Bed Bath and Beyond (BBBY) - the faded glow of an old star

Nothing is given once and for all. More than once the company has gone through the road from a market star loved by analysts, investors and the media to a pariah who only attracted short sellers. One such company is Bed bath and beyondwhich transformed from a dynamically developing business into a company that must constantly restructure its operations. The history of this company is a very interesting example of an attempt to transform a company with several billion dollars in revenues. We invite you to read!

Source: presentation of funds (Investor Group) on April 29, 2019

The story of Bed Bath and Beyond

The beginnings of the company date back to 1971. It was then that the managers of the Arlans discount store: Warren Eisenberg and Leonard Feinstein decided to open their own chain of specialist stores. It was clear to the creators of the network that the time of this type of stores was coming. IN Originally, the Warren and Leonard store was intended to offer a wide range of products related to home products. The first store was located in Springfield, NJ. Initially, the concept was called Bed 'n Bath.

Another 14 stores were opened over the next 16 years. Initially, the network focused its activities in the metropolitan district of New York and California. However, the problem was the competition from firms that specialize in opening 20 square feet of stores. This type of shop could offer customers a much larger assortment in one place. The breakthrough moment was the opening of the first large "superstore" store. Thanks to this, the network stood against competitors such as Linens' n Things, Pacific Linen and Luxury Linens. In 000, the chain changed its name to Bed Bath & Beyond. It was related to a significant increase in the assortment. Offering a wide range of products at affordable prices has become the hallmark of this chain. This, in turn, encouraged the company to open new stores, including those from the "superstore" category.

The expansion plans were far greater than the cash-generating capacity of Bed Bath & Beyond. As a result, the company made its debut on the New York Stock Exchange in 1992. At the beginning of the 90's, the company was one of the most innovative companies in its industry. It was one of the first to introduce a computerized inventory management system, which allowed to reduce the need for working capital. Since Bed Bath & Beyond needed less capital to finance stocks than its competitors, it could grow faster. The company has been using the "category killer" strategy since the 80s, which was successfully used in networks such as Toys R Us, Best Buy and Costso. They simply offered a wider choice of categories and lower prices than local competitors.

The Golden Years (1992 - 2014)

Bed Bath & Beyond was at that time regarded as a typical growth company that had a strong competitive advantage over smaller, local players. Economies of scale combined with good capital management by the company meant that the share price was rising at a very fast pace. It is the economies of scale combined with good inventory management that have allowed us to achieve a sustainable competitive advantage. The larger the chain of stores, the more famous it became. At the same time, the size of the company made it possible to purchase products from manufacturers with large discounts. Part of the discount was returned to customers in the form of lower prices. The lower the prices and the larger the chain, the more customers visited this chain of stores. In turn, the increase in the number of customers increased revenues and improved the company's bargaining power in relation to suppliers.

Despite the fact that the company had numerous competitors, Bed Bath & Beyond was able to find its group of loyal customers. Moreover, the e-commerce offer was very limited. For this reason, if the customer wanted to quickly buy a home item, he would choose the nearest store with a wide range of products. Among them was Bed Bath & Beyond.

The development of the stationary chain of stores combined with good sales per customer allowed the company to generate high revenues. Thanks to the high operating leverage, the company managed to improve its operating margin, which peaked in 2013. At that time, the operating margin was 15%, which was a very good result for a seller of this type of products. For comparison, in the 90s, the company generally had an operating margin of 11%.

Source: presentation of funds on April 29, 2019

Growing cash flows also followed the accounting results. Initially, the company spent most of its operating cash flow on capital expenditure (CAPEX). However, already in 2000 free cash flow (FCF), ie operating cash flows less CAPEX amounted to $ 46 million. Two years later, the FCF was worth $ 216 million. Bed Bath & Beyond has become a cash machine. The generated cash was used to carry out acquisitions and pay the surplus to shareholders. As long as the business model was fulfilling its role, managers did not care that BBBY was underinvested. Years of neglect were covered by rising stock prices and good financial performance. However, the sleep-over period of the online trading revolution had "rebounded" for many years.

Acquisitions - one of the factors of growth and subsequent problems

In addition to organic growth, Bed Bath and Beyond (BBBY) grew through acquisitions. This was the case, for example, in 2002, when a chain of 396 stores took over Harmon Stores, which had 27 stores. Thanks to this acquisition, BBBY was able to grow faster. The transaction was cash.

A year later, Bed Bath and Beyond acquired Christmas Tree Shops for $ 200 million in cash. The acquired company generated revenues of approximately $ 370 million. Christmas Tree Shops had 23 stores in 6 states at the time. Most of them were located in Massachusetts (14). Depending on the location, the chain had stores ranging in size from 6 to 000 square feet, but in recent years the openings of "large stores" have prevailed. Thanks to this transaction, Bed Bath and Beyond diversified its activities, as the acquired chain of stores focused on selling things for homes and gifts. Interestingly, as part of the restructuring, the chain was sold by Bed Bath and Beyond in 50 to Handil Holdings. At the time of sale, the network consisted of 000 stores. The sale price was $ 2020 million.

This was not the end of the acquisitions. In 2007, the company decided to buy Buybuy BABY for $ 67 million (net) and agreed to take over a debt of $ 19 million. Buybuy BABY dealt in the sale of products for children and babies. At that time, the chain consisted of 8 stores ranging in size from 28 to 000 square feet. It was another step that was to make the chain more diversified in terms of products. The whole thing is added to the fact that the founders of Buybuy BABY were Richard and Jeffrey Feinsteins, who were sons of one of the co-founders of Bed Bath & Beyond. In connection with the restructuring, Bed Bath & Beyond announced in 2022 that it is still open to selling the said network to external investors.

5 years later, the company acquired Cost Plus World Market for $ 495 million. At the time of purchase, the acquired company owned 250 stores under the names World Market, Cost Plus World Market, Cost Plus Imports and World Market Stores. The purchased company ran stores with a wide range of products, including furniture, gifts, home accessories and home decorations. In 2020, Bed Bath & Beyond announced its Cost Plus World Market sales plans. Ultimately, they sold a chain of 245 stores for $ 110 million.

Over the next 5 years, the company made another five acquisitions. Below is a brief summary of subsequent acquisitions:

- 2012 - Harbor Linen for $ 105 million in cash

- 2015 - Of a Kind (transaction value not specified)

- 2016 - One Kings Lane (approx. $ 12 million)

- 2016 - PersonalizationMall.com for $ 190 million

- 2017 - Decorist (approx. $ 5 million)

The transactions from 2015-2017 are especially interesting because they concerned purchases of e-commerce companies. It was an attempt to enter the e-commerce market. However, the reluctance to develop these segments and the lack of funds to attempt to create extensive logistics to support the e-commerce market meant that the company was unable to create an interesting offer for its online customers. The aforementioned transactions did not change the company. A good example is Decorist, which was an e-design platform. On August 26, 2022, Bed Bath & Beyond announced that it intends to end Decorist. There was simply no idea and resources to use the platform to increase the company's sales. Most of the acquired businesses have been sold by Bed Bath & Beyond in recent years. This proves ill-considered acquisitions that were unable to build a permanent moat ahead of the competition.

Star Fall: 2015 - 2019

Strategy "Category killers" she was great in the pre-internet days. Thanks to it, customers came to the store and could enjoy a wide range of products and low prices. However, the era of internet commerce has begun. An increasing number of customers (mainly from the "younger generation") preferred to use the offer of online stores than go to the store and buy on the spot. Online stores had significant advantages over stores "Brick-and-mortar". They could offer a wider product offer at a lower price. Companies operating on the e-commerce market did not have to spend a fortune to build new stores with a huge area. Instead, warehouses and a logistics network (if they applied the asset-heavy strategy) or the warehouses themselves (asset light strategy) were enough. Lower rental costs, lower capital expenditure and an aggressive pricing policy allowed online stores to "steal" customers. Bed Bath & Beyond did not create its own brand, did not have a wide category of unique products that would keep customers at home. The remaining price fight for the customer, which had a negative impact on the company's operating profitability.

Moreover, the company was also under pressure from "traditional" companies that were able to build a stronger bond with the client. An example of this type of chain was Walmart (the largest supermarket chain in the United States) and Target. The aforementioned companies had a much larger scale of operations and started selling Bed & Bath products. These retail chains also had a wide portfolio of private labels. In the case of Target, as much as 1/3 of revenues came from the sale of private labels that are not available from competitors. Much larger chains offering products for homes were another competition. They include Home Depot, which offered a much wider range of products than BBBY. A great example was Home Depot's acquisition of a flagship rental in Manhattan. Located on the Upper East Side at 731 Lexington Avenue, the venue has an area of 120 square feet. The transaction took place in 000.

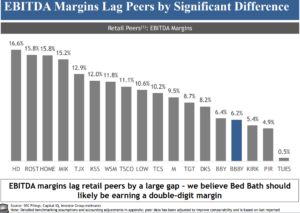

Source: presentation of funds on April 29, 2019

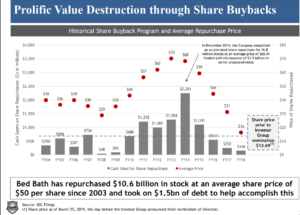

Another problem was the improper allocation of capital. Not very thoughtful acquisitions combined with a really generous policy of paying out capital to shareholders caused that Bed Bath & Beyond did not have the resources to restructure its own business. As a result, the inventory management model was outdated and millions of dollars were wasted in warehouses on the shelves with unsold goods. Another problem was the ill-considered policy of share purchases. Most funds were spent not when stocks were significantly below the intrinsic value, but around historic highs. It was a very bad decision and showed low awareness of how to manage capital.

Source: presentation of funds on April 29, 2019

Activists to the rescue of Bed Bath & Beyond: 2019

At the end of April 2019, three investment funds (Legion Partners, Macellum Capital and Ancora) known for being market activists published a 186-page presentation that presented the "achievements" of the company's managers in recent years in a very negative light. At the time of the publication of the presentation, the funds themselves owned approximately 5% of the company's shares (6,9 million shares) and had experience in restructuring and optimization of many companies operating in the R&C B (Retail & Consumer Business) industries, including Papa John's or Mattel.

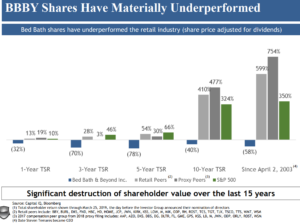

According to activists, from April 2, 2003 until the publication of the presentation, BBBY shares performed much worse than its competitors listed on the stock exchange. The competitor index provided shareholders with an 800% higher return than Bed Bath & Beyond.

Source: presentation of funds on April 29, 2019

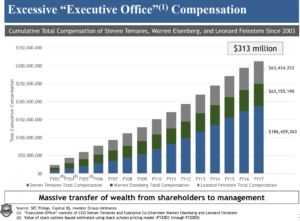

The date of April 2, 2003 is not accidental - then Steven Temares was appointed CEO. Moreover, according to the funds, the management board did not care about the shareholders. During Temares's tenure, the "Executive Office" was awarded $ 300 million, while the funds estimated the "destruction of company value" at $ 8 billion.

Source: presentation of funds on April 29, 2019

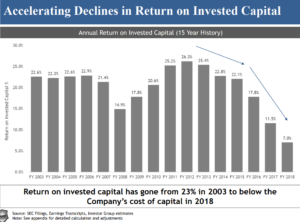

Source: presentation of funds on April 29, 2019

In their opinion, it was necessary to completely change the model of operation and the dismissal of Steven Temares. The fund analysis was not only based on the fund's own beliefs but detailed analysis of the company's operations. The fund's employees visited more than 200 BBBY stores, talked with former employees and surveyed customers of the chain of stores. In addition, they interviewed former CEOs from the retail industry and leading managers of many e-commerce companies. The analysis allowed for the development of a "roadmap" to improve the efficiency of Bed Bath & Beyond.

According to activists, Bed Bath & Beyond should increase its gross margin through a better purchasing policy. This would require finding new sources of attractive products at more affordable prices. This would allow the gross margin on sales to be rebuilt, which would translate into an improvement in net profitability. In addition, BBBY should release capital by selling assets not directly related to the company's operations. Another source of FCF growth was also the optimization of the working capital management policy (in particular inventories). The plan also assumed a change in the corporate culture of the company and a greater emphasis on improving the "customer's experience". Another source of business growth was seen in the area of e-commerce for which the current management board had no idea.

Another downside found by activists was also bad shop organization. After visiting 200 of them and examining several hundred regular customers, the following conclusions were drawn:

- Some product categories (e.g. litter bins) were placed in several different places, which made it difficult for the customer to choose,

- No premium products made only for BBBY,

- Too narrow aisles that made it difficult to avoid customers,

- Product display was much worse than that of competing chains.

According to activists, the "category killer" strategy has worked well for many years in the company's operation, but is now obsolete. What's more, the permission for store managers to perform a similar role as Chief Merchant Officer does not match the current, rapidly changing purchasing trends and more and more demanding customers. The underinvestment of the departments responsible for working capital management and data analysis meant that Bed Bath & Beyond stopped keeping pace with the competition.

Due to pressure from activists, long-time CEO Steven Temares left his position in May 2019. His place was taken by Mark Tritton, who had worked for many years at Target as Chief Marchandising Officer and Executive Vice President. His task was to restructure the company and change the product offer. Many more private label products began to appear on the web. In addition, the offer was reduced as it was decided to reduce the need for working capital. In addition, restructuring plans were announced that concerned both the chain of stores and employees of the headquarters. It was planned to reduce the chain of stores by 44 outlets.

Difficult restructuring: 2020-2022

The company was in a dangerous spiral, customers abandoned online shopping, which forced the optimization of the store structure. It was decided to reduce the number of points of sale in order to optimize the cost structure. This, in turn, reduced traffic in the company's stores. This entailed lower sales, which had a negative impact on BBBY's purchasing power.

The difficult road of restructuring Bed Bath & Beyond was visible in the company's financial statements for the financial year 2020, which ended in February 2020, so before the effects of lockdowns. Here's a handful of financial data:

| $ Million | 2018FY | 2019FY | 2020FY |

| revenues | 12 349 | 12 029 | 11 159 |

| Number of stores | 1 552 | 1 533 | 1 500 |

| Revenue per store | 7,96 | 7,85 | 7,44 |

| Operational profit | 761,3 | -87,1 | -700,1 |

| Operating margin | + 6,16 % | -0,72% | -6,27% |

| Net profit | 424,9 | -137,2 | -613,8 |

| Comparable sales (y / y) | -1,3% | -1,1% | -6,8% |

Source: own study based on the annual reports of BBBY

As you can see, despite the closing of "unprofitable" stores, the revenue per store was decreasing. This is negative news in the inflationary environment. Moreover, comparable sales also dropped. The trend has continued uninterruptedly since 2018. This meant that either the number of customers decreased or their shopping cart decreased. Such a signal meant that the company had to further optimize its marketing and sales strategy.

The following years were even worse. In Q2020 19, the American economy had to deal with the first wave of COVID-19. This forced the stores to close, which had a negative impact on sales. The company was unable to take advantage of the shopping spree that hit American families during COVID-XNUMX. Then many American households decided to renovate their homes. The beneficiaries of this trend were, among others e-commerce companies such as Wayfair. On the other hand, BBBY was not able to flexibly switch to online sales.

| $ Million | 2020FY | 2021FY | 2022FY |

| revenues | 11 159 | 9 233 | 7 867 |

| Number of stores | 1 500 | 1 020 | 953 |

| Revenue per store | 7,44 | 9,05 | 8,25 |

| Operational profit | -700,1 | -336,9 | -407,6 |

| Operating margin | -6,27% | -3,65% | -5,18% |

| Net profit | -613,8 | -150,8 | -559,6 |

| OCF * | 590,9 | 268,1 | 17,8 |

| Purchase of shares | 99,7 | 332,5 | 589,4 |

| Cash and short term investments | 1 386 | 1 356 | 439,5 |

* cash flows from operating activities

The following years are a further problem with the shrinking business. Flows also decreased as a result of lower sales cash from operating activities, i.e. the main source of cash generated by the company. The company tried to obtain funds from the sale of assets, but these were one-time injections of cash. Despite the difficult financial situation, the management board decided to buy back shares for over $ 1 billion. The level of liquid assets owned by the company has dropped dramatically. However, it did not change the weak foundations of the company.

In early March 2022, the share price rose 86% after the news that activist Ryan Cohen owns a 9,8% stake in the company. Cohen is known to be trying to change the way the company operates. Cohen's most famous investment was GameStop, which was one of the stars of 2021. Ryan has announced that he intends to completely renovate Bed Bath & Beyond. The activist announced that he had many scenarios, including selling the entire company to another competitor. Despite this, the company's situation continued to deteriorate, and as a result, Mark Tritton left his position. Mark left BBBY in June 2022.

July 2022 - September 2022: Reddit is back in action

The company was in financial trouble. July 1 rating agency S&P Global Ratings downgraded the company's rating from B + to B-. It was a signal that BBBY's problems were really serious.

The company became a speculative asset, the price of which was able to increase by several percent on one day. Despite this, the course performed very poorly throughout the year. The company was liked by short sellers who believed that BBBY would soon go bankrupt or issue a lot of shares to save liquidity. Individual investors, many of whom exchanged information on Reddit, were of a different opinion. It took very little to increase the rate. For example, in July 2022, the price of one day increased by 8% after the news that the new CEO (Sue Gove) had purchased 50 shares of the company.

Some speculators believed that outside investors would save the company. At the end of July, information appeared that Freeman Capital invested in the company, which revealed itself with over 6% of its shares. The fund suggested BBBY needed to find $ 1bn financing to help finance further restructuring. Bank of America analysts reacted skeptical to Freeman's plans, recalling that the company already has over $ 3 billion in liabilities in the form of interest debt and leasing liabilities.

However, speculators sniffed the chance short squeeze. At the beginning of August, over 50% of free float was sold for a short time. It was an ideal opportunity to try to repeat the story GameStop from 2021. On August 5, 2022, BBBY shares increased by over 30%. This put the short-term players in a very difficult position. Monday, August 8, was even tougher for short sellers, Bed Bath & Beyond grew by over 40%. The following days are a continuation of the rally that ended on August 17, 2022. From the low of July 27 to the intraday peak of August 17, BBBY's shares rose by over 560%. However, the company's fundamental situation continued to be difficult.

BBBY stock chart, interval W1. Source: xNUMX XTB.

At the end of August 2022, the company announced that it intends to close another 150 stores and reduce the number of employees by 20%. Such information in the case of a retail chain means that the company's liquidity situation is very bad. Retail sales are too stable a business for it to turn out within a few months that a dozen or so percent of stores are permanently unprofitable and destroy the value of the enterprise.

CFO Bed Bath & Beyond - Gustavo Arnal - committed suicide in September. An investigation into market manipulation was conducted against Gustavo. Bed Bath & Beyond is a defendant in a class dispute. The company was accused of misrepresenting its true value and delaying the publication of relevant market information. The lawsuit mentions Gustavo Arnal and Ryan Cohen.

Summation

The story of Bed Bath & Beyond is a great story whose moral is that nothing lasts forever. Even a great business model that works for several years may eventually stop working. This was the case with BBBY using strategy "Category killer" he was able to beat smaller competitors, and after many years himself became a victim of success of other market stars (companies from the e-commerce category and more efficient competition operating in the brick-and-mortar model). That is why it is worth following the activities of management boards of companies carefully. Even the best company can lose its competitive advantage if management is unable to achieve long-term goals and listen to customer expectations.

Another moral is that sometimes a sharp change in the share price does not permanently change the foundations of the company. This was the case in August 2022, when the share price increased by several hundred percent and the company's fundamental situation remained weak.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)