Credit Suisse - another Lehman Brothers or a false alarm?

Pale fear fell on the markets. Credit Suisse, a Swiss bank with a long history, is struggling. Is this another Lehman Brothers or just plain media panic? We decided to take a closer look at the numbers, the reasons and the real, without panic, possible scenarios. To understand the issue in depth, however, let's start with the basics.

Banks are interesting businesses. Even their accounting is completely different from "ordinary" companies. What's more, banks play a very important role, which is the proper allocation of capital in the economy. Without loans, it would be difficult for companies and ordinary citizens to implement all their plans. Banks play the role of a relay from those who have too much capital to those who need it. Over the years, they have specialized in their niches. Some of them focused only on servicing individual clients, while some preferred to focus on servicing the enterprise or investment activities. Due to the fact that banks operate in the fractional reserve system, they can operate on a much larger scale than the accumulated deposits potentially allow.

For investment activities, sophisticated risk management models allow banks to trade much more aggressively than the ordinary individual investor can afford. Highly leveraged banks are therefore "fragile" in the turmoil of the market. At the same time, there is a strong network risk in the banking sector, which means that even "healthy" financial institutions may be "infected" by "sick" banks mired in liquidity problems.. There is also counterparty risk in the investment sector. This is especially important in the OTC market where there is a risk that the partner will default and the profitable transaction will turn out to be worthless. For these reasons, central banks closely monitor the condition of banks that are critical for the national or regional economy. Very often it was the central banks that were so-called "Lender of last resort"who saved the financial sector from oppression. In the past few days, rumors have spread about Credit Suisse's deteriorating financial health. This is important information because the bank has assets worth more than 727 billion Swiss francs.

In today's article, we will briefly present the history and business model of one of the most important European banks. We invite you to read!

Credit Suisse story

The history of the bank dates back to July 5, 1856, when Alfred Escher, who was a famous businessman and politician, created Schweizerische Kreditanstalt (SKA). The reason for establishing the bank was the desire to create an institution that was to finance the development of railways in Switzerland. The aim was to avoid financing the development of the railways through French banks that demanded greater control of the rail system. The Schweizerische Kreditanstalt was modeled on the French counterpart - Credit Mobilier - which financed the French railroad. However, the activities of the Swiss bank were much more conservative as the SKA focused on short- and medium-term loans. In the first year of operation, the bank generated as much as a quarter of its revenues thanks to the Swiss Northeastern Railway, which was built by Nordostbahn, a company owned by Alfred Escher. 14 years later, in 1870, the bank opened its first foreign representative office - in New York. At that time, the bank did not develop through the network of branches because it was not involved in retail banking. Credit Suisse has played a very important role in financing Switzerland's economic development. In addition to the railway system, he also took care of financing the development of the electricity network.

READ NECESSARY: SMI 20 - How to invest in Swiss blue chip companies? [Guide]

The bank also developed in other areas of finance, acquiring, financing or opening insurers in Germany, Belgium and Switzerland. SKA was a co-founder of companies such as Swiss RE, Swiss Life and Schweiz. Shares in various undertakings related to the raw materials and agricultural markets were also purchased. The undertakings were not always successful. This was the case in 1886, when the bank recorded a loss for the first time in its history. The reason was unsuccessful investments in "nineteenth-century startups", raw materials, agricultural and trade companies. The projects in which the bank invested seem to be truly non-standard today, in the XNUMXth century the bank established its own sugar factory.

At the beginning of the 1905th century, the bank decided to expand its operations to provide services to individual clients. He focused on middle-class and upper-class clients. He dealt with running savings accounts, currency exchange and accepting deposits. In XNUMX, he opened the first branch outside of Zurich. Basel was chosen.

Dynamic development and acquisitions: 1914 - 2006

World War I meant that the bank gained new customers thanks to restructuring, finding bridge financing or joining enterprises affected by the war. In the crazy twenties, the bank grew dynamically, however Great Depression caused the bank to cut dividends and lower the salaries of its employees. During the Second World War, many property stolen by the German Nazis from their victims ended up in Swiss accounts.

The post-war period saw further development of the bank, also through acquisitions. In 1978, the bank established a joint venture with First Boston dealing with investment banking. In 1988, SKA acquired over 40% of First Boston. Subsequently, as a result of the purchase of the remaining shares of the company, First Boston became a private company. In the mid-90s, the investment activity operated under the name of CSFB (Credit Suisse First Boston).

At the end of the 1997th century, the bank continued its acquisition policy by taking over one of the oldest banks in Switzerland - Bank Leu. In 9, Credit Suisse merged with the insurance company Winterhur Group. After 8 years, Credit Suisse sold its shares to the French insurer Axa for around € XNUMX billion.

However, the bank's reputation has been damaged more than once due to tax scandals. Even before the crisis, the bank was fined by US authorities for violating US sanctions on Iran and several other countries. The bank had to pay over $ 500 million in fines.

Credit Suisse after the subprime crisis

Unlike many European banks, the Swiss institution did not have to rely on government assistance to continue operating. This does not mean that the bank has not lost during the crisis. In 2008, the company generated a net loss of 8,2 billion Swiss francs. The bank began restructuring its assets by selling or closing at a loss many illiquid leveraged and structured products.

Credit Suisse, despite going through the crisis in a fairly orderly manner, was still the hero of numerous scandals. It was like that in 2009 when it came out that the bank helped American citizens avoid paying taxes. The case ended in 2011 with a judgment for 4 Credit Suisse employees. In 2012, German surveillance discovered that the bank offered wealthy German customers the opportunity to buy insurance in a Bermuda company (owned by Credit Suisse) so that you receive untaxed profit. The following years brought new penalties imposed on this institution.

The bank also had reputation problems related to the investment market. The company announced that it wrote off 2021 billion Swiss francs in 4,4 due to the collapse of Archegos Capital Management. Bill Hwang, who managed Archegos, did not make deposits to cover some of the losses generated by the fund. The loss caused the bank to dismiss the director of the risk department.

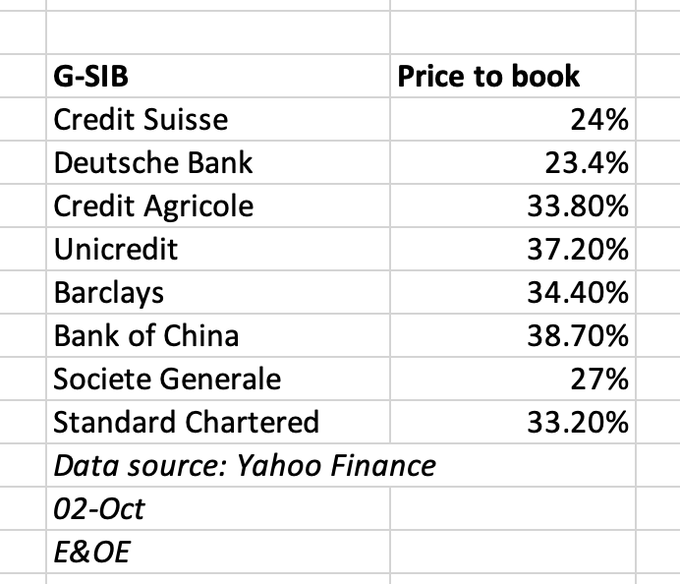

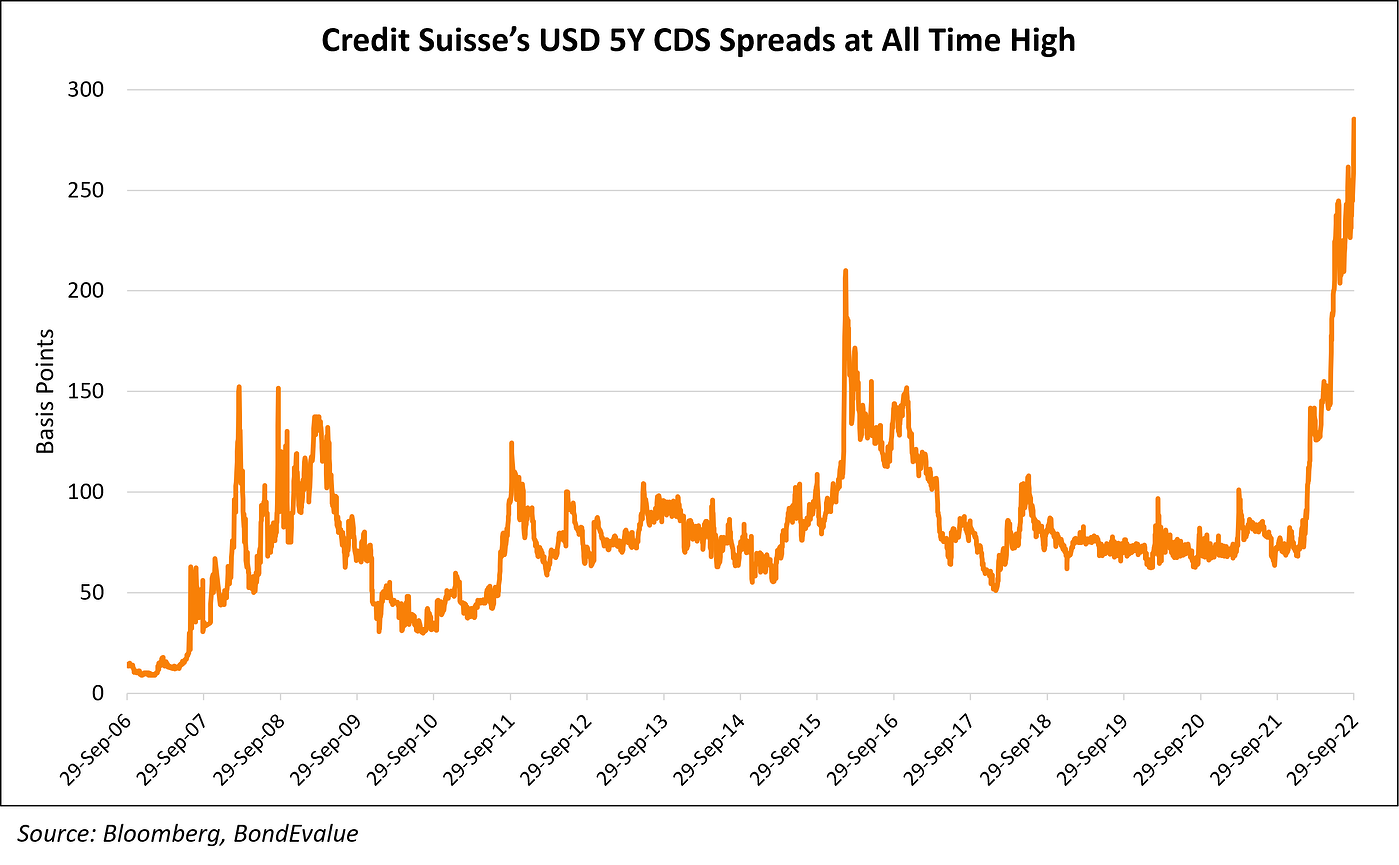

The bank's problems resulted in a weak share price. Credit Suisse is currently trading below its 2008 low. At the turn of September and October, there were more and more voices about the bank's potential liquidity problems. Journalists and analysts began to analyze the behavior 5-year CDSs on debt. Currently, these CDSs are at the level of the subprime crisis. Moreover, the bank's valuation calculated as C / WK (price to book value) is very low. This means that the market is valuing a dollar of equity capital at 25 cents.

Source: Alasdair Macleod

The rumors were caused by the statement by CEO Ulrich Koerner. The director tried to reassure investors by informing that the bank is facing a long restructuring, but the bank's financial situation is stable. It is rumored that on October 27 he will present a new strategy to heal the bank. Later in this article, we'll look at exactly what Credit Suisse does.

Operating activities of Credit Suisse

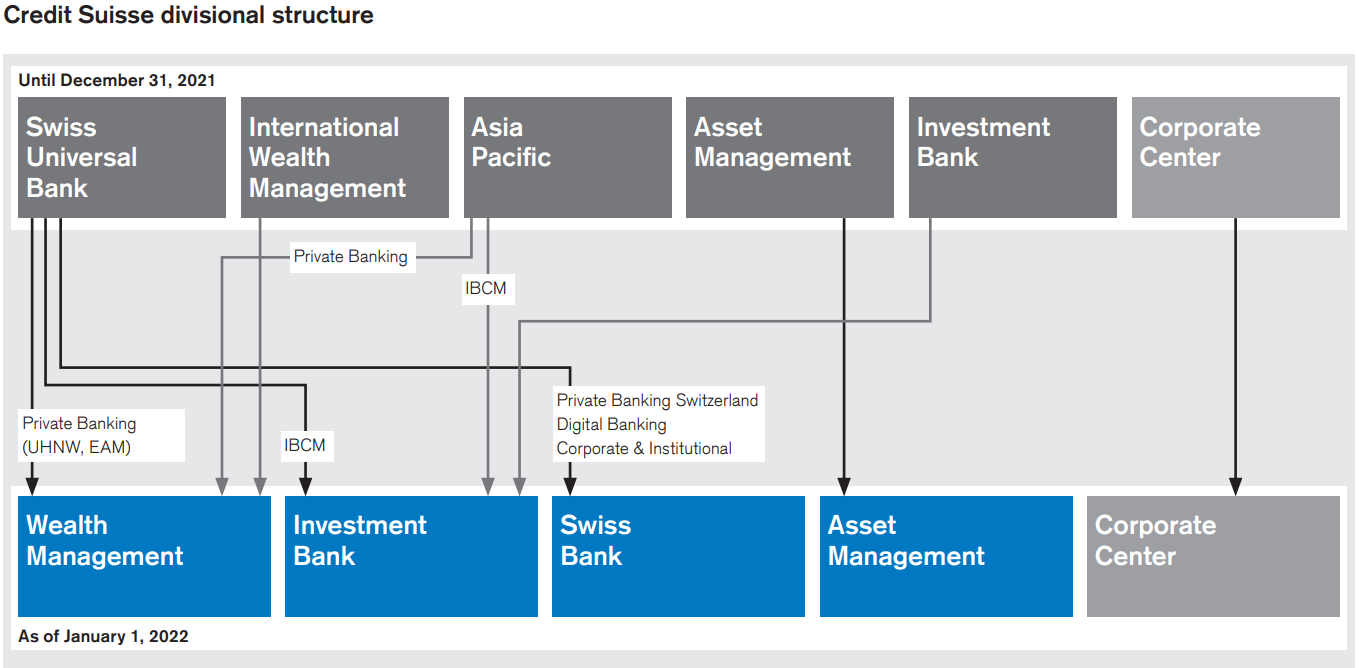

Credit Suisse is a universal bank. He deals with both business activities for retail clients, investment and capital management. Credit Suisse's business is broken down into 4 main business segments. These are:

- Wealth management

- Investment Bank

- Swiss bank

- Asset Management

Source: Credit Suisse Annual Report (2021)

The Wealth Management segment was created as a result of the merger of the foreign WM department with the UHNW (Ultra High Net Worth) customer segment, which until now was included in the Swiss Universal Bank segment. In addition, the Private Banking department in Asia Pacific was transferred to Wealth Management. Such a change in structure allows investors to better track the profitability of this segment. In its financial statements for 2021, the bank announced that it intends to restructure its operations. The restructuring is to consist of closing operations in the least prospective markets and focusing on the most prospective UHNW markets.

The activities of Investment Banking focus on the capital market. There he deals with consulting and investment activities. The IB segment was created from the merger of the Investment Bank department with the IBCM (Investment Banking & Capital Markets) departments in the Swiss bank and the Asia-Pacifik region. At the beginning of 2022, the bank announced that it intends to continue to develop in the segment of securitized products and leveraged financing.

Another segment resulting from the reorganization was "Swiss Bank". The segment includes banking for HNW (High Net Worth) clients and the segment of retail, institutional and corporate clients. The bank intends to develop activities related to electronic banking.

The only segment that has not been reorganized is Asset Management. Credit Suisse intends to expand its operations in the most promising European and Asia-Pacific markets.

As a consequence of creating the global Wealth Management and Invetment Banking segments, it was necessary to integrate the dispersed SRI (Sustainability, Research & Investment Solutions) department into a global division called IS&P (Investment Solutions & Products).

The activities of the global segments have been divided into four regions:

- Switzerland;

- EMEA (Europe, Middle East and Africa);

- Asia-Pacifik;

- America (North, Central and South).

The Asia-Pacific region seems particularly promising for the bank, where the greatest potential is associated with the dynamically developing mainland China. Additionally, Credit Suisse intends to develop its hubs in Singapore and Hong Kong.

In early 2022, the bank announced plans to:

- Reduce capital in investment banking by $ 3 billion by the end of 2022. The saved capital was to be invested in the Wealth Management, Swiss Bank and Asset Management segments.

- Credit Suisse Group is expected to achieve over 10% Return on Tangible Equity to 10% by 2024.

- By 2024, the bank is to achieve a CET1 ratio of 14% (calculated before the Basel III reform)

- Provide approximately 25% of the net profit for 2022 to shareholders.

Summary of the results for Q2022 XNUMX

Further analysis of the bank does not make sense without checking what the bank's operating activity looks like. In the next part of the article, we will briefly present the bank's financial results.

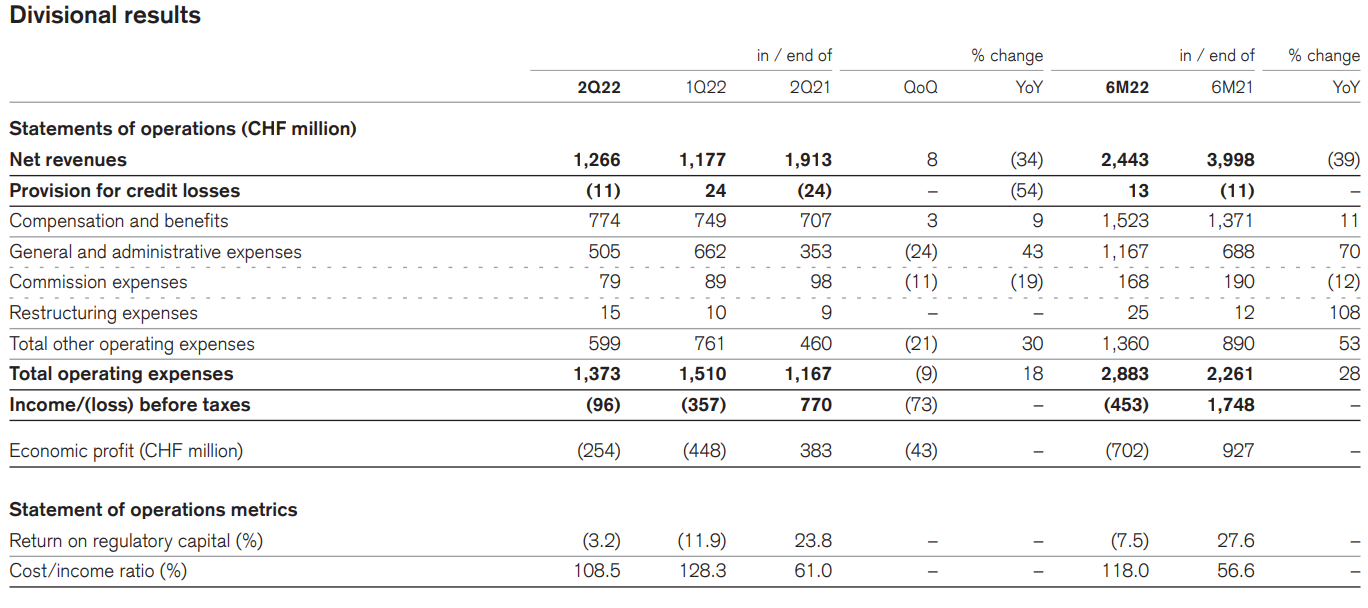

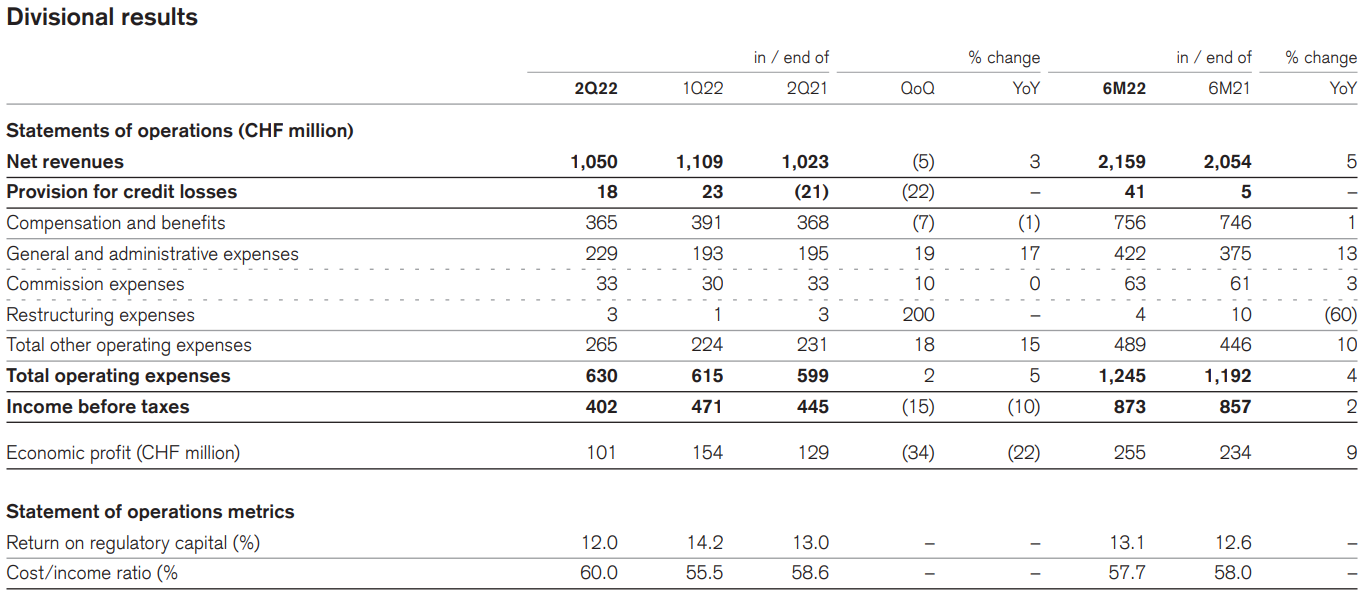

Wealth Management segment

In Q2022 96, the Wealth Management segment generated a gross loss of 2021 million francs. For comparison, in Q770 34, gross profit amounted to 18 million Swiss francs. The reasons for the worse gross profit were falling revenues and an inelastic cost structure. There was a decrease in revenues by XNUMX% y / y and an increase in operating costs by XNUMX%. Administrative and management costs increased the most.

Source: Annual report for 2021

The decrease in sales resulted from worse transaction revenues and performance-based revenues, which fell by 11% during the year. In turn, fee and commission income decreased by approximately 14% year-on-year. The losses from these two sources were partially covered by a 4% increase in interest income. Other revenues were the major contributor to the decline in revenue from the WM segment. In Q2022 178, revenues amounted to -367 million francs compared to +2021 million francs in revenues in Q2022 168. The reason was the investment in the Allfunds Group. In Q317 XNUMX, the loss on investments in Allfunds amounted to CHF XNUMX million, while a year earlier the profit was CHF XNUMX million.

Although this segment of activity is not very profitable, it does not generate any risk for the bank's continued existence. Assets under management in this segment amounted to CHF 2022 billion at the end of Q661,5 XNUMX. Almost half of them were denominated in US dollars.

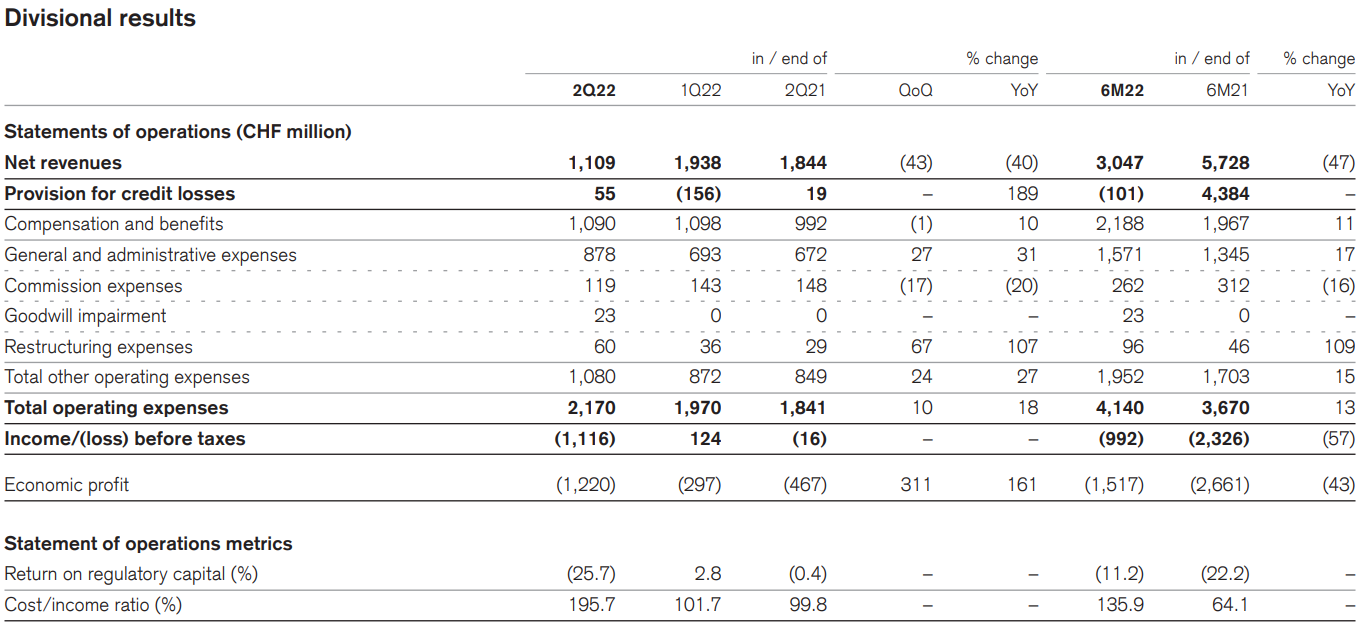

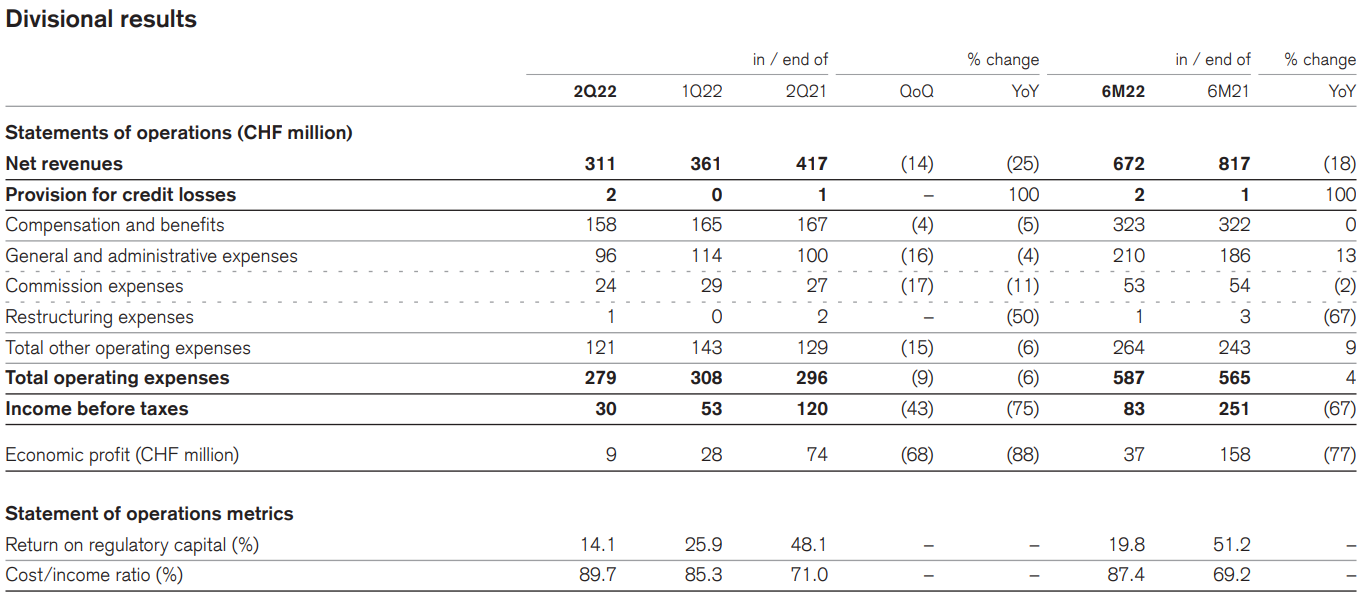

Investment Banking (IB) segment

In Q2022 1, the IB segment generated a gross loss of CHF 116 million. In Q2021 16, the gross loss amounted to 40 million Swiss francs. The reasons for the worse gross profit were falling revenues and increasing operating costs. There was a decrease in revenues by 18% y / y and an increase in operating costs by 31%. Administrative and management costs increased the most (+ XNUMX% y / y).

Source: Annual report for 2021

The significant drop in revenues was due to the drastic contraction of the Capital Markets (CM) segment. CM's revenues in Q2022 38 amounted to CHF 913 million. A year earlier, this revenue amounted to CHF 235 million. The reason for the decline in revenues was lower fees and a loss of 2021 million francs related to the mark-to-market valuation of leveraged products. The decline in revenues was offset by improved revenues generated in the Equity sales and trading (ES&T) segment. The reason for the better performance of the ES&T segment was a one-off event in Q493 29, which was the loss at Archegos, which amounted to CHF XNUMX million. Excluding the impact of a one-off event, ES&T revenue declined XNUMX%.

Investment Banking is very problematic for the company. The reason is not only the reported losses, but also the potential to generate further losses. The problem, however, is that it is difficult to estimate how large the losses may be if the negative scenario materializes.

Swiss Bank segment

In Q2022 402, the Swiss Bank segment generated a gross profit of 445 million francs. A year earlier, the gross profit amounted to 5 million Swiss francs. The reason for the worse gross profit was the faster increase in operating costs (+ 3% y / y) than in revenues (+ 17% y / y). Administrative and management costs increased the most, increasing by XNUMX% y / y.

Source: Annual report for 2021

The Swiss Bank segment has very healthy foundations. In Q2022 595, the segment's revenues increased in all product categories. Interest income amounted to CHF 3 million. The 334% increase in this segment resulted from an increase in the interest margin and a stable level of deposits. This more than covered the lower revenues from treasury products. Fee and commission income amounted to CHF 3 million, which means an increase of XNUMX% y / y. The reasons for the increase were higher revenues from Swisscard and higher fees from lending activities.

This segment of activity is profitable and does not constitute the bank's continued existence. The lending, deposit collection and trading activities generate 12% of the ARRC (Adjusted Return on Regulatory Capital). This means that there is still room for improvement in the profitability of banking operations. Assets under management in this segment totaled CHF 544,5 billion.

Asset Management segment

In Q2022 30, the Swiss Bank segment generated a gross profit of 2021 million francs. For comparison, in Q120 25, gross profit amounted to 6 million Swiss francs. The reason for the worse gross profit was a significant drop in revenues, which amounted to 75%. The XNUMX% y / y decline in operating expenses did not help. Due to operating leverage, gross profit decreased by -XNUMX% y / y.

Source: Annual report for 2021

The reason for such a large drop in revenues was due to drastic reduction of commission from management effects (performance fee). The segment's revenues fell from CHF 79 million to just CHF 5 million. Revenues from management fees and profits from partnerships and investments decreased by 9%. The decrease in gross profit caused the ARRC rate to drop during the year from 49,1% to 14,6%. Assets under management at the end of Q2022 427 amounted to CHF XNUMX billion.

This segment of activity is profitable and does not constitute the bank's continued existence. Despite the fact that the segment is very profitable in normal times, its impact on the entire bank is very small. Therefore, further analysis of the bank will focus on the bank's investment activities.

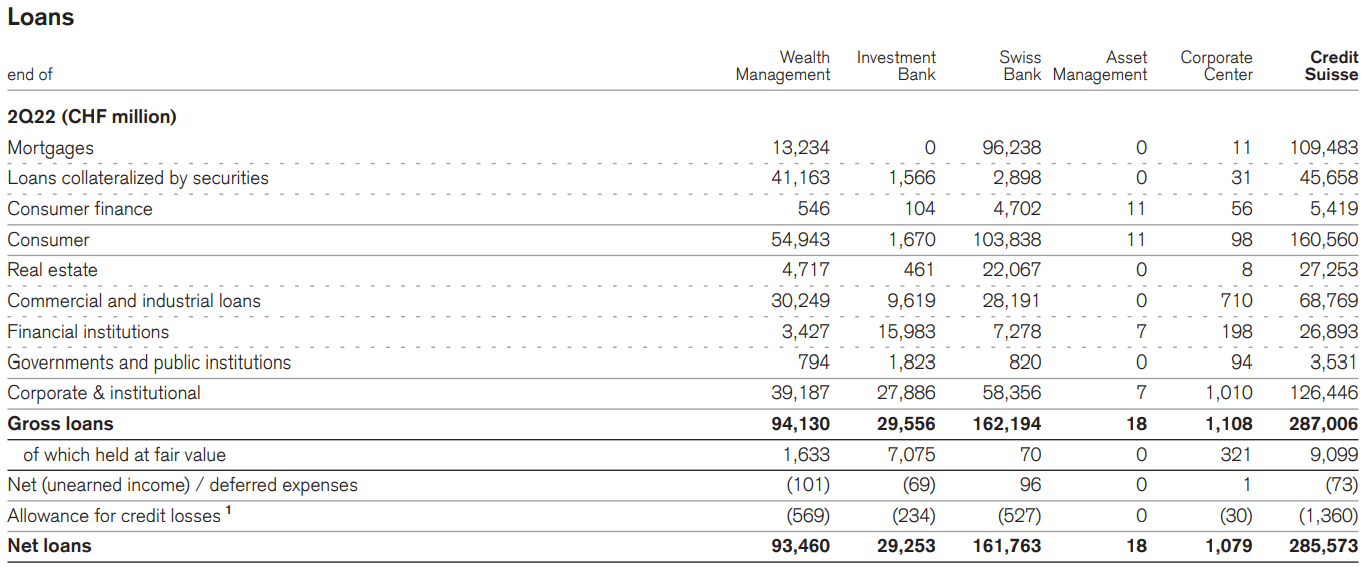

Loan portfolio

At the end of Q2022 287, the bank had loans of XNUMX billion francs. The macroeconomic environment is not conducive to improving the portfolio quality. Rising inflation driven by the price of hydrocarbons and food has forced European central banks to raise interest rates. This, in turn, raises interest costs for enterprises with variable-rate loans. Moreover, the rise in the cost of living is putting household budgets under pressure which reduces consumption levels. An environment of high inflation, declining economic activity and tightening monetary policy is a straight path to recession. This means that the loan portfolio should deteriorate, which will worsen the bank's capital buffers.

Source: Annual report for 2021

Looking at the loan portfolio, it is clear that loans to households (CHF 160,6 billion) are dominant. As much as CHF 109,5 billion are mortgage loans, and CHF 45,7 billion are loans secured by securities. In turn, the loan portfolio for C&I (Corporate & Institutional) amounts to CHF 126,5 billion. It is worth mentioning that of the CHF 287 billion loans, around CHF 247,8 billion are loans and credits secured (e.g. on real estate, shares).

Credit Suisse reported CHF 2022 billion of impaired loans in Q3,08 50, an increase of CHF XNUMX million compared to the previous quarter. As can be seen, the loan portfolio itself does not deteriorate rapidly. While the data is presented reliably, the credit portfolio itself has not deteriorated significantly over the last six months.

Credit Suisse is recognized as a SIFI (Systemically Important Financial Institution). This means that its collapse threatens the stability of the global financial system.

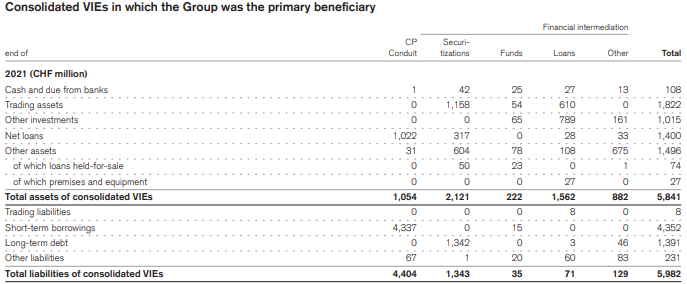

CLO, VIE - worth remembering

As can be seen above, the bank's problem is not related to toxic loans or asset management activities. The problem is the bank's investment activity. Unfortunately, it is difficult to estimate the risk generated by investment activity (on one's own account).

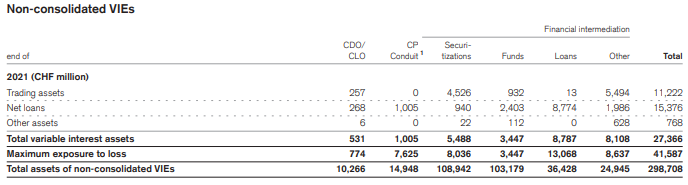

In the report for 2021, Credit Suisse mentioned that "as a normal part of the business, the Group [i.e. Credit Suisse] engages in a variety of transactions that involve VIE (Variable Interest Entities) and are grouped into 3 categories: CDO / CLO, CP and financial intermediation. " Credit Suisse mentioned later in this paragraph that "VIE may be sponsored by the Group or external contractors".

Source: Annual Report for 2021

VIEs are special purpose vehicles that are often used for asset securitization activities. Such entity securitizes some assets (e.g. loans) and looks for entities willing to invest in them. Sometimes banks provide financing to such entities or enter into a transaction on the derivatives market. As can be seen in the image below, liabilities related to CDO / CLO and CP (Commercial Paper) total CHF 8,4 billion (current capitalization is CHF 10 billion). However, if the maximum loss is taken into account (including guarantees, derivatives, etc.), it grows to CHF 41,6 billion. Of course, this does not mean that such an amount is a likely loss for the bank. Part of this exposure is certainly secured, as the bank informs about in the explanatory note.

Source: Annual Report for 2021

What are CDO and CLO? These are shortcuts for: Collateralized debt obligation and Collateralized loan obligation. Credit Suisse buys debt in order to securitize it (convert it into securities). These loans are then sold to VIEs which form the CDO / CLO. VIE then sells these instruments to investors or keeps them on its own balance sheet. Credit Suisse is involved in both the creation of CDOs based on physical assets (loans) and synthetic CDOs / CLOs (based on a reference asset portfolio, without physical replication). In the case of synthetic CDO / CLOs, the bank is often a party to transactions on derivatives.

Credit Suisse liquidity issues

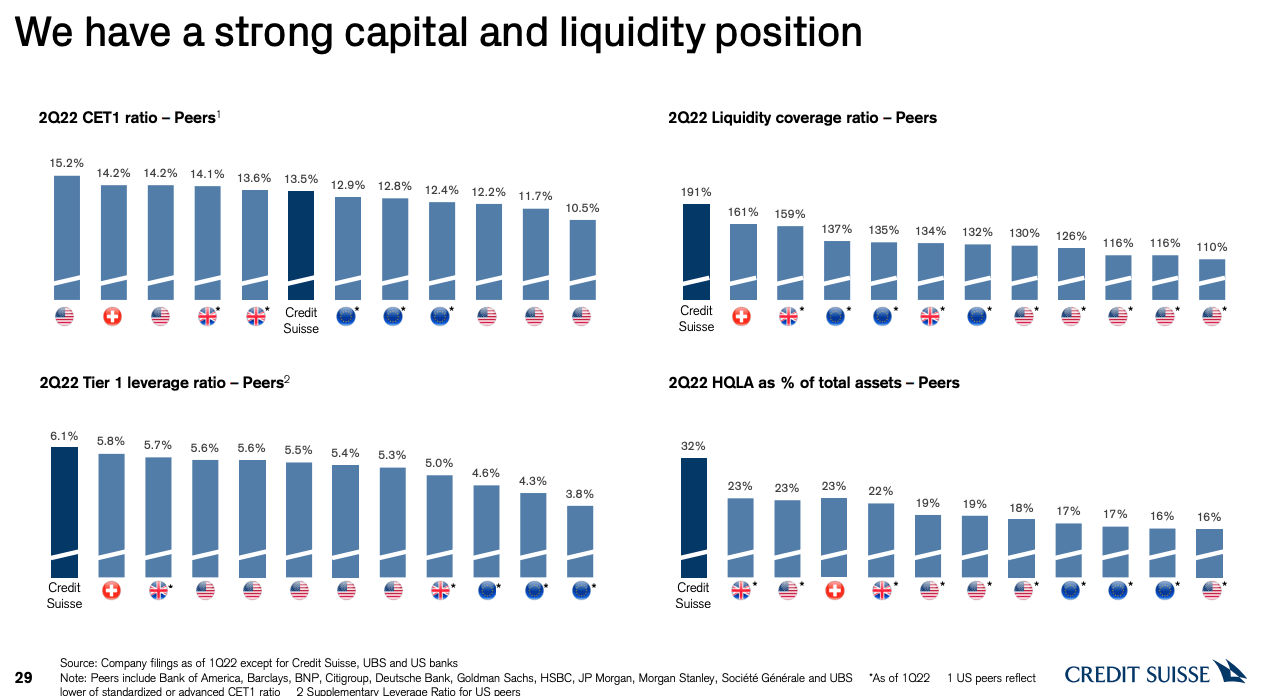

Although the bank is exposed to high risk related to CDO / CLO assets and the growth of non-performing loans (NPLs), Credit Suisse has a very strong capital position. This can be seen from such indicators as CET 1 or Tier 1. The minimum CET1 ratio for Credit Suisse is 10,5%. The bank, in turn, owns it at the level of 13,5%. This means that Credit Suisse has a liquidity buffer. The LCR looks even better (Liquidity Coverage Ratio), which is almost twice its minimum value - 100%.

Source: Credit Suisse presentation

Of course, the market is concerned that it will be necessary to recapitalize the company with several billion francs. Concerns about the bank's solvency are visible in Credit Suisse's 5-year CDS.

Source: BondEvalue

Is Credit Suisse the second Lehman Brothers?

Credit Suisse has had big problems lately. The collapses of the hedge fund Archegos and the British financial firm Greensill cost the bank several billion dollars. Moreover, the bank recently paid an estimated $ 450 million in fines related to the Mozambique corruption scandal.

In addition, the bank has a serious problem with the investment branch of its activity. While retail and commercial banking are profitable and capital management is very profitable, investment banking requires restructuring. There are rumors that a "bad bank" will be created to take on the management of non-performing loans and low-liquid assets. The restructuring of the investment activity itself is not easy. This requires selling illiquid assets with the least possible loss and finding people willing to take over a portfolio of derivatives (swaps, CIRS, futures, options, etc.). It is a very long and expensive process.

It's hard to say what the quality of the assets kept in VIE are and what the investment portfolio looks like. However, Deutsche Bank was in a similarly difficult situation in 2016. Its restructuring takes about 6 years and so far has not translated into high growth for shareholders. Credit Suisse may take a similar path. The probability that Credit Suisse will be the "second Lehman" is, of course, small but non-zero. Currently, the Swiss bank has a strong capital position and there is always a chance that Swiss Central Bank (SNB) implement a rescue plan for the Swiss capital system.

Summation

Credit Suisse is facing a difficult restructuring of its investment banking. It is not a simple and quick process. There are rumors that the bank will need to raise $ 4 billion in capital or create a "bad bank" to manage toxic assets. With a capitalization of $ 10bn, a large share issue can be a problem and put pressure on the stock price to drop further. Investors must also be aware of the risk of dilution. Another problem is that the bank is still at risk of receiving penalties that Credit Suisse receives on a regular basis. The problems of the Swiss bank seem to some journalists similar to those of Lehman Brothers. However, similar accusations have arisen over and over for several years in the case of Deutsche Bank. The German counterpart has been carrying out a painful restructuring for several years. The bank did not collapse, but neither did it provide a high rate of return to its shareholders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)