Bogleheads - save and invest. 9 steps to financial freedom [Guide]

In recent years, the attitude has gained more and more publicity in the matter of wealth management Bogleheads (from the name of the company's founder Vanguard - John Bogle). These are people who follow a simple investment strategy. They don't spend hours and months to make it "Predict" market behavior or find “Next Amazona". These things they leave to professionals or dreamers.

How Bogleheads Invest

What Bogleheads focuses on is ensuring their financial security in the future. Therefore, such people live below their financial capacity, which allows them to generate savings. The funds saved are not kept in the savings account, but invested in low-cost investment products (e.g. in ETFs). According to the assumptions of Bogleheads, investment products must be simple (without the use of options, hedging, etc.).

The following are the most popular "rules" that these people follow:

- Live below your financial capacity - save the surplus,

- Start investing as early as possible,

- Regularly "add" new funds,

- Diversify your assets,

- Risk as much as you can (not too much, not too little)

- Don't worry about predicting market behavior,

- Invest in the stock market using simple solutions (ETFs, cheap funds),

- Minimize commission costs and optimize tax investments,

- Stick to the plan regardless of the market sentiment.

# 1. Live below your ability

The first rule relates to sound management of your funds. In order to invest funds regularly when applying the Bogleheads Principle, it is necessary to increase the level of savings. This means that a follower of these principles should do two things:

- try to increase your income,

- live below the possible level.

To invest funds, a person needs to generate sufficient income to cover running costs. To increase the savings rate, it is necessary to increase your income (additional job, change of job, starting a business). Increasing your income is the "easiest" way to increase your savings without lowering your standard of living.

However, even the greatest income will be useless if the person is only a "money mover". This is a person who spends the earned money on pleasures, raising his social status or inconsiderate expenses. As a result, the "relay", even if it generates high income, is not able to generate savings that it is able to spend on investments. He spends the increase in income on more "sophisticated" pleasures.

Bogleheads start each stream of cash with a "pay yourself" heading. They spend these funds on savings. The rest is spent on expenses. An extreme example of savers is the FIRE (Financial Independence, Retire Early), such people save from 50% -75% of their income in order to achieve financial freedom faster.

# 2-3. Start investing as early as possible + save regularly

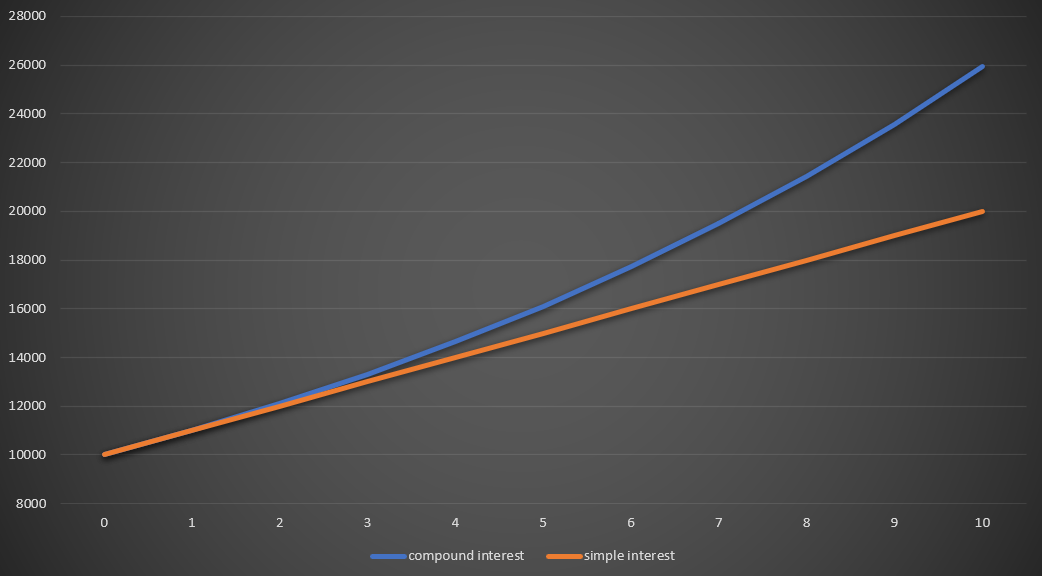

Some say that the eighth wonder of the world is compound interest. This principle works well for those who own assets that are regularly reinvested. The phenomenon of compound interest can be seen in the answer to the following question:

How many assets will an investor who invests PLN 10 for 000 years, achieving an annual rate of return of 10% (after tax)?

"For peasant reason" the answer is PLN 20 (PLN 000 of the initial investment and 10 annual profit for 000 years). However, this is the wrong answer. The correct answer is PLN 1. Almost PLN 000, that's the effect "Compound interest".

| Skirt | initial amount | interest 10% | the amount at the end |

| 1 | 10 000 zł | 1 000 zł | 11 000 zł |

| 2 | 11 000 zł | 1 100 zł | 12 100 zł |

| 3 | 12 100 zł | 1 210 zł | 13 310 zł |

| 10 | 23 579 zł | 2 358 zł | 25 937 zł |

Due to the existence of compound interest, it is worth starting investing as early as possible. Thanks to this, the money saved will work "longer". As a result, financial independence will be achieved faster.

Another aspect is regular "Adding" funds for the investment portfolio. To achieve this, you must live below your "own abilities". Thanks to the constant inflow of free funds, the investor does not worry about the market situation. In such a situation, the investor will both buy "upstairs" and "downstairs". This strategy is called "dollar cost averaging" (DCA - Dollar Cost Averaging). It is one of the oldest market strategies that does not require knowledge of technical and fundamental analysis. It only requires regularity (invest monthly, weekly). By investing a fixed amount, you buy more units of an asset when the price goes down and less when the price goes up. For this purpose, it is worth investing in collective investment instruments (ETFs, index funds).

# 4. Asset diversification

It is worth diversifying your investment portfolio to make it less sensitive to the macroeconomic or market situation of a given investor. Diversification applies to the asset class: stocks, bonds, and commodities. As a result, the portfolio will be "amortized" by the different rates of return achieved by each asset class.

CHECK: How to invest in raw materials, metals and agricultural goods [Guide]

The second type is geographic diversification. Investing in different markets allows you to limit the impact of investing in the market you are in "Lost decade". Examples include the Japanese market in the nineties, or the Greek market after the burst of the real estate bubble and after the debt crisis. Another plus of geographic diversification is creation "Currency basket"which reduces the impact of unfavorable changes in the exchange rate. Investors on the Turkish market have learned about this risk. The sharp weakening of the Turkish lira over the past 10 years has significantly diminished the return achieved on the Turkish equity portfolio.

You can choose either ETFs investing in individual stock markets (e.g. German), or a region (Pacific Asia) or a group of countries (emerging markets). A simpler solution is to buy equity funds of companies of the "world market". You can also invest in specific sectors (technology, etc.).

# 5. Risk as much as you can, but not less

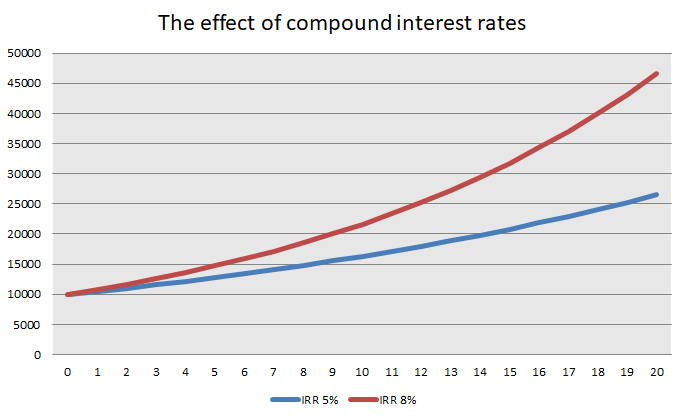

The higher the potential rate of return, the higher the investment risk. For this reason, investing only in "safe" solutions (eg bank deposits) is "deadly" for financial independence plans. To illustrate this fact, below the portfolio rate of return will be presented, which for 20 years reaches 8% and 5% rate of return per year.

For this reason, you should take a bit more risk (add shares to your portfolio). This will help you achieve a higher rate of return and become financially independent faster. On the other hand, you must not invest all your funds in just one company of the "next Amazon", because a mistake could destroy the chance of multiplying funds in the long term.

Below is a table showing what rate of return you need to achieve to make up for losses:

| The size of the loss | How much do you need to earn to make up |

| -33% | + 50 % |

| -50% | + 100 % |

| -90% | + 1000 % |

# 6. Don't worry about predicting market behavior

Danish physicist Niels Bohr once mentioned:

"Predicting is very difficult, especially when it comes to the future."

Due to many factors that affect short-term changes in the price of financial instruments, it is very difficult to precisely determine how much the price of shares, bonds, currencies, commodities or stock indices will change every month, quarter or year.

Investors operating under the Bogleheads rules do not try to buy at the bottom and sell at the top. They try not to invest actively. They prefer systematic, passive investment methods. They also want to invest in diversified solutions to minimize the specific risk (of a single share, bond).

# 7. Invest in the stock market with simple solutions (ETFs, cheap funds)

Although supporters of the Bogleheads movement can be found among professional investors, as a rule, simple financial instruments are used. The KISS principle (Keep It Simple, Stupid). For this reason it is not necessary to use "freaks" (headging or derivatives). Choosing simple and cheap solutions (such as ETFs and cheap index funds) will save you time and not expose yourself to the risk of using instruments that you do not understand.

A great example of exposure to disproportionate risks has been use "Zero-cost" strategy on currency options by Polish exporters before the subprime crisis.

The use of this strategy resulted in an asymmetrical risk sharing (unequal number of options bought and written). "Option scandal" bounced back for many companies in 2008-2009.

# 8. Minimize commission costs and optimize tax investments

In long-term investing, it is necessary to minimize commission and tax costs. Minimizing commission costs requires two approaches: minimizing "asset trading" and looking for an inexpensive broker.

READ: Taxation of Forex Profits [Series]

Reducing asset turnover means none "Active portfolio management". This is a very static approach. Bogleheads approach not recommended "Active response" for market events. Failure to sell stocks and bonds during market corrections reduces commission costs. This "passive" approach is in line with the bullet point of not predicting market behavior. Periodic, of course "Portfolio adjustments" (e.g. as part of the 60-40 strategy) are sometimes necessary. However, Bogleheads don't deal with blindly following the market mods.

Another aspect is choice the right broker. It is best if it provides a wide selection of foreign markets and offers affordable commissions. However, apart from the price itself, an investor should not invest all funds in a broker that has poor reviews but is "cheap". It is necessary to apply the principle of limited trust.

# 9. Stick to the plan regardless of the market sentiment

Consistency is the most difficult part of the Bogleheads strategy. Regularity is required both in controlling the household budget and in applying investment strategies. It is especially important to apply your investment strategy consistently as frequent changes to your strategy will increase your “asset turnover” ratio - which increases your commission costs. While at the start of the road, sticking to the plan may seem simple, but in the long term there are bearish periods in the markets that will impede assets (i.e. "Slips of capital"). It's worth taking a look at the quotes S & P 500 in 2001-2002, when the index was in a long bearish period. The Nasdaq index, which broke the dot.com bubble after fifteen years, is also worth mentioning.

Brokers offering low-commission ETF purchases

The financial industry is a relatively efficient market and is beginning to notice a growing demand for the purchase of ETFs by an increasing number of individual investors who want to regularly invest some of their savings in these instruments.

This means that we can expect more brokers who will offer low-cost and even * commission-free ETF purchases. At the moment, two offers stand out on the European market in this respect - XTB i Rotation.

| Broker |  |

|

| End | Poland | The Netherlands |

| Foundation year | 2005 | 2013 |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

approx. 150 - ETF *without commission approx. 4900 - ETF (total) |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 |

| Commission-free offer (condition) | do 100 000 EUR turnover per month | transaction for min. 1000 EUR |

| Standard commission | 0,2% (min. EUR 10) | 0,03% + EUR 2 |

| Platform | xStation | Web platform |

| - | ||

* Only part of the DeGiro ETF offer is traded commission-free under certain criteria. Details and a list of these ETFs can be found here (PDF).

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Lynx Broker, which was not included in the list, has an equally interesting offer. Reason? Currently, min. The starting amount of the investment is PLN 30, and the waiting time for opening an account is ... over a month.

Summation

Bogleheads is certainly an interesting idea for building wealth and financial freedom. It is worth using cheap investment solutions (eg ETFs) and diversifying in terms of assets, currencies and geographic regions. Of course, saving and investing in diversified, cheap financial assets is only one of the main issues. There is also a need for cash handling as we approach the 'payout' period.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Bogleheads - save and invest. 9 steps to financial freedom [Guide] BOGLEHEADS financial freedom](https://forexclub.pl/wp-content/uploads/2021/02/BOGLEHEADS-wolnosc-finansowa.jpg?v=1614355697)

![Win the book “Step by step. About financial freedom and a prosperous, fulfilled life” [COMPETISE] step by step about financial freedom](https://forexclub.pl/wp-content/uploads/2023/10/krok-po-kroku-o-wolnosci-finansowej-300x200.jpg?v=1697012104)

![Bogleheads - save and invest. 9 steps to financial freedom [Guide] interest rate on bonds](https://forexclub.pl/wp-content/uploads/2021/02/oprocentowanie-obligacji-102x65.jpg?v=1614333071)

![Bogleheads - save and invest. 9 steps to financial freedom [Guide] speculation approach to the forex market](https://forexclub.pl/wp-content/uploads/2021/02/spekulacja-podejscie-do-rynku-forex-102x65.jpg?v=1614536808)