, i.e. expenses of all consumers. Consumer spending is related to the profits of enterprises. The relationship is simple, if consumers spend more, the profits of enterprises / companies will increase, which in turn means that at least theoretically enterprises spend more on investments. Typically, when it comes to readings a value higher than the expected forecast, She should strengthen the currency of a given country.

CBA - otherwise gross domestic product. GDP is nothing but the value of all goods and services produced in a given country in a given unit of time. It is a kind of determinant of the size of the economy. Regarding interpretation, it is usually increase in GDP dynamics in relation to the previous reading, should strengthen the currency of a given country.

Applications for unemployment benefits - very important data on the labor market. They inform about the number of people who first applied for unemployment benefits during the last week. They also testify to the general condition of the labor market, which is why, as a rule larger readings (more benefits) negatively affect the given currency country.

Consumer / producer price index (CPI, PPI) - one of the most popular "measures" of inflation. These are important data for investors, because central banks, when setting interest rates, take into account the size of inflation. High inflation, it may be an impulse to raise interest rates, which, as a consequence, may cause increase in the rate waluty of the country.

PMI index - important data illustrating the economic situation in the United States. Index values are based on surveys that are completed in companies operating in industries service and production. As for the readings, it's very much the value of 50 points is important, because it is considered as a limit value, between slowdown and increase. Similarly, the value above 50 should result strengthening of a given currency, value below 50, its weakening.

Unemployment rate - data on the unemployment rate are somehow related to unemployment benefits, as they also refer to the "strength" of the labor market of a given country. It can be assumed that a greater number of unemployed people will have a negative impact on GDP, because fewer people are working = less consumption. The readings can be interpreted similarly to the data on unemployment benefits, i.e. if the reading will be larger (higher rate), it should have it negative impact on the exchange rate of the country.

Trade balance - in the simplest terms, the trade balance relates to the difference between exports and imports of a given country. if export exceeds import then we say that we have so-called trade surplus. The reverse situation is called trade deficit. The trade surplus causes the demand for the currency of a given country to increase and thus it may cause it its strengthening.

Change in employment - data inform about the number of new people who found employment in a given period of time. The greater number of jobs indicates that the economy is in "good condition", which positively translates into the currency of a given country. The most important data for investors of this type is the so-called change in employment in the non-agricultural sector (USA), i.e. popular Non-farm Payrolls.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response