What is the Forex market volume?

When reading literature or pages devoted to technical analysis, you can often find the importance of the element which is the volume of transactions. Often, it confirms the credibility of a given formation on the chart or reduces the chances of its formation (course response after its occurrence). By investing on regulated markets, i.e. on the stock exchange or derivative instruments such as futures or ETFs, there is no problem with insight into the volume. On Forex market it's a bit more difficult with that ...

Transaction volume on Forex platforms

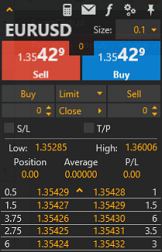

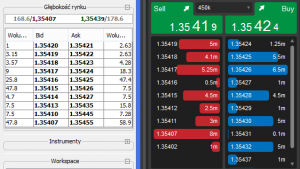

Depending on the platform and broker and the additional tools it offers with the platform, you can get insight into Market Depth (otherwise Depth of Market - HOUSE), or the depth of the market. The depth of the market tells us how many millions of the base currency for a particular pair lies at a given price level. Unfortunately Market Depth it only covers transactions that are available within liquidity providers to which our broker gives us access. It does not illustrate the global volume on the market, however, it tells us how much transaction we can make at a broker at the indicated rate. It is also difficult to say what market share has the visible depth of the market against the background of the total volume, hence it cannot be said with certainty that the presented values are a reliable reflection of the market situation.

READ ALSO: An unnoticed filter of market behavior, or a few words about the volume

Due to the fact that there are many suppliers and not everyone is connected to the same, the depth may vary between brokers ECN / STP at the same time on the same instrument as you can see in the picture below.

The volume on the MetaTrader 4 platform

Do you happen to use the built-in Volumes indicator or do you use the Volume (Ctrl + L) added to the chart? It may surprise you, however, both of these tools do not have much to do with the transaction volume. Both of them are based on… The number of ticks that flowed onto the platform in a given time. Tick is a single price change (not to be confused with the number of pips), i.e. it is information about how often the price has changed in a given time period. This can be treated as an indicator of instrument volatility, but it will also not be a fully reliable measurement.

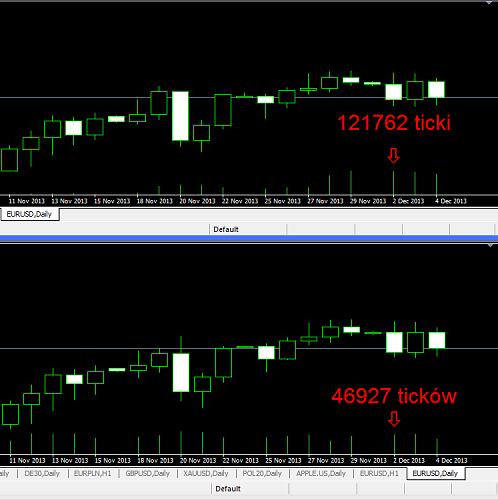

Number of ticks on the MT4 platform

If we take two brokers from MT4 and run Volume on two identical instruments, we will definitely get different results. Although they may be similar, they certainly will not be identical. This is due to the fact that some brokers filter their datafeed to varying degrees. This partly protects their servers against excessive load, and on the other hand, avoids the creation of bad ticks.

READ ALSO: What are Badetic and where do they come from?

Some STP and ECN brokers offering trade through MT4 provide custom tools with the platform in which we already have access to the depth of the market. This is the only solution because MT4 was created in times when the ECN era for the detail was almost unrealistic (in MT5 we already have SUN in standard).

Of course, like the rest of the platforms, it SUN delivered by means of these tools concerns the volume from the liquidity providers to which the given broker is connected.

Where can you get access to the global market depth?

To do this, you need to go to specialized companies that collect and distribute data sources. Of course, access to this information is not free and requires the purchase of a license for their software. These are, for example:

- Reuters,

- Bloomberg,

- eSignal.

| Reuters | Bloomberg | eSignal | |

| The name of the software | the range of FX products | Bloomber Charts | eSignal / Advanced GET |

| Price | depending on the product | b / d | from 145 USD per month / from 295 USD per month |

| Free sample | NEVER | YES | YES |

Of course, the above software gives many, many more possibilities and access to data beyond the FX market itself.

Cheap or expensive?

Well, everyone has to answer this question for himself. Is it really profitable for us to buy the software? How to measure real benefits? First of all, determine whether your strategy really needs confirmation in the form of a reliable volume value to be effective or simply more profitable. If the answer is "NO" then there is nothing to think about. If, on the other hand, it is affirmative, you have to recalculate it and, unfortunately, test access to the volume. In the event that the monthly result will improve by the amount of the license cost, such a move will make sense. It will certainly depend on the volume we operate and the number of transactions we conclude. For long-term traders operating on micro- and mini-lots, the profitability of such a venture will be much lower than for scalpers and day-traders playing with a few or a dozen lots per transaction.

Volume on regulated markets

You can also go to regulated markets (e.g. CME exchange), where investing is no longer based on spot transactions CFD but on futures contracts. Due to the fact that the entire turnover is regulated, we immediately have access to a reliable volume that concerns ... the contracts themselves. It is true that these are completely different instruments than those offered by FX brokers, so theoretically, for contracts, the volume based on contracts is fully reliable for a given exchange. The question, however, is whether this is what we meant? We have access to a reliable volume on the stock exchange, but it forces us to play on the contract, where there is less leverage, more min. position volume and other restrictions. In addition, this instrument may be dependent on what is happening in other markets, including spot trading, so it will not completely solve the problem.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] vs faq](https://forexclub.pl/wp-content/uploads/2023/06/vsa-faq-300x200.jpg?v=1685689430)

![The use of volume on the forex market in practice - Rafał Glinicki [Video] Volume utilization in the forex market](https://forexclub.pl/wp-content/uploads/2023/06/Wykorzystanie-wolumenu-na-rynku-forex-300x200.jpg?v=1685602297)

![Rafał Glinicki – The use of volume on the forex market in practice [Webinar] Rafał Glinicki Using volume in the forex market webinar](https://forexclub.pl/wp-content/uploads/2023/05/rafal-glinicki-Wykorzystanie-wolumenu-na-rynku-forex-webinar-300x200.jpg?v=1684850257)