What is spread trading? Trading futures and options

There are many investment strategies. While everyone knows such strategies like scalping or swing trading it's a lot of interesting strategies not too well known. One of them is spread trading. In today's article, we will briefly describe what this strategy is all about and what its advantages and disadvantages are.

What is spread trading?

In finance, spread trading is also called RVT (relative value trade). The strategy consists in the simultaneous purchase and sale of a given financial instrument. Of course, instruments have different parameters. Spread trading is used quite often in options trading and futures contracts.

The spread itself is the difference between the price of two “legs”, short and long. In the case of futures, spread trading is about making a profit as the spread between instruments narrows or widens. The spreads are either "bought" and/ or "sold". It all depends on whether the trader makes money by widening or narrowing the spread. Spreads on futures contracts can be of the following types:

- intra-market – the same underlying instrument, but different expiry dates,

- inter-market – different underlying instrument, but the same expiry dates.

In the case of using spreads on options, the range of possibilities is much wider. You can use horizontal, vertical and diagonal spreads. More on this issue later in this article.

Types of spread trading on futures

There are many strategies related to spread strategies. We will not describe all of them. We will focus on the most commonly used futures strategies.

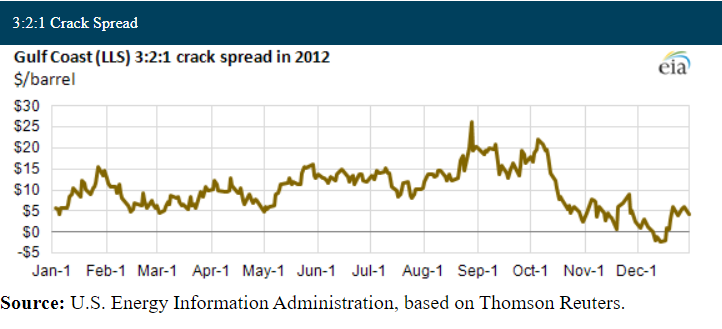

Crack-spread

Crack spread is a term used in the petrochemical industry and by futures speculators. Crack spread is the difference between the price of crude oil and petroleum based products. In simple terms, it is the refinery's profit from the crude oil cracking process.

When trading futures, the crack spread consists in simultaneously taking opposite positions on the price oil and e.g. petrol or heating oil. Such transactions can be made by both petrochemical companies to secure their margins and speculators who will bet on narrowing or widening the spread.

Spread widening is taking a long position on cracked products and simultaneously taking a short position on crude oil. The investor will earn if the price of gasoline or heating oil will grow faster or fall slower than the change in the price of crude oil. The investor will lose when the price of oil rises faster or falls slower than petroleum products.

Some oil processors use the so-called 3-2-1 crack spread. The strategy is to go long on oil (3 barrels) and sell contracts for gasoline (2 barrels) and one barrel of heating oil. Other types of strategy are 5-3-2 and 2-1-1.

Source: EIA.gov

spark spread

It is the difference between the wholesale price of electricity and the price of energy raw materials. Spark spread refers to the relationship between the price of electricity and the price natural gas. There is also the so-called dark spread, which calculates the cost of coal needed to produce energy instead of the cost of natural gas. If the price of electricity grows slower or falls faster than the cost of the raw material, the spread narrows. Otherwise, the spread increases, which is beneficial for electricity producers. This spread can be traded on Intercontinental Exchange (The ICE).

crush spread

This is a strategy that involves taking opposing positions on soybeans and e.g. soybean oil. Soybean processors can use this strategy to secure their raw material processing margin. In this case, the crush spread is a long position on the soybean price and a short position on the soybean oil or soybean meal futures contract.

Speculators can, however, assume how the spread will develop in the future and take positions depending on their predictions. If he decides that the spread will widen, he will take a short position on soybeans and a long position on soy products. If he assumes the spread narrows over time, he assumes the opposite position.

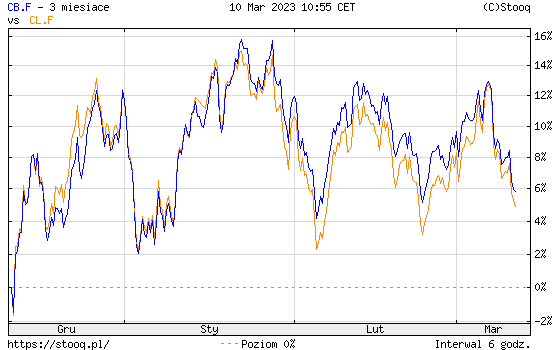

WTI-Brent spread

One of the frequently used spread transactions on futures contracts relates to raw materials that are very strongly correlated with each other. The most popular strategy was to play the spread between the price of WTI and Brent oil. Both types of crude reacted to changes in commodity prices on global markets, but there was always a difference in price between WTI and Brent. Sometimes the spread between these types of oil widened, other times it narrowed. Speculators often used spread strategies with futures contracts.

Spread trading and margin

Margin is otherwise a security deposit. In futures trading, the investor must post collateral in the form of cash or securities. This is because the futures contract has built-in leverage. The margin is to ensure that the investor will be able to cover possible losses on the position. It is worth remembering that the minimum margin is usually lower than for two futures contracts. This is because the volatility of the spread is less than that of a single leg. This allows the trader to build a position with a much larger nominal value.

Spread trading using options

Spread trading is very popular for options trading. Strategies can be distinguished horizontal, vertical i diagonal:

- Horizontal spread is to take opposite positions on options on the same instrument at the same strike price but different expiration dates. The most common type of such a transaction is the calendar spread.

- Vertical spreads are the most common types of option spreads. These are trades that involve counter trades on the same underlying instrument, the same execution date, but different strike prices. These types of trades include bull and bear spreads.

- A diagonal spread is a combination of horizontal and vertical trades. This means that opposite oppositions apply to the same type of option (call or put) and the underlying instrument. The exercise dates and the option exercise price are different.

Of course, we are not going to cover all options spread strategies. We will present only the most popular of each group of option spreads.

Calendar spread

Calendar spreads are executed on instruments with different execution dates. The strategy can be used on futures or options. In the case of options, the calendar spread is the trade applied when the trader sees differences in implied volatility. The simplest calendar strategy is to buy long-term call options and sell short-term call options. The investor will earn in a situation where the price of the underlying instrument does not change significantly over time. This is because the lapse of the time premium is much greater on a short-term option than on a long-term option. After the option expires, the investor can choose to roll over the strategy with another written call option. The maximum trade loss is the difference between the price paid for a long-term call option and the value of the call option written.

Bull spread

This is a directional trade that can be done with a put option or a call option. In both cases, the investor plays for increases.

The simplest to carry out is the bull spread on the call option. It involves buying a call option with a lower strike price and writing a call option with a higher strike price. Both options concern the same underlying instrument and have the same exercise date. Due to the fact that the purchased call option has a higher delta, its premium is higher. This means that assuming a bullish spread from a call requires an initial investment which is also a maximum loss. The maximum profit of the option is: strike price of the written call option - strike price of the purchased call option - premium paid.

You can also create a bullish spread with the put option. In this case, a put option is written at a higher strike price (higher intrinsic value) and an option with a lower strike price is bought. In this case, the investor receives funds on the account, which is the maximum potential profit. The loss is the difference between: the strike price of the put option purchased - the strike price of the put option sold + the net premium received.

- The exercise price of the purchased put option is 15,

- The exercise price of the put option issued is 20,

- net bonus received is 1.

Then the maximum loss is: 15-20+1 = -4

Bear spread

This is a directional trade that can be done with a put option or a call option. In both cases, the investor plays for declines.

The simplest to carry out is the bear spread on the put option. It involves buying a put option with a higher strike price and selling a put option with a lower strike price. Both options concern the same underlying instrument and have the same exercise date. Due to the fact that the put option you bought has more negative delta her bonus is higher. This means that assuming a bear spread from a put option requires an initial investment which is also a maximum loss.

The maximum profit of an option is: the strike price of the put option bought - the strike price of the put option sold - the premium paid.

You can also create a bear spread with a call option. In this case, you write a call option at a lower strike price (higher delta) and buy an option with a higher strike price. In this case, the investor receives funds on the account, which is the maximum potential profit. The loss is the difference between: the exercise price of the issued call option - the exercise price of the purchased call option + the net premium received.

- The exercise price of the purchased call option is 20,

- The exercise price of the issued call option is 15,

- net bonus received is 1.

Then the maximum loss is: 15-20+1 = -4

Diagonal spread

As we already mentioned, it is a combination of horizontal and vertical spreads. Of course, depending on the assumptions made, we can put the emphasis on what will be more in the diagonal spread: vertical or horizontal features. In short, the diagonal spread is the assumption of opposing positions on put and call options. At the same time, both the strike prices (vertical features) and the expiration date of the option (horizontal features) are different. This type of trade is much more complicated to manage than regular (bull, bear) or calendar spreads. For this reason, trading them is only recommended for very experienced traders.

Summation

Spread trading is a very broad concept. This applies to both futures and options trading. Due to the difference in the design of the two instruments, sometimes the spreads differ in their payout profile.

Futures contracts are divided into intra-market and inter-market spreads. Intra-market spreads involve taking opposite positions on the same type of instrument but with different expiration dates. This could be buying a Eurodollar contract expiring in June 2023 and selling a Eurodollar contract expiring in June 2024.

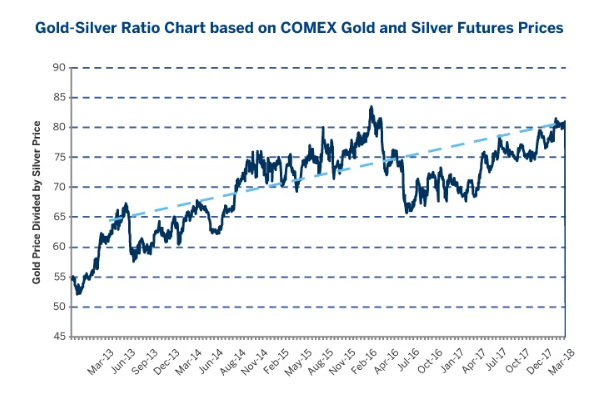

Intermarket spread it is the taking of opposing positions on contracts that expire at the same time but have different underlying instruments. An example is a strategy game gold-silver ratio, where an investor can go long on gold and short position on silver.

One of the disadvantages of futures spread strategies is the so-called legging risk, i.e. the risk of delays in the execution of orders on various markets. The solution is the possibility of using dedicated futures contracts based on an inter-market spread.

The advantage of spread contracts on futures contracts is lower margin requirements. Another advantage is the lower risk of large losses caused by a sharp increase or decrease in the price of the underlying instrument.

For options, there are diagonal, vertical and horizontal spreads. Each has its advantages and disadvantages. For this reason, you should carefully test how a given strategy will behave in different market conditions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)