What are PAMM accounts and how they work?

Alternative forms of investing on Forex marketsuch as PAMM accounts or social trading, are becoming more and more popular. They open up new trading opportunities for both beginners, intermediate and professionals who can easily not only increase their income, but also diversify their investment portfolio. What are PAMM accounts, how do they work and who are they intended for? The following article will answer these questions.

What are PAMM accounts?

PAMM is an abbreviation for Percent Allocation Management Module, i.e. translating the percentage allocation management module literally into Polish. The name itself may seem insignificant, which is why a more extensive explanation is useful.

With PAMM accounts, one trader can make identical transactions on several accounts at the same time without the need to log in. There is also no need to enter passwords, restart the platform, select an appropriate transaction volume and insert orders. In other words, this technology allows you to combine several accounts together into one account.

Managed accounts are a variety of managed accounts or a kind of equivalent of mutual funds.

Who are PAMM accounts for?

It is possible to distinguish two main target groups to which PAMM type accounts are addressed. They are managers and investors.

- Managing they are people who know each other on trade and achieve satisfactory results (read: earn). Thanks to managed accounts and the scale effect, they can significantly increase their revenues without excessive effort, properly performing the same activities as before. By showing the history of their results they may be able to encourage the second group of investors who decide to cooperate.

- Investors is a group that has capital but no knowledge or skills, that is, people who would like to multiply their savings on the currency market, but do not know how they prefer to entrust this task to more experienced traders.

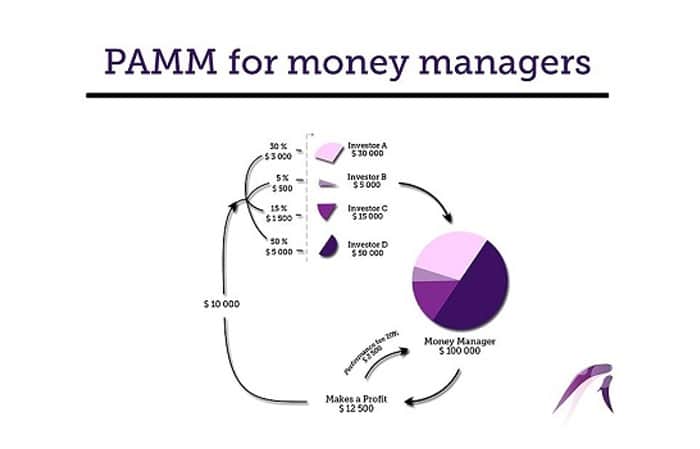

How do PAMM accounts work?

There is no uniform specification of how PAMM works, because Forex brokers Generally, they create their own technologies and solutions that enable the allocation of investors' funds, but the general scheme of operation is always similar. Starting cooperation is very simple:

- Trader opens a managed account for which no deposit is paid.

- The investor establishes an actual account with the same broker and pays a deposit to them.

- The investor connects his account to the managed account.

- Trader begins to invest.

The managed account shows the sum of deposits from investor accounts that have been connected. Let's assume that three investors have connected their bills:

- A - with a deposit of PLN 25,

- B - with a deposit of PLN 25,

- C - With a deposit of $ 50.

The manager sees it as one account with a deposit of PLN 100 and starts investing in it. When opening a transaction with a volume of 000 lots, each investor sees a transaction with a value proportional to the deposit made, i.e. 10 lots, 2,5 lots and 2,5 lots. It is similar with the distribution of the earned profit.

If the trader earns another PLN 100 on the main account, this will be proportionally profitable. will be distributed proportionally among investors in the amount of:

- PLN 25,

- PLN 25,

- and PLN 50.

At the moment when a given investor decides to withdraw part of the deposit, his / her share in the account will decrease, and thus smaller volume will be visible on his account and lower income will be generated on subsequent transactions.

The investor does not transfer his funds anywhere - they are still on his brokerage account. The manager cannot withdraw them or transfer them to another account.

How much is it?

Usually, the only cost that accompanies investments in PAMM accounts is the manager's commission, which depends on the results achieved. This commission is determined in advance in a percentage and settled on a specific date (eg every month, quarterly, every year). If the manager sets his / her rate at 25%, it means that at the beginning of the new billing period he will receive 25% of the generated profits in the PAMM account. The investors' income (value before taxes) will also be reduced.

Sometimes you can come across other types of commission, e.g. annual management fee or volume fee. In practice, investors are reluctant to agree to it, which is why managers are unlikely to do so.

Transaction costs such as commission or spread on the platform affect the investor only indirectly. They affect the level of income obtained by the manager, who obviously does not earn extra money on it.

Legal regulations

Regulators from some countries do not like the idea of PAMM accounts. They feel that the wrong people are managing the funds and are starting to require specific licenses from the managers to increase security.

However, it should be remembered that even having a license, i.e. passing even the most prestigious state or international exam, will not guarantee that a given person will achieve satisfactory results. However, it can be assumed that she will have at least a thorough theoretical knowledge.

In Poland, the regulations concerning the Forex market itself do not specify many issues. This is all the more difficult to expect for PAMM accounts. If we treat them as managed accounts, an Investment Advisor license will be required for such activity. It's just a moot point. The manager himself usually has no contact with the investor. He also does not accept any management funds from him on his account. In a simplified way, we just copy transactions from one account to another.

Some managers, not wanting to legally risk, open companies in countries where regulations do not prohibit being managers on a PAMM account. This does not increase the risk of investment because the safety of funds depends on the choice of the manager himself (his skills) and the brokerage company. Our capital will be in her bank accounts.

Examples of brokers offering PAMM accounts:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response