What is public debt? Reasons, goals, consequences

For as long as we can remember, debt has been present in the history of mankind. The first documented traces of debt go back over 5500 years. It is worth mentioning that the ancient Sumerian civilization dealt with debt, which was common in trade. Unreliable debtors could end up as Slaves. In special situations, debts could be canceled by the king. This practice was echoed by the famous law of the jubilee year, which relieved all adherents of Judaism and Christianity from debt. It was an ancient practice that solved the problem of accumulation of debt.

Obviously, debt is a two-way phenomenon. The debt of one entity is an asset of another. For this reason, there has been constant friction between the debtor and creditors over the years. This article describes the public debt phenomenon.

What is debt?

In a simplified definition, debt can be defined as unfulfilled performance towards another entity. Debt can take many forms, sometimes they are really short term. A person who goes to a restaurant while eating a meal served in a restaurant incurs a short-term debt. This is because she is consuming a meal she has yet to pay for. Only after paying the bill does the debt disappear. So it can be said that the debt does not have to be just about borrowing money. Debt may appear at the hairdresser, beautician or tutoring. In addition to "ordinary" loans and credits, it appears wherever the payment is made "in arrears" (after the service has been performed).

There are two sides to the debt you incur: debtor and creditor. The debtor uses the debt (in money, service) and undertakes to pay it off under certain conditions. The conditions may relate to the interest rate, the amount of installments and the repayment date. The word "may" in the previous sentence is not used accidentally. There is a concept of perpetual debt, an example of such a debt were perpetual bonds issued between the 1888th and 2015th centuries by Great Britain. Most of these bonds were bought back in XNUMX, but the last lots were bought back in XNUMX. In turn, the creditor most often expects in return for the borrowed funds "Risk premium" and "Time bonus", which is included in the interest.

The relationship between the debtor and the creditor at various times ranged from symbiosis to a fierce struggle. In the Middle Ages, some unreliable debtors accused creditors of "usury" which was illegal in many Christian countries. This behavior was an attempt to avoid debt repayment by exploiting loopholes in European legal systems. Creditors tried to minimize the risk of losing money by applying a higher interest rate or looking for a pledge on the debtor's assets. Because lending to states seemed safer, many capital holders preferred to lend to rulers or governments.

The public debt

The easiest division of debt is private debt and the public debt. While private debt should be paid before the death of a given person, public debt in theory never has to be repaid. This is due to the fact that theoretically the state can last "forever". It needs "only" a society that will accept the existence of the state. Citizens of this country also have to pay taxes and pay their liabilities in a currency accepted by the state.

As now, even in the old days, the rulers and governments of countries looked for additional money by issuing debt. There were also situations in which the private debt of the ruler (from a private casket) was repaid from the funds of a given state.

What did countries take loans for? One of the reasons was warsthat required governments to allocate additional resources. This was the case, for example, during the Napoleonic Wars, when the British government won the war but at the cost of a huge debt, which exceeded over 200% then GDP. It was the same during the First and Second World Wars, which left Europe in ruins. Both economically and financially. Then most of the countries of Western Europe became debtors of the United States.

However, states raise additional funds not only for war. Currently, the main reason for incurring debt is the need to cover the budget deficit. Deficit can come from various sources. It may be caused by the necessity to carry out infrastructure expenses which the private sector is not able to provide. Examples include the network of highways, sewage systems and railroads. Generating debt from such ventures may increase the efficiency of the economy and translate into higher tax revenues in the future.

Another reason for issuing debt is loosening of the government's fiscal policy. It may have two sources. One of them is reducing the income side by lowering taxes. In such a situation, the government, without changing the amount spent, "subsidizes" social services by issuing debt. The second reason for loosening the fiscal policy is to increase spending on, for example, social welfare, education or social transfers. The additional funds are not obtained by raising taxes, but by making use of debt.

It is also impossible to forget about The "stabilizing" role of debt. A great example is how governments deal with the freezing of economies. Huge aid programs would not have happened without governments' approval of the rise in debt. In case of German the federal deficit in 2020 amounted to over € 189 billion. The increase in debt has saved more jobs, so there is a chance that the shock caused by the government's response to SARS-Cov-2 will be less than the unacceptable portion of the epidemic's losses to the central budget.

Another reason for issuing debt is the need to "roll over" the old debt. This is when the debt is issued to pay off the maturing debt. In such a situation, the level of debt does not change. On the other hand, the debt maturity structure and its servicing costs are changing. In environment low interest rates, debt rollover reduces the financial cost of debt.

Since the onset of the crisis in 2007-2009, many countries have struggled with increasing indebtedness. The best example is the United States. Debt in relation to GDP in 2005-2020 doubled from 60% to 120%.

United States public debt. Source: fred.stlouisfed.org

You can monitor the current debt of the United States via the website USDebtClock.org.

How can a deficit be financed?

Debt can be financed in many ways. The government can finance debt in the following ways:

- Internal debt

- External debt

- Debt monetization

Internal debt is one of the safest types of debt. It is a debt to domestic financial institutions (banks, insurers, funds) and to its own citizens. Internal debt is most often issued in a currency that is legal tender in the territory of the country. The advantage of such a source of financing is his stability. The country is not as dependent on global capital flows as is the case of foreign debt. This is one of the reasons why Japan, which has one of the largest government debts in relation to GDP is still solvent. External shocks do not cause an outflow of capital, at the same time the country may "grow out of debt", among others by increasing inflation. However, the disadvantage is its limited resource. As a result, too much demand for additional capital may force the country to seek additional funds abroad. Another problem is that government debt financers cannot use these funds to finance private investment.

External debt it is borrowing from foreign countries, financial institutions or private persons. Both high-rated countries and countries with a long history of bankruptcies and insolvencies are taking advantage of this solution. External debt can be denominated in both domestic and foreign currency. Often, countries with high interest rates decide to borrow in foreign currency in order to reduce financial costs. The disadvantage of such a solution is that the budget is exposed to the experience of currency risk. This is especially hard for countries with weak currencies and inflation problems. In such a situation, the weakening of one's own currency increases the costs of servicing foreign debt. External debt can contribute to the financial instability of a country. An example is the debt crisis in Latin America in the XNUMXs and the financial crisis in countries classified as "Asian tigers" 1997 w roku.

Debt monetization it is an action by governments together with central banks to finance budget deficits. This practice has been known for thousands of years. In the beginning, it took on the phenomenon of "coin spoilage", i.e. leaving the face value of the coin, but the value of the metal was reduced. A great example is the monetary crisis in XNUMXth-century Germany caused by the times Kipper and Wipper. The result was an increase in prices and impoverishment of the society. In the XNUMXth century, debt monetization brought about hyperinflation in the Weimar Republic and in Poland.

Debt monetization does not always have dire consequences. It all depends on its scale and macroeconomic environment. In a deflationary environment, debt monetization does not necessarily lead to high inflation. Nowadays, debt monetization has become the "new normal". The national central banks' bond purchases are carried out in Indonesia, Australia, New Zealand, the United States and Japan. Of course, some of them take an intermediate form through quantitative easing (QE).

Structure of Poland's debt

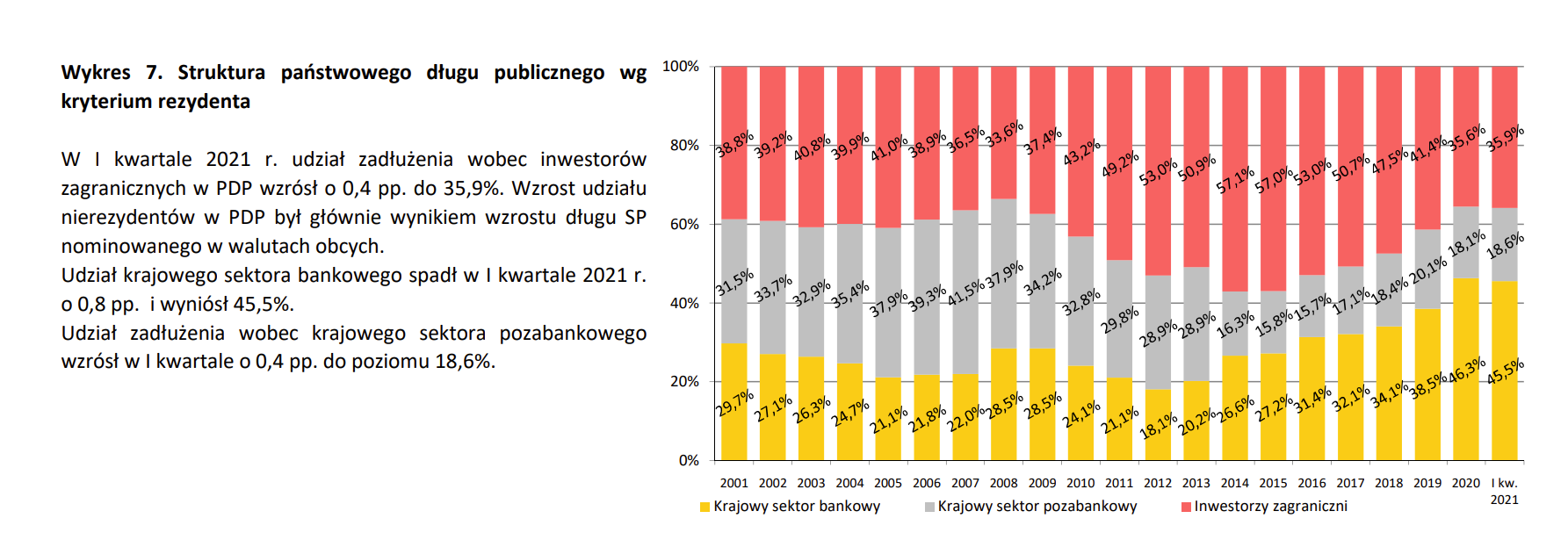

In Poland, the debt structure has not changed much compared to 2001 and 2021. Still over 35% of the debt is held by foreign investors. It is worth noting, however, that over the years 2014-2021 it was possible to increase the share of domestic debt from 43% to 65%. Mainly due to larger purchases of the domestic banking sector.

Consequences of indebtedness - negative scenario

As previously mentioned, debt creates a relationship between the debtor and the creditor. Sometimes it is harmonious and the debts are paid regularly. However, there are situations when the debtor's financial situation is so weak that it is not possible to settle liabilities on a current basis. In such a situation, the debtor and the creditor can reach a consensus or "go to the knives." The solution to the case of unpaid debts could be:

- restructuring

This is the most common form of debt restructuring when the creditor sees an opportunity to recover the debt. Sometimes restructuring entails a reduction in the value of the debt. This is a situation where the debtor cancels the debt due to political reasons or a difficult financial situation of the debtor. This situation only takes place in exceptional circumstances. It was like that in the case of Poland, which negotiated with the Paris Club at the turn of the 6s and XNUMXs. As a result of the negotiations, Poland managed to reduce its debt by about $ XNUMX billion (capital value) and a part of capitalized interest.

- One-sided "freeze of repayment" or "debt cancellation"

Sometimes changes to the regime mean that the new government does not feel like it recognizes the debt that the previous government has incurred. One of the most famous cases is the behavior of the Soviet Russia, which decided that it "did not honor" debts incurred by Tsarist Russia. This caused a significant "cut-off" of the Soviet economy from Western capital and technology in the early 20s.

There have been instances in history where debt cancellation has done more harm than good to the country. This was the case in the XNUMXth century Mexico. In 1861, the new Mexican government announced that it would unilaterally freeze foreign debt payments for two years. This provoked an international intervention (led by France) that lasted until 1867.

Poland also announced the suspension of debt repayment, in 1981, when the government of general Jaruzelski refused to repay the debt due to the difficult economic situation. In the 80s, even the Polish FOZZ (Foreign Debt Service Fund) was established to purchase Polish bonds for a fraction of their value. Ultimately, the debts were partially reduced by the creditors, the remainder was dutifully repaid.

- Declaration of insolvency

It is a "zero option", meaning the state is unable to pay off its debts. Country defaults have happened in history. Spain is one of the record holders, which made it 1500 times between 1900 and 13.

- Inflation increase

Sometimes a sovereign debt crisis can push the central bank and the government into a very expansionary monetary policy. In extreme cases, government spending can be financed by the issuance of money by the central bank. An example of when external debt contributed to hyperinflation is the example of the Weimar Republic. Hyperinflation caused the decline of the German mark and in November 1923 a 100 trillion mark was put into circulation. The situation was stabilized only by the currency reform, which introduced the rentenmark (a brand whose value was based on land owned by the German state).

Views on debt

Depending on the adopted value system, it may have a positive or negative overtone. The same is true of economic theories, which interpret the consequences of an increase in public debt differently.

Keynesians believe that public debt can play a stabilizing role during an economic downturn. According to them, due to the "stickiness" of prices and wages, in times of crises the economy has a problem with quick "adaptation" to new conditions. As a result, unemployment is created and the economy is working below its potential. In such a situation, increases in government spending that are financed by debt could help the economy "recover" from recession faster. Conversely, in good times, governments should maintain fiscal balance or even generate surpluses to pay off previously generated debt.

Conversely, supporters of the classical school of economics believe that increasing debt causes a "crowding out" of private investment, which is detrimental to the economy in the long term. At the same time, the increase in indebtedness "pulls away" some savings, which prevents them from reaching the stock market or private debt. As a result, the stream of savings directed to the government bond market may reduce the efficient allocation of capital in the economy.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)