ASIC - Australian Securities and Investments Commission

Australian Securities and Investments Commission (abbreviated ASIC), is the Australian Securities and Investments Commission. What is ASIC? This entity is an organ of the smallest continent in the world independent of the government. Its main task is primarily the regulation of joint stock companies operating in Australia. The significant role of the Australian Securities and Investments Commission also plays in supervising the operation of enterprises on the domestic market and in creating regulations regarding financial markets. ASIC is also responsible for their enforcement. Over the past few years ASIC has employed around 2 thousands of employees.

The Australian Securities and Investments Commission is not just Australian. Its jurisdiction goes back to the entire Australian Union (Tasmania and smaller islands in the Pacific Ocean and the Indian Ocean). Its functioning determines the legal framework contained in Australian Securities and Investments Commission Act 2001. ASIC is therefore responsible for enforcing the provisions resulting from several acts. These are among others Corporations Act 2001, Insurance Contract Act 1984 and National Consumer Credit Protection Act 2009.

ASIC is the only institution in Australia responsible for maintaining business registers. They cover a number of information on the history of companies, previous addresses, all registration data and identification numbers. The whole is available to everyone in the online version.

Be sure to read: Swiss National Bank (Swiss National Bank)

A short History of ASIC

The Australian Securities Commission conducts its business relatively soon. Does it mean that it is not in front of her was there any responsible regulator for its current tasks? The Australian Securities Commission (ASC) was responsible for regulating the market before the creation of the Australian Securities and Investments Commission (on 1 in July of the year 1998). This body was created 1 January 1991 year under the Act ASC Act 1989.

The main motivator for the creation of the Australian Securities Commission was the standardization of hitherto existing entities. The market was growing in demand for an entity responsible for regulating the functioning of companies in Australia. The tasks of the current ASIC and the preceding ASC have so far been heavily dispersed into several state offices. The changes have supplanted, among others National Companies and Securities Commission (National Commission of Securities and Securities) and Corporate Affairs offices of the states and territories (State and territorial Bureau for Corporate Affairs).

As of 1 on July, 1998 year the Australian Securities Commission has replaced and replaced the ASC. Since July, all issues supervised and regulated so far by the Australian Securities Commission have been taken over by the new regulator. It is worth adding that since 2002, ASIC received several additional rights. Thanks to them, the committee has become one of the most important regulators on the loan market. Another important event in the history of the Australian Securities and Investments Commission 2009 was the receipt of a custody license over the Australian Stock Exchange. Since then, the stock market has been under the constant care of ASIC.

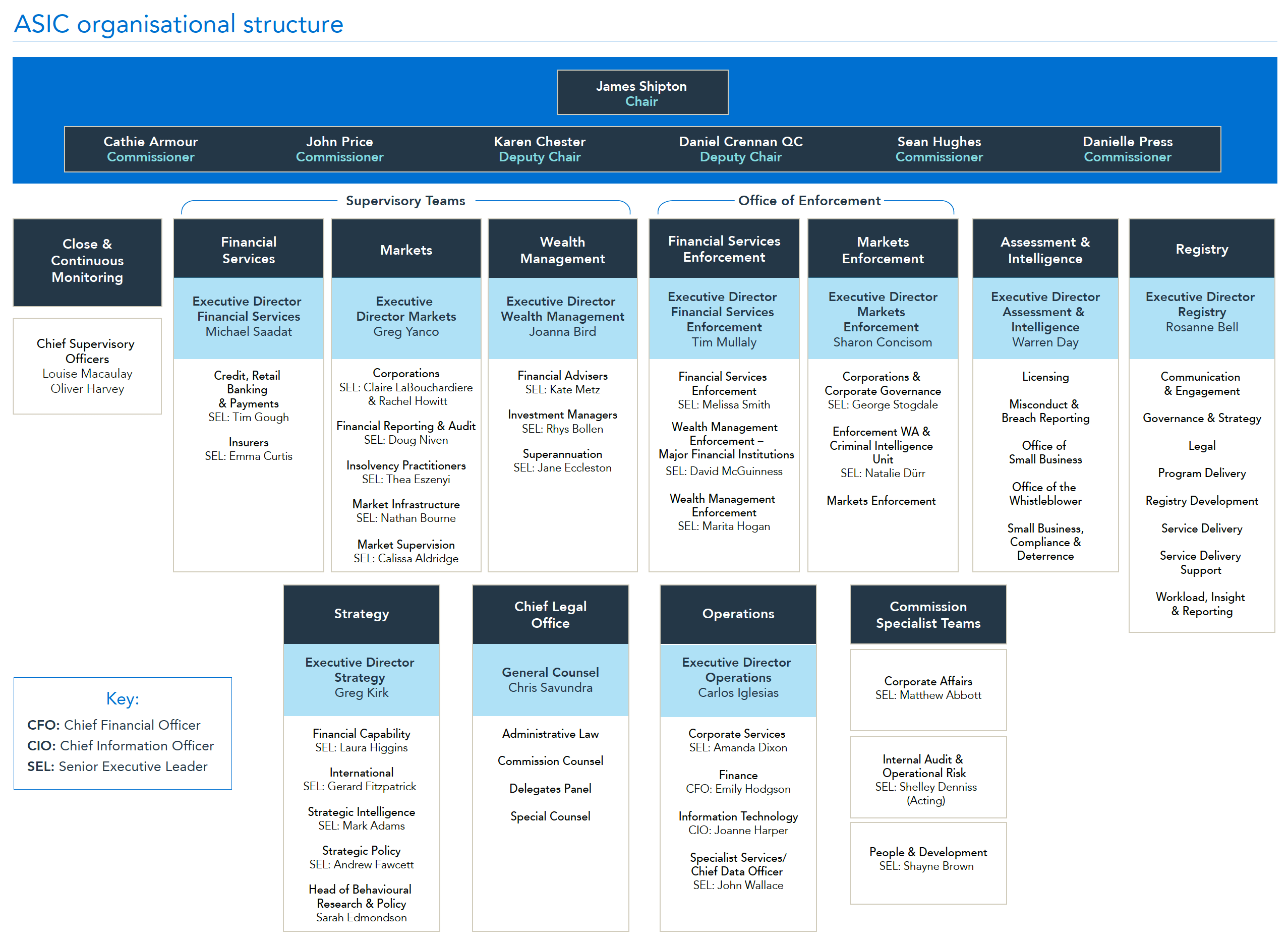

ASIC structure

The current chairman of the Australian Commission (from 2018 year) is James Shipton. He is the president of ASIC. The body of this body also includes vice-presidents and commissioners. Their role is mainly to the role of executive authorities. They are, among others, called to control the work of ASIC in every area of its activity. The senior executives also include Executive Directors of individual departments. They are divided mainly into those responsible for financial markets, insurance, corporate regulations, financial reporting and auditing, market liquidators or licensees (various areas related to finances). Quite a large group in the ASIC structures is also exercised by the main supervising officials. Their role comes down to controlling market regulations, ASIC investments, monitoring the largest financial institutions in their area of operations, or enforcing financial services regulations (including broadly understood investments and capital management).

Objectives, tasks and areas of ASIC functioning

ASIC has a number of duties assigned by relevant legal acts (the above-mentioned acts). These include issues related to supervision and regulations related mainly to joint-stock companies. The Australian Securities and Investments Commission's activities include corporate governance, financial services, insurance, securities and derivative instruments, very broad consumer protection (including shareholders, investors, lenders), as well as educational activities aimed at expanding financial knowledge and economic society. In addition, ASIC is responsible for keeping a register of financial advisors. He is responsible for auditing the financial statements of companies listed on the Australian Stock Exchange. On its website, we can find numerous registers of companies that can be freely searched as part of investment needs.

In the above-mentioned educational activities, it is worth noting here that the ASIC runs a portal named under its wing Money Smart. It publishes publications that are useful in making good financial decisions. The idea of creating a website was primarily aimed at helping novice investors. Money Smart enjoys constant and growing interest. It has been operating since the first half of 2011. We will find there, among others, knowledge in the field of investing, loans, insurance and pensions. We also have the opportunity to read a compendium on managing own finances. There is also a section dedicated to fraud in the financial market and current warnings issued in the regulator's announcements. ASIC also offers knowledge and support in the field of debt elimination and advice on building wealth on the market (large knowledge base, among others, about capital investments in dividend companies). The current Smart Money website has replaced the previous ones - including FIDO and Understanding Money.

An interesting fact is that ASIC also runs a post-graduate program. At the same time, several formal requirements have to be met (among others being an Australian citizen with higher education).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)