CySEC - the infamous guardian of the Cypriot financial industry

CySEC is an abbreviation of Cyprus Securities and Exchange Commission which in translation into Polish means the Cyprus Securities Commission. It is the Cypriot equivalent of the Polish PFSA regulator (Polish Financial Supervision Authority). What is his history and what exactly does he do? About it below.

CySEC's most important tasks

The most important task of the Cyprus Securities and Exchange Commission is the supervision and control of Cypriot financial institutions. The supervisor cares for the transparency of the financial market and that the entities operate in accordance with the applicable regulations. For non-compliance, CySEC may impose penalties or remove licenses from financial institutions. An example is the imposition of a fine on Novax Capital in 2017. The fine was € 175 and it concerned, inter alia, improper internal controls when approving promotional materials or for failure to act in the best interest of the client. In turn, throughout 000, CySEC imposed fines totaling € 7,5 million. In the case of gross violations, the Cypriot supervisory authority more and more often decides to withdraw the granted permits, which most often leads to the termination of the broker activity. Such an example is ACFX broker who encountered this scenario in 2017.

General Information

CySEC was founded in 2001 under the Cyprus Securities and Exchange Commission Law. The importance of the regulator in the international arena grew in 2004. It was related to the accession of Cyprus to the European Union. Cyprus then became a "paradise" for many forex brokers. This was due to the friendly attitude of the regulator towards companies. It also had negative consequences. The friendly regulatory environment and relatively low fines have encouraged many companies with a poor reputation to apply for a Cyprus license.

Some entities regulated by Cypriot supervision are well known to investors from all over Europe, because after Cyprus joins the European Union, companies registered in this country can offer their services to citizens of other Member States. CySEC operates in accordance with MiFID and MiFID II regulations.

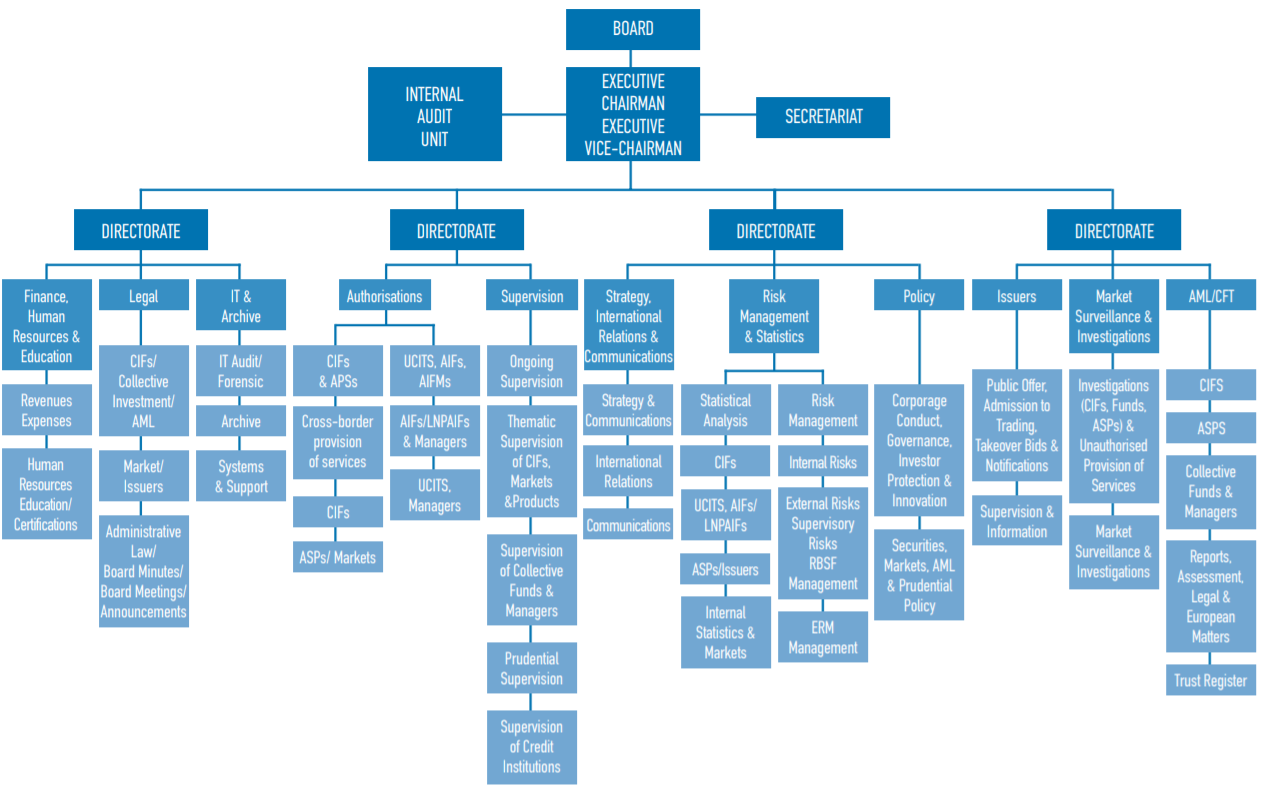

Organizational structure of CySEC

Binary Market - CySEC shows the way

As an example showing how the common market works, one can mention binary options. In 2012, CySEC changed the classification regarding binary options. Thanks to this, trading with binary options has been made available to retail investors. The development of the binary options market has resulted in the emergence of companies offering unfair practices. As a result, in 2016 CySEC tightened the regulations that took away the license of brokers offering 30-second binary options. At the same time, brokers must provide more information about binary options and the possibility of cost-free cancellation within seconds of the transaction. The binary market has become virtually unavailable to retail clients after ESMA's product intervention of July 1, 2018.

CySEC - forex and other markets

CySEC regulates many entities. The companies regulated by the Cypriot agency include forex brokers (e.g. XM, Plus 500 or Easy Markets) or the Cyprus Stock Exchange. Other entities regulated by CySEC are investment funds, mutual funds and the MTF (Emerging Companies Market) platform.

Management

Since September 2011, she is the head of the Cypriot regulator Demetra Kalogerou. Previously, she worked, among others on the Cyprus Stock Exchange. He has 15 years of experience in the financial market. Demetra Kalogerou is also a member of the Cyprus Public Audit Oversight Board, which oversees auditors.

From June 2020, he took the position of vice president at CySEC Dr. George Theocharides. In previous years, he was, among others in the supervisory board of the Cyprus Central Bank and CySEC. At the same time, Dr. George Theocharides works as a researcher at the UCL Center for Blockchain Technologies.

Operational data

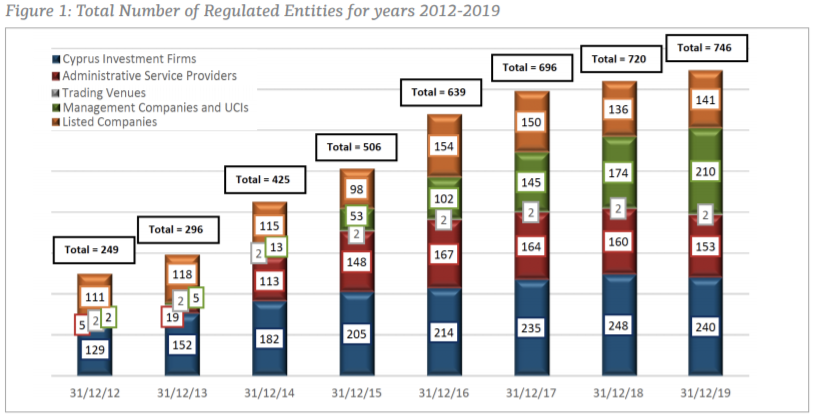

According to data presented in the annual statistical bulletin published on December 23, 2020 by CySEC (Risk Management & Statistics Departmet) it regulates over 700 entities. In 2019, it was 746 entities. Three years ago, there were 100 fewer entities. In 2012, less than 250 entities were regulated.

CySEC enters the Cyprus stock exchange and one MTF platform among the companies belonging to the Trading Venues group.

CIF - Cypriot Investment Firms

According to data collected by CySEC, Cypriot investment companies had 2019 million clients at the end of 1,188. It was about 590 thousand. customers less than the year before. In 2016-2017, the number of customers was approximately 1,4 million. At the end of 2019, there were 240 CIF, i.e. Cyprus Investment Firms (e.g. forex brokers).

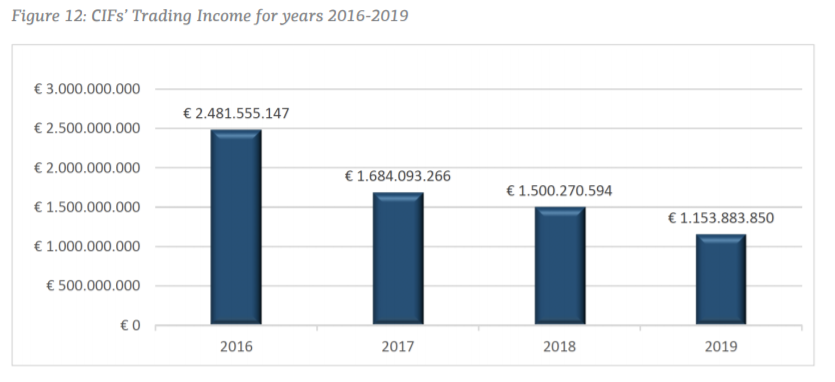

It was another year of the ESMA (European Securities and Markets Authority) regulation, which concerned less leverage. The decrease in the number of customers contributed to a decrease in revenues in CIF entities. At the end of 2019, revenues amounted to € 1,15 billion, down by 23,1% over the year. CIF net profit increased by $ 100 million to € 194 million.

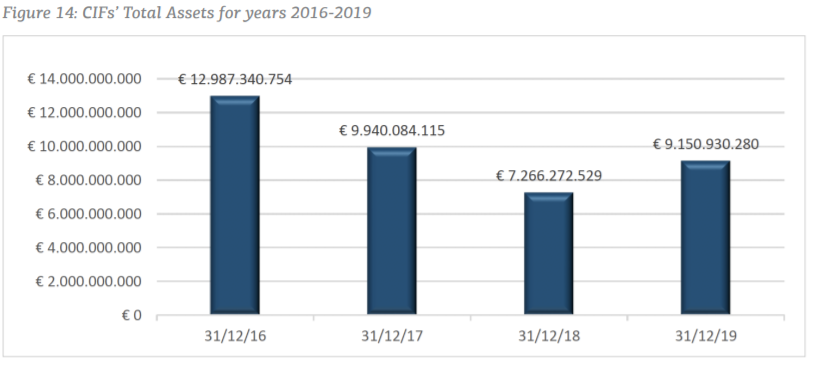

In 2019, the assets collected by CIF increased. At the end of December 2019, Cypriot Investment Firms had a balance sheet total of € 9,15 billion. This meant an increase by € 1,88 billion during the year. However, these levels are still much lower than a few years ago. In 2015, the CIF had assets of € 14,2bn.

CySEC and ICF

There is a compensation fund for investors on the Cypriot market (Investor Compensation Fund). According to CySEC regulations, every Cypriot investment firm (CIF) must be a member of the ICF. The compensation fund protects investors' funds up to an amount of € 20.

Warning List

On the pages of Forex Club in the department List of warnings We regularly publish CySEC announcements regarding new positions on "Blacklist" and financial penalties imposed by the Cypriot regulator, which are related to the Forex / CFD / binary options.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)