Austrian Stock Exchange - How to invest in Austrian companies? [Guide]

The Austrian stock exchange with headquarters in Vienna (Wiener Börse) is one of the oldest venues for trading in securities in the world. It was founded in 1771 during the reign of Maria Theresa. How has it changed over the past 250 years? Will we find companies worth investing in there? We decided to check it. But let's start with a historical outline.

The building of the Austrian Stock Exchange. Source: Wikipedia

Austria at the turn of the XNUMXth and XNUMXth centuries (still known as Austria-Hungary) was one of the largest economies in the world. Vienna was also the financial center for much of Central and Eastern Europe and parts of the Balkans. The defeat during World War I disintegrated Austria-Hungary, and Austria itself became a small country in Central Europe. Despite the developed economy, the country was a shadow of its former power, both in terms of population and area. After World War II, by the decision of the great powers, the country was to remain neutral, which meant that it could not integrate into the post-war Europe that was taking shape: the Coal and Steel Community (the predecessor of the European Union). Austria, despite the neutrality enforced by the Big Three, was able to join the Marshall Plan, but did not join NATO. In 1959, together with Denmark, Norway, Portugal, Switzerland, Sweden and Great Britain, they founded the EFTA (European Free Trade Association) organization. Officially Austria was a member of EFTA from 1960 to 1995. After 35 years, the country decided to join the competitive economic bloc - the European Union.

Austria is one of the richest countries in the world with a very high standard of living. Austria is currently in the lead in terms of GDP per capita after adjusting for purchasing power parity (PPP). However, in terms of the size of the economy, Austria is in the fourth ten in the world (33 place). Austria's nominal GDP is around $ 477 billion, compared to the Polish economy in 2021 of $ 674 billion. Austria is thus a medium-sized, developed economy. It is no wonder that the importance of the Vienna Stock Exchange has declined significantly over the past 100 years. At the turn of the nineteenth and twentieth centuries, it was the main place for securities trading in the great empire, but now it is a regional stock exchange that has shares in smaller, regional stock exchanges (e.g. Prague).

Being a small regional stock exchange does not mean that you cannot make money in this market. There are many companies listed on the Austrian stock exchange that stand a chance of increasing their value in the coming years. In today's article we will show you how to invest in companies from the Austrian stock exchange. We invite you to read.

Austrian stock exchange - basic information

Ludwig van Beethoven

At the beginning, bonds and treasury bills were traded on the stock exchange, and foreign exchange took place. Financial services have developed with the advancement of the economy. As a result, the stock exchange was also used as a place to obtain additional capital by enterprises. In 1818, the first company to debut on the stock exchange was the Oesterreichische Nationalbank. Interestingly, in 1819 the bank's shares (8 pieces) were bought by one of the most famous composers in history - Ludwig van Beethoven.

The nineteenth century was a period of increased investment in transport infrastructure (canals and railways). It is no wonder that it was the railway companies that were looking for capital for development on the Vienna Stock Exchange. Between 1867 and 1873, the Austro-Hungarian Monarchy was in a period of very rapid industrialization and rapid economic growth. As a result, many companies from the banking, transport and industrial sectors made their debut on the stock exchange in this period. It is worth mentioning that companies that debuted a century and a half ago are listed to this day. You can list here PORR AG and Wienerberger AG. The crash of 1873 caused many companies to collapse (almost half of the listed companies disappeared from the market), which had a negative impact on the level of savings in the country. As a consequence, there was a need for legal regulations. Ultimately, the Stock Exchange Act was passed in 1875. It was one of the first acts in the world regulating the stock exchange in a modern way. The act (with minor changes) regulated the Austrian securities market until 1989. The stock exchange has operated practically continuously from the day it was founded. The longer breaks were caused by the two World Wars that hit Europe in the first half of the 1948th century. In XNUMX, the Vienna Stock Exchange resumed trading in shares. However, the development was not dynamic, as there was a "fashion" in Austria at that time for the nationalization of enterprises in "key" sectors.

Better times for the Austrian Stock Exchange came in the 1987s, when there was a large wave of privatization involving companies such as OMV (1988), Austrian Airlines (1988), Verbund (1989) and EVN (XNUMX). Another important change also occurred in the late 80s: the development of auto trading. After 10 years, in 1999, all trading was automatic. It is also worth mentioning that the Austrian trading system was used, inter alia, in in Croatia, Hungary, Slovenia and the Czech Republic.

In 1991, a new one debuted ATX index (Austrian Traded Index), which groups together the 20 largest and most liquid companies Vienna Stock Exchange. Of course, this is not the only index that was calculated by the Vienna Stock Exchange. The oldest is WBI (Wiener Börse Index), which was developed in 1968 and was designed to show the behavior of the "broad market". Currently, it consists of 60 components. Companies from the banking, energy and fuel industries dominate. These three sectors account for almost half of the index.

in 1997, another important step in the development of the viennese stock exchange took place, the merger of the Vienna Stock Exchange with the Austrian Futures and Options Exchange (ÖTOB). As a result, one entity was created that allowed investors to trade on the cash and futures markets. Another important date is the acquisition of the Prague Stock Exchange in 2004.

Investing in Austrian companies

Please note that the Austrian stock market is relatively small which means that many brokers do not offer the option of investing directly in this market. If someone is interested in direct trading on this market, he should look for a brokerage house that allows you to invest cheaply on the Vienna Stock Exchange. Another option is to trade derivatives that give you exposure to this market (e.g. CFDs on the main index). Another option is to find an ETF that invests a significant portion of its assets in Czech companies. The most important benchmark for the Austrian market is the ATX index. In summary, you can invest in Austrian companies using:

- individual selection of companies;

- investing through ETFs;

- use of derivatives that give exposure to this market.

ATX Index - Basic Information

The ATX index groups the 20 largest and most liquid companies listed on the Vienna Stock Exchange. Based on the ATX index, many derivative instruments are created, such as futures, warrants and certificates. The composition of the index is revised every six months. It is worth noting that In contrast to DAX index, ATX does not include dividends in the index. For this reason, it is calculated like most major indices of developed exchanges. To compare the Austrian index with the German DAX, use the ATX Total Return (ATX TR) which includes the effect of dividend reinvestment.

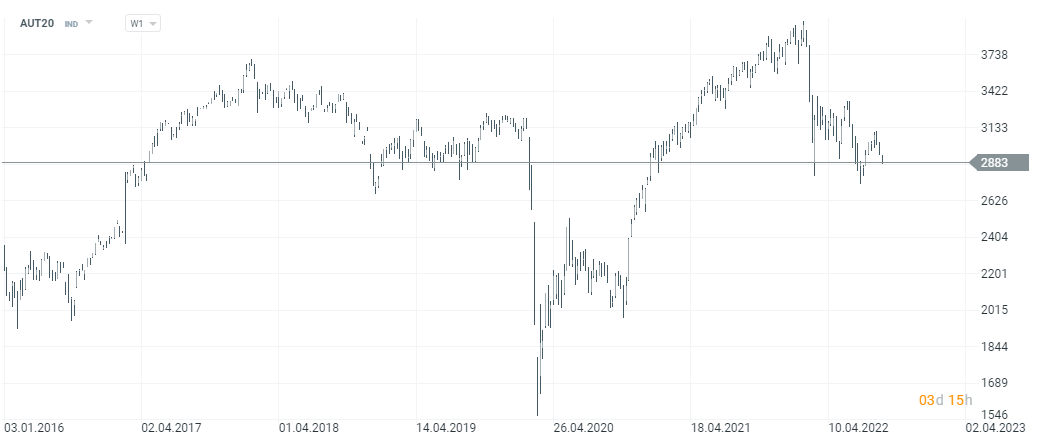

AUT20 chart (CFD on the ATX index), interval W1. Source: xNUMX XTB.

The ATX is a capitalization weighted index that is free float. As already mentioned, ATX revises the index composition every six months. The change criteria are weighted free float capitalization and trading in shares on the stock exchange. The index revisions take place in March and September. The index itself was launched on January 2, 1991 (1000 points), but was calculated back to December 1985. The lowest level of the index was recorded on February 11, 1988 (434,26 points). In turn, the historic record (intraday) took place on July 9, 2007 (5010,93 points). At closing prices, the maximum was set on the same day, but the value was 4 points.

ATX index components

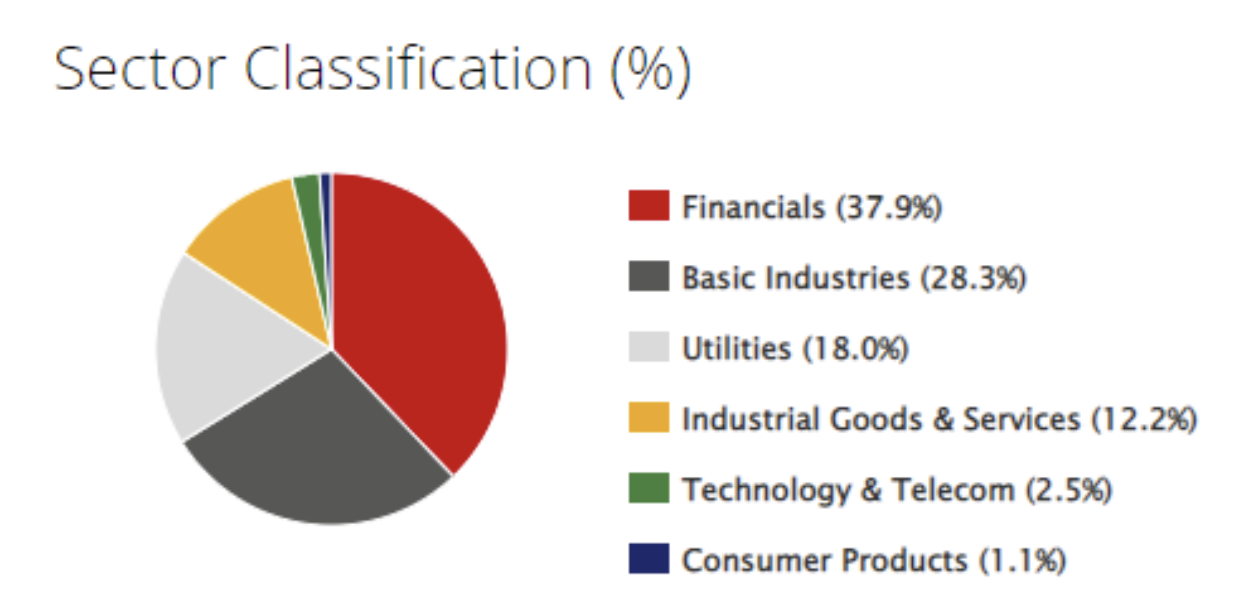

In this part of the article, we will introduce a few selected components of the ATX index. This is a particularly important part of the article for people who want to gain exposure to the Austrian stock market themselves. Due to the fact that the index exposure is dominated by companies from the financial sector, we chose the majority of companies operating in other industries (with the exception of Erste Group). It is worth noting that the index has a very small representation of companies from the IT / telecommunications industry (only AT&S Austria Tech).

Source: Wiener Borse

OMV AG

The history of AMV AG dates back to 1956, when the company started operating as a state-owned company. In 1960, it opened its first refinery in Schwechat near Vienna. In 1968, the company signed the first supply contract natural gas from the USSR. At the end of the 80s, the company was partially privatized. In 1987–1989, 25% of the company's shares were privatized. OMV stands for Österreichische Mineralölverwaltung Aktiengesellschaft. It is one of the 500 largest listed companies. The main activity of the company is mining, processing and sale oil, natural gas and their derivatives. OMV's members include Borealis AG (8th largest producer of polypropylene and polyethylene. The largest shareholder of the company (with over 30% share) is Österreichische Beteiligungs AG, an entity dealing with investment management of the Austrian government. It is worth mentioning that it is one of the largest petrochemical companies in Central Europe and Europe Central and Eastern.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 22 930 | 23 460 | 16 551 | 35 555 |

| operational profit | 3 233 | 3 331 | 1 255 | 5 582 |

| operating margin | 14,10% | 14,20% | 7,58% | 15,70% |

| net profit | 1 438 | 1 678 | 1 258 | 2 093 |

Source: own study

Immofinanz AG

The company was founded in 1990 in Vienna. Although it has been listed on the main market of the Vienna Stock Exchange since 1996, in 2013 there was a parallel listing on the Warsaw Stock Exchange. Immofinanz AG is a real estate company with a portfolio of office buildings, apartments and other facilities worth over € 5 billion. As much as 62% of the portfolio value is invested in office space. According to the data reported by the company, the average level of occupied space in 2021 was 90,6%. On the other hand, real estate intended for rent to individuals and retail stores has an average occupancy rate of 98,7%. The shopping centers included in the Immofinanz portfolio should be mentioned VIVO! and STOP SHOP. By purchasing Immofinanz shares, the investor gains access to real estate portfolios in Austria (18%), Germany (12%), Poland (19%), Romania (15%), the Czech Republic (11%) and Hungary (9%). The remaining shares relate mainly to investments in the Balkans and Slovakia.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 332,75 | 366,15 | 377,70 | 375,05 |

| operational profit | -138,91 | 63,97 | 165,68 | 149,36 |

| operating margin | -41,74% | 17,47% | 43,87% | 39,82% |

| net profit | 217,26 | 358,89 | -167,01 | 347,05 |

Source: own study

Verbund AG

It is the largest electricity supply in Austria. The company was founded in 1947 as Österreichische Elektrizitätswirtschafts-AG. The company was established as a result of the second round of nationalization of enterprises in Austria. The company was partially privatized in 1987, but the majority stake (51%) is still held by the Austrian government. After Austria joined the European Union (1995), the electricity market was partially deregulated. As a result, the company was forced to deeply restructure its operations. Currently, Verbund covers approximately 40% of the annual electricity demand in Austria. Moreover, the company is Austria's largest producer of hydroelectric power (90%). In addition, the subsidiary of Verbund AG - Austrian Power Gird - has the largest high-voltage grid in Austria. In addition, the company also has a gas pipeline network in Austria.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 2 846,4 | 3 894,9 | 3 234,6 | 4 776,6 |

| operational profit | 531,7 | 787,4 | 902,9 | 868,8 |

| operating margin | 18,68% | 20,22% | 27,91% | 18,19% |

| net profit | 433,2 | 554,8 | 631,4 | 873,6 |

Source: own study

Erste group

It is an Austrian bank that focuses its activities on the CEE (Central and Eastern Europe) market. The origins of the company date back to 1819, when Erste österreichische Spar-Casse was founded in Leopoldstadt (then a suburb of Vienna). At the end of the 90s, the bank began to expand into the Central and Eastern European market. The reason was the great potential in these markets because during the period of the socialist regimes in this part of the world the level of banking was at a very low level. In 2000, Erste acquired a majority stake in the largest Czech bank - Česká spořitelna. A year later, the bank took over the largest bank in Slovakia - Slovenská sporiteľňa. Currently, Erste Group has over 15,7 million customers and over 2 040 branches in 7 countries. The bank employs nearly 45 people. Erste Group is listed on the stock exchange in Austria, the Czech Republic and Romania.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 6 909,7 | 7 256,8 | 7 158,4 | 7 599,2 |

| net profit | 1 716,6 | 1 378,1 | 668,5 | 1 775,6 |

Source: own study

DO & CO AG

The company was founded in 1981 and has been listed on the Vienna Stock Exchange since 1998. Do & CO AG initially operated as a catering company. In 1987, she started cooperation with the Lauda Air airline, where she undertook to supply catering during flights. For many years, the company has won tenders for catering services during sports events. Since 1992, Do & CO has been providing catering during Formula 1 races. In addition, the company provided catering during the European Football Championships in 2004, 2012 and 2016. The company currently operates in three segments: restaurant (they have 31 restaurants in the world), event (catering - sports and business events), air (catering during the trip). In Q2022 of the fiscal year 2023/76,2, the highest revenues were generated by the aviation segment, which accounted for XNUMX% of total sales.

| million € | 2019FY | 2020FY | 2021FY | 2022FY |

| revenues | 847,79 | 935,37 | 253,46 | 705,20 |

| operational profit | 50,48 | 3,96 | -22,73 | 46,88 |

| operating margin | 5,95% | 0,42% | -8,97% | 6,64% |

| net profit | 26,40 | -24,87 | -35,51 | 11,00 |

Source: own study

ETFs for the Austrian market

You can also invest in Austrian companies through ETFs. However, it should be remembered that the Vienna Stock Exchange has little turnover and marginal importance for global capital flows. For this reason, there are few ETFs offering exposure to companies listed on the Vienna Stock Exchange.

The largest ETF that gives exposure to the Austrian stock market is iShares MSCI Austria ETF. The fund was established in 1996 and has accumulated approximately $ 63 million in assets under management (AUM) to date. At the end of August 2022, the ETF had 28 companies in its portfolio. The largest components of the index were Erste Group Bank (15,7%), Verbund AG (15,7%) and OMV (12,8%). In terms of costs, it is quite an expensive ETF. The annual management fee is 0,5%.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

CFDs on the Austrian index

The solution may be to invest in the Austrian market via CFDs on the most important index in Austria - ATX. Of course, you should carefully consider the costs of holding the position (swap points) before investing. The Austrian index is very rarely found in the offers of Forex brokers, but it is offered by, for example, the Polish Brokerage House X-Trade Brokers SA. The leverage on this CFD is 1:10.

| Broker |  |

| End | Poland |

| ATX Index symbol | AUT20 |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

| Min. Lot value | Price * EUR 10 |

| Commission | - |

| Platform | xStation |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Austrian Stock Exchange - How to invest in Austrian companies? [Guide] Austrian Stock Exchange - atx index](https://forexclub.pl/wp-content/uploads/2022/08/austriacka-gielda-atx-index.jpg?v=1661931901)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Austrian Stock Exchange - How to invest in Austrian companies? [Guide] whether there is a shortage of beer](https://forexclub.pl/wp-content/uploads/2022/08/czy-zabraknie-piwa-1-102x65.jpg?v=1661932366)

![Austrian Stock Exchange - How to invest in Austrian companies? [Guide] commodity markets inflation](https://forexclub.pl/wp-content/uploads/2021/04/rynki-towarowe-inflacja-102x65.jpg?v=1618232677)