What is the Beige Federal Reserve Book?

Speculation on fiscal policy gathers particular pace, mainly before the meetings. Usually it is possible to change it (increase / decrease interest rates, limitations or increases in asset purchases) is forecast based on macroeconomic readings - mainly labor market, inflation or GDP. Federal Reserve it can be said that it has certain "ranges" within which these readings must fit (eg the inflation target) for the policy to remain unchanged. Thus, in order to create projections related to the future of fiscal policy, the main task is to observe what is happening in the economy. There are, however, "leading" indicators of possible tightening or easing, including the Beige Book of the Federal Reserve in addition to the dot plot. What is? What does it do? What data can we get from it?

Beige book - ordinary report?

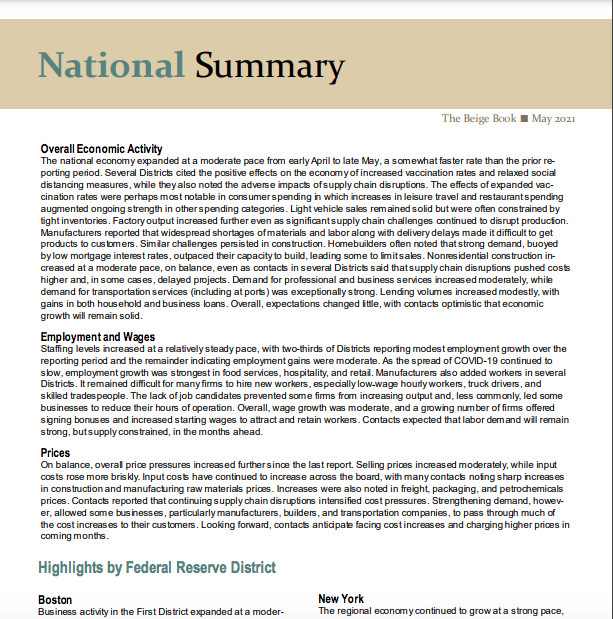

Let's start with the basics. What is the Beige Federal Reserve Book? Nothing other than a report. However, not just what. It is published eight times a year and contains a collection of information on the current economic conditions. The exact publication dates of each report are given on the FED website. The report itself, however, dates back to 1983. Where does such a name come from? The Beige Book owes its name colorful coverswhere it was once physically published.

The publication dates of the Beige Book for 2021. Source: Federal Reserve

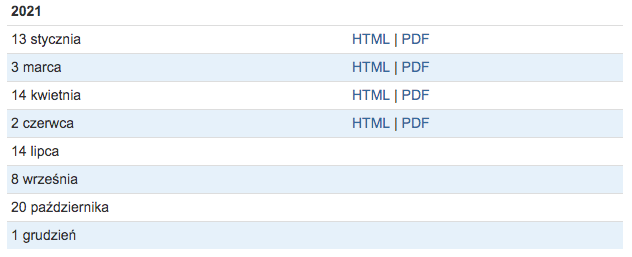

The Beige Book is a collection of a kind of macroeconomic commentaries from twelve districts. Each Federal Reserve Bank collects anecdotal information about the current economic conditions in its district through reports from bank and branch directors and interviews with key business contacts, economists, market experts, and other sources. Usually, this report is published two weeks before the FOMC meeting.

Local branches have a voice

I mentioned above that the report contains twelve "views" on the current macroeconomic situation. These “looks” come from the twelve local Federal Reserve chapters, which are sent to the Fed headquarters and compiled into a single report. The Beige Book consists of exactly 13 parts. First 12 of them contain consistent and accurate analyzes of the economic situation in individual US districts. It is worth mentioning that the report itself is not large in terms of volume. We will find it rather compact information. The data mainly relates to consumer spending and the situation on the labor market. Part 13 provides an overview of the overall economic health of the entire US, providing an overview of all the previous chapters.

Districts included in the Beige Book. Source: Federal Reserve

Local banks participating in the report:

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

Does the Beige Book shape politics?

The Beige Book has an impact on fiscal policy. Of course, this is not an effect on principle, Boston writes that they have a problem with inflation, it is the Fed that changes interest rates. Rather, it is a highly suggestive tool intended to target bankers on local issues. Importantly, the Beige Book does not have to contain "formalized" information. I mean those that come from classic indicators. The data is more local and the bankers of such branches may conduct their own surveys and research. The Beige Book is to describe changes in the economy since the last report. Reaching for the Beige Book is one of the many ways by which The Federal Reserve System works with companies and various organizations for the economic development of their communities. Because this information is collected from a wide range of contacts and data providers through a variety of formal and informal methods. The Beige Book can therefore effectively complement other forms of collecting regional information.

So largely The Beige Book is a tool anticipating future fiscal policy. Whether it is it or not, the Fed must take into account all "reports" from the districts. The current report contains only 30 pages and, looking through the prism of the two previous publications, largely anticipates the potential shift of the Fed to a more hawkish policy.

Summation

The Beige Book of the Federal Reserve (except for the dot chart) is an effective tool for making all kinds of projections (forecasts) regarding a possible change in monetary policy. Although the Beige Book itself is rarely heard in the media, it undoubtedly plays a very large role in the decision-making "base" of the Fed. The fact that it is published at least two weeks before the FOMC meeting. Some treat the Beige Book as a detailed macroeconomic commentary, while others treat it as a living forecast of what may happen in the near future. Therefore, it is a tool that works strictly intuitive. Looking at the current situation, Beige Book suggested inflation problems more than 3 months ago, which Powell called "transitional", and in the end the last FOMC meeting showed two increases in the median of votes until 2023. case) of a bad prophecy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)