Black Thursday - 4 years since SNB intervention. What has this taught us?

If you have been trading for at least four years, you certainly remember perfectly 15 January 2015. Exactly today is the fourth anniversary of the memorable "Black Thursday". What has this event taught us? What has changed, both in the structure of the retail market and in our heads?

Black Thursday - what happened then

January 15 is as important for traders as September 11 is for Americans. If your investment internship is shorter than 4 years, there is a chance that you don't know what's going on. Therefore, we first briefly introduce you to this situation - not from a theoretical point of view, but from a more practical point of view.

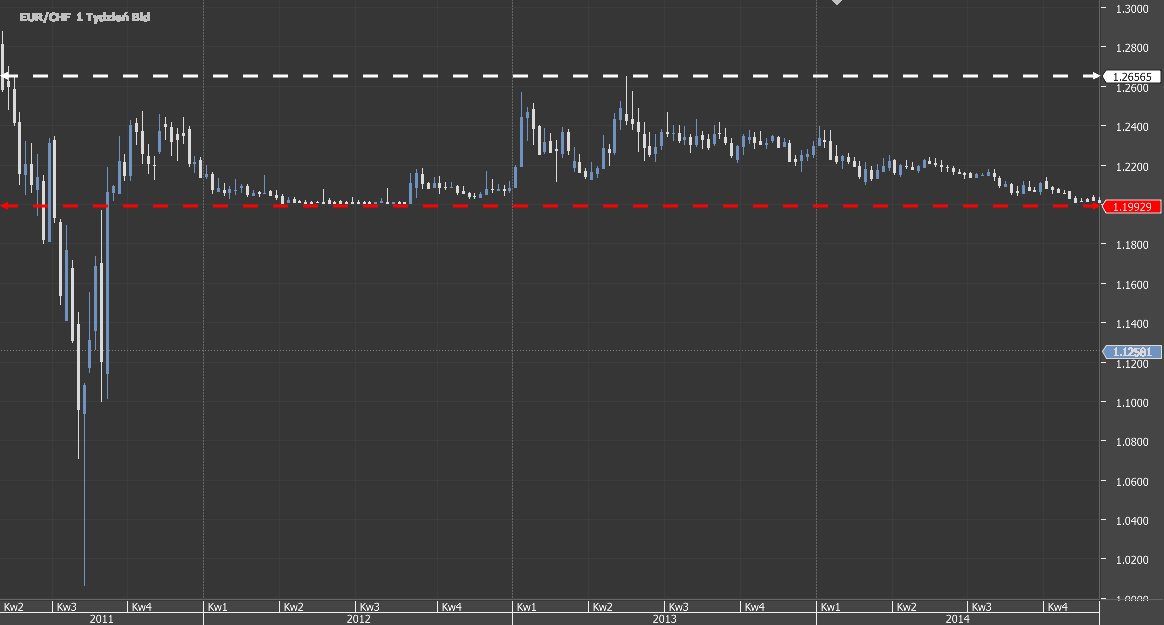

More or less from October 2007 to August 2011, in pairs with the franc, mainly USD / CHF and EUR / CHF, we saw a very strong downward trend. In the case of the EUR / CHF pair, we are talking about a discount of 40%. The appreciation of the Swiss currency was extremely unfavorable for the Swiss economy. The Swiss Central Bank (SNB) said "enough" at this point, announcing the intervention on pairs with CHF and keeping the exchange rate in check, ie around 1,20 for EUR / CHF. The message was unambiguous - no more speculation that was unfavorable to the economy.

As a result, throughout 2012, the maximum amplitude of fluctuations in the EUR / CHF exchange rate did not exceed 2%. When trying to pull the course up, it always dutifully returned downhill quickly. But that also became a temptation for speculators. Since the rate cannot drop lower, theoretically there is only one possible direction - just a little patience. The stagnation continued, and this favored the accumulation of further long positions with Stop Losses below 1,20. It seemed like a recipe for easy profit. Just buy around 1.2000 and wait for the rate to graciously jump on these "Miserable" 0,5%. As it turned out, only until and could not be more wrong.

SNB changes its mind. Or maybe give a lesson?

Not much earlier, the SNB issued a message that it will be boundlessly defending the 1.20 border for EUR / CHF by all means available. Holders of long positions could feel even more confident, which probably resulted in the selection of subsequent longs.

However, a day has come. This day. 15 January 2015 at 10: 30 the Swiss bank issued a message that changes its mind, "Frees the franc exchange rate" and ceases to intervene. In this situation, the lack of support for the rate could only mean one thing - huge drops and the release of many, many stop losses. So it happened. In the first five minutes, the rate fell by 15%, or ca. 1800.0 pips, only to return up 13% a moment later. The next 15 minutes is a huge swing and a discount of another 23%.

Eventually, the EUR / CHF exchange rate weakened by 29%, or approx. 3500.0 pips in just 20 minutes. The chart itself looks quite… abstract :-). Especially if we look carefully at the timeline and prices.

What changed after January 15

Have you watched the market then? In that case, you certainly remember what you felt. You did not have to have open positions to experience these emotions. If your internship is smaller, you probably think "How could you be so naive as to play on the heights?" and/ or "It was enough to be short to make a fortune!" - about it in a moment.

Let's think about what actually changed this event from the perspective of 4 years.

Lack of trust

In life, only death and taxes are certain. A saying as old as the world, but so up to date. The central bank, and not just any country, but the capital of the finance - Switzerland - has declared that it will intervene until the end. Meanwhile, many suspect that it was just a smart game, an attempt on the money of speculators. We have not conducted any investigation in this regard. The only thing that is known is that the mind was changed suddenly and by 180 degrees. If you don't know it yet, don't trust the bankers.

In life, only death and taxes are certain. A saying as old as the world, but so up to date. The central bank, and not just any country, but the capital of the finance - Switzerland - has declared that it will intervene until the end. Meanwhile, many suspect that it was just a smart game, an attempt on the money of speculators. We have not conducted any investigation in this regard. The only thing that is known is that the mind was changed suddenly and by 180 degrees. If you don't know it yet, don't trust the bankers.

Awareness of risk

This event made us aware of the risks we face. In the case of the franc, it was unmasked. Powerful volatility was triggered by the sentence of one man. In this opinion, the consequences for the market were coming, and the market (or rather its participants) had to abolish it quickly.

Many investors quickly became aware of what the leveraged markets really are, what is the scale of risk, you can not be anything in 100% sure, and that the scale of risk can be huge. Unfortunately, some of them became convinced about it on their own skin, not only cleansing the account to zero, but entering a serious debit.

Limitations of brokers

One would expect that the Forex market, which is advertised as a market with powerful liquidity (at least from the perspective of the average retailer), this type of problems do not apply. And yet. Broker's infrastructure and access to liquidity have been put to a serious test. The number of pending orders started, current attempts to modify them and liquidity problems at their suppliers resulted in many problems:

- spreads skyrocketed to astronomical values - from 1.0-2.0 pips to even several hundred.

- the servers were overloaded - some companies shut down trading for several dozen minutes.

- the liquidity was so dispersed that in the charts subsequent tics were running at distances of several hundred pips from each other.

- huge gaps were created on the charts.

- there were big problems with opening and closing the position.

- pending orders placed before the intervention were carried out with large slips.

In short: brokers were not prepared for such events, because they practically do not occur. But they did occur nonetheless. And they may appear in the future. In practice, it turned out that even knowing what was going on and taking a short position on xxx / CHF pairs, whether “hot” or ahead, it was very difficult to make a profit in such conditions *.

* There were even cases of correction of transactions even a few days after 15 January. Profitable positions were canceled and even transformed into losses. Brokers argued that "An adjustment due to the conclusion of transactions at prices that did not actually occur".

Regulations matter

The aftermath of the SNB intervention was not only the problems of traders but also brokers. The customers of the then Alpari UK (including me) were convinced about it. As a result of the turmoil on CHF couples, and not only, the huge scale of customer debts, which could not be effectively and quickly enforced, led to the disruption of this broker. Alpari UK went bankrupt.

The British guarantee fund worked correctly, but you had to wait for the money to be recovered. The 100% was guaranteed by 50 000 GBP.

There were more injured brokers. Excel Markets also went bankrupt. FXCM lost over 200 million USD, and IG Group 30 million GBP (we've described more in this article). With time, it turned out that, by a strange coincidence, also the famous IronFX did not have much problems with making payouts much later.

Relatively few companies declared that they did not feel the consequences of the SNB intervention. Selected brokers, in a goodwill gesture, decided to redeem the resulting debts on clients' accounts.

However, this situation shows that the choice of broker matters. And if not a broker, then at least the regulation under which it works. We can not predict the actions of central banks or clients of a given entity, but we can insure ourselves by choosing a large, stable and properly regulated company.

Regulatory changes and debits

Liquidity problem, slip on SL, delayed Stop-Out mechanisms, large lever used to a large extent. Undoubtedly, this all contributed to the emergence in some cases of huge debits on the accounts of customers exceeding even a million zlotys.

Liquidity problem, slip on SL, delayed Stop-Out mechanisms, large lever used to a large extent. Undoubtedly, this all contributed to the emergence in some cases of huge debits on the accounts of customers exceeding even a million zlotys.

The consequences of the debut wave were the ideas of regulators on how to reduce the risk and scale of losses of retailers. These ideas are already in place, but we can safely assume that it was the effects of the SNB intervention that drew the attention of financial supervisors and made the scale of the threat aware. The Polish Financial Supervision Authority (KNF) broke out on the first fire, which in July of the same year limited the leverage to 1: 100. It was only later that ideas from the European Union began to appear.

From the perspective of European regulators, the risk has been limited. In the EU, the maximum leverage for USD / CHF is now 1: 30, Stop-Out levels have been unified, and debits are unspectacular to retailers (introduction of mandatory protection against negative balances).

Huffing for cold

Before January 15 on the fingers of one hand I could count how many brokers were serious about the theoretical risks, i.e. those that may occur and do not have to. I am referring to future market events that may cause uncertainty, above-average volatility, and liquidity disruptions. Few broker decided, at such moments, to limit internal leverage or, as a last resort, freeze trade for selected instruments. And let us remind you that in these times the 1 leverage was easily achieved: 100, 1: 200, and even 1: 500.

The traders were also not better, reacting to the above-mentioned preventive measures of the few brokers with indignation "How can you do that ?!". Now it turns out that not only "you can", Of "it's necessary to".

And now virtually all retail brokers choose this path. Limiting the leverage for instruments that may temporarily be subject to higher investment risk is a standard. The election in the US, or the referendum on the Brexit case, means that now in such moments on the main currency pairs we have a lever, even 250 times (!) smaller than 4 years ago.

Summation

Can an event from before 4 be repeated someday? Of course. Will it happen again? It is not known. This scenario may occur on any instrument. Could it be predicted? According to some, the SNB's intervention was quite obvious (read it: "Was it possible to earn from the Swiss franc massacre?").

Let's learn from history. Let our actions aim at limiting and controlling the risk, not at its escalation. Think, analyze, let us not manipulate.

Good luck!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response