The Chinese real estate market - everything you need to know about it

The recent turmoil with the Chinese company Evergande Group once again drew attention to the real estate market in the Middle Kingdom. It is an interesting sector. The huge population (about 1,4 billion people) and the rapid increase in real wages contributed to the optimistic forecasts for this market. Tier 1 cities were particularly popular (incl. Peking, Canton, Shanghai) and Tier 2. However, not everyone was optimistic about this market. For over a decade, it has been heard that the real estate market in China is a loser and is facing a correction. Some people mentioned Chinageddon, an economic crisis in this country that will be caused by the bursting of the real estate bubble. Nothing like this has happened so far.

Canton source: www.xinhuanet.com

The amazing development of the real estate market meant that China has already caught up with the "West" in many statistics. For example, the average per capita residential property was around 2017 square feet in 450. This indicator is higher than in Spain (approx. 400) and comparable with France and Great Britain. Note that GDP per capita adjusted for purchasing power parity is lower in China than in Western Europe.

The indicator that tells about the importance of the real estate market in the Chinese economy is real estate activity to GDP ratio. In the United States, it is around 17%. In France and Great Britain, the relationship between these variables was around 20%. In China, the rate was 2017% in 29, which was higher than in Spain during the bursting of the property bubble. It is worth noting that the ratio of sales on the real estate market to GDP alone reached 2019% in 10.

Regional economies also benefited from the growing real estate market. The province's income from the sale of land often accounted for 20-40% of the total income (according to The report of Statista). Thanks to this source, the provinces could cover expenses for education, health care and infrastructure projects.

Be sure to read: How to invest in Asian Indices? [Guide]

Urbanization in China

Along with the opening of the Chinese economy to the world, there has been a process of strong urbanization. The regions by the Ocean were the windows to the world. This was due to logistical reasons (lower transport costs for exported goods) and the policy of the Chinese government, which created special economic zones in coastal provinces. This stimulated the development of cities such as Guangzhou, Shenzhen, Shanghai and Dalian. This started a real "migration of peoples". Many young people from the countryside came from the interior for work. This caused a "boom" in the real estate market. In 1982, only 20% of the population lived in cities, it is worth mentioning that in 1953 the rate was 13,3%. After the transformation of the economy, urbanization grew rapidly. As early as 2005, 43% of Chinese citizens lived in cities. In 2020, urbanization was 60,6%. In less than 40 years, there has been an unprecedented increase in demand for new apartments. Real estate developers benefited from this, as they often sold their flats “on the trunk”.

Ghost towns and vacancies

In 2011, there were approximately 64 million vacant spaces in China. The vacancies include both single buildings and apartments in multi-family buildings. Of course, this is a shocking number, but the scale of China, with more than 1,3 billion people, must be taken into account. In 2019, the number of vacancies amounted to 65 million. This meant that around 20% of all apartments in Chinese cities were empty. For comparison, in the United States, this rate was 7%. However, according to Professor Gan Li of the Southwestern University of Finance and Economics (Chegdu), the vacancy rate is around 50 million.

There are also named places "Ghost cities"which are built "for the future"to support government urbanization plans. The Chinese company Baidu (the owner of the popular search engine in China) has selected several cities based on their online activity, where the “residence” rate is 10% or less. These are cities such as Kongbashi and Tongliao. Sometimes the construction of cities results from government plans regarding, for example, the location of potential industrial hubs.

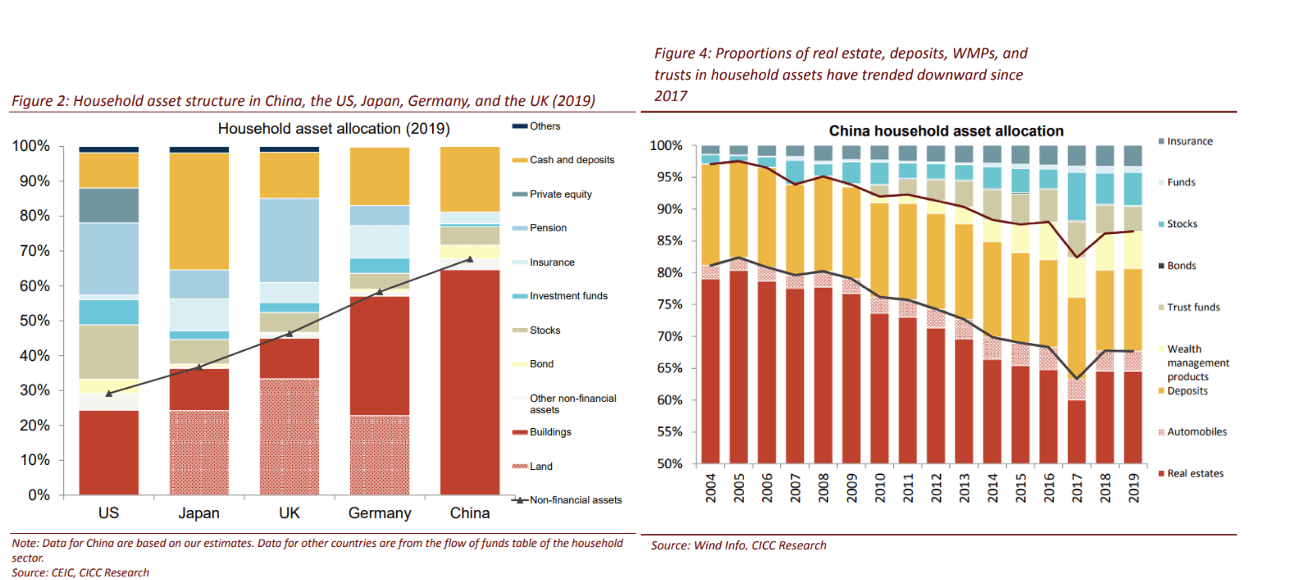

Flats - the favorite asset of the Chinese

For many Chinese, the real estate market is a "natural choice" to invest free funds. The rise in prices in the last few decades has created the belief that real estate prices in China can only rise. At the same time, investing in the stock market is still not very popular. On the other hand, the supply of bonds for individual clients is limited, which results from the fact that enterprises prefer to use bank loans.

It is not surprising then that over 60% of Chinese property is real estate. For many, it is an investment of capital for progressive urbanization. In the next decade, over 300 million people from rural areas will move to cities. For this reason, wealthy people are buying apartments that are now empty but to be filled with newcomers from the interior. Due to the fact that real estate prices were rising all the time, the lack of current cash flow from renting apartments was not a problem.

Real estate prices rise

One indicator that aggregates property prices in China is CNRPPI (China Nominal Residential Property Price Index), which is prepared by the Bank for International Settlements. In the years 2005 - 2020 it increased by over 86%. Over the last 10 years, the index has increased by 41%, but by only 10% in real terms. IN Australia real price increases were 15% over the same period, in Finland (+ 1%), France (+ 6%) and South Korea (+ 10%). As you can see, real estate price growth in China has not been dynamic in recent years. For comparison, in the period 2010 - 2020 real property price growth in India was over 70%.

However, the aggregate index is only part of the truth about the real estate market in China. According to the National Bureau of Statistics, in 2021 in Beijing, the average price per square meter was 42,3 thousand. RMB. In 2008, it was around 11. RMB per m2. In the years 2010 - 2015, the price per square meter in this city was stable and amounted to approx. PLN 20 thousand. RMB. Then the price doubled in 5 years.

Rising real estate prices make it increasingly difficult for the average Chinese family to buy real estate. The Chinese daily Global Times, in a 2018 article on Housing cost key constraint to Chinese consumption, mentioned that in Tier1 cities, the price-to-annual household income ratio was above 50. A “reasonable” amount is considered to be 3-6. In Tier 3 and Tier 4 cities, the ratio ranged from 30 to 40. Limited availability of flats attracted the attention of the government, who “would prefer” the prices to be more affordable.

Rising rental prices were another problem. In cities such as Shanghai, Beijing, Tiajin or Guangzhou, the price of renting a flat accounted for about 60% of the median salary (data: Formal Private Housing Sector, Li Sun's work titled Housing Affordability in Chinese Cities).

liabilities

For the government, rising real estate prices have become a major problem. The rise in real estate prices hindered social mobility and was one of the factors that discouraged young Chinese from starting families. For this reason, there are plans to cool the real estate market.

The period of "deleveraging" of the economy coincided with the attempt to cool down the real estate market. China has a very high level of private (non-financial) debt, which exceeded 200% around 2016. For comparison, in the United States in 2008 the above-mentioned ratio was 170%. The limitation of lending by banks had an impact, inter alia, in in the real estate sector, because developers did not have such "ease" in increasing their debt. This made it possible to "maintain" the level of debt in relation to GDP, until COVID-19, when this type of debt increased to 225% of GDP.

However, the cooling of the economic situation, coupled with difficulties in financing lending, caused some developers to face liquidity problems. This was due to the enormous expenditure on "land banks" to reserve good locations for future housing developments. At the same time, the increase in demand encouraged developers to make speculative investments, where the level of flats purchased at the construction stage was low.

Another problem was the developers' willingness to "diversify" their activities, even if managers had no experience in a given industry. An example is the investment by Evergrande in the very demanding electric car market. NSShelf invested $ 2019 billion in 23 in an electric car plant and two EV battery factories in Guangzhou. Currently, China Evergrande New Energy Vehicle Group has huge problems with continuing ambitious investment plans.

Ambitious projects had to be financed by debt. For many companies in this industry, debt financing is not unusual. Properly applied leverage can help companies spread their wings faster. However, if the borrowed money is invested in weak business projects, with a low ROIC, sooner or later problems will arise.

Evergrande Problems

Evergrande is the "hero" of the last few weeks. It is one of the largest residential developers in China. The company was founded in 1996 by Xu Jiayin. Evergrande has benefited from China's tremendous pace of urbanization. In 2009, the company made its debut on the Hong Kong Stock Exchange. The company sells its apartments to the middle and upper class. At the end of June 2021, the company owned a 214 million square meter (GFA) land bank for which the company had paid a total of RMB 460 billion. About 70% of the land bank relates to land located in the Tier 1 and Tier 2 regions. In H2,3, contract sales increased by only 11% y / y, despite the fact that in terms of GFA sales increased by 6%. This meant that the company began selling cheaper flats and using larger promotions. Despite the difficult liquidity situation, Evergrande launched 2021 projects in the first 65 months of 35 (including in Beijing, Guangzhou and Shenzhen). The current capitalization is around HKD XNUMX billion (Hong Kong dollar).

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 311 022 | 466 196 | 477 561 | 507 248 |

| operational profit | 78 144 | 133 253 | 87 143 | 63 520 |

| net profit | 24 372 | 37 390 | 17 280 | 8 076 |

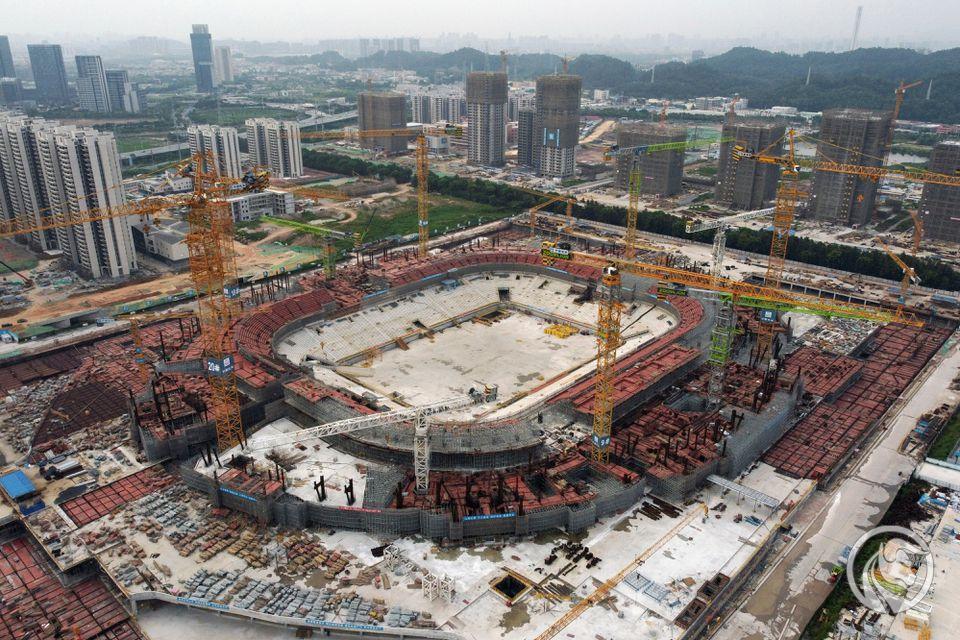

Evergrande's financial problems have been known for several quarters. The company is known for its momentum. Below we present a crowning example of momentum. For its football club, Guangzhou FC (formerly Guangzhou Evergrande Taobao Football Club), has started a project to build a 100-seat stadium (more than Camp Nou in Catalonia). The current work progress is as follows:

Source: reuters.com

The project is to cost $ 1,9 billion and will be one of the flagships of Guangzhou. The stadium is to be ready by the end of 2022. According to the project, the stadium will look like a lotus flower. Below is the final look of the stadium:

There are currently plans to resell the project to Guangzhou City Construction Investment Group. Guangzhou FC football club, which is looking for a new sponsor, also has financial problems.

The restructuring process applies not only to development projects, but also to Evergrande's shares in other businesses. In late September, the company announced that it had found a buyer for a 19,93% stake in Shengjing Bank for $ 1,55 billion. However, it is still a drop in the ocean of the company's needs. The company that manufactures and sells electric cars is also being restructured. Currently, according to CNWire, Evergrande has instructed R&D employees (not related to the Hengchi 5 and Hengchi 6 models) to stay on vacation until October.

The company's debts are around $ 300 billion. It should be remembered that the company still has very large assets that Evergrande will try to liquidate. The problem, however, is that he needs money fast. This means that you may need to sell at a discount to the accounting valuation. For now, the company is trying to reach an agreement with creditors, which was mentioned in the announcement of September 22. The coming months give an answer as to whether the company will be able to restructure its debt.

Chinese developers

Below is a short summary of selected Chinese developers. Some of them focus on investing in less developed cities (Tier 3 and Tier 4). In turn, others prefer to develop development projects in the richest Chinese cities (Tier 1 and Tier 2). we invite you to read

Country Garden Holdings

Country Garden Holdings

The company was founded in 1992. Its headquarters are in Foshan. Country Garden Holdings is a holding and real estate developer. Most of the projects are built in mainland China. The company deals with the construction of residential buildings (apartments, condos), parking lots and stationary stores. In addition, the company deals with the construction and management of hotels. At the end of June 2021, the company was developing over 3 projects in 100 regions. Most projects are developed in Guangzhou (Guangdong) - 582. The next in terms of projects is the Jiangsu region (381). The company is also investing in a land bank. In terms of area, less developed regions (Tier 3-4) dominate. These regions account for 84% of recent purchases. In H2021 219, the company purchased 88,4 plots of land, paying RMB 2007 billion for them. Country Garden Holdings also has a number of side activities. It develops, among others, the segment of construction robots and robots for the hotel and restaurant industry. The company is listed on the Hong Kong Stock Exchange (ticker: 170). Current capitalization is over XNUMX billion Hong Kong dollars.

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 226 900 | 379 079 | 485 908 | 462 856 |

| operational profit | 40 553 | 72 475 | 91 214 | 70 975 |

| net profit | 26 064 | 34 618 | 39 550 | 35 068 |

China Vanke Co

Source: caixinglobal

The origins of the company date back to 1984. From the beginning of its activity, the company was associated with the dynamically developing city - Shenzhen. It has been listed on the Shenzhen stock exchange since 1991. It was the second IPO in the history of this stock exchange. The company generates most of its revenues from the real estate market. The main activity of the company is designing, developing and selling apartments. At the end of June 2021, the company had 160,66 million square meters (GFA - Gross Floor Area) projects (under development or planned). Of which 112,83 million m2 is currently under construction and 47,83 million m2 is under design. The average price per m2 of land in new projects is PLN 7,5 thousand. RMB. Such high costs of purchasing plots are due to large-scale projects in Shanghai. The company also provides real estate rental services. It has approximately 148 apartments in 000 cities. About 33% of the apartments are currently rented. The company also provides real estate management services and has a warehouse business. Currently, the company's capitalization is over 95 billion HKD.

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 242 897 | 297 679 | 367 893 | 419 112 |

| operational profit | 47 967 | 69 244 | 79 309 | 73 743 |

| net profit | 28 052 | 33 773 | 38 872 | 41 516 |

Sunac China Holdings

The company was founded in 2003. The main activity of the company is designing, building and selling apartments. In addition, Sunac China Holdings and its subsidiaries operate in the commercial real estate market. The company also grew through acquisitions. The most famous of these was the acquisition of 13 "tourism" projects from Dalian Wanda for $ 6,6 billion (2017). In the same year, Sunac also acquired shares in the streaming service Le.com. Such actions are part of the "diversification" strategy popular in China. However, it should be borne in mind that over 90% of revenues are still generated from core activities (sale of real estate). In the first half of 2021, the company generated approximately 2,5% of revenues from property management. Sunac has been listed on the Hong Kong Stock Exchange since 2010 (ticker: 1918). The current capitalization is less than 70 billion Hong Kong dollars.

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 65 874 | 124 746 | 169 316 | 230 587 |

| operational profit | 4 649 | 19 419 | 26 953 | 31 885 |

| net profit | 11 004 | 16 567 | 26 078 | 35 644 |

China Overseas Land & Investment

Source: investopoli.com

The company was founded in 1979 in Hong Kong. It is a subsidiary of China State Construction Engineering Corporation Limited (CSCEC). The company initially operated as a construction company that developed infrastructure projects in Hong Kong, Macau and mainland China. In 1992, the company made its debut on the Hong Kong Stock Exchange. In 2007, she joined the Hang Seng index. It is the largest developer and operator of office buildings in China. Since the beginning of the XNUMXs, the company has been developing housing projects. Over the past 40 years, the company has completed 1700 development projects in mainland China, HK, Macau, New York, Sydney and Singapore. The area of completed residential buildings exceeded 200 million square meters.

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 138 748 | 150 587 | 163 651 | 185 790 |

| operational profit | 45 336 | 52 955 | 52 342 | 56 040 |

| net profit | 34 065 | 39 434 | 41 618 | 43 904 |

PolyProperty

The history of the company dates back to 1973. Its headquarters are in Hong Kong and Shanghai. Poly Property is a subsidiary of China Poly Group. The company designs and develops development projects. Poly Property focuses on projects in the middle and high-end categories. The company is constantly increasing the average price per square meter of the apartment sold. In the first half of 2021 it was 13,8 thousand. RMB per m2 (Mainland China). In 2019, Poly Property sold flats at an average price of PLN 12,5 thousand. RMB per m2. However, the price varies by region. In Hong Kong, it is 344 thousand. RMB per 1m2, in the Yangtze River Delta 20,3 thousand. RMB for 1m2. On the other hand, in less developed regions, the price per square meter does not exceed RMB 10. The prices mentioned relate to "identified sale". If we take into account the "contracted sale", ie buying "a hole in the ground" then the average price for 000 m1 is over 2 thousand. RMB. The company also invests in a "land bank" with an estimated GFA 17,5 million. Mainly focused on Tier 16 (1%) and Tier 18 (2%) cities. The current capitalization of the company is HKD 65 billion.

| HKD million | 2017 | 2018 | 2019 | 2020 |

| revenues | 31 703 | 23 234 | 39 944 | 31 281 |

| operational profit | 3 770 | 5 890 | 10 032 | 7 522 |

| net profit | 2 462 | 2 242 | 3 833 | 1 880 |

Shimao Property

Source: Shimao Property

The company was founded in 2001 thanks to the Chinese billionaire Hui Wing Mau. After five years, it made its debut on the Hong Kong stock exchange. The company deals with the construction of residential buildings, offices, hotels and industrial buildings. It focuses its activities in the regions of Tier 1 (24% of sales in 2020) and Tier 2 (41% of sales in 2020). The largest sales are generated in Guangzhou, Beijing, Fuzhou and Hangzhou. In H152, contract sales amounted to RMB 38 billion and were higher by 1% y / y. The average price for 17,7 square meter of an apartment was PLN 19 thousand. RMB. The company also invests in a land bank. In the first half of the year, the company invested in 3 plots of 20,1 million square meters (GFA). The company paid RMB XNUMX billion for them. The land bank is approximately 73 million square meters in total (in more than 100 cities). Development projects are already under development on 50,7 million m2. About 75% of the land bank is located in Tier 1 and Tier 2. The company's current capitalization exceeds RMB 49 billion.

| million RMB | 2017 | 2018 | 2019 | 2020 |

| revenues | 70 426 | 85 513 | 111 517 | 135 353 |

| operational profit | 16 616 | 21 076 | 26 647 | 29 467 |

| net profit | 7 840 | 8 835 | 10 898 | 12 628 |

Summation

The problems of real estate companies in China can, paradoxically, be a good investment opportunity. For companies with a strong balance sheet and efficient management, the period of market turbulence may allow them to take over many interesting investment projects at a discount. Urbanization in China will continue. For this reason, a further increase in demand for new apartments should be expected. Market panic is overestimating all companies in the industry, but for some companies, the fall in share prices may be exaggerated. Purging this market of weaker players can be good for the industry as a whole. The 2007-2009 crisis in the United States did not “kill” all developers. Currently, some of them are valued higher than at the peak of the American real estate bubble (e.g. DR Horton). Therefore, it is worth observing the Chinese real estate market, as interesting investment opportunities may arise there. Of course, it should be borne in mind that if the Chinese government wants to cut margins in this sector, it will lead to it. However, if the market declines continue, for many Chinese developers the risk-reward ratio will be very tempting.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)